Understanding Money and Monetary Policy in Economics

Money serves as a medium of exchange, store of value, and unit of account in an economy. It is vital for economic transactions and stability. The quantity of money is measured using concepts like liquidity and monetary aggregates. The demand for money is linked to the Quantity Theory of Money, which relates money supply, velocity, price level, and real GDP. Central banks use monetary policy tools to regulate the money supply and achieve economic objectives.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

BNR-Monetary policy EPRN, 03/07/2019

I. Introduction What is money? The money is defined as anything that is generally accepted in payment for goods and services or in repayment of debts. Example: Currency consisting of RFW (notes and coins); Checks because checking account deposits are money as well; Savings deposits can also function as money if they can be quickly and easily converted into currency or checking account deposits.

CTD Why money so important? Because of its functions: medium of exchange; medium of account; store of value. However, there are many other assets which serve as stores of value: bonds, stocks, real estate, and so on; Money pays no interest to its holder: it is inferior as a store of value to these other interest bearing assets, particularly when price level is rising: Loose of purchasing power.

II. How the quantity of money measured in an economy? II. How the quantity of money measured in an economy? Use of the concept of liquidity: easy of which an asset can be used in transaction. Example of monetary aggregates in Rwanda M1: currency in circulation (C) out the banking system and demand deposits (D); M2: M1+ savings deposits in FRW; M3=M2+ deposits in foreign currency.

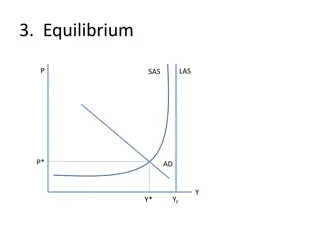

Demand for money Quantity Theory of Money: M V= P Y M: quantity of money in the economy; V: velocity of money (average number of times per unit of that a unit of money is spent in buying goods and services produced in the economy); P: price level; Y: real GDP Classical economists: Y and V are constant: contribute to link money with nominal GDP However, V may change due to innovations in financial systems for example

V 7.0 6.5 6.0 5.5 5.0 4.5 4.0 3.5 98 00 02 04 06 08 10 12 14 16

BNR-Monetary policy 1995-2018: Monetary targeting regime; Reserve money: operating target; M3: Intermediate target Assumptions: Stability of money multiplier and stability of velocity of money

Money and reserve money evolution 15 10 5 0 -5 -10 -15 00 02 04 06 08 10 12 14 16 18 DM3 DMM

Price based monetary policy framework Price based monetary policy framework Focus of BNR: align the central bank rate (CBR, previously called KRR) with interbank market rates to anchor short-term interest rates; Inflation band 22.0 BNR medium term benchmark: 5% 17.0 12.0 7.0 2.0 -3.0 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 May-13 Jan-14 Sep-14 May-15 Jan-16 Sep-16 May-17 Jan-18 Sep-18 Headline Inflation Core Inflation Lower Band Upper Band Benchmark

Interest rates band 12.0 10.0 8.0 6.0 4.0 2.0 0.0 Repo_rate CBR Interbank_rate Lower band Upper band T-bills-WA

Monetary policy instruments Open market operations ( OMOS) based on: Repo/ reverse repo operations; Treasury bills; Standing facilities ( deposit and lending); Sales to banks ( foreign currency) Monetary policy communication