Understanding Bond Valuation and Types

Explore the world of bond valuation, from the definition of bonds to the different types such as zero-coupon, coupon, self-amortizing, and perpetual bonds. Learn about bond issuers, including the US government and agencies, and delve into the specifics of US government bonds like Treasury Bills, Notes, and Bonds. Discover the features of Treasury Strips and Agencies Bonds, and grasp the risks associated with different bond investments.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Bond Valuation Global Financial Management Campbell R. Harvey Fuqua School of Business Duke University charvey@mail.duke.edu http://www.duke.edu/~charvey 1

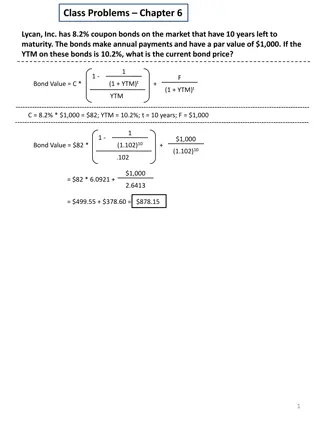

Definition of a Bond A bond is a security that obligates the issuer to make specified interest and principal payments to the holder on specified dates. Coupon rate Face value (or par) Maturity (or term) Bonds are sometimes called fixed income securities. n n 2

Types of Bonds Pure Discount or Zero-Coupon Bonds Pay no coupons prior to maturity. Pay the bond s face value at maturity. Coupon Bonds Pay a stated coupon at periodic intervals prior to maturity. Pay the bond s face value at maturity. Perpetual Bonds (Consols) No maturity date. Pay a stated coupon at periodic intervals. n n n 3

Types of Bonds Self-Amortizing Bonds Pay a regular fixed amount each payment period over the life of the bond. Principal repaid over time rather than at maturity. n 4

Bond Issuers Federal Government and its Agencies Local Municipalities Corporations n n n 5

U.S. Government Bonds Treasury Bills No coupons (zero coupon security) Face value paid at maturity Maturities up to one year Treasury Notes Coupons paid semiannually Face value paid at maturity Maturities from 2-10 years n n 6

U.S. Government Bonds Treasury Bonds Coupons paid semiannually Face value paid at maturity Maturities over 10 years The 30-year bond is called the long bond. Treasury Strips Zero-coupon bond Created by stripping the coupons and principal from Treasury bonds and notes. n n 7

Agencies Bonds Mortgage-Backed Bonds Bonds issued by U.S. Government agencies that are backed by a pool of home mortgages. Self-amortizing bonds. Maturities up to 20 years. n 8

U.S. Government Bonds No default risk. Considered to be riskfree. Exempt from state and local taxes. Sold regularly through a network of primary dealers. Traded regularly in the over-the-counter market. n n n n 9

Municipal Bonds Maturities from one month to 40 years. Exempt from federal, state, and local taxes. Generally two types: Revenue bonds General Obligation bonds Riskier than U.S. Government bonds. n n n n 10

Corporate Bonds Secured Bonds (Asset-Backed) Secured by real property Ownership of the property reverts to the bondholders upon default. Debentures General creditors Have priority over stockholders, but are subordinate to secured debt. n n 11

Common Features of Corporate Bonds Senior versus subordinated bonds Convertible bonds Callable bonds Putable bonds Sinking funds n n n n n 12

Bond Ratings S&P AAA Quality of Issue Moody s Aaa Highest quality. Very small risk of default. Aa AA High quality. Small risk of default. A A High-Medium quality. Strong attributes, but potentially vulnerable. Medium quality. Currently adequate, but potentially unreliable. Some speculative element. Long-run prospects questionable. Able to pay currently, but at risk of default in the future. Poor quality. Clear danger of default . Baa BBB Ba BB B B Caa CCC Ca CC High specullative quality. May be in default. C C Lowest rated. Poor prospects of repayment. D - In default. 13

Valuing Zero Coupon Bonds What is the current market price of a U.S. Treasury strip that matures in exactly 5 years and has a face value of $1,000. The yield to maturity is rd=7.5%. 1000 1075 . l = $696. 56 5 What is the yield to maturity on a U.S. Treasury strip that pays $1,000 in exactly 7 years and is currently selling for $591.11? l 1000 1 + rd = 59111 . 7 14

Bond Yields and Prices The case of zero coupon bonds Consider three zero-coupon bonds, all with face value of F=100 yield to maturity of r=10%, compounded annually. We obtain the following table: l Bond 1 Bond 2 Bond 3 Time / Bond value 10% $90.91 $75.13 $62.09 100 0 0 0 0 0 0 1 2 3 4 5 100 100 15

The Impact of Price Responses Suppose the yield would drop suddenly to 9%, or increase to 10%. How would prices respond? l Yield Bond 1 1 Year Bond 2 3 Year Bond 3 5 Year 10% 9% $90.91 $91.74 0.91% $90.09 -0.91% $75.13 $77.22 2.70% $73.12 -2.75% $62.09 $64.99 4.46% $59.35 -4.63% % change 11% % change Bond prices move up if the yield drops, decrease if yield rises Prices respond more strongly for higher maturities l l 16

Bond Valuation: An Example What is the market price of a U.S. Treasury bond that has a coupon rate of 9%, a face value of $1,000 and matures exactly 10 years from today if the required yield to maturity is 10% compounded semiannually? l 0 6 12 18 24 ... 120 Months 45 45 45 45 1045 45 0 05 . 1 1000 105 . + B = = 1 $937. 69 20 20 105 . 17

Valuing Coupon Bonds The General Formula What is the market price of a U.S. Treasury bond that has a coupon rate of 9%, a face value of $1,000 and matures exactly 10 years from today if the required yield to maturity is 10% compounded semiannually? l 0 1 2 3 4 ... n C C C C C+F + 1 C r d F r ( ) n = = + + 1 1 B CA F r ( ( ) ) n d n n + + 1 1 r d d 18

Bond Yields and Prices The case of coupon bonds Suppose you purchase the U.S. Treasury bond described earlier and immediately thereafter interest rates fall so that the new yield to maturity on the bond is 8% compounded semiannually. What is the bond s new market price? Suppose the interest rises, so that the new yield is 12% compounded semiannually. What is the market price now? Suppose the interest equals the coupon rate of 9%. What do you observe? Note: Coupon bonds can be regarded as portfolios of zero-coupon bonds (how?) What implication does this have for price responses? l l l 19

Valuing Coupon Bonds (cont.) New Semiannual yield = 8%/2 = 4% n n + 1 C r F + = 1 B ( ) n + 1 r 1 r What is the price of the bond if the yield to maturity is 8% compounded semiannually? 0 04 104 104 . . . n 1 1 1000 , B = + = 1 * 45 $1067. 95 20 20 Similarly: If r=12%: B=$ 827.95 If r= 9%: B=$1,000.00 n 20

Relationship Between Bond Prices and Yields Bond prices are inversely related to interest rates (or yields). A bond sells at par only if its coupon rate equals the coupon rate A bond sells at a premium if its coupon is above the coupon rate. A bond sells a a discount if its coupon is below the coupon rate. n n n n 21

Volatility of Coupon Bonds Consider two bonds with 10% annual coupons with maturities of 5 years and 10 years. The yield is 8% What are the responses to a 1% price change? l l l Yield 5-year bond 10-year bond $1,079.85 $1,038.90 -3.79% $1,123.01 4.00% 3.89% 8% 9% $1,134.20 $1,064.18 -6.17% $1,210.71 6.75% 6.46% % Change 7% % Change Average The sensitivity of a coupon bond increases with the maturity? l 22

Bond Prices and Yields Bond Price Longer term bonds are more sensitive to changes in interest rates than shorter term bonds. F c Yield 23

Bond Yields and Prices The problem Consider the following two bonds: Both have a maturity of 5 years Both have yield of 8% First has 6% coupon, other has 10% coupon, compounded annually. Then, what are the price sensitivities of these bonds to a 1% increase (decrease) in bond yields? Yield 6%-Bond 8% $920.15 9% $883.31 % Change -4.00% 7% $959.00 % Change 4.22% Average 4.11% l l 10%-Bond $1,079.85 $1,038.90 -3.79% $1,123.01 4.00% 3.89% Why do we get different answers? l 24

Duration Approximating the maturity of a bond Calculate the average maturity of a bond: Coupon bond is like portfolio of zero coupon bonds Compute average maturity of this portfolio Give each zero coupon bond a weight equal to the proportion in the total value of the portfolio Write value of the bond as: C r r + + + 1 1 1 ( ) ( ) ( l l + C C 1 ( F n ) C 1 2 t n + = + + + ... + + ... B 2 t ) r r The factor: C B ( 1+ t t ) r is the proportion of the t-th coupon payment in the total value of the bond. 25

Duration: A Definition Duration is defined as a weighted average of the maturities of the individual payments: C B r B r B + + 1 1 ( ) ( ) ( l + + C + 1 C ( F r C 1 2 t n = + + + ... + + ... 2 D t n 2 t n ) 1 ) r B This definition of duration is sometimes also referred to as Macaulay Duration. The duration of a zero coupon bond is equal to its maturity. l 26

Calculating Duration Calculate the duration of the 6% 5-year bond: l Time Payment PV(Payment)% of PV 55.56 51.44 47.63 44.10 721.42 920.15 Time*%PV 1 2 3 4 5 60 60 60 60 6.04% 5.59% 5.18% 4.79% 78.40% 100.00% 0.06 0.11 0.16 0.19 3.92 4.44 1060 Calculate the duration of the 10% 5-year bond: l Time Payment PV(Payment)% of PV 92.59 85.73 79.38 73.50 748.64 1079.85 Time*%PV 1 2 3 4 5 100 100 100 100 1100 8.57% 7.94% 7.35% 6.81% 69.33% 100.00% 0.09 0.16 0.22 0.27 3.47 4.20 The duration of the bond with the lower coupon is higher Why? l 27

Duration: An Exercise What is the interest rate sensitivity of the following two bonds. Assume coupons are paid annually. Bond A Bond B Coupon rate 10% 0% Face value $1,000 $1,000 Maturity 5 years 10 years YTM 10% 10% Price $1,000 $385.54 28

Duration Exercise (cont.) Year (t) 1 2 3 4 5 6 7 8 9 10 Totals Duration PV(A) $90.91 $82.64 $75.13 $68.30 $683.01 0 0 0 0 0 $1000.00 PV(A) x t $90.91 $165.89 $225.39 $273.21 $3,415.07 0 0 0 0 0 $4,170.47 4.17 PV(B) 0 0 0 0 0 0 0 0 0 $385.54 $385.54 PV(B)xt 0 0 0 0 0 0 0 0 0 $3,855.43 $3,855.43 10.00 29

Duration Exercise (cont.) Percentage change in bond price for a small increase in the interest rate: n Pct. Change = - [1/(1.10)][4.17] = - 3.79% Bond A Pct. Change = - [1/(1.10)][10.00] = - 9.09% Bond B 30

Duration and Volatility For a zero-coupon bond with maturity n we have derived: l 1 B r B n + = 1 r For a coupon-bond with maturity n we can show: l 1 B r B D + = 1 r The right hand side is sometimes also called modified duration. Hence, in order to analyze bond volatility, duration, and not maturity is the appropriate measure. Duration and maturity are the same only for zero-coupon bonds! l 31

Duration and Volatility The example reconsidered Compute the right hand side for the two 5-year bonds in the previous example: 6%-coupon bond: D/(1+r) = 4.44/1.08=4.11 10%-coupon bond: D/(1+r) = 4.20/1.08=3.89 But these are exactly the average price responses we found before! Hence, differences in duration explain variation of price responses across bonds with the same maturity. l l 32

Is Duration always Exact? Consider the two 5-year bonds (6% and 10%) from the example before, but interest rates can change by moving 3% up or down: Yield 6%-Bond 5-year bond 8% $920.15 $1,079.85 11% $815.21 $963.04 % Change -11.40% -10.82% 5% $1,043.29 $1,216.47 % Change 13.38% 12.65% Average 12.39% 11.73% l This is different from the duration calculation which gives: 6% coupon bond: 3*4.11%=12.33%<12.39% 10% coupon bond: 3*3.89%=11.67%<11.73% Result is imprecise for larger interest rate movements Relationship between bond price and yield is convex, but Duration is a linear approximation l l 33

The Term Structure of Interest Rates The term structure of interest rates is the relationship between time to maturity and yield to maturity: n Yield 6.00 5.75 5.00 Maturity 1 2 3 34

Spot and Forward Rates A spot rate is a rate agreed upon today, for a loan that is to be made today. (e.g. r1=5% indicates that the current rate for a one- year loan is 5%). A forward rate is a rate agreed upon today, for a loan that is to be made in the future. (e.g. 2f1=7% indicates that we could contract today to borrow money at7% for one year, starting two years from today). r1=5.00%, r2=5.75%, r3=6.00% We can either: Invest $100 for three years , or: Invest $100 for two years, and contract (today) at the one year rate, two years forward l l 35

Forward Rates A first look at arbitrage Which investment strategy is optimal: Invest $100 for three years: $100*(1.06)3= Invest $100 for two years, and invest the proceeds at the two-year forward rate: $100*(1.0575)2(1+2f1)= Hence the first strategy is optimal if 2f1<6.50%, the second if 2f1>6.50%. Hence 2f1=6.50% (Why?) More generally: (1+rn+t)n+t=(1+rn)n(1+nft) l l 36

When should you borrow? Suppose you wish to borrow $20,000 in two years in order to borrow a car, and you know you can repay the loan in three years? You have two options: I. 1. Borrow $17,884 now at 6%, repay $20,000*(1.06)3 =$21,300.35 in three years . 2. Invest the proceeds from the loan for two years at 5.75% to have $17,884*(1.0575)2=$20,000 in two years. II. Wait for two years, borrow at the prevailing one year loan rate in 1 year? <forget about the cut the bank gets> When would you follow strategy I (lock in the current rate) rather than wait (strategy II)? l l 37

When to borrow (cont.) If you lock in the current rate, then you secure a borrowing rate of: $ 21,300.35/$20,000=1.065, i. e. 6.5% This is exactly the forward rate we calculated above Why? Hence, you would borrow and lock in rates now, if you expect that the one-year interest rate is going to be higher than 6.5% i 1999. When would you set the cut-off rate for waiting higher? (lower?) If everybody invests this way, then the forward rate equals the expected future spot rate. Why? l l l 38

Summary Bonds can be valued by discounting future cash flows at the yield to maturity Bond prices changes inverse with yield Price response of bond to interest rates depends on term to maturity. Works well for zero-coupon bond Coupon bonds are like portfolios of zero-coupon bonds Need duration as average maturity for coupon bonds Only an approximation The term structure implies terms for future borrowing: Forward rates Compare with expected future spot rates l l l l l 39