Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

Understanding Public Information Act Cost Rules

Learn about the cost rules under the Public Information Act, including calculations for copies and inspections, allowable charges, exceptions, when labor charges apply, and more. Discover how to determine costs related to reproducing public information based on the format it exists in and the amount

1 views • 33 slides

ELC Confinement Facilities Funding Overview

The ELC Confinement Facilities Funding initiative, updated as of August 31, 2021, provides essential financial support for the detection and mitigation of COVID-19 in various confinement facilities. The total award of $18,200,000 is allocated towards personnel, supplies, allowable costs like compute

0 views • 8 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

Understanding Administrative Costs in Grant Management

Administrative costs are essential for managing grants effectively. Learn about the difference between direct and indirect costs, and why tracking and reporting accurately is crucial to avoid disallowed costs. Explore the definition, classification, and significance of administrative costs in grant

0 views • 22 slides

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

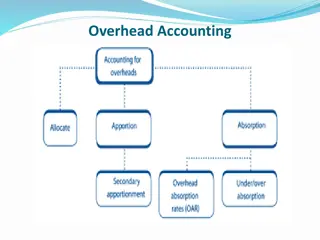

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Overview of New Civil Procedure Rules on Costs: CPR Parts 58 & 59

The new Civil Procedure Rules (CPR) Parts 58 & 59 introduce changes in the assessment and taxation of costs in legal proceedings. Detailed assessment replaces taxation, standard basis, fixed costs, and more defined, with new definitions and procedures outlined. Order 59 expands the powers to tax cos

0 views • 22 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

NIH Budget Basics and Tips for Grant Applications

Explore the essential components of preparing a budget for NIH grants, including types of budgets, cost principles, and tips for getting started. Learn about allowable costs, FOAs, funding limits, and common pitfalls to avoid when applying for NIH grants.

0 views • 40 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Cooperative Agreement for Emergency Response: Public Health Workforce Expansion for COVID-19

This agreement outlines the funding, allowable workforce costs, milestones, and available funds allocation for expanding and sustaining the public health workforce to support COVID-19 prevention, preparedness, response, and recovery efforts. Key components include workforce metrics reporting, allowa

6 views • 11 slides

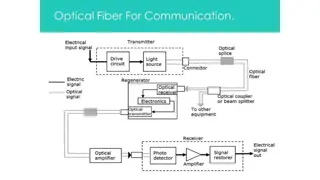

Overview of Point-to-Point Fiber Optic Communication System

Point-to-point fiber optic communication systems involve converting voice signals from a microphone into digital signals using a coder, transmitting light signals through a semiconductor diode laser over optical fibers, and decoding the signals back to analog for sound production. The system offers

0 views • 11 slides

Understanding Costs in Business: Types and Significance

Costs in business play a crucial role in determining profitability and decision-making. This article explores various types of costs such as direct, indirect, fixed, and variable costs, along with their definitions, uses, and impact on business operations. Understanding these costs is essential for

0 views • 13 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Guidelines for Allowable and Not Allowable Expenses in Program Funding

Ensure that program funds are used appropriately by adhering to guidelines that outline allowable expenses, factors affecting cost allowability, and common budget considerations. Eligible expenses include materials, professional services, transportation, and more, while not allowable costs involve i

1 views • 7 slides

Understanding Financial Management of Special Education Programs

Federal IDEA Part B funds support special education programs, helping LEAs implement IDEA. These funds must be used for allowable purposes like special education services, appropriate technology, and early intervening services. It's essential to use IDEA Part B funds to pay for excess costs and supp

1 views • 105 slides

How to Fill Out a Nursing Assistant Certification Reimbursement Request Form

Detailed instructions on filling out Form 06-123 for Nursing Assistant Certification (NAC) reimbursement requests. Sections covered include Provider Information, Direct Care Costs, Operating Costs, Total Costs, and Provider Authorization. The form requires manual entry of some totals and provides au

0 views • 16 slides

Grant Management Handbook for WorkReady U Recipients

This handbook provides detailed guidelines and procedures for managing grants awarded to recipients of WorkReady U. It covers topics such as fiscal policies, maintenance of effort, allowable costs, program income, procurement, and property management.

0 views • 49 slides

Analysis of 2021 Marginal Generation Costs for San Diego Gas & Electric

The analysis presents the 2021 Marginal Generation Costs methodology filed by San Diego Gas & Electric in April 2016 for the Time-of-Use (TOU) OIR Workshop. It includes forecasts for Marginal Energy Costs (MEC) and Marginal Generation Capacity Costs (MGCC) for the calendar year 2021, based on market

0 views • 6 slides

Comprehensive Guide to Grant Proposal Budgeting

Learn about preparing grant proposal budgets, understanding acronyms like SCDD and RFP, training modules for SCDD Cycle 44 RFP, and the guidelines from organizations like SCDD, USC, UCLA, UCEDD, and more. Explore the budget terms, allowable costs, and examples to create a detailed grant budget.

0 views • 36 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Managing Participant Support Costs for Undergraduate Research Experiences (REU)

Participant support costs for REU programs include stipends, travel allowances, and registration fees for non-employee participants. The Uniform Guidance outlines guidelines for allowable costs, while NSF provides stipend guidelines. Institutions like Brown University have specific procedures for st

0 views • 6 slides

Guidelines for Operating Fresh Fruit and Vegetable Program

This content provides detailed guidelines for operating a fresh fruit and vegetable program in schools participating in the NSLP. It covers key aspects such as allowable costs, administrative requirements, spending plans, service rules, and FAQ about product options. The information emphasizes the i

0 views • 19 slides

Arkansas Tech University Procurement Card Policies & Guidelines

Arkansas Tech University's procurement card program helps manage lower-dollar supply purchases, allowing full-time employees to make official business purchases. The program emphasizes accountability, prohibiting personal purchases and emphasizing liability at the department level. Only certain char

0 views • 24 slides

Billing Documentation Guidelines for OSAP Programs

Audits are imminent for OSAP/BHSD programs, emphasizing the importance of proper documentation to ensure compliance and accuracy in billing. Providers must adhere to strict guidelines for submitting audits and desk audits annually, promptly informing OSAP of any staff changes. The documentation cove

0 views • 25 slides

Project Cost Estimation for Microgrid Equipment and Installation

This module delves into estimating project costs for microgrid equipment, including procurement, installation, design, and engineering. It covers categories such as installation costs, design and engineering costs, overhead costs, and contingency costs, to provide a comprehensive understanding of es

0 views • 18 slides

Financial Management Training for Independent Living Centers

Learn about financial management best practices for Independent Living Centers, including internal controls, monitoring, audits, fraud prevention, budgeting techniques, allowable costs, procurement procedures, federal compliance, cybersecurity, and lobbying activities.

0 views • 34 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Guidelines on Allowable Costs and Related Parties in Long-term Debt Training

Explore guidelines on allowable costs and transactions with related parties in long-term debt training programs. Learn about costs paid to other agencies, examples of allowed costs, and costs not allowed. Gain insights into the XI-Q Bond Agency Guide and upcoming training sessions. Have questions? F

0 views • 6 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Sri Lanka Accounting Standards LKAS 23: Borrowing Cost Overview

This document provides an overview of Sri Lanka Accounting Standards LKAS 23 on borrowing costs, covering its introduction, scope, definition, and accounting treatment. It explains how borrowing costs are recognized, the scope of the standard, and the classification of borrowing costs. Additionally,

0 views • 12 slides

Financial Guidelines Overview for Collaborative Projects

Introduction to the financial framework for collaborative projects, including budget formats, budget lines, and principles of alignment in accordance with partner universities. Details on budget limits, implementation periods, activity year breakdown, and justification requirements are provided. Key

0 views • 27 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Costs in Power Sector Decision-Making

Operational, decommissioning, and investment decisions in the power sector are influenced by different categories of costs. Operational decisions focus on variable costs like fuel and CO2 expenses, while decommissioning decisions consider both variable and fixed costs. Investment decisions require a

0 views • 6 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides