Understanding Bond Premiums and Their Impact on Financial Decision-Making

Bond premiums occur when bond prices increase in the secondary market due to a drop in market interest rates. They can be used for approved project costs, debt service, or reducing bond principal. Utilizing bond premiums wisely can lead to cost savings for taxpayers. Learn how bond premiums can affect bond issuance and financial decisions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

What is Bond Premium? A bond premium occurs when the price of the bond has increased in the secondary market due to a drop in market interest rates. A bond sold at a premium to par has a market price that is above the face value amount. Three authorized uses of Bond Premium: Used to pay for costs of approved project for which bonds are issued Pay debt service related to the bonds Reduce the principal amount of the bonds being issued

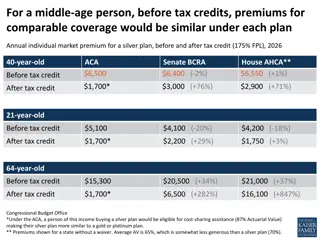

Bonds and Premiums City is issuing $98.5M in bonds - closing scheduled for March How did we get to $98.5M? Voters authorized issuance of bonds not to exceed $106.5M to be reduced by amount of pay-go of $7,927,272 approved by RIDE thus $106,500,000 minus $7,927,272 = $98,572,728

Use of Bond Premiums Bond premiums do not have to be repaid unlike debt, which requires repayment of principal and interest So if use bond premiums to fund project costs, no additional cost to taxpayers above what was approved. Assume bond premium of $10M money available for project would be $108.5M under this scenario taxpayers only obligated to pay principal and interest on $98.5M bonds being issued

Use of Premiums - continued If the assumed $10M is used to reduce the principal amount of bonds issued, then the bonds issued would be $88.5M. If the assumed $10M is used to pay debt service, then the impact over the 25- year life of the bonds is $400,000 per year. This amounts to a savings of 4- cents for residential and 6 cents for commercial ( .43% of the tax rate) based on current year taxes and assessed value in the initial year only. The savings would carry over from year to year but the rate would not be reduced except in the initial year. Note that any savings from the scenarios above would be affected by any additional borrowings needed to build the high school.