Michigan OIG: Cost Avoidance and Investigation Types Overview

Michigan's Office of Inspector General (OIG) within the Department of Health & Human Services conducts investigations to ensure data integrity, targeting areas like cost avoidance, fraud, and program violations in public assistance programs. The OIG's efforts have resulted in significant savings and disqualifications, showcasing their commitment to program integrity and taxpayer protection.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

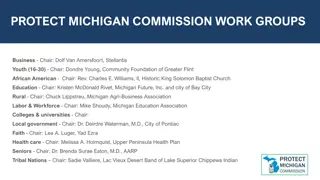

2020 PARIS Training Conference Reaching Out for Data Integrity Panel Discussion: Measuring Cost Avoidance David Russell Office of Inspector General Michigan Department of Health & Human Services March 10-11, 2020

Michigans Makeup Overview: Michigan has 83 Counties 9.9 Million residents 1.2 Million public assistance recipients $2.02 Million in payments 2.91 Medicaid recipients Public assistance and Medicaid is administered via the Michigan Department of Health & Human Services (MDHHS) Michigan s programs are state managed, and state administered

Michigans OIG Michigan s Office of Inspector General is housed within MDHHS 100+/- Investigators responsible for recipient Program Integrity Latest OIG-Enforcement Division Statistics: Determined $110.4 million of fraud, cost savings and established program disqualifications Completed 7,134 fraud investigation dispositions Completed 24,712 Front End Eligibility (FEE)1 investigations Identified $85.3 million in cost avoidance in FEE investigations Established an additional $6 million in cost savings from intentional program violation (IPV) disqualifications Identified $11.8 million of program fraud

Investigation Types Pre-Certification Investigations: Front End Eligibility (FEE): OIG investigates when applications or re-certifications for public assistance contain suspicious or error-prone information. Agents investigate, substantiate or refute discrepancies and suspicious activities; the results may involve an assistance case not being opened, reduced benefits issued and/or case closure. These cases are used to calculate cost avoidance Some may be assigned as fraud investigations based on identified financial loss

Investigation Types Fraud Investigations: OIG investigates instances of alleged fraud in all programs administered by the department. Examples include: Cash, SNAP, childcare, Medicaid, etc. Vendor fraud and state employees alleged to be involved in program fraud or certain crimes against MDHHS. All investigations found to contain criminal activity are forwarded to the appropriate authority for criminal disposition or are sent to the appropriate area within MDHHS for administrative action. These cases are used to calculate overpayments Some may be assigned a FEE component where the fraud continues (e.g., OIG analytics identified the case for investigation and the worker was unaware of the fraud.)

Why ID Cost Avoidance? The primary impact of FEE investigations is the potential for taxpayer cost avoidance on cases that are denied, reduced or applications retracted by the household. Measuring/Calculating Cost Avoidance is a component of OIG s case management system. It is used to report out for: Annual Reports Legislative Requests Staffing enhancement requests System enhancement requests OIG investigators collect key data points at each FEE investigation disposition. Data is used by the case management system to automatically calculate and report on cost avoidance.

Automate for Efficiency MIGS tables are updated each fiscal year with average monthly household grants for each program/person. FAP = SNAP These amounts will be used in the cost avoidance calculation and may/may not be annualized. Medicaid-utilize average monthly capitation payment. For programs that affect one person for one lump sum, there is only one entry. It will not be annualized. E.g., SER or MA one-time (costly procedure).

Outcomes Impact The outcome chosen and agreed to by the Case Worker is used to determine if cost avoidance is counted. E.g.: Benefits Denied = Cost Avoidance Full Benefits = No Cost Avoidance Benefits Reduced = Partial (actual) Cost Avoidance is calculated

Data Collection At the completion of the investigation, the investigator identifies the number of household members affected by an outcome (e.g., Denial of Application), by program. The Case Worker will have an opportunity to agree or change the outcome, and dollar value of the actual cost avoidance.

Disqualification Value Don t forget the value of the disqualification when measuring program integrity efforts. OIG includes this number in annual reports, etc. The value is based on a monthly program amount for a single individual multiplied by the time period (months) of the disqualification: 1 year = 12 months 2 years = 24 months 10 years = 120 months Lifetime = 240 months (20 years was internally chosen)

Consistency Key Principles: Pick a method to calculate/measure cost avoidance and stick with it. o Provides a valid metric to compare year over year. Be able to explain how you derived your numbers. Improve on methodology as technology allows. When setting up our current cost avoidance formula, OIG reviewed the standard lifecycle of a SNAP case, which was 24 months in Michigan. OIG went with a 12-month multiplier to be conservative. In Michigan, for FY 2018, PARIS (Interstate, Federal and Veteran) matches resulted in $40.5 million in annual cost avoidance through OIG efforts.

Questions? David M. Russell, Director Operations Division Michigan DHHS-Inspector General 517-284-4010 (desk) 517-896-9597 (cell) RussellD3@michigan.gov