Understanding Callable Bonds in Bond Investments

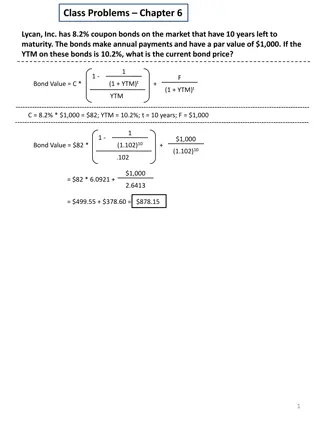

Callable bonds are a type of bond where the issuer reserves the right to redeem the bond at different times, potentially at different values. Investors face uncertainty about when the bond will be redeemed, but it can only be called at predetermined times. Common questions revolve around determining maximum bond price for desired yield or minimum yield for a given bond price. Problem-solving strategies involve analyzing the bond's call times and corresponding prices for desired yield rates.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

SOA Exam FM Module 3 Section 7 Callable Bonds

Definition A callable bond is a bond in which the issuer reserves the right to redeem the bond at different discrete times (referred to as calling the bond), possibly for different redemption values.

Definition A callable bond is a bond in which the issuer reserves the right to redeem the bond at different discrete times (referred to as calling the bond), possibly for different redemption values. When a callable bond is bought, no one knows when the bond will be called (redeemed); however, it can only be called at one of the times agreed upon at issue.

Definition A callable bond is a bond in which the issuer reserves the right to redeem the bond at different discrete times (referred to as calling the bond), possibly for different redemption values. When a callable bond is bought, no one knows when the bond will be called (redeemed); however, it can only be called at one of the times agreed upon at issue. Callable bond problems will be obvious by the wording of the problem. Unless told that the bond is callable within the wording of the problem, assume all bonds are held to maturity and redeemed for the stated redemption value.

Common Types of Questions 1. Determine the maximum price that can be paid for the bond in order to guarantee a certain yield rate.

Common Types of Questions 1. Determine the maximum price that can be paid for the bond in order to guarantee a certain yield rate. 2. Determine the minimum yield rate for a bond that was bought at a certain price

Problem Solving Strategies 1. Determine the maximum price that can be paid for the bond in order to guarantee a certain yield rate.

Problem Solving Strategies 1. Determine the maximum price that can be paid for the bond in order to guarantee a certain yield rate. Populate the following two-column table. Time at which bond is called ? Price in order to receive desired yield rate ?(?)

Problem Solving Strategies 1. Determine the maximum price that can be paid for the bond in order to guarantee a certain yield rate. Populate the following two-column table. Time at which bond is called ? Price in order to receive desired yield rate ?(?) Choose the lowest price in the table.

Problem Solving Strategies 2. Determine the minimum yield rate for a bond that was bought at a certain price.

Problem Solving Strategies 2. Determine the minimum yield rate for a bond that was bought at a certain price. Populate the following two-column table. Time at which bond is called ? Yield rate that produces the given price ?

Problem Solving Strategies 2. Determine the minimum yield rate for a bond that was bought at a certain price. Populate the following two-column table. Time at which bond is called ? Yield rate that produces the given price ? Choose the lowest yield rate in the table.