Filing a Candidate’s Statement of Organization

The process of filing a Candidate's Statement of Organization (CFA-1) in Indiana. Understand the deadlines based on the salary for the elected office and the campaign finance committee requirements.

1 views • 10 slides

RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

Online Consumer Complaint Filing and Response Process in India

Learn how to file a consumer complaint online and write a response as an opposite party in Consumer Forums of India through the Edaakhil portal. Understand the steps for registration, login, and filing a response for approved complaints and responses. Discover how to search for cases and access case

4 views • 15 slides

Online Application Filing Guide for Consumer Complaints in India

Learn how to file complaints at Consumer Commissions of India online through the E-daakhil portal. Explore steps for filing applications, searching by reference number, conducting an advanced search, viewing case details, and submitting applications with necessary documents.

3 views • 13 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Navigating Hart-Scott Act Filing Requirements (2024)

This guide provides an overview of the HSR filing process, including reportable transaction thresholds, exemptions, and filing requirements. It explains the key aspects like size-of-the-transaction test, size-of-the-persons test, types of transactions involved, and the valuation of voting securities

4 views • 60 slides

Process for Filing a Petition for Divorce in India

Filing a Petition for Divorce in India\n\nFiling a Petition: The divorce process in India begins with the crucial step of filing a petition. This is the formal action taken by one spouse, known as the petitioner, to initiate the legal proceedings for divorce. The petition is filed in the appropriate

0 views • 4 slides

Simplifying Income Tax Filing_ A Friendly Guide

Get expert income tax return filing service providers in Punjagutta, Begumpet, Banjara Hills, Hyderabad. We offer online tax filing, ITR filing and tax preparation services.

1 views • 2 slides

ITR filing services in Udaipur

ITR filing services in Udaipur, provided by the renowned company CA Vatsalya Soni, offer comprehensive and expert assistance to individuals and businesses in navigating the complexities of income tax returns.

0 views • 1 slides

Virginia ACA Carrier Teleconference 2025: Important Updates and Deadlines

The teleconference scheduled for today covers a range of important topics for the 2025 plan year in Virginia, including critical dates, rate filing information, new benchmark and Essential Health Benefits (EHBs), mental health parity, compliance binder filing reminders, the Commonwealth Health Reins

2 views • 26 slides

Unemployment Benefits and Resources for Workers

Provides information on unemployment insurance programs, benefits, and resources for workers who lost their jobs or had hours reduced. Discusses the unemployment insurance program, online certification, and filing a claim process. Connects to federal, state, and local resources for employment and tr

0 views • 26 slides

Benefits of filing the Return of Income

Filing your Return of Income (ROI) is crucial for compliance and offers benefits like improved credit scores, visa application support, loss carryforward, and tax refunds. The best time to file is by the due date, with necessary documents such as For

1 views • 3 slides

Understanding the Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Understanding HSR Filing Requirements and Process

This resource provides guidance on the Hart-Scott-Rodino (HSR) Act filing requirements and process for companies engaging in reportable transactions. It covers HSR overview, transaction types, valuation of voting securities, and contact information for legal counsel. The guide emphasizes the importa

0 views • 60 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Guide to Filing for Conservatorship in Fresno, CA Probate Court

Comprehensive guide on filing for conservatorship in Fresno, CA Probate Court, covering basics, costs, required forms, service procedures, and due diligence efforts. Detailed information on the process including filing location, fees, required documents, and serving requirements. Includes tips on du

0 views • 22 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Critical Load Status of Water and Sewer Facilities - Filing Requirements and Impacts

Water and wastewater utilities in Texas are required to provide critical load status information to various entities by November 1, 2021. The Senate Bill 3 of the 87th Legislature outlines the filing requirements and impacts on electric utilities and Retail Electric Providers (REPs). The process inv

2 views • 4 slides

Comprehensive Guide to Filing in Business Organizations

Filing is essential for maintaining records in business organizations. It involves systematic arrangement of documents for easy access and reference. The objectives, functions, and importance of filing are discussed in this informative guide.

0 views • 16 slides

Trust Income Computation and Application Guidelines

Learn about income computation of trusts using ITR-5 vs. ITR-7, types of institutions, components of income, application of income, and important guidelines including amendments by FA2022 for charitable and religious trusts.

0 views • 47 slides

Efficient Office Document Management Practices

Explore the key aspects of office document management, including filing and indexing systems, classification of records, steps in the record cycle, and the functions of filing and indexing. Learn how to organize, store, retrieve, and dispose of documents effectively to ensure operational efficiency.

1 views • 26 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Texas DWC Medical Fee Dispute Resolution Overview

The Texas Department of Insurance, Division of Workers Compensation offers Medical Fee Dispute Resolution (MFDR) services to help healthcare providers resolve disputes with insurance carriers over medical bills. MFDR specializes in DWC medical fee guidelines, billing policies, and reimbursement calc

0 views • 24 slides

Security and Authentication in Electronic Filing Systems: Arkansas Subcommittee Report

Explore the subcommittee report on security and authentication in electronic filing systems for campaign and finance reports in Arkansas. Learn about user authentication, risks, mitigation strategies, and approaches used in other states. Discover the filing processes in both paper and electronic for

0 views • 24 slides

Streamline GST Filing with CMA Data Software

For businesses operating in India, navigating the complexities of the Goods and Services Tax (GST) can be a time-consuming and error-prone process. Managing invoices, calculating tax liabilities, and filing returns accurately all contribute to the ad

3 views • 5 slides

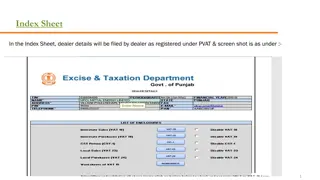

Overview of Dealer Details Filing Procedures Under Different Forms

This content outlines the process for dealers to file various details under different forms such as Index Sheet, VAT-18, VAT-19, CST Form, VAT-23, VAT-24, Worksheet-4, Worksheet-5, and Worksheet-6. With the arrival of GST, changes in the filing requirements have been highlighted, emphasizing the imp

0 views • 10 slides

Effective Strategies for Document Removal Orders in Filing Offices

This presentation delves into court-ordered removal of filings, specifically focusing on expungement orders. It distinguishes what removal entails and what it does not address, offering guidance on addressing fraudulent or improper filings. The discussion includes maintaining the ministerial role of

0 views • 14 slides

Understanding the California Supreme Court Review Process

Explore the workings of the California Supreme Court in considering petitions for review, filing statistics, and the challenges faced by litigants seeking review. Learn about the criteria for selecting petitions, filing statistics, and client considerations in pursuing a petition. Discover the small

0 views • 14 slides

Understanding Life Insurance Claims

Filing life insurance claims can be confusing, but with the right knowledge, you can ensure a smooth and timely payout. This guide walks beneficiaries through the essential steps, including gathering documents, filing claims, and working with insuran

0 views • 4 slides

Understanding Late Filing Penalty Appeals and Reasonable Excuses

Explore the process of appealing late filing penalties with HMRC, including what constitutes a reasonable excuse. Learn about common scenarios accepted as reasonable, as well as those that won't be considered valid reasons. Understand the importance of taking reasonable care in meeting tax obligatio

0 views • 21 slides

Understanding Gift Tax Returns: A Comprehensive Overview

This presentation covers the basics of preparing and filing federal estate and gift tax returns. It explains who is required to file Form 709, what constitutes a gift, when to file, and exceptions to gift tax filing requirements, providing a fundamental understanding for individuals involved in esta

0 views • 27 slides

Latest Amendments Under Refund FA 2022 and Inverted Duty Structure in GST Law

Latest amendments under Refund FA 2022 include extension of time limit for filing refunds, addressing inverted duty structure issues, and procedural changes for various refund scenarios under GST law. The amendments aim to streamline refund processes and provide relief to taxpayers. The changes also

0 views • 59 slides

Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virgi

0 views • 19 slides

Election Filing Deadlines and Procedures for 2024

Detailed information on candidate filing deadlines and procedures for the 2024 election season, covering key dates for filing, deadlines for petitions, withdrawals, challenges, and ballot vacancies for Democratic, Republican, and Libertarian parties in Indiana.

0 views • 10 slides

Louisiana Department of Revenue Electronic Filing Guidelines

This content provides a comprehensive overview of the electronic filing process for individual income tax returns with the Louisiana Department of Revenue. It covers important details such as filing requirements, third-party filings, ERO application procedures, retention of paper documents, and more

0 views • 30 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Guide to Filing 2015 Federal Tax Return with 1040NR-EZ Form

Learn about filing your 2015 Federal Tax Return using the 1040NR-EZ form, including guidance on completing the form, using tax preparation software, and determining eligibility. Understand the criteria for completing the 1040NR-EZ form and find resources to help you navigate through the tax filing p

0 views • 78 slides

Intent to Register for Courses at Western University - Important Information

Ensure you successfully complete your Intent to Register process for courses at Western University from March 1st to April 2nd. Follow steps outlined, review academic requirements, submit online forms by the deadline. Check eligibility, and register for courses via student portal. Learn how to use t

0 views • 31 slides

Understanding UCC Article 9 Filing System

The UCC Article 9 filing system plays a crucial role in perfecting security interests and providing public notice for creditors' rights adjustments. It emphasizes the importance of proper filing, searchers' due diligence, and the neutral role of the filing office in maintaining accurate records. Key

0 views • 40 slides

Understanding the E-Filing Process for Guardianship/Probate

Explore the e-filing procedure and process for guardianship/probate cases, covering document formats, form/template modifications, and designations of emails for pro se parties and unrepresented individuals. Learn about acceptable document formats, necessary modifications, and recommendations for em

0 views • 17 slides