Managing Mortgage Interest Payments and Buy-Downs in Rising Rates Scenario

Understanding Mortgage Interest Differential (MID) payments and the concept of buy-downs to adjust mortgage terms in the face of rising interest rates. Learn about calculations and necessary information for managing mortgage payments effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Mortgage Interest Differential Payments (MID) Rising Interest Rates

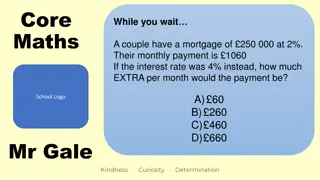

MID Payment Buy Down An amount that when added to the down payment will reduce the replacement dwelling mortgage to an amount that can be amortized with the same monthly principal and interest payment over the same remaining term as the displacement mortgage.

MID Payment Buy Down $100,000 Mortgage, Term 360 Months, Interest Rate 4.5%, Payment = $506.69 $80,164 Mortgage, Term 360 Months, Interest Rate 6.5% Payment = $506.69 $100,000 $80,164 = $19,836

Items Needed Original Mortgage Payoff Information Most Recent Mortgage Statement New Closing Statement Prevailing Interest Rate (TC62-50) Mortgage Differential Calculator

Points Origination Points Loan Discount (Buy Down) Points

Agents Responsibility Early contact and communication Early Communication with the bank Collect required information Early Encourage to pay on loan at closing Update Prevailing Mortgage Rates Do not disclose amounts until approved

Project Impacts Budget Average $40,000 10 Relocations = $400,000.00

QUESTIONS? 11

Required Notices

All notices shall be provided with appropriate translation and counseling. Agent shall deliver each notice in person. When not personally delivered, a notice shall be sent by certified mail, return receipt requested.

General Relocation Notice Issued to all persons scheduled to move Issued as soon as practical after right of way authorization Typically issued when worksheet information is being gathered KYTC s Relocation Assistance Brochure contains the information required of the General Relocation Notice.

Notice of Relocation Eligibility/90 Day Notice Notice of Relocation Eligibility is typically combined with the 90 Day Notice. Notice is to be issued at: Issuance of Notice of Intent to Acquire Initiation of Negotiations Actual acquisition of the property

Timeline for Issuance of Notice of Relocation Eligibility/90 Day Notice Owners: Notice is issued at the initiation of negotiations Tenants: Notice is issued no later than 7 working days from the date of initiation of negotiations Subsequent Occupants: Notice is issued no later than 7 working days from the date KYTC obtains possession of the property.

A 90 Day Notice CANNOT be issued to a person being displaced from a dwelling until at least one comparable replacement dwelling is made available.

Alternate Procedure for Issuing 90 Day Notice Issued to tenant occupants when there is not sufficient rental replacement housing. Requires prior approval from Central Office. Delivered to the tenant occupant within 7 working days of the initiation of negotiations. Includes an explanation of all services and payments the occupant is eligible to receive. Does not include a 90 Day Notice

30 Day Notice to Vacate Issued promptly after KYTC obtains possession of the property. 60 days have passed since the issuance of the 90 day notice. The notice shall state the date by which the property is to be vacated.