Understanding Balance Sheets in Financial Management

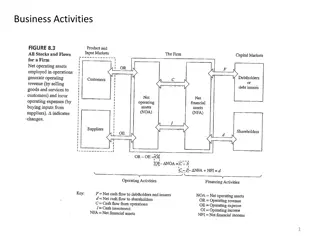

A balance sheet is a crucial financial statement that reflects the assets, liabilities, and owner's equity of a business at a specific point in time. It provides a snapshot of the financial health of a company, helping stakeholders assess its overall standing. Assets are items of value owned by the business, liabilities are debts owed, and owner's equity represents the net worth. The balance sheet is prepared annually but can be generated at any time for decision-making and analysis purposes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

BALANCE SHEET FINANCIAL MANAGEMENT AND COST ACCOUNTIG DBM-422) A K JHA

INTRODUCTION A Balance Sheet is prepared from the Real and Personal Accounts. The Balance Sheet summarises the financial status of a business at a point in time. It contains summary of assets, liabilities and shows the owners equity. It estimates net worth or owners equity. Most transactions affect the Balance sheet and thus, it may change every day.

PURPOSE OF A BALANCE SHEET To provide information on Financial Status/ condition of a business at a given date/ point in time. It includes everything that is Owned and Owed by a business or individual at a given point in time. Anything having value and owned by the business or individual is an asset. Liabilities are any debt or financial obligation owed to someone else or outsider. It is the Owner s Equity that matters. Owner s equity or net worth is the amount invested in the business by the owner or proprietor. Owner s Equity = Total Assets Total Liabilities

PREPARING A BALANCE SHEET Balance Sheets are mostly prepared at the end of the financial year or accounting period. Although it can be prepared anytime, if required Represents both end of the year and beginning of the year. The losing balance of previous year as opening balance of current year. This is for comparison purpose and analysis.

GENERAL FORMAT OF A BALANCE SHEET Assets Liabilities Current Assets Other Assets Rs XXX Rs XXX Current Liabilities Other Liabilities Rs XX Rs XXX Total Assets Rs XXX Total Liabilities Rs XXX Owner s Equity Total Liabilities and Owner s Equity Rs XXX Rs XXX

ASSETS An asset can be sold to generate additional income. Current assets are the goods which have already been produced and which can be sold quickly without disrupting future production activities. Grains Cash Non Current Assets/Others Assets Machinery Equipment Building , etc.

Classification of Assets 1.Fixed Assets: Fixed assets have long life i.e. more than one year, acquired and held permanently in business .They are used for purpose of earning profits and they are not for sale.e.g. Land, machinery. Tangible assets: Which can be seen, touched etc. e.g. Machinery, building Intangible assets: those which cannot be seen and touched and seen e.g. Patent, Trade Mark etc. 2. Current Assets: These are assets which can be converted into cash a short period of time. e.g. Cash at bank, debtors, Investment etc. 3. Fictitious Assets: These are not real assets and are fictitious in nature. These are unwritten losses or Shares of Debentures, heavy advertisement expenses, etc. Fictitious assets although intangible and hence are worthless items. All such expenses have debit balances and are to be written off through Profit and Loss Account, slowly during future years and unwritten off portion of such expenses appear in Balance Sheet. 4.Wasting Assets : Assets that lose value through wear and tear or constant use, for instance ,mines, quarries etc. Natural resources like timber land, mineral, deposits, oil reserves etc, can or use etc. Once coal has been taken out from mine new coal could not be generated so mine is treated as wasted assets.

LIABILITIES An obligation or outsider s claim Current Liabilities: Need to be paid within a year. Accounts payable Principal and accumulated interest on short-term loans Principal payments on long-term loans to be paid Noncurrent Liabilities: Which are not required to be paid in full within the year.

OWNER EQUITY The amount of money remained or left with the owner, if the assets are disposed of and all liabilities are paid. It is the balance left after deducting the total value of liabilities from the total vaule of assets. It is also called the net worth It depicts the owner s existing investment in he business. Owner s Equity = Total Assets Total Liabilities