Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Understanding Concepts of National Income in Economics

Explore the concepts of national income presented by Dr. Rashmi Pandey, covering key indicators such as Gross National Product (GNP), Gross Domestic Product (GDP), Net National Product (NNP), Net Domestic Product (NDP), Personal Income, Disposable Income, Per Capita Income, and Real Income. Gain ins

0 views • 22 slides

Understanding National Income and Its Importance in Economics

National income is a crucial measure of the value of goods and services produced in an economy. It provides insights into economic growth, living standards, income distribution, and more. Concepts such as GDP, GNP, Personal Income, and Per Capita Income help in understanding the economic health of a

5 views • 14 slides

Understanding Segmented Income Statements and the Contribution Approach

Segmented income statements help analyze segment profitability, make decisions, and measure segment manager performance. This approach involves traceable fixed costs, common fixed costs, and segment margins. Segment margin represents profitability after covering all costs associated with the segment

2 views • 16 slides

Understanding Primary Market Rights Issue in Securities Market

Rights issue in the primary market allows existing shareholders to purchase additional securities at a discounted price. This presentation covers the overview, types of securities offered, key terms, key documents, application processes, and allotment status. It is intended for educational purposes

0 views • 35 slides

Understanding Valuation of Fixed Income Securities

Explore the valuation process for fixed income securities like bonds with a focus on characteristics, capitalization of cash flows, and bond yields. Learn about the features of fixed income securities and how to calculate their present value based on cash flows and discount rates.

0 views • 9 slides

Understanding Income Tax in India: Gross vs Total Income

In India, income tax is calculated based on the total income or taxable total income. The gross total income includes earnings from all sources like salary, property, business, and capital gains. Various additions such as clubbing provisions, adjustments for losses, unexplained credits, investments,

0 views • 7 slides

Understanding Tax Obligations and Assessable Income in Australia

In Australia, residents are taxed on worldwide income while non-residents are taxed only on Australian-sourced income. The tax liability is calculated based on taxable income, tax offsets, other liabilities like Medicare levy, and PAYG credits. Assessable income includes employment income, super pen

1 views • 13 slides

Understanding the Significance of Capital Market in Finance

Capital Market plays a crucial role in facilitating long-term finance for companies and governments, offering avenues for investors, promoting economic growth, and ensuring stability in securities. It encompasses functions like fund mobilization, capital formation, and technological advancement. Wit

0 views • 11 slides

Accounting Treatment of Casual Incomes and Interest on Securities in Income Tax

This content discusses the accounting treatment of casual incomes and interest on securities in income tax, presented through two problems with solutions. The first problem involves computing income from other sources based on lottery winnings and betting amounts. The second problem deals with calcu

0 views • 13 slides

Understanding Lipids: Waxes, Fats, and Fixed Oils

Lipids are organic compounds like waxes, fats, and fixed oils found in plants and animals. Fixed oils are reserve food materials, while fats are solid at higher temperatures. These substances are esters of glycerol and fatty acids, with various components giving them unique properties and flavors. C

0 views • 20 slides

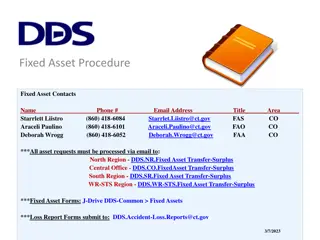

Fixed Asset Management Procedures and Contacts Overview

This document provides an overview of fixed asset management procedures, contacts, categories, and responsibilities within the State of Connecticut. It covers the definition of fixed assets, capital vs. controllable equipment, receiving new assets, inventory audits, asset management responsibilities

0 views • 15 slides

Understanding Dematerialisation in Securities Market

Dematerialisation is the conversion of physical securities into electronic form, making it convenient and secure for investors. This presentation covers the process, prerequisites, and steps involved in dematerialising securities, along with examples of securities that can be dematerialised. It also

1 views • 39 slides

Listing of Securities in Stock Exchange: Requirements and Obligations

Understanding the process of listing securities in a stock exchange involves fulfilling specific conditions before listing, such as offering shares to the public and having a broad-based capital structure. Obligations post-listing include paying annual listing fees, complying with exchange regulatio

1 views • 12 slides

Understanding the Importance of Money Markets and Bond Markets

Money markets play a crucial role in the financial system by providing short-term, low-risk, and liquid investment options. Participants include institutional investors and dealers who engage in large transactions. Money market securities have specific characteristics, such as large denominations, l

0 views • 23 slides

Introduction to Lipid Biosynthesis and Fixed Oils in Pharmacognosy Lecture

In this lecture by Asst. Prof. Dr. Ibrahim Salih, the focus is on lipid biosynthesis, specifically the three phases involved: glycerol formation, fatty acid biosynthesis, and triglyceride production. The classification of fixed oils into drying, semi-drying, and non-drying categories based on their

0 views • 13 slides

Next Generation Digital Data and Processing Standard in Financial Trade

ISDA CDM (Common Domain Model) presents a higher-order financial trade data and contract model with advantages over FpML/FIX. It offers fully described business events, data, and processing standards, capturing life cycle events across various products along with participants. The model includes bui

0 views • 4 slides

Overview of Indian Capital Market and Financial Institutions

The Indian Capital Market comprises securities market and financial institutions, facilitating the trading of government securities, industrial securities, and providing medium to long-term funds. Financial intermediaries like merchant bankers, mutual funds, and venture capital companies contribute

0 views • 5 slides

Understanding Income from House Property in Taxation

House property income refers to rent received from properties owned by an individual, charged under income tax. It is based on the concept of annual value, representing the expected rental income or market value of the property. The annual value is taxable under the head "Income from House Property.

1 views • 12 slides

Understanding Income Tax Law and Practice with Dr. C. Saffina

Dive into the realm of Income Tax Law and Practice hosted by Dr. C. Saffina, Assistant Professor of Commerce, as the concept of income from other sources is explained. Explore what is taxable income, such as dividends, interest on securities, and winnings from gambling, and learn how to compute inco

0 views • 14 slides

Role of Securities Firms and Investment Banks in Financial Markets

Securities firms and investment banks play a vital role in facilitating the transfer of funds between suppliers and users in financial markets with efficiency and low costs. Investment banks assist businesses and governments in raising funds through securities issuance, while securities firms aid in

0 views • 26 slides

Understanding Absorption and Marginal Costing in Accounting

Absorption costing, also known as full costing, encompasses all costs including fixed and variable related to production. It aids in determining income by considering direct costs and fixed factory overheads. Meanwhile, marginal costing focuses on only variable manufacturing costs and treats fixed f

1 views • 14 slides

Understanding Capital Market and Its Significance

Capital market refers to the market for long-term finance where financial assets like Shares, Debentures, and Bonds are traded. It plays a vital role in mobilizing funds for companies and governments, facilitating capital formation, and promoting economic growth. The classification includes Industri

0 views • 11 slides

Overview of Income Tax Authorities in India

The Income Tax Act in India empowers the Central Government to levy taxes on all income except agricultural income. The Income Tax Department, governed by the Central Board of Direct Taxes, plays a crucial role in revenue mobilization. Understanding the functioning, powers, and limitations of tax au

0 views • 14 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Private Placement of Securities: Overview and Methods to Raise Capital

Private placement of securities involves offering securities to a select group of investors by a company, excluding public offering. This presentation covers the meaning of private placement, provisions of law, methods to raise capital through private placement, and understanding the Private Placeme

3 views • 16 slides

Understanding Clubbing of Income in Taxation

Clubbing of income refers to including another person's income in the taxpayer's total income to prevent tax avoidance practices like transferring assets to family members. This concept is addressed in sections 60 to 64 of the Income Tax Act. Key terms include transferor, transferee, revocable trans

1 views • 16 slides

Overview of the Securities and Exchange Board of India (SEBI)

The Securities and Exchange Board of India (SEBI) was established in 1992 to regulate and promote the development of the securities market. SEBI aims to protect investor interests, prevent malpractices, and ensure a fair and transparent market. Through its objectives, SEBI plays a crucial role in re

0 views • 5 slides

The Rise and Fall of Bernard Madoff and His Securities Firm

Bernard Lawrence Madoff, a former prominent figure in high finance, founded Madoff Securities and revolutionized the securities market. However, his firm's success was built on a fraudulent scheme that collapsed in 2008, causing immense losses to investors.

0 views • 20 slides

Understanding Fixed Income Securities: Bonds Overview

Learn about fixed income securities in week 2 of the Fundamentals of Investment course, focusing on bond characteristics, types, and risks. Bonds are vital debt instruments issued by organizations to raise funds, with features like fixed maturity dates and interest rates. Explore various bond types

0 views • 20 slides

Analysis of Irish Farmer Incomes Based on Income Tax Returns

This paper presents an analysis of Irish farmer incomes in 2010 using self-assessment income tax returns from the Revenue Commissioners. The study focused on various income sources such as trading income, rental income, employment income, social welfare transfers, and pension income. The dataset com

1 views • 12 slides

Managing Personal Finances: Understanding Income and Expenses

Develop confidence in managing personal finances by recognizing financial concepts related to income, expenses, and financial control. Learn to distinguish between sources of fixed, variable, and occasional income, as well as fixed, variable, and occasional expenses. Understand the advantages of kee

0 views • 4 slides

The Role and Purpose of Securities and Exchange Board of India (SEBI)

Established in 1988 by the Government of India, Securities and Exchange Board of India (SEBI) plays a crucial role in regulating the securities market. SEBI aims to promote investor protection, ensure fair practices, and facilitate efficient resource mobilization. By monitoring and enforcing regulat

0 views • 15 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Introduction to Security Types in Financial Markets

This chapter provides an overview of different types of securities traded in financial markets worldwide. It covers classifications of financial assets, including money market instruments, fixed-income securities, equities, futures, and options. The focus is on interest-bearing assets, such as Treas

0 views • 21 slides

Understanding Fixed-Income Securities for Investment

Fixed-income securities offer fixed returns up to a redemption date or indefinitely, comprising long-term debt securities and preferred stocks. These investments involve various risk factors, including default risk. Long-term debt securities, such as bonds, provide a safe asset but require careful c

0 views • 47 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Set-off of Losses in Income Tax

Set-off of losses in income tax allows taxpayers to reduce their taxable income by offsetting losses from one source against income from another source. This process helps in minimizing tax liability and optimizing tax planning strategies. There are specific rules and exceptions regarding the set-of

0 views • 4 slides

Understanding Income from Other Sources in Taxation

Delve into the world of income from other sources in taxation, covering specific incomes like dividends, winnings, employee contributions, interest on securities, and income from rentals. Explore the tax liabilities associated with different types of income and gain insights into the nuances of tax

0 views • 15 slides

Comprehensive Guide to Global Securities Operations

Explore the world of global securities operations through this detailed guide, covering topics such as course outlines, study plans, exam preparation, taking the exam, securities investment, and ordinary shares. Gain insights into how securities investment firms operate, the role of investment banks

0 views • 102 slides