Financial Risk Evaluation: AMERIND Program Analysis

Through a comprehensive analysis of AMERIND program components like Core Values, Member Services, Competitor Comparison, Program Performance, and Sustainability, this report delves into key aspects such as risk exposure, potential liabilities, and operational efficiency. Findings highlight areas nee

1 views • 24 slides

Land Bank

Land Bank provided an update to the Select Committee on Finance on its progress since May 2022. The presentation covered areas such as financial sustainability, funding models, strategic overview, and progress made in addressing liabilities. Despite challenges, the Bank has shown improvements in fin

3 views • 33 slides

Compliance and Risk Assessment Matrix for Electrical Safety Standards

Evaluation of compliance and risk assessment methods for adherence to electrical safety standards to prevent hazards like fires and electric shocks. The matrix includes metrics, frequency of assessments, and tools used to quantify risk levels and ensure safety measures meet industry benchmarks. Non-

0 views • 4 slides

Limited Liabilities Partnership

Limited Liability Partnership (LLP) is a unique business structure that combines aspects of a traditional partnership and a limited liability corporation. It offers partners the benefits of limited liability while providing flexible management and tax options. This structure is commonly utilized by

0 views • 23 slides

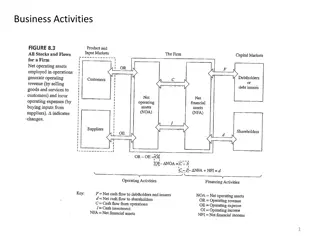

Effective Working Capital Management in Business

Working capital management is crucial for businesses to optimize cash flow and ensure operational efficiency. It involves balancing current assets and liabilities, with a focus on accounts payable, accounts receivable, inventory, and cash. Proper management of working capital is essential for busine

1 views • 9 slides

Understanding Data Use Agreements (DUAs) in Sponsored Projects Office

Data Use Agreements (DUAs) are contractual agreements between data providers and recipients, ensuring proper handling of non-public data, especially data subject to restrictions like HIPAA. DUAs address data use limitations, liability, publication, exchange, storage, and protection protocols. HIPAA

6 views • 19 slides

Insights into the Perfumery Industry in Kannauj

A presentation by the Additional Commissioner highlighting the historical backdrop and current state of the perfumery industry in Kannauj, including statistics on registered firms, tax liabilities, and the process of itra extraction. The industry plays a significant role in the region's economy, wit

0 views • 18 slides

Maximising Benefits: Tips for NRI Income Tax Returns from India to England

Non-Resident Indians (NRIs) living in England can benefit from \"Maximising Benefits: Tips for NRI Income Tax Returns from India to England\". Practical strategies and expert advice are provided to help NRIs maximise available deductions, credits, and exemptions. From understanding the intricacies o

8 views • 4 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

GASB 96: Subscription-Based Information Technology Arrangements (SBITAs) Overview

GASB 96 provides guidance on accounting for subscription-based information technology arrangements for government end users. It outlines criteria for determining control of IT assets, distinguishes SBITAs from leases, and explains the recognition and measurement of subscription liabilities and asset

0 views • 26 slides

Insurance Policy Document

\nAn insurance policy is a formal contract between an insurer and the insured, detailing the terms and conditions under which the insurer agrees to compensate the insured for specified losses, damages, or liabilities. This document outlines the various aspects of an insurance policy, including cover

1 views • 4 slides

Financial Ratio Analysis and Profitability Ratios Overview

This unit focuses on financial ratio analysis, specifically profitability ratios like gross profit margin, designed to assess a business's financial performance based on its financial statements. By comparing information such as revenues, costs, assets, and liabilities, businesses can evaluate their

1 views • 13 slides

Understanding Financial Leverage and Its Implications

Financial leverage refers to a firm's ability to use fixed financial costs to amplify the impact of changes in earnings before interest and tax on its earnings per share. It involves concepts like EBIT, EBT, preference dividends, and tax rates, and can be measured through the degree of financial lev

1 views • 7 slides

Understanding Fiduciary Duties and Relationships

Exploring the scope, liabilities, and establishment of fiduciary relationships under law and through de facto circumstances. Emphasizes the importance of acting in good faith and putting the client's interests first.

0 views • 40 slides

Understanding Marine Hull Insurance for Vessels

Marine Hull Insurance encompasses the protection of various vessels, such as ocean-going ships, fishing vessels, and more, covering damages, liabilities, and construction risks. The policy, issued for 12 months, includes Charterers Liability, Ship Repairers Liability, and indemnity for vessels under

0 views • 15 slides

Understanding Piecemeal Distribution of Cash in Partnership Dissolution

Piecemeal distribution of cash in partnership dissolution involves systematically distributing cash over stages as assets are realized and liabilities settled. Realization expenses, contingent liabilities, outside liabilities, partners' loans, and partners' capitals are settled in a specific order.

0 views • 6 slides

Minimizing Risk Exposure in Contracts

This presentation led by Sidney W. Degan, III, focuses on reducing risk exposure through contract provisions such as indemnity and additional insured clauses. It emphasizes the importance of considering anti-indemnity statutes, the role of certificates of insurance, and the implications of dealing w

0 views • 22 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

0 views • 13 slides

Areas Requiring Deeper Scrutiny in Taxation - Saravanan B., IRS

Explore the various areas necessitating closer examination in taxation, such as adjustments in income, capital gains computation, liabilities, and more. Saravanan B., an IRS official from Chennai, highlights key points for scrutiny in financial statements and profit-loss accounts.

0 views • 28 slides

Understanding the Basics of Torts in Business Law

Explore the fundamental concepts of torts in business law through an overview of various types of wrongful acts, such as interference with enjoyment, defamation, negligence, injunctions, strict liability, intentional torts, and trespass. Learn about the responsibilities and liabilities associated wi

0 views • 41 slides

Rights and Liabilities of Minors in Partnership according to Sec. 30 by Dr. Satyendra Kumar Singh

Minors can be admitted to the benefits of partnership with the consent of all partners. They have rights to share property and profits, access firm accounts, and sue for accounts. However, minors have liabilities and limitations in partnership, where their share is initially liable for firm acts but

0 views • 9 slides

OECD Due Diligence Guidance: Establish Strong Management Systems

The OECD Due Diligence Guidance outlines the importance of establishing strong management systems for responsible sourcing of minerals from conflict-affected and high-risk areas. This involves adopting company policies, engaging with suppliers, implementing grievance mechanisms, and utilizing the 3P

0 views • 13 slides

Introduction to Principles of Accounts Level 1: Basics of Accounting and Bookkeeping

Understanding the fundamentals of accounting including bookkeeping, classification of data, users of accounting information, assets, liabilities, and capital. Practice exercises to classify items and review concepts of assets, liabilities, and equity.

0 views • 24 slides

Accounting for Foreign Branches: Converting Trial Balances and Exchange Rates

A foreign branch maintains its accounts in a foreign currency, requiring the head office to convert the trial balance into its own currency before finalizing accounts. Fixed and fluctuating exchange rates impact the conversion process, with specific rules for fixed assets, liabilities, and current a

0 views • 7 slides

Understanding IAS 39: Financial Instruments Recognition and Measurement

This content provides an overview of an IFRS seminar on IAS 39, focusing on key concepts such as the classification and measurement of financial assets, impairment, reclassification, and more. It covers definitions of financial instruments, financial assets, equity instruments, and financial liabili

1 views • 43 slides

Understanding Provisions, Contingent Liabilities, and Assets in Accounting

This content covers the concept of provisions, contingent liabilities, and contingent assets in accounting, highlighting the criteria for recognizing a liability as a provision. It explains the types of obligations, the importance of a reliable estimate, and specific applications such as onerous con

0 views • 13 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Guide to Filling Out Parent's Financial Statement Section 4: Assets and Liabilities

Learn how to accurately complete Section 4 - Assets and Liabilities of the Parent's Financial Statement. This section covers details on rental payments, homeownership information, bank accounts, investments, retirement savings, and education funds. Follow the instructions provided to showcase the fa

0 views • 8 slides

Understanding Liabilities of Directors under Companies Act, 2013

Director's liabilities under the Companies Act, 2013 include definitions of directors, shadow directors, officers, and those in default. Responsibility for default and potential prosecutions for wrongful actions are discussed. Changes in definitions and concepts are highlighted to illustrate the leg

0 views • 37 slides

Understanding Final Accounts: Key Concepts and Definitions

Explore the essential key words related to final accounts such as Debtors, Creditors, Assets, Liabilities, Fixed Assets, Current Assets, Current Liabilities, Long-term Liabilities, Purchases, Sales, and Gains. These images provide a visual representation of the concepts to help you grasp the fundame

0 views • 12 slides

Understanding Net Worth: Integers and Financial Assets

Learn about net worth, liabilities, and assets by exploring how integers are used to determine the financial standing of individuals. Discover the concepts of liabilities, responsibilities, and assets through real-life examples of notable personalities. Dive into calculations and understand how net

0 views • 18 slides

Legal Provisions Regarding Affidavits and Liabilities in Financial Matters

The ARAA 2003 mandates that all plights must be supported by affidavits and payment of court fees. Affidavits are considered substantive evidence in court proceedings, allowing for judgment without witness deposition. Financial liabilities for mortgagees and guarantors are joint and several, with a

0 views • 14 slides

Understanding Reformulated Balance Sheets in Financial Analysis

Reformulated balance sheets in financial analysis involve categorizing assets and liabilities into operating and financial components for a more detailed credit analysis. This process helps differentiate between assets and liabilities used in business operations versus financing activities, providin

0 views • 17 slides

Liability of the Mediator in Mediation Processes: A Comparative Perspective

Exploring the liability aspects of mediators in various jurisdictions, this academic session discusses different types of liabilities, submitting liability claims, and scenarios where mediators may face liability issues. It delves into contractual, tortious, and criminal liabilities, examining the n

0 views • 11 slides

Understanding Directors and Officers Liability Insurance

Explore the intricacies of Directors and Officers Liability Insurance, including coverage scope, directors' duties, potential liabilities, recent cases, and Employment Practices Liability. Learn about the evolution of D&O insurance, claims trends, and premium trends. Understand wrongful acts, Compan

0 views • 21 slides

Understanding the Role and Liabilities of Promoters in Company Formation

Promotion in the formation of a company involves the initial groundwork by a promoter, who assembles funds, property, and managerial expertise. Promoters have a fiduciary duty towards the company and original shareholders, necessitating full disclosure of all material facts. They can be held liable

0 views • 20 slides

Understanding Financial Instruments in IFRS: Key Concepts and Overview

This content provides an overview of financial instruments under IFRS, focusing on their classification as assets, liabilities, or equity. It explains the presentation of compound financial instruments and outlines key concepts related to financial assets, financial liabilities, and equity instrumen

0 views • 28 slides

Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are

0 views • 34 slides

Understanding Debt Capital in Chapter 8 of Accounting for Managers

Explore the concept of debt capital and liabilities in Chapter 8 of Accounting for Managers by Professor Zhou Ning from Beihang University. Learn about the nature of liabilities, legal obligations, contingencies, and levels of likelihood in financial reporting. Discover how to differentiate between

0 views • 21 slides

Understanding Balance Sheets in Financial Management

A balance sheet is a crucial financial statement that reflects the assets, liabilities, and owner's equity of a business at a specific point in time. It provides a snapshot of the financial health of a company, helping stakeholders assess its overall standing. Assets are items of value owned by the

0 views • 9 slides