Evolution of Money: From Barter to Fiat Currency

The evolution of money traces back to barter economies where a mutual coincidence of wants was necessary for trade. Settlers in Colonial America used commodity money and fiat money, with specie coins becoming popular due to their mineral content. The term "dollars" originated from the German pronunciation of "talers," becoming the primary monetary unit in the U.S. money system.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Bell Work What is money? How would you define it? Where does it come from? How does it get its value?

In Lakech by Luis Valdez Tu eres me otro yo You are my other me Si te hago da o a ti, If I do harm to you, Me hago da o a mi mismo I do harm to myself Si te amo y respeto If I love and respect you Me amo y respeto yo I love and respect myself

Bell Work What is money? How would you define it? Where does it come from? How does it get its value?

Money and Banking How has money evolved to meet the needs of people everywhere? How did the creation of the Fed improve our banking system? How has technology affected the way we use money?

This American Life: Money Intro https://www.thisamericanlife.org/423/the-invention-of-money

Bell Work What do you think we would we do if there was no such thing as money?

In Lakech by Luis Valdez Tu eres me otro yo You are my other me Si te hago da o a ti, If I do harm to you, Me hago da o a mi mismo I do harm to myself Si te amo y respeto If I love and respect you Me amo y respeto yo I love and respect myself

Bell Work What do you think we would we do if there was no such thing as money?

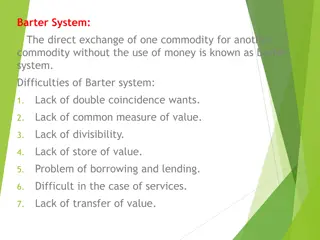

The Evolution of Money In a barter economy, a mutual coincidence of wants is required for trade to take place. Settlers in Colonial America used commodity money or fiat money. Early paper currency in Colonial America was a form of fiat money. Specie silver or gold coins were the most desirable form of money because of their mineral content and because they were in limited supply. Pesos (pieces of eight) and resembled Austrian talers. Because the German pronunciation of talers sounded like dollars, the term dollars became so popular that it became the basic monetary unit in the U.S. money system.

Reflection What do you think about the idea that money is fiction? How do you think that reality might effect you?

Bell Work What might be some of the characteristics of money (what are some things you think money should be or be able to do)?

In Lakech by Luis Valdez Tu eres me otro yo You are my other me Si te hago da o a ti, If I do harm to you, Me hago da o a mi mismo I do harm to myself Si te amo y respeto If I love and respect you Me amo y respeto yo I love and respect myself

Bell Work What might be some of the characteristics of money (what are some things you think money should be or be able to do)?

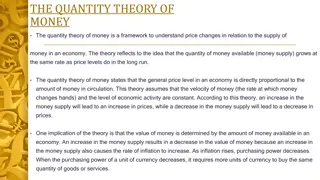

Characteristics and Functions of Money Money must be portable, durable, divisible, and available, but in limited supply. Money plays three roles in the economy: a medium of exchange, a measure of value, and a store of value. Modern money shares the same fundamental characteristics of all money: portability, durability, divisibility, and scarcity. Components of modern money include Federal Reserve Notes, metallic coins, and demand deposit accounts (DDAs). The Fed defines money supply as M1 and M2. M1: coins, currency, traveler s checks, DDAs o M2: everything in M1, plus savings deposits, time deposits, and money market funds o

Early Banking in America During the Revolutionary War, Continental dollars were printed. The Constitution left the printing of paper currency to the individual states. State banks received their operating charters from individual state governments. Problems with pre-Civil War currency included: each bank printed its own currency, resulting in many different notes; banks issued too many notes; counterfeiting. Congress printed paper money for the first time to pay for the Civil War. The National Banking System was established in 1863, consisting of national banks that issued currency backed by federal bonds. Other federal currencies included Gold Certificates and Silver Certificates.

Bell Work What do you think the Gold Standard for money is? Do you think we should use it or not? Why?

In Lakech by Luis Valdez Tu eres me otro yo You are my other me Si te hago da o a ti, If I do harm to you, Me hago da o a mi mismo I do harm to myself Si te amo y respeto If I love and respect you Me amo y respeto yo I love and respect myself

Bell Work What do you think the Gold Standard for money is? Do you think we should use it or not? Why?

The Gold Standard The United States went on the gold standard in 1900, allowing people to exchange other federal currencies for gold. Advantages of a gold standard: people feel secure about currency and the government does not create too much money, so the money keeps its value. Disadvantages of a gold standard: slowing of the money supply if gold is scarce and the risk that people may convert their currency, depleting the gold supply. In 1933, President Roosevelt issued orders denying U.S. citizens the right to redeem dollars for gold, although foreign countries could still do so. In 1971, President Nixon declared that the U.S. would no longer redeem any dollars for gold.

Creation of the Fed Congress created the Federal Reserve System in 1913 as the nation s central bank. During the Great Depression, many smaller banks failed. In 1933, President Roosevelt declared a bank holiday, during which all banks were required to close; most were allowed to reopen after Congress passed legislation to strengthen the banking industry. The Federal Deposit Insurance Corporation (FDIC) was formed in 1933 to insure customer deposits. All other forms of federal currency have now been replaced by Federal Reserve Notes. Our monetary system today is sound and has a uniform currency, but some banks have become so large that they cannot be allowed to fail.

This American Life: The Lie that Saved Brazil https://www.thisamericanlife.org/423/the-invention-of-money

Today most of our money is issued by A.individual states. B.the Federal Reserve System. C.the U.S. president. D.Congress.

What must two people who want to trade with each other have in a barter economy? A.Mutual coincidence of wants B.Pesos C.Federal Reserve notes D.Fiat money

How was commodity money different from fiat money? A.Commodity money could be used only to settle debts, while fiat money could be used only to make purchases. B.Fiat money could be used only to settle debts, while commodity money could be used only to make purchases. C.Fiat money had an alternative use as an economic good, while commodity money did not. D.Commodity money had an alternative use as an economic good, while fiat money did not.

Specie was money in the form of A.paper currency. B.silver or gold coins. C.Continental dollars. D.commodities such as corn, hemp, gunpowder, and musket balls.

What are the four characteristics of money? A.Portability, durability, divisibility, scarcity B.Immobility, weakness, divisibility, abundance C.Exchange, value, storage, scarcity D.Portability, value, divisibility, storage

When money serves as a store of value, it _____ purchasing power. A.loses B.saves C.buys D.sells

The dollar, or monetary unit and standard unit of currency in the U.S. monetary system, was modeled after A.the French franc. B.the British pound. C.the Spanish peso. D.the Austrian taler.

By the end of the Revolutionary War, Continental dollars were A.backed by gold. B.printed by the federal government. C.considered worthless. D.all held by banks.

Who issued paper currency in the United States during the first half of the 19th century? A.A central bank B.The national bank C.State banks D.The Federal Reserve

Why did the federal government begin printing greenbacks in 1861? A.To help pay for the Civil War B.To compete with state banks C.To revive the Continental dollar D.To ruin the Confederate economy

When did the United States go on the gold standard? A.1900 B.1878 C.1861 D.1934

In 1933, President Roosevelt issued a series of orders that effectively _____ the gold standard to the American people. A.guaranteed B.explained C.promised D.denied

In 1913, Congress created A.the gold standard. B.the Federal Reserve System. C.silver certificates. D.the Federal Deposit Insurance Corporation.

Who owns the Federal Reserve System? A.Privately owned commercial banks B.The federal government C.The American people D.The Federal Deposit Insurance Corporation

What problem or problems was the Fed supposed to help solve? A.There were many national banks and no centralized system for keeping them strong. B.Banks were vulnerable to failure because of a lack of reserves. C.The nation was operating with several different forms of national currency. D.A, B, and C

To counter bank runs during the Great Depression, the federal government A.declared a bank holiday. B.issued silver certificates. C.went on the gold standard. D.created the Federal Reserve System.

What is the main purpose of the FDIC? A.To function as a central bank B.To insure bank deposits C.To control the money supply D.To combat counterfeiting

Reflection Do you think the fact that the Federal Reserve is controlled by private banks, and not the federal government, a good thing or a bad thing? Why?

Bell Work When you deposit money in a savings account, what do you think happens to it?

In Lakech by Luis Valdez Tu eres me otro yo You are my other me Si te hago da o a ti, If I do harm to you, Me hago da o a mi mismo I do harm to myself Si te amo y respeto If I love and respect you Me amo y respeto yo I love and respect myself

Bell Work When you deposit money in a savings account, what do you think happens to it?

Crash Course: Money and Finance https://www.youtube.com/watch?v=Dugn51K_6WA

How a Bank Gets its Money Most banks are established as corporations so that they can raise money by issuing stock and so that shareholders will not be responsible for the bank s debt. New banks may begin operations by accepting deposits and paying interest on them, and may offer certificates of deposit (CDs). When a bank receives a new deposit or CD, it must keep 20 percent of the deposit as a fractional reserve, but is allowed to lend the remaining 80 percent. Banks earn money on consumer and business loans, investments, and fees charged to consumers.

Selecting a Bank To evaluate your banking needs, consider which services you need, the bills you normally pay, and how you wish to pay them. Services offered by banks include checking accounts or DDAs, savings accounts, time deposits, debit cards, credit cards, smart cards, electronic funds transfer (EFT), and safety-deposit boxes.

Rounding Out your Financial Literacy Saving on a regular basis will provide funds for future use and will demonstrate that you have the discipline and patience to embark on a career-long path to financial success. Pay attention to products and fees charged by your bank so that you can avoid unnecessary fees. You can make yourself creditworthy by purchasing an item on time and keeping up with the payments or by building a good financial relationship with a bank.

Selecting a Bank Activity Work in a group of 4 Use the Bank Comparison Worksheet to collect information about 4 different banks Determine what you consider the positive and negative features of each bank Decide which of the 4 banks would be the best choice for your needs.

What is the difference between a commercial bank and a credit union? A.A commercial bank is in business to make a profit, whereas a credit union is a nonprofit service cooperative. B.A commercial bank accepts deposits, makes loans, and provides other financial services, whereas a credit union does not. C.A credit union is in business to make a profit, whereas a commercial bank is a nonprofit service cooperative. D.A credit union accepts deposits, makes loans, and provides other financial services, whereas a commercial bank does not.