Labor Audit Alert: Is Your Business Prepared for a Department of Labor Audit?

A Department of Labor (DOL) audit can be a thorough review to ensure your business complies with labor laws and regulations. Preparing for this process can save you time, stress, and potential penalties. Here's a breakdown of key dos and don'ts to he

Uploaded on | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

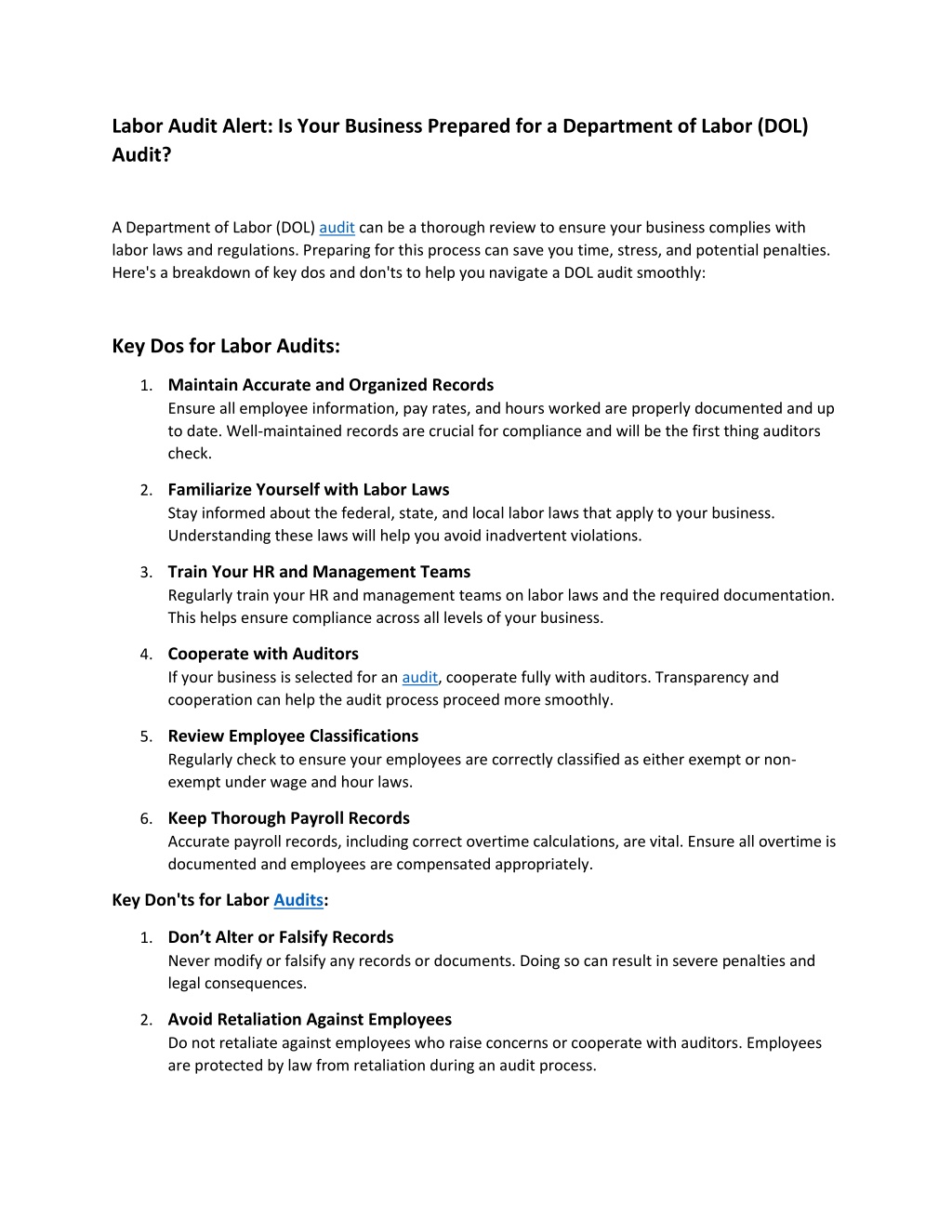

Labor Audit Alert: Is Your Business Prepared for a Department of Labor (DOL) Audit? A Department of Labor (DOL) audit can be a thorough review to ensure your business complies with labor laws and regulations. Preparing for this process can save you time, stress, and potential penalties. Here's a breakdown of key dos and don'ts to help you navigate a DOL audit smoothly: Key Dos for Labor Audits: 1.Maintain Accurate and Organized Records Ensure all employee information, pay rates, and hours worked are properly documented and up to date. Well-maintained records are crucial for compliance and will be the first thing auditors check. 2.Familiarize Yourself with Labor Laws Stay informed about the federal, state, and local labor laws that apply to your business. Understanding these laws will help you avoid inadvertent violations. 3.Train Your HR and Management Teams Regularly train your HR and management teams on labor laws and the required documentation. This helps ensure compliance across all levels of your business. 4.Cooperate with Auditors If your business is selected for an audit, cooperate fully with auditors. Transparency and cooperation can help the audit process proceed more smoothly. 5.Review Employee Classifications Regularly check to ensure your employees are correctly classified as either exempt or non- exempt under wage and hour laws. 6.Keep Thorough Payroll Records Accurate payroll records, including correct overtime calculations, are vital. Ensure all overtime is documented and employees are compensated appropriately. Key Don'ts for Labor Audits: 1.Don t Alter or Falsify Records Never modify or falsify any records or documents. Doing so can result in severe penalties and legal consequences. 2.Avoid Retaliation Against Employees Do not retaliate against employees who raise concerns or cooperate with auditors. Employees are protected by law from retaliation during an audit process.

3.Ensure Fair Employment Practices Make sure your employment practices, including pay rates and promotions, are non- discriminatory. Discriminatory practices are not only illegal but can also result in penalties. 4.Don t Misclassify Employees Misclassifying employees as independent contractors to avoid paying benefits or taxes is illegal. Be sure to classify your workers correctly according to DOL guidelines. 5.Properly Compensate for Overtime Ensure that eligible employees are paid appropriately for all overtime hours worked, including correct overtime rates. This is a common area of scrutiny in audits. Final Thoughts Since labor laws can vary by state, it s a good idea to consult with a CPA or HR expert for specific guidance tailored to your location. Additionally, while not required by law, reviewing your employee handbook every two years can demonstrate your business s commitment to fair treatment and compliance during a DOL audit. Proactive preparation is key to ensuring your business is compliant and ready for a labor audit.