Small Contractors Bonding and Access to Capital Initiative

This session focuses on the bonding application process for small contractors, covering key principles, types of bonds, underwriting criteria, and factors that make a contractor a good risk. It addresses why contractors fail, the importance of reputation and financial information, and the roles of bonding agents, lenders, and public agencies in the bonding process.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

SMALL CONTRACTORS INITIATIVE BONDING & ACCESS TO CAPITAL

SMALL CONTRACTORS INITIATIVE SESSION 7 BONDING

SESSION OVERVIEW Introduction PART A: BOND APPLICATION PROCESS Surety Bond Basics What Makes a Good Risk How to Find a Bond Common Questions Resources PART B: APPLICATION FORM Submission Requirements Application Process Resources U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 3

INTRODUCTION This session will review the basics of bonding. Part A focuses on reviewing the key principles in construction bonding and the bonding application process. Part B focuses on completing a bond application and reporting standards. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 4

PART A: BOND APPLICATION PROCESS U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 5

PART A: LEARNING OBJECTIVES 1. Review the principles of construction bonding. 2. Understand the application process. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 6

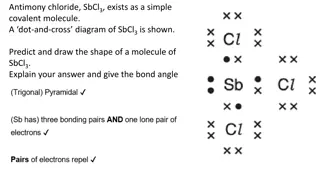

SURETY BOND BASICS (REVIEW) What is a surety bond? Why get a bond? What are the types of construction bonds? What are the key underwriting criteria? U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 7

WHY DO CONTRACTORS FAIL? This question helps understand why bonding agents ask for a lot of information. When a contractor fails on a project, who loses money? Client Lender Public agency Bonding company You Who has the most experience with this kind of hurt ? Typically, lenders and bonding companies. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 8

WHAT MAKES A CONTRACTOR A GOOD RISK ? Beyond performance and credit quality, sureties are interested in firms with solid reputations that demonstrate an ability to generate quality internal financial and work- in-process information in a timely fashion. Michael Cusack Senior Vice President and Managing Director of Surety Aon Construction Services Group U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 9

HOW TO FIND A BOND Agent will work with you on: Agent will suggest one or two surety companies to approach. Agent will review your needs and capabilities. Find an agent, or producer. Prequalifying. Job-specific bond application. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 10

PERSONAL CREDIT BONDS U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 11

PREQUALIFICATION Before surety underwrites a bond, the contractor typically undergoes a careful, rigorous, and thorough process, often referred to as prequalification. Each surety company has its own underwriting standards and requirements. But there are shared fundamentals common to most surety companies. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 12

HOW TO FIND A BONDING AGENT U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 13

A CONVERSATION WITH A BONDING AGENT [AGENT] Why should we write a bond on your project? [CONTRACTOR] Well, let me tell you about my company U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 14

We know what were doing, and we do it well. Track record Good management Trustworthy U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 15

My companys finances are in good shape, and getting better. Good financial management systems. Sufficient and growing working capital on hand. Solid projections for volume and earnings. Banking relationship. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 16

Weve got solid plans for growth, and this job is one we can do well. Business plan. Marketing plan. Contracting opportunities. Certifications. Job size relative to capacity and projections. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 17

WHAT IF NOT APPROVED? 1. Ask for clear, specific feedback. 2. Discuss with the bonding agent how you can address the deficiencies. 3. Devise an action plan for resubmitting. 4. With the agent, consider approaching other surety companies. 5. Take advantage of SBA programs. 6. Consider other approaches to getting the work (e.g., partnering, subcontracting). U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 18

COMMON QUESTIONS 1. Who pays the agent? 2. What type of bonding requirements are typical for different project sizes? 3. What factors affect pricing? 4. Does bonding apply only to one project, or is it like insurance and covers many projects? U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 19

PART A: RESOURCES These links provide good background information on bonding: SBA, Surety Bonds: The Basics. JW Surety, What Is A Payment Bond? Surety Information Office, How To Obtain Surety Bonds. Donohue & Thomas, Construction Surety Bonds in Plain English. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 20

PART B: APPLICATION FORM U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 21

PART B: LEARNING OBJECTIVES 1. Gather and present the business information and plan in a format acceptable to bond agents and the SBA. 2. Identify strategies for addressing concerns or weaknesses in the application. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 22

REQUIREMENTS There are common elements to all applications for a bond. Some items will be specific to a particular bonding agent or surety. Certain items are specific to the job you are bidding on. The agent will let you know what they need. Be prepared! U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 23

WHAT TO SUBMIT: ALL BOND APPLICANTS Historical and current financial statements. Jobs in progress schedule. Evidence of working capital. Forms provided by bonding agent: Contractor questionnaire. Bond request form. Financial statements and jobs-in-progress schedule. Continuity plan backed by life insurance. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 24

WHAT TO SUBMIT: LARGER BONDS Business plan. Multiyear revenue and cashflow projections. Financial statements compiled and/or reviewed by CPA. Evidence of financial management systems sufficient to handle: Accounting for construction. Job cost tracking. Estimating. Cashflow projections. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 25

PREPARING YOUR APPLICATION Assemble everything that you have prepared. Complete the forms provided. Review with facilitator and/or bonding agent. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 26

WHAT HAPPENS NEXT? If your information is complete, the process from first meeting with an agent to getting bond approval takes about 2 to 4 weeks. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 27

SAMPLES These are sample documents that will be similar to what is expected of a contractor applying for a bond: Cover letter from bonding agent. Contractors questionnaire. Personal financial statement. Jobs-in-progress schedule. Bond request form with job cost breakdown. U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 28

LINK TO ACTION PLAN U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 29

PART B: RESOURCES These links provide detailed information on bonding: Surety Information Office, Choosing the Right Surety Bond Producer. SBA, Application for SBA Surety Bond Guarantee. Surety Information Office, Why do Contractors Fail? U.S. Dept. of Housing and Urban Development U.S. Small Business Administration 30