Lowell Joint School District - Measure LL Project Updates

Lowell Joint School District, known for its tradition of excellence since 1906, authorized a $48 million General Obligation Bond (Measure LL) in 2018. The bond funds are being used for various school facility improvements such as repairing roofs, upgrading safety systems, renovating classrooms, and

2 views • 19 slides

Maximum Price Calculation for Callable Bond with Annual Yield Requirement

A 20-year callable bond example is provided with a $1000 face value and 3% annual coupons, callable at different redemption values over specific years. The task is to determine the maximum price a buyer should pay to achieve a minimum annual yield of 5%. The calculation involves identifying the time

0 views • 33 slides

Understanding Callable Bonds in Bond Investments

Callable bonds are a type of bond where the issuer reserves the right to redeem the bond at different times, potentially at different values. Investors face uncertainty about when the bond will be redeemed, but it can only be called at predetermined times. Common questions revolve around determining

0 views • 13 slides

Granny's Tree Climbing - A Poetic Adventure by Ruskin Bond

In this whimsical poem by Ruskin Bond, we are introduced to Granny, a sprightly sixty-two-year-old who defies convention by indulging in her lifelong passion for tree climbing. Despite admonishments from her family, Granny remains steadfast in her joy as she embarks on a delightful tree-climbing esc

0 views • 19 slides

Bringing Up Kari: A Tale of Compassion and Bond Between a Boy and an Elephant

Revolving around a young elephant named Kari and a nine-year-old boy, this heartwarming story explores the strong bond they share. Through adventures and challenges, the narrator teaches Kari valuable skills, nurturing a deep connection built on compassion and understanding. As Kari grows, so does t

0 views • 7 slides

Oregon Health Authority Measure 110 Grant Proposals Webinar Overview

Oregon Health Authority (OHA) hosted a webinar on Measure 110, focusing on Behavioral Health Resource Networks (BHRNs) and grant proposals. The webinar featured introductions to OHA staff, details about Measure 110, BHRN structure, Q&A session, and contact information for grant-related queries. Meas

0 views • 39 slides

Exploring the Human-Animal Bond in Veterinary Medicine

Delve into the significance of the human-animal bond in veterinary medicine, highlighting the mutually beneficial relationship between animals and humans over time. Understand how this bond has evolved, the role of veterinary assistants in fostering this connection, and the changing dynamics of huma

0 views • 26 slides

City of Atascadero Sales Tax Measure Consideration by City Council

City of Atascadero is considering placing a one-cent sales tax override measure on the November ballot to address financial challenges and maintain essential services. The proposed measure aims to generate funds for public safety, park maintenance, infrastructure, graffiti removal, and other city se

0 views • 15 slides

Understanding Alkynes in Organic Chemistry

Alkynes are unsaturated hydrocarbons with at least one triple bond, following a molecular formula of CnH2n-2. This group of compounds is discussed in Chapter three, covering topics like structure, hybridization, common naming, physical properties, preparation, and reactions. The sp hybridization of

1 views • 20 slides

Exploring Growth and Opportunities in the Green Bond Markets

Delve into the burgeoning Chinese green bond market with insights on green bonds growth, sector allocations, Latin American issuance trends, sustainable investment needs in Latin America, China's green bond growth, and global green bond market size comparisons. Discover the significance of Green Pan

0 views • 14 slides

Understanding Corporate Bond Ratings and Credit Risk in International Finance

Corporate bond ratings provide signals on default probability, impacting borrowing costs. Higher ratings signify lower risk and interest rates. Credit spreads measure the difference between risky bonds and risk-free assets, with risk-free assets like US Treasury bonds seen as default-free. The longe

1 views • 19 slides

Arlington ISD Citizens Bond Oversight Committee Report August 2016

The Arlington ISD Citizens Bond Oversight Committee (CBOC) was established to provide transparency, enhance public confidence, provide findings and recommendations to the Board of Trustees, monitor progress of the 2014 Bond program, and find ways to maximize the bond's potential. The committee compr

0 views • 27 slides

Bonded Warehouse Facility and New Bond Process

Bonded warehouse facilities offer a convenient way for traders and industrialists to store goods without paying duties. The process involves applying for a new bond with specific requirements and inspections by officers. Necessary documents and approvals are essential to secure the bond premises, en

0 views • 31 slides

Understanding Polarity in Covalent Bonds

The difference between a polar molecule and a nonpolar molecule lies in the distribution of electrons. A polar molecule has an asymmetric electron distribution due to a significant difference in electronegativity, while a nonpolar molecule has a symmetric electron distribution. You can predict polar

0 views • 15 slides

City of Oakland Finance Dept. Public Outreach Session - Measure W Vacant Property Tax Implementation Ordinance

The City of Oakland Finance Department conducted a public outreach session on the implementation of Measure W, a vacant property tax ordinance. The session aimed to receive public input, provide an overview of the tax and exemptions, and outline the implementation process. Measure W, approved by cit

0 views • 11 slides

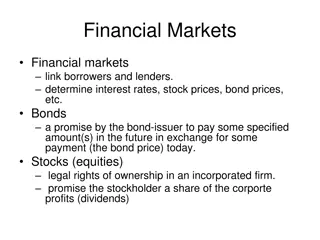

Understanding the Bond Market: Maturity, Yield, and Pricing

Financial markets facilitate borrowing and lending, influencing interest rates, stock prices, and bond prices. Bonds promise future payments in exchange for current prices, while stocks offer ownership rights and dividends. The bond market involves maturity dates, coupon rates, and yield to maturity

0 views • 17 slides

Overview of Measure T Project and Program in 2022

This content provides an overview of the Measure T Project and Program in 2022, showcasing details such as revenues, maintenance of effort, project specifics including street segments, sidewalk lengths, and curb ramps installed or replaced. Images are included for various project locations like Blan

0 views • 14 slides

Understanding Callable Bonds and Bond Amortization

Callable bonds provide issuers with the right to redeem the bond before maturity under certain conditions. This article discusses the concept of callable bonds, bond amortization, premium bonds, discount bonds, and provides examples of calculating bond values based on specific scenarios.

0 views • 12 slides

Understanding Bond Premiums and Their Impact on Financial Decision-Making

Bond premiums occur when bond prices increase in the secondary market due to a drop in market interest rates. They can be used for approved project costs, debt service, or reducing bond principal. Utilizing bond premiums wisely can lead to cost savings for taxpayers. Learn how bond premiums can affe

0 views • 5 slides

Exploring the Legacy of James Bond: 60 Years, 27 Films, and Countless Adventures

James Bond, the iconic British spy character, has been portrayed by various actors over the past 60 years in a total of 27 films. From Sean Connery to Daniel Craig, the character has evolved while maintaining his charm and mystery. The latest film, "No Time to Die," continues the legacy with action-

0 views • 11 slides

Determinants of Liquidity in the South African Bond Market

The presentation explores the determinants of liquidity in the South African bond market, emphasizing its importance for economic stability and growth. It discusses the significance of market liquidity, impacts of illiquidity, and compares the efficiency of the South African bond market with others

0 views • 24 slides

Understanding Bond Valuation Models and Yield Relationship

Explore the fundamentals of bond valuation, including the present value model and the yield model, to understand how bond prices are determined based on factors like market price, coupon payments, and yield to maturity. Learn about the price-yield curve, convexity, and how to calculate expected yiel

0 views • 25 slides

Understanding Elderly Bond Property Compliance in Oregon

Oregon Housing and Community Services (OHCS) issues tax-exempt bonds for the development of housing for low-income elderly and disabled individuals. Bond properties must meet program requirements to maintain compliance and avoid risks to bond series and credit ratings. OHCS plays a vital role in mon

0 views • 57 slides

Lowell Joint School District Bond Feasibility Survey Findings

The conducted survey by Dr. Timothy McLarney aimed to determine the feasibility of a bond measure for the Lowell Joint School District. The study focused on gathering community input to create a measure aligned with priorities, with an emphasis on education quality, crime reduction, job creation, an

0 views • 15 slides

Exploring the World of Cherries and Ruskin Bond

Delve into the fascinating world of cherries and acclaimed Indian author Ruskin Bond. Learn about the rich cultivation of cherries in the northern regions of India, particularly in Jammu and Kashmir. Discover key details about Ruskin Bond's life and literary achievements, including his extensive bod

0 views • 8 slides

Offshore Renminbi Bond Markets: Achievements and Challenges

The article discusses the achievements and challenges of the offshore Renminbi bond markets, highlighting the role of foreign currency debt in public debt management, the development of the RMB market, examples of sovereign issuances, and the practice and goals of international FX. It covers the evo

0 views • 7 slides

Understanding Bond Markets: Insights from Dr. Lakshmi Kalyanaraman

Explore the world of bond markets through Dr. Lakshmi Kalyanaraman's perspective. Learn about bond instruments, issuers, market classifications, and associated risks. Discover the dynamics of Treasury notes and bonds in financing national debt and their unique characteristics such as default risk, i

0 views • 37 slides

Bond Analysis and Valuation Techniques by Binam Ghimire

Explore the analysis and valuation of bonds in-depth with a focus on present value techniques, bond yields, and calculating future bond prices. Understand the process of pricing a bond by determining cash flows, coupon payments, and par value. Dive into the calculations involved in determining the p

0 views • 40 slides

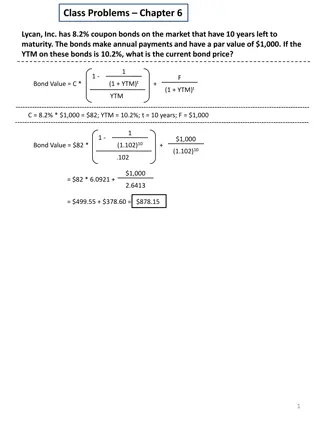

Bond Pricing and Yield Calculation Examples

The provided content illustrates calculations for bond pricing and yield in various scenarios. It covers topics such as determining current bond prices based on coupon rates, yield to maturity, and time to maturity. Additionally, it explores scenarios with different bond characteristics like annual

0 views • 5 slides

Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Not

0 views • 39 slides

Understanding Bond Valuation and Pricing

This informative content delves into valuing bonds, explaining concepts such as face value, coupon rates, and the relationship between bond prices and interest rates. It covers terminology, misconceptions about coupon rates, and provides examples to illustrate bond valuation calculations. The conten

0 views • 41 slides

Understanding Bond Basics for Investing Success

Explore the fundamental concepts of bonds and learn how market rates impact bond prices, guiding you through making informed investment decisions. Discover the relationship between interest rates and bond values, essential for navigating the world of public funds investing.

0 views • 30 slides

Emergency Bond Hearings Transcript Review Insights

Analysis of emergency bond hearings transcripts from various dates revealed insights such as objection rates, agreement rates, and no-position rates, showing trends in case outcomes. Comparison with Appleseed's data provided further context on objection, agreement, and no-position rates. The timelin

0 views • 11 slides

Update on Potential Bond Measure - April 12, 2018

The update on the potential bond measure as of April 12, 2018, includes completed presentations to various officials and upcoming presentation schedules. The new requirement AB 195, effective January 1, 2018, has implications on how bond measures are displayed on the ballot, potentially affecting vo

0 views • 7 slides

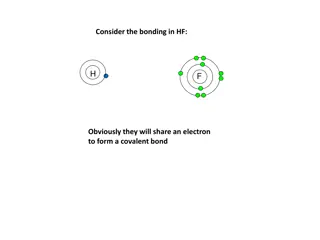

Understanding Bonding in HF Molecule

In HF bonding, hydrogen and fluorine share an electron to form a covalent bond. Fluorine, being more electronegative, attracts the bonding electrons more, resulting in a polar covalent bond. If hydrogen was less electronegative, the bonding electrons would shift further towards fluorine until an ion

0 views • 11 slides

TCIC Conditions of Bond - Implementation Overview

The TCIC Conditions of Bond outline the procedures and requirements for entry into TCIC for cases involving violent and family violence-related offenses in Texas. HB 766 and SB 6 impact the Texas Code of Criminal Procedure, defining duties for Magistrates, Sheriffs, and DPS. Magistrates must notify

0 views • 34 slides

Bond's Mission: Opening Scene from a Spy Thriller

British secret agent James Bond embarks on a mission in the Middle East to confront terrorists aiming for world domination. Bond's sleek yet ruthless character is highlighted as he tracks down his murdered contact and pursues the killers through a bustling city.

0 views • 7 slides

Understanding Bond Lengths and Strengths in Chemistry

Bond lengths represent the critical distance between bonded atoms for maximum stability, while bond strengths are measured through dissociation energy and average bond energy. Methods for measuring bond lengths include X-ray diffraction and spectroscopic methods, with bond energies reflecting the st

0 views • 38 slides

Measure B Advisory Board Conference Agenda 2023

The Measure B Advisory Board (MBAB) Committee is hosting a conference to discuss the purpose of Measure B funds, proposal processes, deadlines, and supporting documentation requirements. The unspent funds are designated for specific areas, and proposals must be submitted by July 17, 2023. Entities s

0 views • 8 slides

First-Line Psychosocial Care for Children and Adolescents on Antipsychotics: Performance Measure Results

The performance measure assessed the use of first-line psychosocial care for children and adolescents on antipsychotics in Virginia, showing a total measure result of 68.98%. The measure aims to promote safer interventions before prescribing antipsychotic medications to minimize risks. Results were

0 views • 25 slides