Suspicious Activity Reporting & Beneficial Ownership System Guidelines

Learn about the dos and don'ts of reporting suspicious activities and transactions, understanding beneficial ownership, and the importance of secure search systems. Discover insights on submitting reports, maintaining integrity, and transitioning from reactive to proactive reporting in various sectors like corporate services and banking.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Suspicious Activity or Transaction Reporting & Beneficial Ownership Secure Search System Dummy Text Presented by: Dwyane A. Thomas Ag. Deputy Director Financial Investigation Agency

AGENDA Suspicious T ransaction or Activity Report Do s and Don ts when submitting SARs/STRs Reports received from various sectors Reactive vs. Proactive reporting Reporting a Client subject to a Sanction Beneficial Ownership Secure Search system (BOSSs) Security of information Level of population 2017 2019 statistics (Expectation vs Reality) Dummy Text Integrity of information

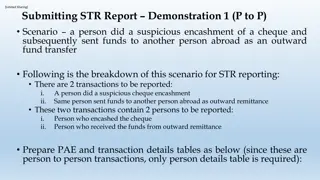

Dos Do s and Don ts when submitting a STR/SAR Submit a SAR for suspicious behavior, Provide a detailed clear trail Provide all supporting documentation (source of funds, linked accounts, due diligence details etc.) Report within a reasonable timeframe Provide a soft copy SAR form Avoid Tipping Off Audit Trail all supplemental SAR information Do maintain your SARs as per the prescribed record keeping requirements Provide your contact details to the FIA Dummy Text

Donts Do s and Don ts when submitting a STR/SAR Do not terminate the relationship intentionally prior or post raising the SAR unless there is a logical and/or unavoidable reason behind such action. Please wait for an official response from the FIA. Do not insert refer to documents attached under Source ofSuspicion. A brief explanation in the space provided is required and ALWAYS identify the suspicion clearly and concisely . Dummy Text

Corporate Service Providers Corporate Service Providers What we ve seen What we want to see Proactive reporting Reactive reporting Timely reporting (time sensitive) Late reporting Complete information Lack of supporting information C KYC / Ongoing monitoring clients Unidentified breaches Use of Internal reporting register Unaware of clients activities

Banking Sector Banking Sector What we ve seen What we want to see Proactive reporting Reactive reporting Time sensitive reporting Late reporting (6 month delays) Complete information (CDD, etc.) Lack of supporting information Better use of internal processes Incomplete responses Communication with customers Lack of dialogue with customers

Shifting from Reactive to Proactive Reporting Shifting from Reactive to Proactive Reporting Reactive Proactive Stalled investigation Enhanced analysis/investigation capabilities Loss of data and evidence Readily accessible data/evidence Investigation in other jurisdiction Better chances of convictions Reputational risk Less reputational risk Possible collapse of financial centre Enhanced client monitoring

Obligation to Financial Investigation Agency In general, a regulated person shall not carry on business with Individuals, business entities, organizations, jurisdictions, territories or states subject to United Nations or any other sanctions applicable in the jurisdiction as it is an offence. If the regulated entity receives instructions or a business request from a person or persons designated on sanction list, the compliance officer/MLRO of the regulated entity shall immediately submit Suspicious Activity Report to the Financial Investigation Agency. Dummy Text

Obligation to Governors Office (Licensing) A regulated entity must inform the Governor as soon as practicable if it knows or suspects that a customer is from a Sanctioned Nation. When reporting, the regulated entity must state: (a) the information or other matter on which the knowledge or suspicion is based, (b) any information it holds about the customer by which the customer can be identified, and (c) the nature and amount or quantity of any funds or economic resources held by the relevant regulated entity for the customer The Governor may, grant a licence authorising an activity that would otherwise be prohibited with a designated person and likewise vary or revoke the said licence. Dummy Text

Report Suspicious Activities or Transactions Organisations and Businesses are obligated to make SAR/STR. As soon as an Organisation or Business knows or suspects or has reasonable grounds to suspect that funds are the proceeds of a criminal activity , or are related to terrorist financing, it should report promptly its suspicion to the Financial Investigation Agency . Y our MLRO can send a Suspicious Activity Report to the FIA: Electronically to reportingauthority@bvifia.org by fax to 284-494-1435 by courier or hand delivered to the Financial Investigation Agency , 2nd Floor , Ritter House, Wickham s Cay II, Road T own, T ortola Dummy Text Reporting a SAR/STR protects you and your organisation/business from the risk of laundering the proceeds of crime or being used as a vehicle for terrorism financing.

Summary It is important that the Organisation and Business report Suspicious T ransactions or Suspicious Activities. Keep staff educated and informed of their obligations under the applicable legislation in order to lawfully operate within the T erritory . Implement your compliance policies and encourage a culture of compliance in your organisation. Dummy Text

Beneficial Ownership Secure Search system (BOSSs) Du m my Tex t EXPECTATIONS ACTUALS 500000 160 450000 140 400000 142 120 350000 100 300000 250000 80 200000 60 150000 40 100000 39 38 20 50000 0 0 Annual Total Annual Total 2017 2018 2019 2017 2018 2019

Beneficial Ownership Secure Search system (BOSSs) Other Facts:- Population Currently 95% as of 1 June 2019 Security of information Highest level of encryption Restricted searchability No unauthorised searching Integrity of information ALWAYS verify information Still one of a kind Duplication will eventually happen Dummy Text

THANK YOU ANY QUESTIONS? Dummy Text

Dummy Text