Understanding Reformulated Balance Sheets in Financial Analysis

Reformulated balance sheets in financial analysis involve categorizing assets and liabilities into operating and financial components for a more detailed credit analysis. This process helps differentiate between assets and liabilities used in business operations versus financing activities, providing valuable insights for equity analysis and overall financial evaluation.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

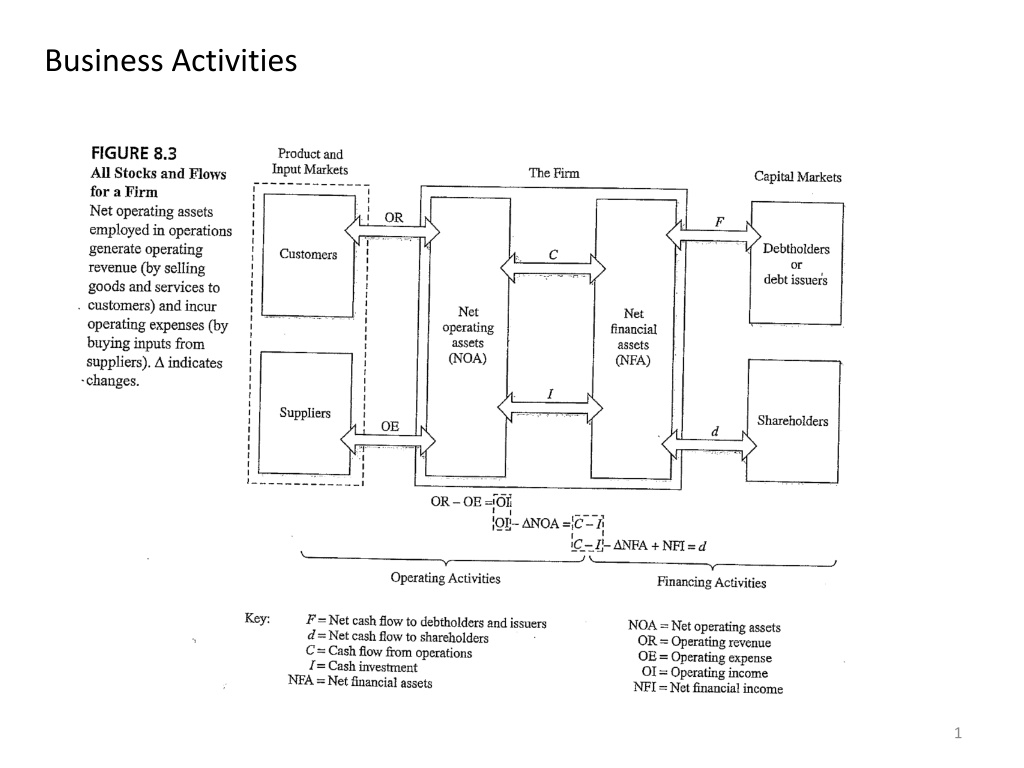

Reformulated balance sheet Published balance sheets list assets and liabilities, usually classified into current and long-term categories This division is useful for credit analysis For equity analysis, it is more useful to reformulate the balance sheet into operating and financial assets and operating and financial liabilities Operating assets and liabilities : assets and liabilities used in the business of selling to customers; involves customers and suppliers Financing assets and liabilities : assets and liabilities used in the financing of the business; involves trading in capital markets 2

Balance Sheet Assets Liabilities and Equity Operating assets OA Operating liabilities OL Financial assets FA Financial obligations FO Common stockholders equity CSE Total assets OA+FA Total claims OL+FO+ CSE Reformulated Balance Sheet Operating Assets Financial Obligations and Owners Equity Operating assets OA Financial obligations FO Operating liabilities (OL) Financial assets (FA) Net financial obligations NFO Common stockholders equity CSE Net operating assets NOA Total claims NFO+ CSE 3

Reformulated Balance Sheet Assets Liabilities and Stockholders Equity Financial assets: Financial liabilities: Cash equivalents Short-term borrowings Short-term investments Current maturities of long-term debt Short-term notes receivable Short-term notes payable Long-term debt investments Long-term borrowing (bank loans, bonds payable, notes payable) Lease obligations Preferred stock Operating assets: Operating liabilities: All else All else Minority (noncontroling) interest Common equity 4

Net operating assets (NOA) = OA OL NOA also sometimes referred to as enterprise assets If FA > FO: Net financial assets (NFA) = FA FO Common shareholders equity (CSE) = NOA + NFA Usually FA < FO: Net financial obligations(NFO) = NFA Common shareholders equity (CSE) = NOA NFO NFA/NFO also sometimes referred to as net debt 5

Reformulated income statement The income statement reports profits and losses that NOA and NFA have produced over a given period The reformulated statement groups these items into operating and financing categories Includes dirty-surplus items from the statement of shareholders equity 6

Reformulated Income Statement Operating revenue OR Operating expense (OE) Operating income OI Financial expense XX Financial income (XX) (NFE) Comprehensive income CI 7

Reformulated Comprehensive Income Statement Net sales - Expenses to generate sales Operating income from sales (before tax) - Tax on operating income from sales (4) Operating income from sales after tax +/- Other operating income (expense) requiring tax allocation (1) - Tax on other operating income +/- After-tax operating items (3) Operating income (after tax) - Net financial expenses after tax (2) - Minority interest = Comprehensive income to common shareholders 8

(1) Other operating income (expense) requiring tax allocation Restructuring charges Asset impairments Merger expenses Gains and losses on asset sales Gains and losses on security transactions Taxes have to be calculated on these items 9

(2) Net financial expenses after tax + Interest expense Taxes have to be calculated on these items - Interest revenue +/- Realized gains and losses on financial assets = Net taxable financial expense before tax - Tax benefit from net financial expenses = Net taxable financial expenses after tax +/- Gains and losses on debt retirement Will come from reformulated shareholders equity +/- Dirty-surplus financial items +/- Hidden dirty-surplus financing items 10

(3) After-tax operating items Equity share in subsidiary income Operating items in extraordinary income Dirty-surplus operating items Hidden dirty-surplus operating items These items are already after-tax 11

(4) Tax on operating income from sales + Tax as reported Will come from (2) + Tax benefit from net financial expenses Will come from (1) - Tax allocated to other operating income 12

Reformulated statement of shareholders equity The statement of owners equity gives the reconciliation of beginning and ending owners equity The reformulated statement groups these items into (1) transactions with shareholders and (2) comprehensive income 13

Reformulated Statement of Common Shareholders Equity Beginning book value of common equity + Net effect of transactions with common shareholders + Capital contributions (share issues) - Share repurchases - Dividends = Net cash contribution (negative net dividends) + Effect of operations and non-equity financing + Net income (from income statement) + Other comprehensive income - Preferred dividends = Comprehensive income available to common shareholders Closing book value of common equity 14

Beginning/Closing book value of common equity must be adjusted for: (-) preferred stock, unless it is reported outside of shareholders equity, such as redeemable preferred stock (-) noncontrolling (or minority) interests (+) dividends payable 15

Comprehensive income = Net income + other comprehensive income Other comprehensive income arises because of dirty surplus accounting Dirty surplus accounting is the practice of reporting income items in the statement of shareholders equity rather than in the income statement. Dirty surplus items are unrealized gains and losses in assets and/or liabilities due to changes in market prices Unrealized gains and losses on securities available for sale Foreign currency translation gains and losses Gains and losses on derivative instruments Changes in assets and liabilities due to pensions and postemployment benefits All dirty surplus income items are reported on an after-tax basis 16

Dirty surplus items Operating income items Changes in accounting for contingencies Additional minimum pension liability Tax benefits of loss carryforwards acquired Tax benefits of dividends paid to ESOPs Unrealized gains and losses on equity securities available for sale Foreign currency translation gains and losses Gains and losses on derivative instruments designated as cash flow hedges Some adjustments of deferred tax valuation allowances Change in funding status of pension plans Restatement of prior years income due to a change in accounting principles Financing income (or expense) items Preferred dividends Unrealized gains and losses on debt securities available for sale 17