Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate. Grantees must provide controversy representation and education, with a focus on advocating for issues impacting low-income and ESL taxpayers. Oversight is mandated by authorizing legislation, including rules for federal agency oversight of grantees.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

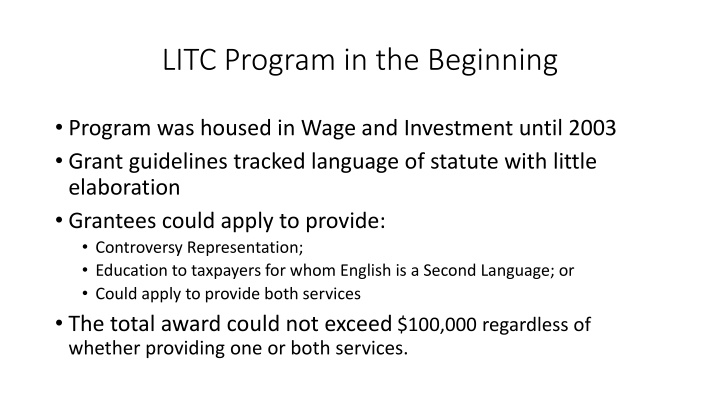

LITC Program in the Beginning Program was housed in Wage and Investment until 2003 Grant guidelines tracked language of statute with little elaboration Grantees could apply to provide: Controversy Representation; Education to taxpayers for whom English is a Second Language; or Could apply to provide both services The total award could not exceed $100,000 regardless of whether providing one or both services.

LITC Program in 2021 129 Grantees in 46 states receive just under $12 million in grant funds

LITC Missions Today Low Income Taxpayer Clinics ensure the fairness and integrity of the tax system for taxpayers who are low-income or speak English as a second language by: Providing pro bono representation on their behalf in tax disputes with the IRS; Educating them about their rights and responsibilities as taxpayers; and Identifying and advocating for issues that impact these taxpayers.

LITCs Today LITC Program Office reports to the National Taxpayer Advocate who is independent but still a part of the Internal Revenue Service All grantees must provide both controversy representation and education While providing education to taxpayers who speak English as a Second Language is still a key focus, educating low-income taxpayers is also considered a goal of the program All grantees are encouraged to advocate advocate on behalf of low- income and ESL taxpayers on issues that impact these taxpayers The maximum award remains $100,000 per grant year

Grantee Oversight Authorizing Legislation Congress enacted Internal Revenue Code (IRC) 7526 in the IRS Restructuring and Reform Act of 1998 (RRA 98) Required dollar-for-dollar match for the federal grant funds Prohibited utilizing indirect costs to meet the matching funds requirement Rules for Federal Agency Oversight of Grantees Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, 2 C.F.R. Subt. A, Ch. II, Pt. 200. 2 C.F.R. 1000.306 Cost sharing or matching 2 C.F.R. 1000.336 Access to records

Role of LITC Program Office Oversight Balancing the need to oversee while enabling the clinics to maintain independence Periodic site visits Financial sampling Monitor Collect enough information to understand the quantity and quality of the work of the clinics without being burdensome Guidance Provide Operational Standards and Practices Assistance Provide individualized advice, share best practices, arrange mentors Support the practice community

LITC Toolkit The Toolkit is a grantee-only access website and provides an array of information including: Practitioner Tools Grants Management Publicity Materials Clinic Training Resources

Grantee Conference Subject matter can be tailored to the issues common to the taxpayers served by the clinics Agency grantor as sponsor, can solicit and encourage participation in conference by leaders and agency subject matter experts Provides a forum for the practitioners to provide the agency members thoughts about: Administrative issues Process Problems Can provide valuable information and insights to the agency about its program administration Grantor can highlight important information about changes to grant rules, share grant administration best practices, foster a sense of community Utilize engagement and participation to help identify and foster emerging leaders

LITC Program Results 20,259 Taxpayers represented 15,802 Taxpayers provided consultation 41,840 Taxpayer educated Publication 5066, LITC Program Report- includes clinic success stories which help demonstrate the program s impact.

Speaker Information Tamara Borland Director, LITC Program 1111 Constitution Avenue N.W., Room 1034 Washington D.C. 20224 202-317-3074 Tamara.A.Borland@irs.gov Please note any views expressed by the speaker are personal and do not represent the viewpoint of the Taxpayer Advocate Service or Internal Revenue Service.