Money Management Lessons for Year 8 PSHE Students

Explore attitudes towards money, learn about budgeting, and consider the impact of money on happiness and life choices in this comprehensive PSHE lesson for Year 8 students. Activities include analyzing feelings towards money, discussing the relationship between money and happiness, budgeting hypothetical million-pound winnings, and providing financial advice to fictional characters facing money problems.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

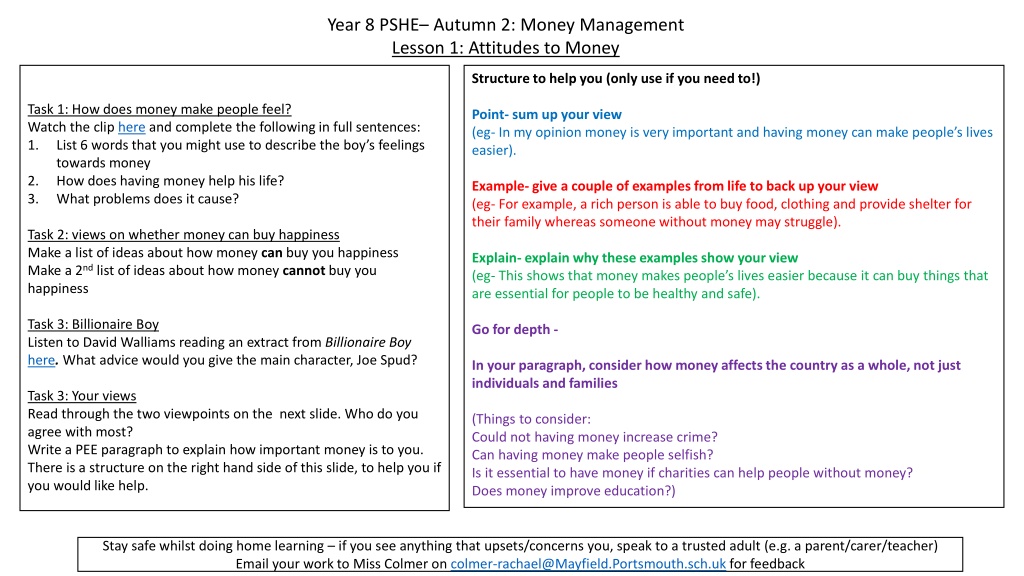

Year 8 PSHE Autumn 2: Money Management Lesson 1: Attitudes to Money Structure to help you (only use if you need to!) Task 1: How does money make people feel? Watch the clip here and complete the following in full sentences: 1. List 6 words that you might use to describe the boy s feelings towards money 2. How does having money help his life? 3. What problems does it cause? Point- sum up your view (eg- In my opinion money is very important and having money can make people s lives easier). Example- give a couple of examples from life to back up your view (eg- For example, a rich person is able to buy food, clothing and provide shelter for their family whereas someone without money may struggle). Task 2: views on whether money can buy happiness Make a list of ideas about how money can buy you happiness Make a 2nd list of ideas about how money cannot buy you happiness Explain- explain why these examples show your view (eg- This shows that money makes people s lives easier because it can buy things that are essential for people to be healthy and safe). Task 3: Billionaire Boy Listen to David Walliams reading an extract from Billionaire Boy here. What advice would you give the main character, Joe Spud? Go for depth - In your paragraph, consider how money affects the country as a whole, not just individuals and families Task 3: Your views Read through the two viewpoints on the next slide. Who do you agree with most? Write a PEE paragraph to explain how important money is to you. There is a structure on the right hand side of this slide, to help you if you would like help. (Things to consider: Could not having money increase crime? Can having money make people selfish? Is it essential to have money if charities can help people without money? Does money improve education?) Stay safe whilst doing home learning if you see anything that upsets/concerns you, speak to a trusted adult (e.g. a parent/carer/teacher) Email your work to Miss Colmer on colmer-rachael@Mayfield.Portsmouth.sch.uk for feedback

Money is the most important thing in life. Without money, you cannot have a good home, a nice car or buy lots of nice things that make you happy. You also cannot buy essentials like food so it must be the most important thing. Person A Money really isn t that important at all. You can get the essentials, like food, at a low cost. It s much more important that you have kind friends and family or carers who love you that s where happiness comes from. Person B Who do you agree with the most? Why? Discuss with your partner

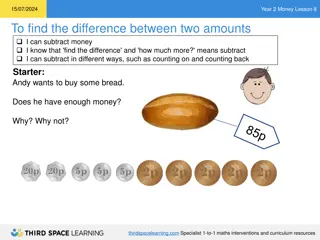

Year 8 PSHE Autumn 2: Money Management Lesson 2: Budgeting Task 1: Millionaire Imagine you have just won 1 million pounds! Write a list of things that you would spend the money on. You should write at least 10 things. Split your list into 3 categories: Must haves Want, but not essential Could do without Task 3: Applying this to real life For each of the following items, make a note of how much you think they would cost: Fifa 21 Tube of Pringles Apple Watch Haribo Xbox Series X Harry Potter book Some additional information please read Essentials and luxuries can be different for different people, but we all have to work to a budget and try and ensure we cover the essentials before spending on luxuries. Sort them from the one you think would be least expensive, up to the one you think would be most expensive. Use the answers on slide 5 to check your answers. Correct any that you did not initially have correct. You are going to complete some activities and see if you can budget your money, and plan what you might do with the remaining money. Task 4: Giving advice Read the information about Beth on slide 6 and answer the following: What money problems does she have? What can she do to save money? What could they buy with the money you have saved them? Any other financial advice that you could give them? SMSC: Cultural: Does Beth need to spend money on Luxuries? Task 2: Spending money Complete the tasks on slide 4. You should think carefully about your choices and their costs. Stay safe whilst doing home learning if you see anything that upsets/concerns you, speak to a trusted adult (e.g. a parent/carer/teacher) Email your work to Miss Colmer on colmer-rachael@Mayfield.Portsmouth.sch.uk for feedback

Imagine your parents/carers give you 5 a day. With that money, you have to get yourself to school and buy your lunch and break time snack. Create a budget plan of what you would spend your money on. You should show what you would pay for/buy and how much you would be paying. Use the menu prices to work out the costs. Do you have any money left each day? If so, how much? Imagine your parents/carers say you can keep any money that is left over. What might you do with that money? Be ready to share your ideas with the class. Has everyone factored in all the things they need to pay for?

Be a reflective learner and use the answers below to check your work. Correct any that you did not initially have right, in purple pen Prices were correct 15 Oct 2020

Below is information about a university student called Beth, who would like to re-work her spending to ensure she can afford the essentials. Can you help her do this? Can you work out how to help her afford any luxuries? Name: Beth Age: 18 The cost of living: Likes: Clothes shopping Dislikes: Junk food Birthday present for brother/sister 15 Snacks 4.00 Chinese takeaway 10 Top up your mobile 10 Go for a gym session 5 See a live band 10 Go out with friends 12 Travel 10 miles on a bus 2 Buy a second hand computer game 10 New make-up 8 Visit hairdresser 20 Go to a fast food outlet for lunch 7 Buy some new clothes 20 Situation: In her first year at University studying for a degree in Law. Money Coming in (Income): 120 per week from her student loan. Works in the student bar for two nights a week ( 5 hours a night at 5.50 per hour). Parents send her 25 per week. Everyday spending (Expenditure): Self-catering accommodation in the halls of residence 100 per week. Goes to see a live band every week. Eats take away food two nights per week. Spends 40 at local supermarket each week. Dream item: New bike 400 Things on her mind: Recently spent 1000 on a new store card and is worried about repaying the money

Year 8 PSHE Autumn 2: Money Management Lesson 3: Making Budgets Task 1: Careers link What might a financial advisor do? Make a mind map of your ideas. Task 3: Helping your first customer Read the information on Steve on slide 9. Explain how Steve could benefit from making a budget. When you have finished, look at the career profile on the next page and add anything that you did not already know to your mind map, using your purple pen. Sentence starters to help you: Task 2: Designing a business You are going to set up your own business as a financial advisor and need to advise your clients well, so that they spread the word that you are the best person to see for financial advice! Some of Steve s problems before he had a budget were As Steve s financial advisor, I suggested that he should This would help Steve financially, because Decide on a company name, logo and slogan Make a list of what you expect your incomings and outgoings will be (just descriptions, not costs what things would you need to spend money on? Where might you get money coming in from?) Go for depth! Evaluate how useful a budget is to help someone to save money Stay safe whilst doing home learning if you see anything that upsets/concerns you, speak to a trusted adult (e.g. a parent/carer/teacher) Email your work to Miss Colmer on colmer-rachael@Mayfield.Portsmouth.sch.uk for feedback

Career Profile: Financial Advisor Main role: Financial Advisors give clients specialist advice on how to manage their money. The role involves researching the marketplace and recommending products and services that are available to people, and helping them to make good financial decisions. Qualifications needed: Before becoming a financial advisor, you would need a qualification in financial advice that is recognised by the Financial Conduct Authority. GCSEs in Maths and English, as well as work experience in sales, finance or customer service will help, too. Salary: Financial Advisors can earn around 23,000 when they start and can earn more money with experience. Some experienced financial advisors can earn up to 73,000.

Steve is your newest customer. He is 18 and works in an office. He receives 900 per month after tax but has been told if he works hard he can get a pay rise of an extra 100 per month. He has to pay the following costs each month. Some are essential and other costs are luxuries. 40 gym 100 food shopping 20 clothing 15 debt to family (this will be paid back in 10 months) 60 going out and entertainment 50 pet costs eg food and insurance 40 on morning coffees on his way to work 220 towards household bills 50 phone bill 100 travel costs (Steve lives 5 miles from work and catches the bus everyday) Steve wants to save some money each month to help towards buying a holiday next year. He would also like to know how much money he has spare each month and would like suggestions for what to do with it to make the most of his money.