Understanding the Loanable Funds Market and Interest Rates

In the loanable funds market, equilibrium interest rates are determined by the interaction of supply and demand. Businesses decide to borrow based on the rate of return, affecting the quantity of loanable funds demanded. Lenders, driven by profit opportunities, supply funds at varying interest rates. Shifts in demand and supply can be influenced by factors like business opportunities, government borrowing, and inflation expectations, impacting interest rates and economic growth.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Equilibrium Interest Rate Savers and buyers are matched in markets governed by supply and demand There are many markets, but economists view them as one the loanable funds market The price determined in the loanable funds market is the interest rate, r May be measured in terms of nominal or real interest rate

Demand for Loanable Funds Demand for loanable funds is downward sloping because businesses decide whether to borrow based on rate of return Rate of return = Revenue from project Cost of project 100 Cost of project The lower the interest rate, the larger total quantity of loanable funds demanded

Supply of Loanable Funds Supply of loanable funds is upward sloping because lenders are more willing to forego immediate use of their money when the profit is greater. Equilibrium interest rate, rE, is the rate at which quantity supplied = quantity demanded. This creates efficiency, in that more profitable projects are funded AND lenders with more reasonable rates receive business leading to greater long-run economic growth for the economy.

Shifts of Demand for Loanable Funds Changes in perceived business opportunities (and the potential rate of return) can increase/decrease the amount of desired spending. Changes in government borrowing (i.e., in times of deficit) can create significant changes in demand for funding. A major concern of budget deficit is that it raises interest rates, leading to lower business investment spending. Economists call the negative effect of budget deficits on investment spending crowding out. 1. 2.

Shifts of Supply of Loanable Funds Changes in private savings behavior make greater/fewer loanable funds available. Changes in capital inflows as a result of changes in the perceived safety of investing in a country will also alter availability of funding. 1. 2.

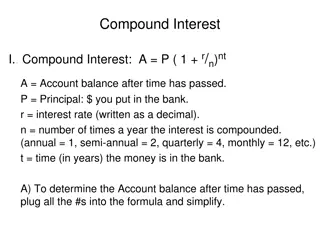

Inflation and Interest Rates Changes in expectations about inflation can shift both supply and demand for loanable funds. The true cost of borrowing/payoff of lending is the REAL interest rate. Expectations about inflation rates are based on recent experience, so interest rates lag behind true inflation trends.

Fisher Effect The Fisher effect states that expected real interest rate is unaffected by changes in expected future inflation. Only nominal interest rate is affected. Let s graph this

Reconciling the 2 Interest Rate Models In the liquidity preference model of the interest rate, we stated that r is the rate at which MD = MS. In the loanable funds model, r is the rate at which demand for loanable funds = supply of loanable funds.

Interest Rate in the Short Run In the liquidity preference model, decreased interest leads to a rise in investment spending, and a resulting rise in GDP and consumer spending. That means there is a corresponding rise in savings, increasing the supply of loanable funds and increasing investment spending. The interest rate in the money market and loanable funds market is always the same. In the short run, money market events drive r and impact the loanable funds market.

Interest Rate in the Long Run In the long run, changes in the money supply don t affect the interest rate. In the long run, an increase in the money supply causes an equal increase in price levels, so there would be a rightward shift in MD raising the interest rate back to equilibrium. This is the result of a shift in supply in the loanable funds market, as prices rise. In the long run, the loanable funds market determines r, as it is the level at which supply meets demand for loanable funds which meets potential output.