Renewing Richmond's Conservation Reserve Fund

Richmond's Conservation Reserve Fund has a successful 18-year track record in protecting water and air quality, biodiversity, working farms and forests, outdoor recreation, historic resources, and education. Established in 2005 and last renewed by voters in 2023, the fund has brought in over $2.0 mi

0 views • 9 slides

Work Group meeting

This review project aims to assess the need for a special industry rule for trucking companies given the shift to market-based sourcing by the MTC. Factors prompting the review include distortion in applying the mileage approach, differences in revenue per mile among states, and the nature of taxpay

0 views • 21 slides

Advanced Analytics in Indirect Taxation by Central Board of Indirect Taxes & Customs

The Central Board of Indirect Taxes & Customs in India leverages technology through ADVAIT to provide near real-time data capture, predictive analytics, and fraud detection in the realm of indirect taxation. This initiative enhances taxpayer service with cutting-edge data visualization, mobile acces

2 views • 28 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

Ohio's New Tax System Overview May 2023

Ohio is launching a new tax system in May 2023 aiming to improve taxpayer service, modernize technical systems, enhance user experience, and ensure secure taxpayer information. The project scope includes Individual Income Tax and School District Tax, with key dates set for testing in August 2023 and

5 views • 11 slides

Enhancing Tax Compliance: Factors, Audit, and Investigation" (56 characters)

Exploring factors influencing taxpayer behavior towards tax compliance, this study delves into the impact of tax audit and investigation procedures on adherence to tax laws at both corporate and individual levels. Previous research gaps are identified and addressed to provide a comprehensive underst

1 views • 20 slides

Issuance of notice in Form GST ASMT-10

Form GST ASMT-10 is a scrutiny notice issued to intimate the discrepancies observed by the officer while verifying the GST returns filed by the taxpayer.\n\nUpon scrutiny of GST returns by GST authorities, if any discrepancy is noticed, he may issue a notice in Form GST ASMT-10. In the said notice t

1 views • 6 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Conference Cost Submission, Approval, and Reporting Guidelines for DOJ Programs

This policy outlines the requirements and procedures for managing conference costs within the Department of Justice (DOJ). It covers planning, approval, attendance, and reporting of conferences while ensuring efficient and responsible use of federal funds. The guidelines aim to promote cost-effectiv

3 views • 48 slides

Nevada Department of Taxation Compliance Division Audit Process Overview

Responsible for ensuring taxpayer compliance with various taxes, the Nevada Department of Taxation Compliance Division conducts audits locally and nationwide. From refund verification to audit selection criteria, learn about the audit process, taxes audited, time periods, initial contact procedures,

5 views • 18 slides

Community Programs and Service Fund (Fund 80) Overview

The Community Programs and Service Fund (Fund 80) is a local taxpayer-funded initiative that allows school boards to provide community education, training, recreational, cultural, and athletic programs and services. This fund is separate from the regular school curriculum and operates under specific

0 views • 20 slides

Taxpayer Information for Direct Fee Payments - Guidelines and Forms

Guidelines and procedures for providing taxpayer information to the IRS for direct fee payments made to representatives of claimants for Social Security and Supplemental Security Income benefits. Learn how to register, complete required forms, and request direct payment online. Find information on e

0 views • 30 slides

Insights into Post-Award Challenges in NIH Grants Administration

Explore the complexities and issues in post-award management of NIH grants through case studies and real-life examples. Key aspects discussed include changes in recipient organizations, research team delays, large balances, and unexpected changes post-award. Gain perspectives on federal policies, ta

0 views • 41 slides

Challenges of Kenyan Taxation System and Solutions

The Kenyan taxation system faces complexities in terms of the ITax system, low taxpayer acceptance, capacity issues at the Kenya Revenue Authority (KRA), and lack of political will. Simplifying the filing process, increasing taxpayer education on the importance of taxes, enhancing KRA capacity, and

1 views • 13 slides

Nassau County Property Assessments Overview

The Nassau County Department of Assessment oversees valuing a large number of residential and commercial parcels, implementing a reassessment in 2018 to address inaccuracies and disparities in property values. The Taxpayer Protection Plan (TPP) was introduced to phase in assessment increases over fi

0 views • 9 slides

Legal Professional Privilege in the Protection of Taxpayer Rights: South African Perspective

Legal professional privilege plays a crucial role in safeguarding taxpayer rights in South Africa. This privilege ensures that communications between a legal advisor and client remain confidential, promoting fairness in litigation and enabling a proper functioning adversarial system of justice. The

0 views • 16 slides

Enhancing Taxpayer Education for Voluntary Compliance

Liberian taxes operate on a self-assessment system, where taxpayers must assess, submit returns, and pay taxes. Taxpayer education is crucial in promoting voluntary compliance. The Liberia Revenue Authority's Taxpayer Service Division conducts extensive educational programs covering tax types, respo

0 views • 21 slides

Afghanistan Revenue Department Implements Value Added Tax

The Afghanistan Revenue Department has introduced Value Added Tax (VAT) as a step towards self-reliance and economic stability. The program aims to inform taxpayers about VAT, its purpose, implementation process, and impact on domestic revenues. By adopting VAT, Afghanistan aims to decrease reliance

0 views • 35 slides

Advancing Government through Acquisition Innovation Initiatives

This content highlights various initiatives and efforts aimed at advancing government functions through innovative acquisition practices. The focus is on strengthening the partnership between the government and industry to create new value for the customer, improving outcomes, and effectively utiliz

3 views • 19 slides

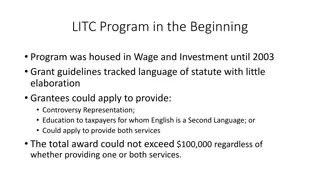

Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate.

0 views • 10 slides

Understanding Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

Overview of Suspension and Debarment in Government Contracts

Learn about Suspension and Debarment in government contracts, how it safeguards against fraud and abuse, and the role of key officials in ensuring responsible business conduct. Understand the importance of S&D actions for maintaining integrity in federal procurement processes and protecting taxpayer

0 views • 24 slides

Understanding Income Tax: Overview and Application

The Income Tax Act covers three modules - administration, taxes, and general provisions. It distinguishes between direct and indirect taxes, and outlines various types of taxes like income tax, VAT, and customs duty. Tax revenue funds government departments, and the taxation scheme calculates taxabl

0 views • 58 slides

Michigan OIG: Cost Avoidance and Investigation Types Overview

Michigan's Office of Inspector General (OIG) within the Department of Health & Human Services conducts investigations to ensure data integrity, targeting areas like cost avoidance, fraud, and program violations in public assistance programs. The OIG's efforts have resulted in significant savings and

0 views • 12 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Understanding the Enforceability of Taxpayer Bill of Rights (TBOR)

Explore the enforceability of the Taxpayer Bill of Rights (TBOR) as outlined in IRC 7803(a)(3), delving into its history, statutory interpretation, the question of remedy, and enforcement issues. Discover the evolution of TBOR, statutory text, and challenges surrounding its enforcement.

0 views • 21 slides

Economic and Revenue Review Update Briefing for Money Committees

Adjusting for timing issues and taxpayer rebates, general fund revenues grew 10.3% year-over-year in October. With one-third of the fiscal year completed, revenues are up 8.3% adjusted for policy and timing impacts. The impact of the increased standard deduction is expected to reduce withholding rat

0 views • 15 slides

Federal Lending Update and Housing Finance Reform Overview

The VA 2019 Lenders Conference provided insights on the positive economic environment, unique features of the VA Home Loan Program, and the President's plan to reform the housing finance system. Encouraging demographic trends and the goals of the reform were discussed, emphasizing reduced taxpayer r

0 views • 21 slides

Completing W-9 Supplier Vendor Change Request Form Instructions

Learn how to correctly complete a W-9 form for suppliers and vendors with examples for individuals, S-Corporations, and Limited Liability Companies. Follow step-by-step instructions to ensure accurate submission based on taxpayer identification numbers.

0 views • 16 slides

Financial Management Training Highlights

This content showcases key aspects of financial management training sessions conducted by the USDA Office of the Chief Financial Officer. It covers topics such as CAP Goal 9 - Getting Payments Right, Payment Integrity, and definitions of improper payments. The sessions emphasize stewardship of taxpa

0 views • 16 slides

2018 Legislative Update and Policy Statements

The 2018 legislative update and policy statements were presented by various officials from the Policy Services Division of the Louisiana Department of Revenue. The update includes information on extraordinary sessions, bills, acts, vetoed bills, and more. Additionally, specific sales tax updates wer

1 views • 86 slides

PA IFTA Litigation: R&R Express Audit Findings

In the Pennsylvania IFTA litigation involving R&R Express, audit findings revealed discrepancies in trip reports, conflicting route information, and incomplete fuel tickets. The auditor assessed unreported mileage and fuel consumption, leading to adjustments in the taxpayer's reported averages. Cred

0 views • 50 slides

UK Export Finance: Supporting UK Businesses to Thrive in International Trade

UK Export Finance (UKEF) is the world's first export credit agency, established in 1919. Their mission is to ensure that no viable UK export fails due to lack of finance or insurance while operating at no net cost to the taxpayer. UKEF provides a range of products such as insurance, financing, guara

0 views • 10 slides

National Fuels Supplier Engagement Overview

National Fuels Supplier Engagement provides commercial services to the public sector, saving money for the taxpayer by managing procurement activities for common goods and services. Crown Commercial Service (CCS) works with a vast network of customer organizations and suppliers, aiming to achieve va

0 views • 13 slides

Overview of PATH Act of 2015: Depreciation and R&D Tax Credit

The PATH Act of 2015 focuses on depreciation and the R&D Tax Credit, extending approximately 50 taxpayer-favorable tax extenders. It includes enhancements such as 15-year improvement property rules, new bonus depreciation rules, and Section 179 expensing. The Act incorporates permanent provisions li

0 views • 23 slides

Understanding Income Taxes and Contributions in Quebec

This resource provides comprehensive information on income taxes and contributions in Quebec, covering topics such as taxable income, tax deductions, rights and responsibilities of taxpayers, and ways to reduce tax payments through investment plans like TFSAs and RRSPs. It also emphasizes the import

0 views • 43 slides

Understanding TABOR: Taxpayer's Bill of Rights Overview

The Taxpayer's Bill of Rights (TABOR) is a crucial constitutional amendment in Colorado that limits government spending and empowers citizens to vote on expenditure increases. TABOR aims to secure individual freedoms and prevent excessive government control through financial accountability. This bri

0 views • 10 slides

Understanding Bond Elections and Key Financial Terminology

Explore the intricacies of bond elections, financial terminology, and the role of a state treasurer in managing municipal finances. Discover the difference between par and premium bonds, the importance of coupon rates, and how proceeds impact taxpayer funds. Gain insights into optimizing financial s

0 views • 12 slides

Alabama Department of Revenue Motor Fuel Single Point Filing and Payment System Overview

The Alabama Department of Revenue has implemented a Motor Fuel Single Point Filing and Payment System for taxpayers to electronically file and pay county or municipal motor fuel excise taxes through a single point. The system is designed to facilitate easy and timely tax payments without any charges

0 views • 14 slides

Understanding Income Taxes and Contributions in Canada

This content provides an overview of income taxes and contributions in Canada, covering topics such as tax facts, tax basics, taxpayer rights and responsibilities, types of taxes, government revenues, and key messages for Canadian taxpayers. It emphasizes the importance of filing tax returns accurat

0 views • 43 slides