Understanding Bond Elections and Key Financial Terminology

Explore the intricacies of bond elections, financial terminology, and the role of a state treasurer in managing municipal finances. Discover the difference between par and premium bonds, the importance of coupon rates, and how proceeds impact taxpayer funds. Gain insights into optimizing financial strategies while ensuring transparency and accountability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

David C. Damschen Utah State Treasurer S.B. 122 S.B. 122 Bond Elections Amendments Bond Elections Amendments 2018 Legislative Session David Damschen, CTP Utah State Treasurer

How many legs does a dog have if you call the tail a leg?... Four. Calling a tail a leg doesn t make it a leg. ~Abraham Lincoln David C. Damschen | Utah State Treasurer

Basic Anatomy Of The Abuse An unfortunate loophole in statute A handful of willing municipalities An illusionof doing more with less A handfulof enabler professionals David C. Damschen | Utah State Treasurer

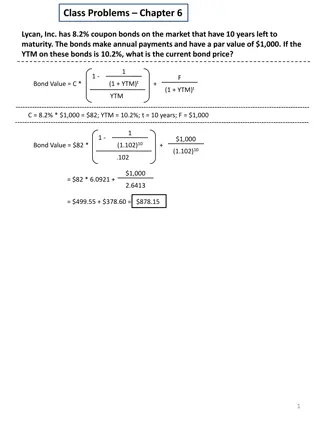

Key Terminology Par: The amount of principal borrowed or the face value of a bond, which is multiplied by its coupon rate to determine interest cost. Premium: Premium: Money in addition to par that is offered to a municipality at the time a bond is sold in exchange for a coupon rate which exceeds the municipality s market cost of interest. Proceeds: Proceeds: The total amount received (borrowed) by a municipality in exchange for a bond. This includes both par and premium. David C. Damschen | Utah State Treasurer

Key Terminology Coupon Rate: The interest rate paid to bond purchasers. The coupon rate multiplied by par equals annual interest payment. Debt Service Payment: Principal and interest paid on a periodic basis. Yield: The market cost of interest paid by a bond issuer. If a bond is sold at par, the coupon rate and yield are equal. If premium is received, the coupon rate is higher than the yield. David C. Damschen | Utah State Treasurer

Base Case: Par Bonds Voters authorize $10MM Proceeds received: $10MM Issuer s market borrowing cost 2.5% Par bonds, coupon 2.5%, yield 2.5% David C. Damschen | Utah State Treasurer

Abusive: Proceeds > Authorized Voters authorize $10MM Proceeds (par + premium) received: $11.33MM Issuer s market borrowing cost 2.5% Premium bonds, coupon 5%, yield 2.5% Leverages investor demand Proceeds exceed voter authorization David C. Damschen | Utah State Treasurer

Optimized & Taxpayer-Friendly Voters authorize $10MM Proceeds (par + premium) received: $10MM Issuer s market borrowing cost 2.5% Premium bonds, coupon 5%, yield 2.5% Leverages investor demand Proceeds don t exceed voter authorization The secret? Downsize par! David C. Damschen | Utah State Treasurer

Comparatively If voters authorize $10 million in borrowing: Base/Par Total Proceeds: $10,000,000 Optimized Total Proceeds: $10,000,000 Abusive Total Proceeds: $11,334,323 Coupon Rate: 2.5% Yield: 2.5% Coupon Rate: 5.0% Yield: 2.5% Coupon Rate: 5.0% Yield: 2.5% At the end of 10 years: $12,950,457 in principal & interest At the end of 10 years: $11,425,876 in principal & interest At the end of 10 years: $11,425,876 in principal & interest David C. Damschen | Utah State Treasurer

The Effects Of SB 122 (Sponsored by Senator Howard Stephenson and Representative Dan McCay.) Improves transparency and accountability in the administration of voter-approved debt; Eliminates inconsistencies in legal treatment by bond counsel of bonding transactions by providing greater clarity on appropriate limits to local borrowing; Maintains the flexibility that local governments need to effectively minimize borrowing costs; and Provides the latitudethat local governments need to ensure they can cover costs of bond issuance. David C. Damschen | Utah State Treasurer

S.B. 122 enhances transparency and compels fidelity with voter intent The bill does not impact the cost of a municipality s borrowing. The bill does not impact a municipality s credit rating. The bill does not limit how much a municipality can borrow. David C. Damschen | Utah State Treasurer

David C. Damschen Utah State Treasurer S.B. 122 S.B. 122 Bond Elections Amendments Bond Elections Amendments 2018 Legislative Session David Damschen, CTP Utah State Treasurer