Understanding Interest Rates and APR: A Comprehensive Guide

Explore the world of interest rates, APR, and effective annual rates in this detailed guide. Learn about interest rate quotes, adjustments, real vs. nominal rates, the yield curve, and how to convert APR to EAR. Dive into the nuances of financial calculations and the impact of compounding periods on interest earnings.

Uploaded on Oct 08, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Interest Rates Chapter 5.1-5.3

Outline Interest Rate Quotes and Adjustments The Effective Annual Rate (EAR) and the Annual Percentage Rate (APR) The determinants of Interest Rates Real versus Nominal Interest Rates The Yield Curve Further questions

Interest Rates Quotes and Adjustments

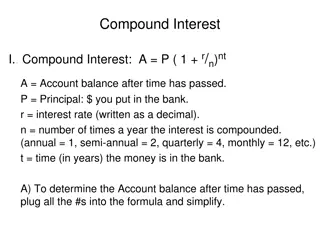

The Effective Annual Rate (EAR) The effective annual rate reflects the dollar interest received from investing $1 for 1 year. This is the rate we have been considering up till now. This EAR is often quoted as Annual Percentage Rate or APR when payments are made throughout the year such as mortgages, car loans and other investments

Effective Annual Rate Interest rates for periods smaller than one year: Given a certain EAR we can calculate the interest accumulated for a shorter period than one year. Example: Receiving 5% for one year is equivalent to receiving 2.47% every six months (1+r)0.5=(1.05)0.5=1.0247 At the end of the first six months we have $1.0247. If this amount is reinvested for the rest of the year, then $1.05 is accumulated in total $1.0247 (1.0247)=$1.05

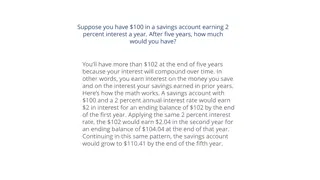

Annual Percentage Rate (APR) The annual percentage rate (APR) indicates the amount of simple interest earned in one year, that is the amount without the effect of compounding it does not fully take into account the time value of money The APR is quoted for a given number of compounding periods The compounding period can be annual , semiannual , quarterly , monthly , or even daily

Converting APR to EAR The interest received per compounding period for an APR with k compounding periods is: Interest Rate per Compounding Period =APR k Converting APR to EAR k 1+EAR= 1+APR k

Application: Amortizing Loans In amortizing loans each periodic payment is the same which means that each period you pay interest on the loan and some part of the loan balance.

Application: Amortizing Loans

Nominal and Real Interest Rates Nominal interest rate: is the rate we have been using till now for discounting future cash flows and it indicates the rate at which your money will grow if invested for a certain period Real interest rate: is the rate of growth of your purchasing power, after adjusting for inflation. rR=1+r rR is the real interest rate 1+i-1 r-i i is the rate of inflation

rR=1+r 1+i-1 r-i

The Yield Curve of Interest Rates Interest rates change depending on the horizon of the investment: Banks often offer different rates on loans depending on their term The Yield Curve: depicts the Term Structure of interest rates or the relation between the investment term and the interest rate

The Term Structure of Risk-Free U.S. Interest Rates

Present Value Calculation We can calculate the present value of a stream of cash flows using the term structure of interest rates PV =C1 C2 CN + 2+... 1+r2 ( ) 1+rN ( ) 1+r1 N

Present Value Calculation PV =C1 C2 CN + 2+... 1+r2 ( ) 1+rN ( ) 1+r1 N

College Question 10 (2nd Edition): Your son has been accepted into college. This college guarantees that your son s tuition will not increase for the four years he attends college. The first $10,000 tuition payment is due in six months. After that, the same payment is due every six months until you have made a total of eight payments. The college offers a bank account that allows you to withdraw money every six months and has a fixed APR of 4% (semiannual) guaranteed to remain the same over the next four years. How much money must you deposit today if you intend to make no further deposits and would like to make all the tuition payments from this account, leaving the account empty when the last payment is made?

College Eight payments of $10,000 due semiannually and starting six months from now. The six month interest rate is rsixmonth=4% =2% 2 The required deposit to cover all future tuition expenses =$73,254.8 PV =$10,000 1 1- 1.028 2%

Car Dealer Loan Question 22 (2nd Edition): You need a new car and the dealer has offered you a price of $20,000, with the following payment options: (a) pay cash and receive a $2000 rebate, of (b) pay a $5000 down payment and finance the rest with a 0% APR loan over 30 months. But having just quit your job and started an MBA program, you are in debt and you expect to be in debt for at least the next 2.5 years. You plan to use credit cards to pay your expenses; luckily you have one with a low (fixed) rate of 15% APR (monthly). Which payment option is best for you?

Car Dealer Loan The car dealer is offering tow alternatives: (a) A loan at 0% APR compounded monthly or in other words: an initial payment of $5,000 and 30 monthly payments of $500 thereafter. (b) $2,000 rebate. The cost of the car under dealer financing is: rsixmonth=15% =1.25% 12 =$17,444.5 PV =$5,000+$500 1 1- 1.012530 1.25%

Mortgage Refinancing You hold a 15 year mortgage with 6% APR (compounded monthly) and monthly payment of $1240. Your mortgage is 60 months old (you have just paid your 60th payment). You have just noticed that mortgage rates have fallen and are now at 4% APR. You are considering whether to refinance your mortgage and role over the outstanding balance into a new 15 year term mortgage at the new rate. (a) What are the required monthly payments on the new mortgage? (b) How much would you be willing to pay in fees to refinance your mortgage? (c) What if your mortgage was 120 months old?