Introduction to Security Types in Financial Markets

This chapter provides an overview of different types of securities traded in financial markets worldwide. It covers classifications of financial assets, including money market instruments, fixed-income securities, equities, futures, and options. The focus is on interest-bearing assets, such as Treasury bills and notes, explaining their value, risks, and potential gains/losses. Through examples and illustrations, readers gain insights into the diverse world of securities.

Uploaded on Oct 01, 2024 | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chapter 3 Overview of Security Types

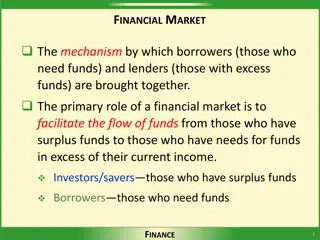

3.1 Classifying Securities The goal in this chapter is to introduce you to some of the different types of securities that are routinely bought and sold in the financial markets around the world. Financial Assets such as bonds and stocks are often called securities. They are often called financial instruments as well. Classification of Financial Assets Basic Types Major Subtypes Money market instruments Fixed-income securities Interest-bearing Common stock Preferred stock Equities Futures Options Derivatives

3.2 Interest- Bearing Assets The value of interest bearing assets depends on interest rates. The reason that these assets pay interest is that they all begin life as a loan of some sort, so they are all debt obligations of the issuer. Basic Types of Interest Bearing Assets 1. Money Market Instruments: Debt obligations of large corporations and governments with an original maturity of one year or less. Most money market instruments are liquid especially the T- bills. Example: Treasury Bill , or T- bill for short. Every week, the U.S treasury borrows billions of dollars by selling T bills to the public. Most money market instruments are sold on a discount basis. This means that T-bills for example are sold at a price that is less than their stated face value. In other words, an investor buys a T-bills at one price and later, when the bill matures, receives the full face value. The difference is the interest earned.

3.2 Interest- Bearing Assets Potential Gains/Loss from Buying Money Market Instrument: The potential gain from buying a money market instrument is fixed because the owner is promised a fixed future payment. The most important risk is the risk of default. Which is the probability that the borrower will not repay the loan as promised. Prices Quotation of Market Instrument: Prices of money market instruments are quoted in the financial press. Usually interest rates are quoted not prices (so some calculation need to be made to convert interest rates to prices).

3.2 Interest- Bearing Assets 2. Fixed Income Securitas: Longer term debt obligation often of corporation and governments that promise to make fixed payments according to present schedule and have life that exceed 12 months at the time they are issued. Example: notes, bonds. The US Treasury sells between $25 billion and $35 billion of two year notes to the public. If you buy a two year note when its issued, you will receive a check every six months for two years for a fixed amount , called the bond coupon, and at the end of two years you will receive the face amount on the note.

3.2 Interest- Bearing Assets Numerical Example: Suppose you buy $1 million in face amount of a 4%, two year note. The 4% is called the coupon rate and it tells you that you will receive 4% of the $1 million face value each year or $40,000 in two $20,000 semiannual coupon "payments. In two years, in addition to your final 20,000 coupon payment , you will receive the $ 1 million face value. The price you would pay for this note depends on the market condition.

3.2 Interest- Bearing Assets Don t confuse the coupon rate with current yield which is the annual coupon divided by the current bond price. Example: Suppose you buy $100,000 in face amount of a just issued five year US treasury note. If the coupon rate is 5% , what will you receive over the next five years if you hold on to your investment? you will receive 5% of $100,000 or $5,000 per year, paid in two semiannual coupons of $2,500. In five years, in addition to the final $2,500 coupon payment, you will receive the $100,000 face amount. Fixed Income Price Quotes: Corporate bond dealers now report trade information through what is known as the Trade Reporting and Compliance Engine (TRACE) system. Potential gains/losses: Fixed coupon payments and final payment at maturity, except when the borrower defaults. Possibility of gain (loss) from fall (rise) in interest rates Depending on the debt issue, illiquidity can be a problem.

3.3 Equities Common stock: Represents ownership in a corporation. A part owner receives a pro rated share of whatever is left over after all obligations have been met in the event of a liquidation. Examples: IBM shares, Microsoft shares, Intel shares, Dell shares, etc. Potential gains/losses: Many companies pay cash dividends to their shareholders. However, neither the timing nor the amount of any dividend is guaranteed. The stock value may rise or fall depending on the prospects for the company and market-wide circumstances.

3.3 Equity Preferred stock: The dividend is usually fixed and must be paid before any dividends for the common shareholders. In the event of a liquidation, preferred shares have a particular face value. Example: Bank of America (BAC) preferred stock Potential gains/losses: Dividends are promised. However, there is no legal requirement that the dividends be paid, as long as no common dividends are distributed. The stock value may rise or fall depending on the prospects for the company and market-wide circumstances.

3.4 Derivatives Financial assets are grouped into two types: Primary asset: Security originally sold by a business or government to raise money such as stocks and bonds. Derivative asset: A financial asset that is derived from an existing traded asset, rather than issued by a business or government to raise capital. More generally, any financial asset that is not a primary asset.

3.4 Derivatives Future Contract: An agreement made today regarding the term of trade that will take place in the future. Future contracts are traded at future exchanges, which are regulated markets that match buyers and sellers. There are two broad categories of future contracts: Financial futures and commodity futures. Financial Futures: assets are tangible, usually stocks, bonds, currencies or money market instruments. Commodity Futures: the underlying asset is real asset, either an agricultural product such as cattle or wheat or natural source product such as gold or oil.

3.4 Derivatives Future contracts are risky because the price of gold in the future can differ from the future contract price today. With future contracts, there is no exchange of money today (the day of the contract). The terms of a futures contract are standardized. What to trade; Where to trade; When to trade; How much to trade; what quality of good to trade all standardized under the terms of the futures contract.

3.4 Derivatives Example of Future contract: Suppose you want to buy 100 ounces of gold in six months. You want to lock the current price which is $1,600 per ounce in six months for the 100 ounces of gold. In other words, you and the seller ,through a future exchange, agree that six months form now, you will exchange $160,000 for 100 ounces of gold. This agreement is a future contract. In six months, if gold is selling for $1,700 per ounce: you benefit from the future account because you have to pay only $1,600 per ounce. In six months, if gold is selling for $1,500 per ounce: you lose, because you are forced to pay $1,600 per ounce.

3.4 Derivatives Potential gains/losses: At maturity, you gain if your contracted price is better than the market price of the underlying asset, and vice versa. If you sell your contract before its maturity, you may gain or lose depending on the market price for the contract. Note that enormous gains and losses are possible. A futures contract represents a zero-sum game between a buyer and a seller. Gains realized by the buyer are offset by losses realized by the seller (and vice-versa).

3.4 Derivatives Option Contracts: An agreement that gives the owner the right but not the obligation to buy or sell a specific asset at a specific price for a set period of time. Call Option: An option that gives the owner the right but not the obligation to buy an asset. Put option: An option that gives the owner the right but not the obligation to sell an asset. Option Premium: the price you pay to buy an option. Strike Price: The price specified in an option contract at which an underlying asset can be bought (for a call option) or sold (for a put option). Also called the striking price or exercise price. Using an option to buy or sell an asset is called exercising the option.

Potential gain/loss for call option Potential gains and losses from call options: Buyers: Profit when the market price minus the strike price is greater than the option premium. Best case, theoretically unlimited profits. Worst case, the call buyer loses the entire premium. Sellers: Profit when the market price minus the strike price is less than the option premium. Best case, the call seller collects the entire premium. Worst case, theoretically unlimited losses. Note that, for buyers, losses are limited, but gains are not.

Potential gain/loss for put option Potential gains and losses from put options: Buyers: Profit when the strike price minus the market price is greater than the option premium. Best case, market price (for the underlying) is zero. Worst case, the put buyer loses the entire premium. Sellers: Profit when the strike price minus the market price is less than the option premium. Best case, the put seller collects the entire premium. Worst case, market price (for the underlying) is zero. Note that, for buyers and sellers, gains and losses are limited.

3.4 Derivatives An American option can be exercised anytime up to and including the expiration date, while a European option can be exercised only on the expiration date. Options differ from futures in two main ways: Holders of call options have no obligation to buy the underlying asset. Holders of put options have no obligation to sell the underlying asset. To avoid this obligation, buyers of calls and puts must pay a price today. Holders of futures contracts do not pay for the contract today.

3.4 Derivatives Option price quote: Most option contracts are standardized. The method of decoding option symbols The symbols expand from 5 letters to 20 letters and numbers. The stated goal is to reduce confusion by explicitly stating: the underlying stock symbol option expiration date whether the option is a call or a put the dollar part of the strike price the decimal part of the strike price The investor can either buy or sell (the right to buy= call option) , or buy/sell (the right to sell/put option). When buying an option, investor needs to look at the Ask price. When selling an option, investor needs to look at the Bid Price.

Stocks Vs. Options Stocks: Suppose you have $10,000 for investments. Macron Technology is selling at $50 per share. Number of shares bought = $10,000 / $50 = 200 If Macron is selling for $55 per share 3 months later, gain = ($55 200) - $10,000 = $1,000, or we say 55-50 = $5 $5 200 = $1000 so the return = $1000/10,000 = 10% If Macron is selling for $45 per share 3 months later, gain = ($45 200) - $10,000 = -$1,000, or we say 45-50 = -$5 -$5 200 = -$1000 so the return = $-1000/10,000 = -10%

Stocks Vs. Options Options: A call option with a $50 strike price and 3 months to maturity is also available at a premium of $4. Traded option contracts are on a bundle of 100 shares. One call contract costs $4 100 = $400, so number of contracts bought = $10,000 / $400 = 25 (for 25 100 = 2,500 shares) If Macron is selling for $55 per share 3 months later, gain = {($55 $50) 2,500} - $10,000 = $2,500 or : since it s a call option: the break even point = strike price+ premium for one share. Higher than this point, will be profit. 50+4 = 54 . 55- 54 = $1 for one share. $1 2500 shares = $2,500 , 2500/10,000 = 25% If Macron is selling for $45 per share 3 months later, loss = ($0 2,500) $10,000 = -$10,000 Since its less than the break even point, then there will be a loss of the premium amount.