Evolution of Money: From Barter to Electronic Banking

Money has evolved from the barter system to electronic banking through various stages like animal money, metallic money, paper money, and credit money. The invention of money was crucial to overcome the limitations of barter, leading to the ideal utilization of resources and solving issues like the double coincidence of wants. The development of money has been ongoing throughout human civilization, shaping the way we exchange goods and services.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

BARTER SYSTEM AND EVOLUTION OF MONEY

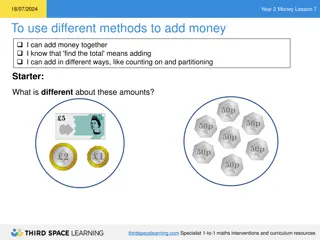

Introduction- Money is something which is generally accepted as a medium of exchange. It is one of the most basic and significant inventions of mankind. Before money came into use, exchange took place through barter system, i.e. , goods were exchanged for goods. Definition- Barter means direct exchange of goods or barter refers to exchanging of goods without the use of money. For example, corn may be exchanged for cloth, house for horses, fruits for utensils and so on.

Simple system No Question of Under- Production, or of Un-Employment or of Over- Full Employment No Problems of International Trade Ideal Utilisation of Natural Resources No Problem of Concentration of Economic Power in one hand.

Barter system involves various difficulties and inconveniencies which are discussed below: Double Coincidence of Wants Absence of Common Measure of value Lack of Divisibility The Problem of Storing wealth Difficulty of Deferred Payments Problem Of Transportation

INVENTION Of MONEY: In order to overcome the difficulties of barter system money was invented. According to Crowther- Money is one of the most fundamental of all man s inventions. Every branch of knowledge has its fundamental discovery. In mechanics its wheel, in science fire, in politics vote. Similarly, in economics, in the whole commercial side of man s social existence, money is the essential invention of which all the rest is based.

DEVELOPMENT OF MONEY: The origin of money is not known because of non-availability of recorded information; its deep rooted in antiquity. The evolution of money has been a secular process and shall continue to remain so, but the development of money in the present form can be historically traced as it has passed through different stages in accordance with the growth human civilisation.

These stages are discussed below: Animal Money Commodity Money Metallic Money Paper Money Credit Money Electronic banking Stage

Main types of money exist in a modern economy: 1.Metallic money: Standard Money Token Money 2.Paper Money: Representative Paper money Convertible Paper Money Inconvertible Paper Money Fiat Money 3. Credit Money 4. Near money

According to Walker, Money is what money does. Crowther defines it, anything that is generally acceptable as a means of exchange and at the same time act as a measure and store of value.

On the basis of the constituents of money, the following four approaches to the money are generally followed: Traditional Approach: M= C+DD (where C= currency, DD= demand deposits) Monetarist Approach: M= C+DD+TD (where C= currency, DD= demand deposits, TD= time deposit)

Liquidity Approach: M=C+DD+TD+SB+S etc (where C= currency, DD= demand deposits, TD= time deposit, SB= saving bank deposits, S= shares) The Central Bank Approach: M= C+DD+TD+NBFI+CUA

Various functions of money can be classified into three broad groups: 1.Primary Functions: Medium of Exchange Measure of Value 2. Secondary Functions: Standard of Deferred Payments Store of Value Transfer of Value

3. Contingent Functions: Distribution of National Income Maximisation of Satisfaction Basis of Credit System Liquidity To Wealth