Next Generation Digital Data and Processing Standard in Financial Trade

ISDA CDM (Common Domain Model) presents a higher-order financial trade data and contract model with advantages over FpML/FIX. It offers fully described business events, data, and processing standards, capturing life cycle events across various products along with participants. The model includes built-in data rules for input validation, tracks cause and effects, records lineages, and provides a strong foundation for digital capital markets. Current product support includes OTC derivatives, Repos, Securities Finance, and Securities (equities and fixed income), with ongoing progress in Margin and Collateral. Anatomy of a CDM event and the digital trade life cycle are outlined, showcasing the benefits over existing standards. A collaborative test conducted on DLT further demonstrates the practical applications of CDM in trade workflows.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

ISDA CDM (Common Domain Model) Next generation digital data & processing standard A higher order financial trade data and contract model Advantages over FpML/FIX : Fully described Business Events, Data and processing standards, lineages Captures life cycle events across multiple products along with actors / participants Built-in data rules to validate input semantics Tracks cause and effects Records lineages (built-in audit trail) Represented in Json Strong foundation for digital capital markets (contracts, DLT) Current product support: OTC derivatives, Repos and Securities Finance, Securities (equities and fixed income) In progress: Margin and Collateral

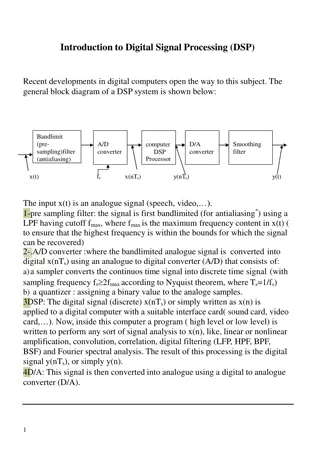

Anatomy of a CDM Event ( Smart Data for Smart Contracts) Prior Event Header From CDM Hash To .. . . . Pointer to other dependent events ex: Amendments, Observations Event Lineage References to new contracts Event Effect Primitives (ex: Execution, Allocation, Transfer ) Building blocks to represent Business Process References to existing contracts Inputs New Contracts Outputs

CDM & digital trade life cycle Order / DRFQ Advantages over FIX/FpML/ISO 20022 . . Business Events fully expressed Built-in Lineage Cause and Effects Capture entire life cycle Json format Single standard for multiple assets trade life cycle Transfer Execution . . . . Digital Assets Settlement Allocation . . . . CDM event lineage . . Session Netting

Sample CDM WG collaborative test conducted on DLT (New Trade) Bank B Bank A Trade Match Smart Contract (calculating agent) Pending Pending Bank A Node Bank B Node Executed Trade Executed Trade New Trade New Trade R(A) R(B) R(A) R(B) S S Vault Vault Novation, Clearing Novation, Clearing Bank C Node Regulator Others CCPs, FCMs, Prime Brokers DTCC, Custodians, CSDs, Buy Side, Administrators Life Cycle Life Cycle S Vault Corda DLT Network Termination, Expiration Termination, Expiration New Trade Match Request, New Trade Match Accepted / Rejected Request Sent, Request Received, Request Notify