Understanding Balance Sheets and Income Statements in Financial Reporting

Balance sheets provide a snapshot of a company's assets, liabilities, and shareholders' equity at a specific point in time, with assets listed on the left and liabilities and equity on the right. Current assets are those expected to be converted into cash within a year, while non-current assets are not. Fixed assets include goods or services for production, and tangible assets like buildings, equipment, and intangible assets such as copyrights and trademarks. Current liabilities are debts due within a year.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Balance Sheet & Income Statement

Balance sheet The balance sheet is a s_______ of a company s a_____, l_______ and shareholders equity on a specific d___. napshot iabilities ssets ate

Balance sheet eft Normally on the l __ side , companies list their ______. On the r____ side they list their l________ and s__________ e_____ quity assets iabilities ight hareholders

Current assets Current assets are balance sheet accounts that represent the value of all assets that can reasonably expected to be c_______ i___ cash within a year. nto onverted

Current assets Current assets include cash and cash equivalents a_______ receivable, i________, marketable securities, p_____ expenses and other l_____assets that can be readily converted to c___. ccounts repaid nventory iquid ash

Non-Current assets Non-Current assets are assets which the company does not experct to c_____ to cash w____ a year or would take more than _ year to sell. a onvert ithin

Fixed assets roduction A fixed asset is bought for p________ or supply of g_____or s______, for r_____ to third parties or for use in an organization. oods ervices ental

Tangible vs. Intangible assets A fixed asset can include t______ items such as laptops. Buildings, r___ e____, equipment and furniture are good examples of tangible assets. angible eal state

Tangible vs. Intangible assets Intangible items, such as a c_______, t_________, p_____ or g______ (fondo de comercio) are good examples of intangible assets. opyright oodwill rademarks atents

Current liabilities Current liabilities are a company's debts or obligations that are due within _ year, appearing on the company's balance sheet and include s____ t____ debt, accounts p______ (aka t____ c______ and other debts. a hort erm ayable rade reditors

Long term liabilities Long-term liabilities, in accounting, form part of a section of the b_____ s____ that lists liabilities not due within the next ___ months. alance heet 12

Shareholders equity Shareholders' equity represents the net w____ (=value) of a company, or the amount that would be returned to shareholders if all the company's assets were l________ and all its debts r_____. iquidated orth epaid

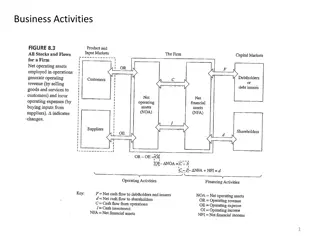

Shareholders equity We arrive at shareholders' equity by ________ a firms total liabilities ____ its total assets. It is one of the most common financial metrics employed by analysts to determine the financial value of a company. subtracting from

Income statement The income statement is a financial report that shows how much money a company e_____ and s____ over a specific time p____. eriod arned pent

The bottom line The bottom line is also known as the company sn___ income or n___ earnings. If the company s earnings are positive we can say it t_____ o__ a profit. urned ut et et

Earnings per share The financial statement also reports earnings per share (EPS) which tell you how much money a s_________ would receive if the company decided to distribute all the net e_______ for a period among its shareholders. hareholder arnings

Earnings per share Calculating EPS We a___ __ earnings per share by ___ ___ net income __ the number of shares outstanding. rrive at dividing by

Reserves or retained earnings Often times, a considerable portion of Net Income is reinvested in the business under r______ or r_______ e_______. eserves etained arnings

Lines of an income statement urnover The top line indicates t_______ or sales. The second line shows COGS (____ of _____ ____) which shows the amount of money the company spent on producing the goods it sold during the accounting period. cost goods sold

Lines of an income statement from subtracting at By _________ COGS ____ turnover we arrive __ a subtotal called g______ p_______ . rofit ross

Lines of an income statement verheads The following section deals with o________, which are fixed running expenses that support a company s operation as a whole (adminstrative personnel, research and development).

Lines of an income statement Operating expenses (aka overheads) such as marketing costs d____ from costs of sales (=COGS) because they cannot be linked directly to the production of the costs being sold. iffer

Lines of an income statement Depreciation ___________ is the process by which a company allocates an asset s costs over its useful life. Companies s______ (=allocate) the cost of these assets over the periods they are used. pread

Lines of a balance sheet The depreciation reported on the balance sheet is the accumulated or the cumulative total amount of depreciation that has been reported as expense on the income statement from the time the assets were acquired until the date of the balance sheet.

Lines of an income statement Once COGS and overheads (=operating expenses) are _______ ____ gross profit you arrive __ the EBIT (= operating profit). deducted from at EBIT s ____ __ earnings before interest and taxes tands for

Arriving at the bottom line Interest income = money companies make from i_______ in other business. (+) Interest expense = money companies paid in interest from money they b_______. (-) Income tax = also deducted (-) nvesting orrowed

How much are the companys assets worth? balance sheet The _______ _____ tells how much the company s assets ___ ____. are worth

Did the company make a profit or loss last year? ncome tatement The i______ s________ allows the company directors __ determine _ the company _____ a profit or loss last year. made to if

How well did the company perform? rofit oss The p___ and l____ account lets the shareholders see how well the company _____________. (has) performed

What does the company owe? alance heet The b______ s____ lets shareholders know what the company o____. wes

What does the company own? The balance sheet provides infomation about what the compay o____ . wns

Is the company doing well? ncome tatement The i______ s________ enables the shareholders __ see whether the company is ____ ____ doing well to

How much has the company borrowed from banks? alance heet The b______ s____ indicates how much money the company ____________ from banks. has borrowed

How much did the company spend on producing the goods it sells? rofit oss The P___ and L___ Account helps the Production Manager to determine ____ _____ the company _______ producing goods it sells. how much spent on