Financial Intelligence Centre, Ghana

The FATF Recommendations for preventive measures, customer due diligence, reliance on third parties, internal controls, and reporting of suspicious transactions in Ghana's financial sector.

4 views • 17 slides

FICA Presented by: Robert Krautkramer

FICA, presented by Robert Krautkramer, aims to create transparency in financial transactions to combat money laundering and terrorism financing. The content explains the concepts of money laundering, the risk-based approach for accountable institutions, and the specific requirements for AIs to compl

2 views • 33 slides

Boost Your Business with SMS gateway for transactions : A Overview

\"Discover how leveraging an SMS gateway for transactions can propel your business forward in this comprehensive overview. Explore the benefits of seamless communication, enhanced customer engagement, and streamlined transactions. Unlock the potential to boost sales, improve efficiency, and cultivat

1 views • 6 slides

Understanding Taxation and Reporting of Futures and Options (F&O) Transactions

Explore the taxation aspects and reporting requirements related to Futures and Options (F&O) transactions. Learn about the types of F&O transactions, relevant heads of income for reporting income/loss, and the provisions of Section 43(5) of the Income Tax Act, 1961, defining speculative tran

1 views • 24 slides

Database System Concurrency Control and Transactions Overview

Studying relational models, SQL, database system architecture, operator implementations, data layouts, and query optimization laid the foundation for advanced topics like Concurrency Control and Recovery. Discover how transactions group related actions, ACID properties ensure data integrity, and the

0 views • 57 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

0 views • 3 slides

Taxation of F&O Transactions under Indian Income Tax Law

This content discusses the taxation of Futures and Options (F&O) transactions in India under the Income Tax Act of 1961. It covers the types of F&O transactions, relevant heads of income for reporting income or loss, and the provisions of Section 43(5) related to speculative transactions. The articl

0 views • 24 slides

Export Compliance Guidelines and Red Flag Indicators

Ensure compliance with export controls by screening for prohibited destinations, end-users, and end-uses. Know red flag indicators to identify suspicious export transactions. Catch all controls outline general prohibitions to prevent violations. Stay informed and vigilant to maintain export complian

1 views • 8 slides

Accounting for Independent Branches: Salient Features and Transactions

Independent branches maintain separate sets of accounts and carry out business transactions autonomously. The accounting system of an independent branch involves double entry bookkeeping, reconciliation of accounts between the branch and head office, and recording transactions like dispatch of goods

2 views • 10 slides

Exploring NIH Other Transactions: A Comprehensive Overview

Join the Office for Extramural Research (OER) and the Office of Policy for Extramural Research Administration (OPERA) in a detailed session on NIH Other Transactions (OTs). Learn about the authority, characteristics, implementation, and contacts related to OTs, a unique type of legal instrument beyo

0 views • 23 slides

Phishing Survival Guide: Educating Children and Parents

Empower children to identify and respond to phishing attacks with this comprehensive phishing survival guide. The guide includes learning outcomes, lesson notes, and instructions to create an engaging pocket guide for parents. Learn how to report suspicious emails, handle suspicious links, and prote

0 views • 4 slides

Legal Implications of the Digital Economy in Malawi

Explore the legal implications of the digital economy in Malawi as discussed at the ICAM Annual Lakeshore Conference. Topics include the Electronic Transactions and Cyber Security Act, principles of implementation, Malawi CERT, data privacy, and the significance of the digital economy in transformin

0 views • 44 slides

Essential Knowledge for Sales & Finance Transactions

Understanding the intricacies of titles in sales and finance transactions is crucial to avoid costly mistakes and ensure smooth processes. This guide highlights the importance of titles, handling trade-in packets, and managing drive-away transactions effectively. It emphasizes the significance of ve

0 views • 7 slides

Understanding Suspicious Activity Reports (SARs) and the Role of UKFIU in Tackling Illicit Finance

Explore the significance of Suspicious Activity Reports (SARs) in combating illicit finance, with a focus on reporting AML concerns, the role of the UKFIU, and the value of SARs in identifying money laundering activities. Learn about the quality of SARs, reporting breaches of standards and regulatio

0 views • 26 slides

UCPath vs KFS GL Reconciliation Tips & Audit Messages

Explore essential tips for reconciling UCPath and KFS GL transactions, including checking if transactions were posted, identifying period mismatches, and understanding audit messages in DOPE reports. Learn how to handle unposted transactions and recognize future or past period discrepancies to ensur

0 views • 10 slides

Understanding Properties of Database Transactions

Database transactions play a crucial role in ensuring data integrity and consistency within a database system. This content explores the fundamental properties of transactions, such as atomicity, durability, consistency, and isolation. It delves into the requirements and implications of each propert

2 views • 44 slides

Texas Standard Electronic Transactions (TX.SET) Overview

Texas Standard Electronic Transactions (TX.SET) provide an interactive platform for various transactions involving ERCOT and non-ERCOT entities. The TX.SET Version 4.0 includes a range of transaction names and documents related to service orders, outages, invoices, customer information maintenance,

0 views • 33 slides

Phishing Survival Guide: How to Recognize and Respond to Suspicious Emails

Learn how to spot a phishing email and what steps to take if you receive one or fall victim to a phishing scam. Find out how to identify suspicious links, recognize phishing attempts, and protect yourself from giving out personal information or losing money. Stay informed and secure in the digital a

2 views • 5 slides

Understanding Suspicious Transactions and Activities in Financial Investigations

This guidance note by Senior Analyst Westmore Jeffers provides assistance and practical advice on reporting suspicious financial activities. It outlines the legislation, obligations, and definitions related to suspicious transactions and activities. The document emphasizes the importance of vigilanc

0 views • 20 slides

Suspicious Activity Reporting & Beneficial Ownership System Guidelines

Learn about the dos and don'ts of reporting suspicious activities and transactions, understanding beneficial ownership, and the importance of secure search systems. Discover insights on submitting reports, maintaining integrity, and transitioning from reactive to proactive reporting in various secto

0 views • 15 slides

Understanding Blockchain Technology and Its Applications

Blockchain technology enables secure, decentralized transactions by utilizing open ledgers and cryptographic techniques. It eliminates the need for intermediaries, reduces fees, enhances privacy, and provides a permanent record of transactions. With a focus on concepts like open ledger, history, net

0 views • 35 slides

Compliance Obligations and PAN Requirements for Financial Transactions

This outreach program by the Directorate of Income Tax in Nagpur, in collaboration with the Nagpur Branch of WIRC of ICAI, focuses on effective compliance with Statement of Financial Transactions (SFT). It covers PAN compliance obligations, forms, and penalties for non-compliance related to specifie

0 views • 14 slides

Types of Suspicious Messages by Cyber Sprinters and Urgent Call for Assistance

Cyber Sprinters are warning about three types of suspicious messages: Evil Emailers using phishing tactics, Malicious Messenger engaging in smishing, and Phoney Phone Caller utilizing vishing. The South West Constabulary urgently seeks the Cyber Crime Response Unit's help to investigate a group of c

1 views • 7 slides

Understanding Related Party Transactions in Corporate Governance

Related Party Transactions (RPT) are vital in today's business world, ensuring transparency and disclosure in transactions involving parties related to the company. This article explores the significance of RPT, definitions under CA 2013 and SEBI LODR 2015, as well as the identification criteria as

0 views • 30 slides

Understanding Investment Accounts and Transactions in Financial Accounting

Investment accounts involve transactions such as purchasing and selling bonds, debentures, and stocks, with considerations for interest payments, market prices, and accrued interest. Differentiating between Ex-Interest and Cum-Interest transactions is crucial in determining the capital cost of inves

0 views • 7 slides

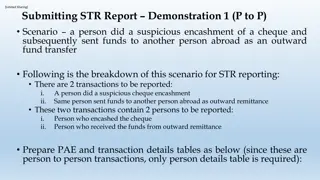

Demonstration: Reporting Suspicious Transactions and Persons for STR

Demonstrating the process of reporting suspicious cheque encashment and outward fund transfer transactions involving two individuals - one who encashed the cheque and the other who received funds abroad. Includes detailed person and transaction information for both instances, along with the preparat

0 views • 41 slides

Efficient Submission of Forms Solution via EDI Transactions

Streamlining the submission of Forms Solution to the Bureau through mandated EDI transactions. Claims adjusters must provide injured workers with a copy of the form. Key features include form generation via accepted EDI transactions, avoiding paper versions, and ensuring timely filing. Details on Ag

0 views • 16 slides

Benefits of E-Banking and Its Impact on Customer Service

E-banking provides various benefits such as offering extra service channels, convenience, flexibility with online banking, reduction in cash transactions, self-inquiry facilities, remote and anytime banking, branch networking, and electronic data interchange. These benefits enhance customer service

0 views • 22 slides

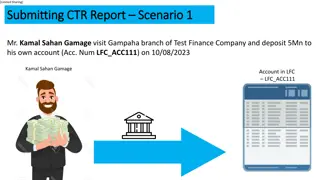

Financial Transactions Summary for Mr. Kamal Sahan Gamage

Mr. Kamal Sahan Gamage conducted two financial transactions at the Gampaha branch of Test Finance Company. On 10/08/2023, he deposited 5 million LKR into his account (LFC_ACC111). On 10/10/2022, he withdrew 1 million LKR via a cash cheque from the collection account (COL_ACC100). Both transactions w

0 views • 24 slides

Overview of Anti-Money Laundering Obligations for Notaries in Ireland

The Faculty of Notaries Public in Ireland hosted a session on Anti-Money Laundering Compliance Unit (AMLCU), emphasizing obligations under the Criminal Justice Act. Established in 2010, AMLCU plays a vital role in combating money laundering and terrorist financing. The event highlighted risk assessm

0 views • 14 slides

High-Performance Transactions for Persistent Memories

Explore the optimization of transactions for persistent memories, focusing on ordering constraints, synchronous vs. deferred commit transactions, persistency models, and performance evaluation. The study aims to improve transaction performance in the presence of high persistent memory latencies by m

0 views • 26 slides

Building Effective Board Memos for City Transactions

Guidance on building a board memo for the Board of Estimates, a public board overseeing city transactions. Learn about the reviewing agencies involved, such as the Law Department, Dept. of Finance/BBMR, MWBOO, and Pre-Audits, and their roles in the approval process. Follow their guidelines to ensure

0 views • 18 slides

360 Control Manager & Cardholder Training Commercial Card Payment Solutions

Explore how 360 Control Manager provides an online Employee Expense Reporting tool for coding transactions related to the company's Visa business cards. Learn how to access the system, code transactions, split a transaction, add comments, attach receipts, and follow a 3-step process for coding, revi

0 views • 18 slides

Understanding Secure Electronic Transactions (SET)

Secure Electronic Transactions (SET) is an encryption and security specification designed to protect credit card transactions on the Internet. SET provides a secure way to utilize existing credit card payment infrastructure on open networks, such as the Internet, involving participants like clients,

1 views • 6 slides

Understanding PeopleSoft Asset Management at Georgia University System Summit

Explore key questions surrounding PeopleSoft Asset Management at Georgia University System Summit, including processes for adding and capitalizing assets, handling open transactions, and differentiating between open and pending transactions. Gain insights into updating tables, managing asset details

0 views • 33 slides

Google Spanner: A Distributed Multiversion Database Overview

Represented at OSDI 2012 by Wilson Hsieh, Google Spanner is a globally distributed database system that offers general-purpose transactions and SQL query support. It features lock-free distributed read transactions, ensuring external consistency of distributed transactions. Spanner enables property

0 views • 27 slides

Understanding Database Transactions in SQL

Database transactions in SQL ensure data integrity and consistency by allowing users to group SQL commands into atomic units that can be committed or rolled back as needed. Learn about the ACID properties of transactions, autocommit mode, and how to create and manage transactions effectively.

0 views • 29 slides

A Practical Guide for Anti-Money Laundering Policies & Procedures

This comprehensive guide provides essential information on developing effective policies and procedures for anti-money laundering (AML) compliance. Covering topics such as risk assessment, customer due diligence, reporting suspicious activities, and integrating AML controls into daily transactions,

0 views • 13 slides

Taxation Guidelines for Share and Derivative Transactions by CA Mahavir Atal

Guidelines by CA Mahavir Atal regarding taxation of share and derivative transactions, including determining business income vs. capital gain, treatment of shares as stock-in-trade, maintaining separate portfolios, and the classification of transactions as either business or investment. The circular

0 views • 31 slides

Distributed Transactions in Spanner: Insights and Mechanisms

Spanner, a strictly serializable system, leverages TrueTime for timestamping to enforce the invariant between transactions. It ensures efficient read-only transactions and multi-shard transactions. Mechanisms like 2PL, 2PC, and (Multi)Paxos contribute to Spanner's fault tolerance and scalability. Le

0 views • 21 slides