Understanding Late Filing Penalty Appeals and Reasonable Excuses

Explore the process of appealing late filing penalties with HMRC, including what constitutes a reasonable excuse. Learn about common scenarios accepted as reasonable, as well as those that won't be considered valid reasons. Understand the importance of taking reasonable care in meeting tax obligations to avoid penalties.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

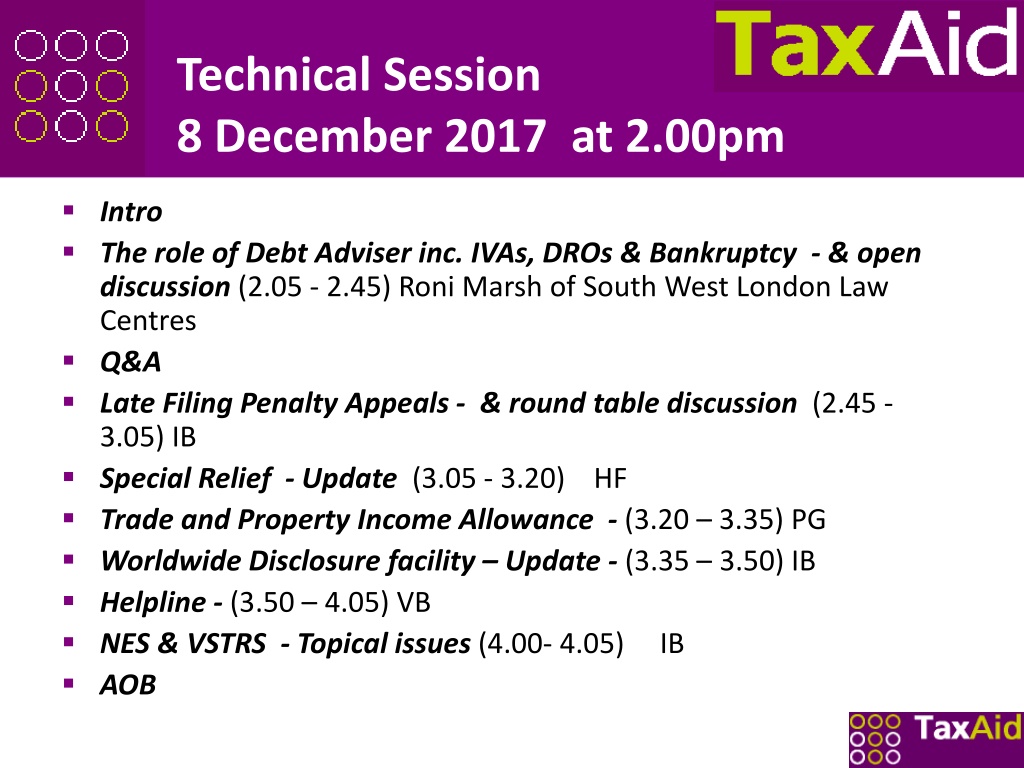

Technical Session 8 December 2017 at 2.00pm Intro The role of Debt Adviser inc. IVAs, DROs & Bankruptcy - & open discussion (2.05 - 2.45) Roni Marsh of South West London Law Centres Q&A Late Filing Penalty Appeals - & round table discussion (2.45 - 3.05) IB Special Relief - Update (3.05 - 3.20) HF Trade and Property Income Allowance - (3.20 3.35) PG Worldwide Disclosure facility Update - (3.35 3.50) IB Helpline - (3.50 4.05) VB NES & VSTRS - Topical issues (4.00- 4.05) IB AOB

Late Filing Penalty Appeals Refresh HMRC s view (Next 3 slides) Can appeal in writing - SA370 (SA371 for P ships) or by signed letter Can also appeal online TaxAid experience - KANA results Round table discussion What to do? Appeals via KANA outcomes/trends Client appeal independently Appeal via NES

HMRC view: Late Filing Penalty Appeals What may count as a reasonable excuse A reasonable excuse is something that stopped you meeting a tax obligation that you took reasonable care to meet, for example: your partner or another close relative died shortly before the tax return or payment deadline you had an unexpected stay in hospital that prevented you from dealing with your tax affairs you had a serious or life-threatening illness your computer or software failed just before or while you were preparing your online return service issues with HM Revenue and Customs (HMRC) online services a fire, flood or theft prevented you from completing your tax return postal delays that you couldn t have predicted delays related to a disability you have You must send your return or payment as soon as possible after your reasonable excuse is resolved.

HMRC view: Late Filing Penalty Appeals Doesn t count as a reasonable excuse The following won t be accepted by HMRC as a reasonable excuse: you relied on someone else to send your return and they didn t your cheque bounced or payment failed because you didn t have enough money you found the HMRC online system too difficult to use you didn t get a reminder from HMRC you made a mistake on your tax return

HMRC: Late Filing Penalty Appeals reasonable care Definition of Reasonable fair and sensible, appropriate; moderate. Synonyms: logical, fair, fair-minded, just, equitable, decent. But: reasonable care is narrowly drawn/interpreted by HMRC Julian Stafford points out, HMRC approach the reasonableness test on the basis that the excuse presented has to be cast-iron , copper-bottomed . See published guidance SA370 notes Tribunals are able to take a much broader view of the facts including oral testimony.

Special Relief Update - HF See handout HF email

Trade and Property Income Allowance - PG The basics: Tax allowances for property and trading income introduced from 6 April 2017 For individuals of 1,000 each will take effect from the tax year 2017/18. The new tax allowances for property and trading income cover all of an individual s relevant income (before expenses) then they will no longer have to declare or pay tax on this income. Those with higher amounts of income will have the choice, when calculating their taxable profits, of deducting the allowance from their receipts, instead of deducting the actual allowable expenses. The trading allowance will also apply for Class 4 National Insurance contribution purposes. The new allowances will not apply to partnership income from carrying on a trade, profession or property business in partnership.

Worldwide Disclosure Facility Background Over 100 countries have committed to exchange information on a multilateral basis under the Organisation for Economic Co-operation and Development Common Reporting Standard (CRS). The CRS dramatically increases international tax transparency. The facility opened on 5 September 2016 final chance to come forward to disclose a UK tax liability that relates wholly or partly to an offshore issue can use the facility. An offshore issue includes unpaid or omitted tax relating to: income arising from a source in a territory outside the UK assets situated or held in a territory outside the UK activities carried on wholly or mainly in a territory outside the UK anything having effect as if it were income, assets or activities of a kind described above Digital facility

Worldwide Disclosure Facility (WDF) TaxAid callers & the WDF [] The letter

Helpline Opening hours Recruitment of Volunteer Helpline Advisers GDPR Digital Solutions Helpline User Pack and Routes to Resolution You cant stop the waves .. You can t stop the waves .!

Helpline Routes to Resolution London Appointments and Outreach appointments Enquiry appointments Transfers to NES FTTS Deloitte Pilot You cant stop the waves .. You can t stop the waves .! Corporation Tax and VAT

Direct Call or Walk In Referral from organisation Referral from friend or family Vulnerable Assisted by other service: Support services, social services, mental health services Often multiple problems

Organisation and Borough dependant Face2Face, Telephone or Online Advice Referral to other internal services Referral to other external services Use of volunteers for issues not covered

Emergency Check: court, response deadlines Financial Statement Creditor List Priority and non-priority debts Personal Circumstances Bank Account Financial Capability Assessment Grant Assesment Debt Options

Negotiations + Rent/Mortgage Benefits, Discretionary Housing Payment Council Tax Enforcement Agents, Prison risk, 13A Reduction applications Gas and Electric Direct payments, Grants, prepayment meters Court Fine Direct Deductions, New hearing Tax Tax code change, write off

Take No Action Write Offs Payment Holiday/Moratorium Negotiated Agreement with Creditors Debt Reorganisation/Consolidation Loan/Equity Release Debt Management Plan (DMP) Full and Final Settlement Voluntary Charge

Administration Order Debt Relief Order Bankruptcy Individual Voluntary Arrangement