Types of Securities: Owned Capital vs Borrowed Capital in Business Financing

Owned capital, contributed by owners, provides permanent risk capital to a business with high returns but lacks withdrawal flexibility. Borrowed capital, obtained through loans, offers fixed-period finance with tax advantages and flexible repayment options, but involves fixed interest payments and is not permanent. Both types have their advantages and disadvantages in funding business operations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

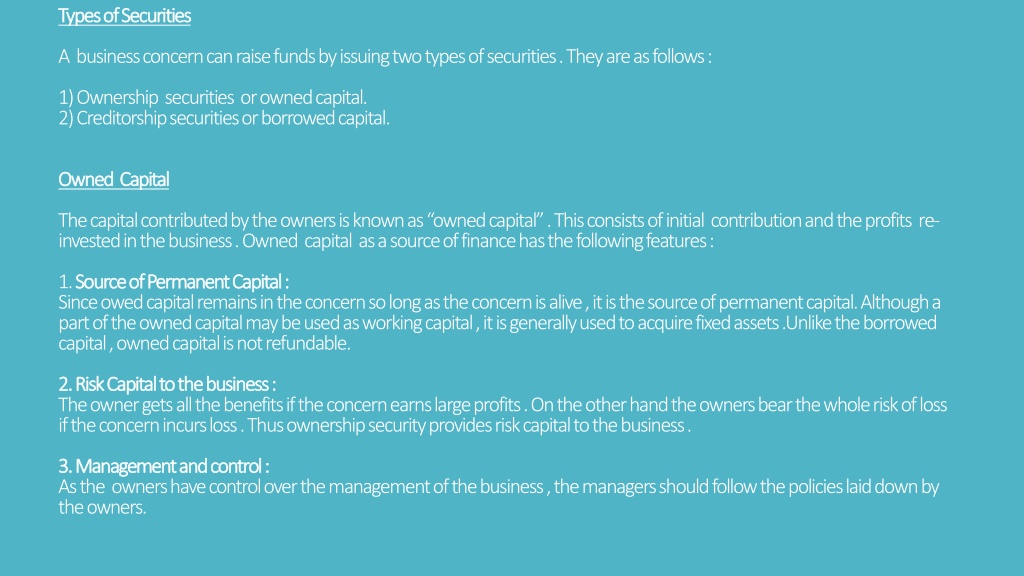

Types of Securities Types of Securities A business concern can raise funds by issuing two types of securities . They are as follows : 1) Ownership securities or owned capital. 2) Creditorship securities or borrowed capital. Owned Capital Owned Capital The capital contributed by the owners is known as owned capital . This consists of initial contribution and the profits re- invested in the business . Owned capital as a source of finance has the following features : 1. Source of Permanent Capital : Source of Permanent Capital : Since owed capital remains in the concern so long as the concern is alive , it is the source of permanent capital. Although a part of the owned capital may be used as working capital , it is generally used to acquire fixed assets .Unlike the borrowed capital , owned capital is not refundable. 2. Risk Capital to the business : 2. Risk Capital to the business : The owner gets all the benefits if the concern earns large profits . On the other hand the owners bear the whole risk of loss if the concern incurs loss . Thus ownership security provides risk capital to the business . 3. Management and control : 3. Management and control : As the owners have control over the management of the business , the managers should follow the policies laid down by the owners.

4. Residual Profit in the form of Dividend : 4. Residual Profit in the form of Dividend : Dividends to the ownership securities are to be distributed only if there are profits . Advantages 1. It provides risk capital. 2. It is permanently available in the business. 3. The owners get high returns , if the business is good . 4. It acts as a basis for the control and management of the concern . Disadvantages 1. The sum invested in a concern is not withdrawable especially if the concern is a joint stock company . 2. A company , may find it difficult to raise additional ownership capital unless it has high profit earning capacity , or growth prospects. 3. The amount of capital which may be raised as owners fund depends on the number of persons prepared to bear the risk involved , and their personal savings. Borrowing Capital Borrowing Capital Finance raised by ways of loans and credit from the public , banks , and financial institutions is known as borrowed capital . The sources of the borrowed funds like debentures , public deposits , banks etc ., may serve the purposes of long term , medium-term and short term finance . Borrowed capital as a source of finance has the following features :

Available for a fixed period 1. Usually , borrowed capital is raised for a fixed period such as long term , medium term and short term . When this fixed period is over , it has to be paid back . 2. it involves the payment of fixed rate of interest at regular intervals . 3 . It is backed by the security of tangible assets of the company . 4. The lenders do not have any control over the company . 5. The lenders are not treated as owners of the company . Advantages 1. It does not effect the owners control over management . 2 . It can be used for expansion or modernisation when additional share capital is not readily available . 3. Since interest on the loan is fixed , the charge on profits remains the same. 4. Since interest on loan can be written off expense , borrowed capital has a tax advantage. 5. It is flexible source of finance as the amount of loan can be so adjusted as to suit the exigencies of the situation . 6. Loans can be repaid in instalments as and when sufficient funds are available . This will reduce interest burden . 7. The lenders are treated as creditors only .

Disadvantages 1. It involves fixed payment of interest . 2. It is not available for permanent use. 3. Any default in payment of loan should adversely affect the business. 4. Funds can be borrowed only if a concern can offer suitable assets as security . Distinction between Ownership Capital and Creditorship Capital Ownership Capital Ownership Capital Creditorship Capital Creditorship Capital 1. It comprises the amounts contributed by the owners and their profits reinvested in the business. 1. It consists of funds available in the form of loan or credit . 2. It is permanently invested in the business. 2. It is not a permanent source of finance. 3. It is the risk capital of the business. 3. It is generally safe.

SHARES SHARES The capital of a company is usually divided into certain indivisible units of definite sums. These units are called Shares . Shares represent the interest of shareholders in a company measured in terms of money . They carry with them certain rights and liabilities . Shares are also called ownership securities and can be transferred from one person to another person . Those who subscribe shares are called shareholders .They are owners the company .In India , a public limited company may issue two kinds of shares . They are : (1) Preference Shares and (2) Equity Shares . Preference Shares Preference Shares Preference shares are those shares which carry preferential rights in respect of dividend and repayment of capital in the event of winding up of the company . Companies may resort to this technique ass long-term capital on account of the above advantages . Since preference shareholders have no voting rights , they do not to take any risk and hence ownership is not affected. Holders of preference shares enjoy certain privileges which can not be claimed by the equity shareholders. These privileges are : (1) the cumulative dividend if in any year dividend is not paid. (2) the right to convert their shares into equity shares. (3) the right to participate in profits left after payment of dividend to the preference and equity shareholders. By virtue of these special privileges enjoyed by preference shareholders, they are denied the right to take part in the matters which may by discussed at general body meeting . They cannot also take part in the election of directors . In effect, the management and control of the company vests with the equity shareholders.

Kinds of preference shares Kinds of preference shares (i) Cumulative Preference Shares : Preference shares which guarantee a fixed rate of dividend is known ass Cumulative Preference Shares . If the dividend at a fixed rate cannot be paid in any year on account of inadequate profits , arrears of dividend will accumulate and will have to be paid out of the profit of future years . All preference shares are considered cumulative unless otherwise mentioned . (ii) Non cumulative Preference Shares : Non cumulative Preference Shares are those shares on which the dividend does not on accumulating . In the case of such shares , a fixed rate of dividend is paid of the profits of the company. If no profits areavailable in any year , the shareholders get nothing , not can they claim unpaid fixed dividend in subsequent years. (iii) Participating Preference Shares : Participating Preference Shares are shares which are not only entitled to a fixed preferential dividend but also to participate in the surplus profits along with the equity shareholders. (iv) Non-Participating Preference Shares : Non participating Preference Shares are shares which entitle the shareholders , only the fixed preferential dividend . (v) Convertible Preference Shares :The holders of convertible preferential shares have the option to convert them into equity shares within a certain period . (vi)Non convertible Preference Shares : These are the shares which are to be redeemed or refunded at the expiry of a fixed period. (vii) Irredeemable Preference Shares : Irredeemable preference Shares are those shares which are repayable on the winding up of the company only

Advantages of Preference Shares The company ahs the following benefits through the issue of preference shares : (a) The preference shares attract funds from those investors who prefer safety and a fixed rate of return on their investment . (b) Since thee preference shareholders have only restricted voting rights , the management can retain control over the company by issuing preference shares to outsiders . (c) Preference Shareholders are entitled to a fixed rate of dividend . (d) As preference shares carry fixed rate of dividend , they do not impose heavy burden on the company . (e) A company cam raise finance for a long term without creating any charge over its assets . Disadvantages of Preference Shares In spite of the above advantages , preference shares are subject to the following limitations : (a)Preference shares are costlier. (b)Investors do not prefer these shares . (c)Preference shares adversely affect the credit worthiness of the company . (d)Redeemable preference shares are to be repaid after a fixed time . This becomes a burden to the company .

Equity Shares Equity Shares Shareswhich do not enjoy any of the preference attached to the preference shares are known as equity shares or ordinary shares . Equity shares are the most important sources of finance for fixed capital and they represent the ownership capital of a company . Equity shareholders are the real owners of the company and near the risk of business . Hence they are known as risk bearers and the capital they contribute is called venture capital . Dividend on equity shares is paid after the dividend on preference shares has been paid . In the case of winding up , equity capital can be paid back only after claim including those of preference shareholders has been settled . Advantages Equity share offers the following benefits as it is regarded as the corner-stone of the capital structure of a company : (i)It is the permanent resource of the company. (ii)It does not impose any obligation on the company . (iii)It does not create any charge over the assets of the company . (iv)It provides risk capital which serves as a base for outside borrowings. (v)As it enjoys free transferability , it provides liquidity to the investors funds. Disadvantages Equity shares of finance are subject to the following limitations : (i)The affairs of the company may be manipulated as the control rests with the equity shareholders.

(ii)Excessive issue of equity shares sometimes leads to over capitalisation . (iii)If the company issues only equity shares , it will lose the opportunity of trading by issuing other securities . (v)Higher dividends on equity shares during prosperous periods push up their market values . This will give an opportunity for speculative trading . Distinction between Preference Shares and Equity Shares Equity Share Equity Share Preference Share Preference Share Distinction between Preference Shares and Equity Shares 1. Its nominal value is generally lower. 1. Its nominal value is generally higher. 2. Its rate of dividend varies in accordance with the profits of the company. 2. Its rate of dividend is fixed. 3. It has no right to get the arrears of dividend . 3. Holders of cumulative preference shares have a right to get the arrears of dividend . 4. It cannot be redeemed. 4. It is redeemable. 5. It has voting rights on all matters. 5. It has no voting right except on matters affecting it . 6. It has comparatively more risk. 6. It has comparatively less risk . 7.There is no priority for the equity shareholders in the matter of dividend and repayment of capital. 7. There is priority regarding payment of dividend and repayment of capital . 8.It is highly speculative as the rate of dividend varies. 8. It is less speculative as the rate of dividend is fixed.