Partnership Final Account

Partnership final account in the case of admission of a partner in a firm involves dividing the accounting year into two periods, determining expenses and incomes, and sharing profits accordingly. Different methods like Fixed capital method and Fluctuation capital method are used for this purpose. T

1 views • 12 slides

CSUEB Hospitality Policy Overview

This overview provides information on the Hospitality Policy at CSUEB, applicable to all hospitality expenses regardless of funding source. It outlines the criteria for hospitality expenses, examples of approved activities, meeting examples covered under the policy, and expenditure limits per person

0 views • 37 slides

Mowi Q1 2024 Financial Performance Overview

Mowi's Q1 2024 presentation highlighted operational revenues of EUR 1.33 billion and operational EBIT of EUR 201 million. The quarter posed challenges for Farming Norway, while seeing strong performance in other farming countries. Operational highlights included seasonal effects on costs, record-hig

1 views • 43 slides

GPSA Travel Grant: Enhancing Professional Development Opportunities

The GPSA Travel Grant Committee provides reimbursement for graduate and professional students to achieve their professional goals by covering registration and travel costs to conferences, workshops, internships, and more. Applications are accepted during specific periods with decisions communicated

0 views • 13 slides

Year End Journal Entries

Explore the significance of year-end journal entries, their various categories like expense accruals, revenue deferrals, prepaid expenses, and revenue receivable. Understand the process for submission, key dates, and the difference between accrual and deferral entries. Discover how to handle entries

0 views • 14 slides

GPSA Travel Grant: Reimbursement for Professional Development

The GPSA Travel Grant Committee provides reimbursement for graduate and professional students to support their professional and developmental goals by covering registration and travel expenses to conferences, workshops, and more. Applications open during specific periods, and eligible expenses inclu

0 views • 13 slides

Witness Expenses and Compensation in Civil Procedure

Witnesses play a crucial role in the administration of justice, and fair compensation for their expenses, including travel costs, is a fundamental right in a civilized justice system. This article discusses the provisions in the Code of Civil Procedure for the payment of witness expenses and the sca

0 views • 25 slides

Proposed Dues Change for OPEIU Local 39: An Overview

OPEIU Local 39 is proposing changes to its dues structure from a flat rate to a percentage based on compensation, aiming for equity among members. The shift is driven by the 2019 OPEIU International Convention decision and the merger with Local 95. The new dues structure will align more fairly with

0 views • 11 slides

Understanding Net Profit Calculation in Profit and Loss Accounts

Net profit, also known as the bottom line, is a crucial indicator of a business's financial performance. It is calculated by deducting total expenses from gross profit. In the provided example for Frying Tonite, the net profit is $30,110 after subtracting expenses of $38,590 from a gross profit of $

0 views • 11 slides

Understanding Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

Understanding Financial Aid for Educational Expenses

Financial aid is assistance available to help cover educational expenses such as tuition, fees, books, supplies, and living costs while in school. It can come in the form of grants, scholarships, loans, departmental payments, veteran's benefits, and more. This assistance can cover a range of items s

0 views • 13 slides

UAMS Travel Management Guidelines FY22

UAMS Travel Management provides guidelines for submitting, processing, and approving travel expenses efficiently. The guidelines emphasize proper coding, T-card details, trip resubmission through Workflow, and the requirement of a Justification to Open Closed Trip form. Prior approvals for expenses,

0 views • 52 slides

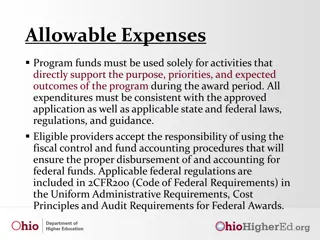

Guidelines for Allowable and Not Allowable Expenses in Program Funding

Ensure that program funds are used appropriately by adhering to guidelines that outline allowable expenses, factors affecting cost allowability, and common budget considerations. Eligible expenses include materials, professional services, transportation, and more, while not allowable costs involve i

1 views • 7 slides

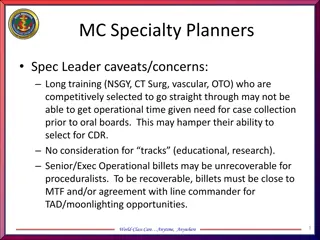

Navy MC Career Progression in Operational Medicine

This detailed presentation outlines the career pathways and operational opportunities for Navy Medical Corps specialists, emphasizing the need for a balance between clinical excellence and operational leadership. It discusses the various operational billets available at different career stages, the

0 views • 25 slides

Understanding Move Related Payments and Expenses

Explore the intricate world of move-related payments and expenses categorized by numbers (10, 20, 30, 40, 50). From fixed rate move payments to direct loss payments and ineligible moving expenses, grasp the details of items, inventories, and costs involved in relocations. Delve into the nuances of p

2 views • 52 slides

Understanding Overhead Costs in Accounting

Overhead costs are supplementary expenses that cannot be easily allocated to specific cost objects. This includes indirect materials, labor, and expenses. Accounting and control of overheads involve steps like classification, codification, collection, allocation, apportionment, absorption, under/ove

1 views • 17 slides

Understanding Sue and Labour Expenses in Marine Insurance

Explore the nuances of Sue and Labour expenses under H&M policies on German terms versus P&I insurance. Delve into the coverage of expenses, potential overlaps, salvage costs, ransom payments, and clauses dictating justified measures and necessary actions.

0 views • 29 slides

Military Service Funerals: Honoring Those Who Served

Service funerals for military personnel are arranged and funded by the armed forces, reflecting the wishes of the family. Whether following operational or non-operational deaths, the Ministry of Defence provides support and grants to assist with funeral expenses. Families can choose between a servic

0 views • 31 slides

Essential Business Travel Services and Expenses Guide

Learn about important business travel services and expenses for November 2012, covering airfare, lodging, vehicle use, conference fees, and miscellaneous expenses. Find out about per-diem rates, rental agreement options, and how to book airfare through Jackson Travel for SOU employees. Get insights

0 views • 15 slides

Understanding the UO One Card Program

The UO One Card is a corporate credit card designed for individual business travel expenses. It allows UO employees to separate personal and business expenses, streamlines expense reporting, and offers benefits like no interest fees and insurance coverage. Eligible travelers can apply through a simp

0 views • 11 slides

Kentucky Crime Victims Compensation Program Overview

Kentucky Claims Commission Crime Victims Compensation Program provides financial assistance to eligible individuals who have suffered from criminally injurious conduct. Established in the mid-1970s, this program helps victims with various expenses incurred as a result of the crime, such as medical c

0 views • 13 slides

AmpliFund Expense Reporting Guidelines

Guidelines for entering and managing expenses in AmpliFund for grant management, including specific steps for adding expenses, marking expenses for review, and ensuring accuracy in financial reporting.

0 views • 15 slides

Managing Personal Finances: Understanding Income and Expenses

Develop confidence in managing personal finances by recognizing financial concepts related to income, expenses, and financial control. Learn to distinguish between sources of fixed, variable, and occasional income, as well as fixed, variable, and occasional expenses. Understand the advantages of kee

0 views • 4 slides

Understanding Income Statements and Their Types

Income statements are crucial financial documents that showcase a company's operating performance. Single-step income statements group all revenues and expenses together for simplicity, while multiple-step statements provide intermediate subtotals for better analysis. The presentation delves into th

0 views • 15 slides

Financial Update and Budget Meeting Highlights

The financial update and budget meeting on February 6, 2014, emphasized the importance of staying focused on the mission and executing the strategy to achieve growth and financial strength. The meeting discussed operating expenses by campus, operating reserves from FY2008 to FY2014, operating fund r

0 views • 21 slides

Travel and Training Expenses Final Report Guidelines

Submit your Travel and Training Expenses Final Report correctly and on time to ensure timely reimbursement. Plan ahead, follow the approval process, and keep track of all receipts for a smooth expense reporting procedure. Remember important details such as required documentation, submission deadline

0 views • 7 slides

Lincoln Academy Financial Report and Budget Review 2020-2021

Lincoln Academy's financial report highlights a positive margin in 2019-20 but projects operational margin declines in 2020-21 due to reduced student count and increased expenses. The report discusses revenue sources, staff additions, funding changes, COVID-19 expenses, and budget flexibility amidst

0 views • 5 slides

Abellon Clean Energy Limited Comments on Draft CERC RE Tariff Regulations, 2024

Abellon Clean Energy Limited provides detailed comments on proposed regulations for waste-to-energy projects, suggesting revisions in capital cost, fuel cost, operational expenses, auxiliary consumption, interest on loan, and depreciation. The comments emphasize the need for real-time data, consider

0 views • 7 slides

Breakdown of Income & Expenses for USA Wrestling Events in South Dakota (2016-17)

The provided data details the income and expenses breakdown for sanctioned USA wrestling events in South Dakota during the operating year of 2016-17. It includes specific event information, revenue, expenses, net profits, and comparisons over the last five years. Various USA wrestling events in diff

0 views • 11 slides

Barristers Council Financial Policies and Guidelines

Detailed overview of the financial policies and guidelines for members of the Barristers Council, including approved expenses, travel reimbursement rules, and non-approved expenses. It covers essential expenses, travel arrangements, hotel accommodations, transportation costs, and pre-approval requir

0 views • 13 slides

Managing Personal Expenses - Tips and Guidelines

Understand the difference between personal expenses and payment types like PCard, learn how to handle personal expenses effectively, adhere to guidelines, and avoid misusing funds. Explore tips for managing personal expenses on PCard and ensure compliance with regulations.

0 views • 33 slides

Understanding Availability and Maintainability in Engineering

Availability and maintainability are crucial aspects in engineering, defining the system's operable state and its ability to fulfill missions. Availability is the probability of the system being operational when called for, contingent on factors such as failure occurrence, maintenance frequency, and

0 views • 74 slides

Understanding Costs in Power Sector Decision-Making

Operational, decommissioning, and investment decisions in the power sector are influenced by different categories of costs. Operational decisions focus on variable costs like fuel and CO2 expenses, while decommissioning decisions consider both variable and fixed costs. Investment decisions require a

0 views • 6 slides

C-WAM: U.S. Army Operational Wargaming Analysis Model

The Center for Army Analysis Wargame Analysis Model (C-WAM) is a manual, computer-aided, time-step, force-on-force simulation methodology used by the U.S. Army to analyze campaign-level operational courses of action. Developed over ten years, C-WAM provides a detailed understanding of theater backdr

0 views • 20 slides

SGA Budget Report 2019-2020 Overview

The SGA Budget Report for 2019-2020 provides a detailed breakdown of expenses, including employee salaries, club allocations, sports club funding, and total line item expenses. The report also highlights specific club allocations for organizations like The Westfield Voice, Circle K Club, EMS Club, a

0 views • 18 slides

Understanding Accruals and Prepayments in Accounting

Accruals and prepayments are essential concepts in accounting that ensure accurate financial reporting. Accrual basis of accounting requires recognizing income and expenses when earned or incurred, regardless of cash flow timing. Accrued expenditure represents unpaid expenses at year-end, impacting

0 views • 13 slides

Understanding Recruitment vs. Relocation Expenses

The guidance distinguishes between recruitment and relocation expenses based on the date of the signed Letter of Offer at the University of New Mexico. Recruitment expenses incurred before the offer date may be reimbursed, including house hunting costs. However, expenses incurred after signify reloc

0 views • 7 slides

Understanding Deductible Expenses in Pensions for Veterans

This detailed content explains the deductible expenses involved in pensions for veterans, outlining how specific expenses can reduce a veteran's "countable income" to determine eligibility for improved pension benefits. It covers various income considerations, recurring and nonrecurring income defin

0 views • 17 slides

Understanding the Expense Prediction Bias: Study on Underestimation of Future Expenses

Expense Prediction Bias (EPB) refers to the persistent underestimation of future expenses. Research shows that individuals tend to under-predict their future expenses due to various factors. This study explores the magnitude of EPB in an adult sample, highlighting a mean EPB of $63.58, with predicte

0 views • 28 slides

Understanding Account Codes for Business Management Specialists

This content covers the basics of account codes, including types of expenses, selecting account codes for documents, allowable expenses, and more. It delves into operating ledger categories, computer account codes, and the selection process for different expenses, providing valuable insights for fin

0 views • 18 slides