Insurance Policy Document

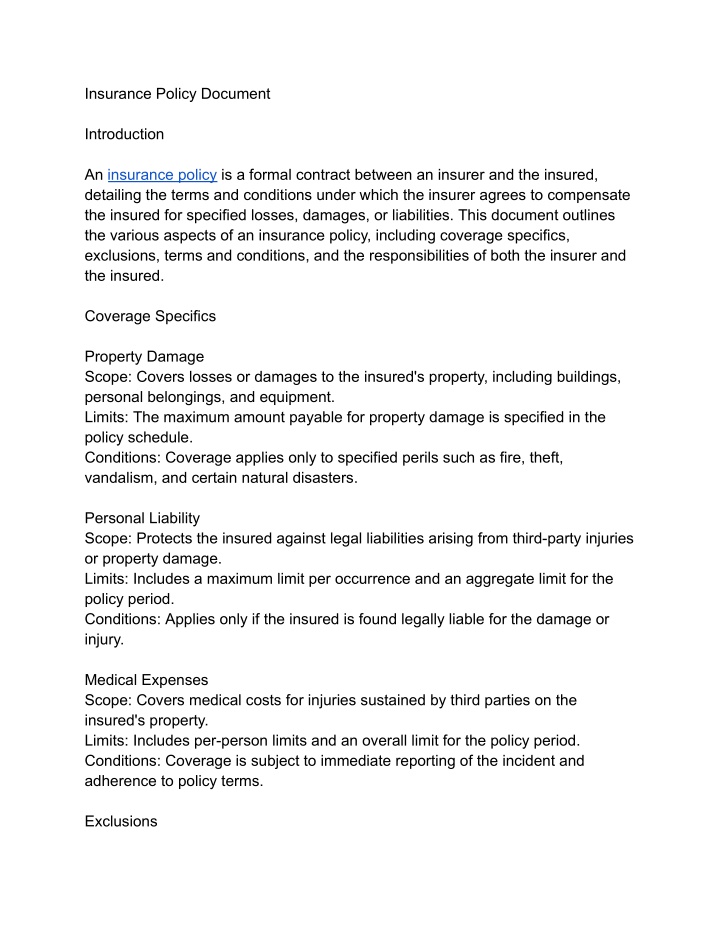

nAn insurance policy is a formal contract between an insurer and the insured, detailing the terms and conditions under which the insurer agrees to compensate the insured for specified losses, damages, or liabilities. This document outlines the various aspects of an insurance policy, including coverage specifics, exclusions, terms and conditions, and the responsibilities of both the insurer and the insured.

Uploaded on | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Insurance Policy Document Introduction An insurance policy is a formal contract between an insurer and the insured, detailing the terms and conditions under which the insurer agrees to compensate the insured for specified losses, damages, or liabilities. This document outlines the various aspects of an insurance policy, including coverage specifics, exclusions, terms and conditions, and the responsibilities of both the insurer and the insured. Coverage Specifics Property Damage Scope: Covers losses or damages to the insured's property, including buildings, personal belongings, and equipment. Limits: The maximum amount payable for property damage is specified in the policy schedule. Conditions: Coverage applies only to specified perils such as fire, theft, vandalism, and certain natural disasters. Personal Liability Scope: Protects the insured against legal liabilities arising from third-party injuries or property damage. Limits: Includes a maximum limit per occurrence and an aggregate limit for the policy period. Conditions: Applies only if the insured is found legally liable for the damage or injury. Medical Expenses Scope: Covers medical costs for injuries sustained by third parties on the insured's property. Limits: Includes per-person limits and an overall limit for the policy period. Conditions: Coverage is subject to immediate reporting of the incident and adherence to policy terms. Exclusions

Intentional Damage: No coverage for losses caused by intentional acts of the insured or beneficiaries Wear and Tear: Excludes normal wear and tear, deterioration, and mechanical breakdowns. Pre-existing Conditions: No coverage for damages or losses existing before the policy inception date. Certain Natural Disasters: Specific exclusions may include earthquakes, floods, or other catastrophic events unless expressly covered. Terms and Conditions Policy Duration and Renewal Term: The policy is typically valid for one year, with specified start and end dates. Renewal: Policies can be renewed annually, subject to underwriting approval and payment of the renewal premium. Non-renewal: Either party may choose not to renew the policy, with appropriate notice given as stipulated in the policy terms. Premium Payment Schedule: Premiums are due annually, semi-annually, or monthly, as per the policy agreement. Grace Period: A grace period of typically 30 days is provided for late payments. Non-payment: Failure to pay premiums within the grace period may result in policy cancellation. Cancellation By Insurer: The insurer can cancel the policy for reasons such as non-payment of premiums, fraud, or significant risk changes. By Insured: The insured can cancel the policy at any time, with potential refunds based on the insurer's short-rate cancellation table. Responsibilities of the Insurer Provision of Coverage: The insurer must provide coverage as detailed in the policy, subject to the policy terms and conditions.

Claims Processing: The insurer is responsible for timely processing and settlement of valid claims. Dispute Resolution: In case of disputes, the insurer must follow the resolution procedures outlined in the policy, including mediation or arbitration if necessary. Responsibilities of the Insured Premium Payments: The insured must pay all premiums on time to keep the policy in force. Maintenance: The insured is responsible for maintaining the insured property in good condition. Reporting Claims: All claims must be reported promptly, with required documentation provided to support the claim. Filing Claims Steps for Filing a Claim 1. Notification: Inform the insurer immediately after a loss or incident occurs. 2. Documentation: Provide detailed documentation, including photographs, receipts, and any relevant reports (e.g., police or fire department reports). 3. Submission: Submit the completed claim form along with all necessary documentation. 4. Investigation: The insurer will investigate the claim, which may include site visits and interviews. 5. Settlement: The insurer will determine the claim's validity and process payment if the claim is approved. Investigation Process Assessment: The insurer will assess the damage or loss to determine the extent of coverage. Verification: All provided documentation and statements will be verified for accuracy. Resolution: The claim will be resolved by either approval and payment or denial, with reasons provided for any denial. Conclusion

An insurance policy is a critical document that outlines the terms under which an insurer provides financial protection to the insured. Understanding the coverage specifics, exclusions, terms and conditions, and the responsibilities of both parties ensures that the insurance benefits can be properly utilized and that both the insurer and the insured can fulfill their obligations.