The Importance of Final Accounts and the Accounting Cycle

Final accounts are prepared at the end of the financial year to assess business profitability, manage operations effectively, and determine tax obligations. The accounting cycle involves steps like pre-adjustment trial balance, adjustments, and post-closing trial balance to ensure accuracy and compliance with GAAP. These processes help in evaluating business performance and making informed decisions for future improvements.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

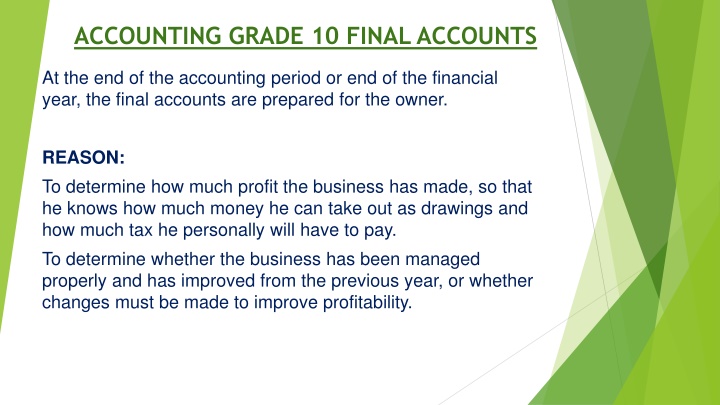

ACCOUNTING GRADE 10 FINAL ACCOUNTS At the end of the accounting period or end of the financial year, the final accounts are prepared for the owner. REASON: To determine how much profit the business has made, so that he knows how much money he can take out as drawings and how much tax he personally will have to pay. To determine whether the business has been managed properly and has improved from the previous year, or whether changes must be made to improve profitability.

THE ACCOUNTING CYCLE At the end of the accounting period the work is done in the following order: Pre-adjustment Trial Balance Adjustments Post-adjustment Trial Balance Closing transfers to Final accounts Final accounts Post-closing Trial Balance

PRE-ADJUSTMENT TRIAL BALANCE After all the journals have been posted to the accounts in the General Ledger, a Trial Balance is drawn up to make sure that the books balance. i.e. the debit total equals the credit total. This is a control measure to ensure that the books and the final results are accurate.

ADJUSTMENTS Journal entries are made to adjust the books so that they comply with all aspects of GAAP. They are done before the closing transfers. It is impossible for all the totals and balances of the accounts to be 100% correct on the last day of the accounting period because: Consumables bought have not all been used, e.g. packing material, fuel, stationery. Expenses have been paid for the next accounting period e.g. insurance.

Income has been earned, but not yet received e.g. interest on fixed deposit. Some expenses have not been paid by the year-end e.g. telephone. Payment has been received for a service, but the service has not been provided yet e.g. rent income. Trading stock account does not tally with actual stock available (physical stock-taking) i.e. there is a deficit, or there is surplus stock on hand. Fixed assets must be depreciated.

The accounts which are not correct must be corrected to make them accurate for the financial period {GAAP matching} This will bring new accounts into being: NEW ASSETS Consumable stores on hand the business can use the product next year or get the money back. Prepaid expenses the business will receive the service in the future or get the money back. Accrued Income money is owing to the business. NEW LIABILITIES Accrued expenses money is owing by business. Income received in advance the business has received money, but has not earned it.

NEW EXPENSES [GAAP Prudence] Trading Stock Deficit stock disappears from the shelves, but as there was no break-in, the business cannot claim insurance. Depreciation reduction of the value of fixed assets because of normal wear and tear . NEW INCOME Trading Stock Surplus there would be more stock on the shelves than there should be. It would mean that maybe someone bought and paid for goods, but forgot to take them.

The following information has been taken from Astra Food Store for the year ended 28 February 20.9 PRE- ADJUSTMENT TRIAL BALANCE ON 30 JUNE 20.9 Balance Sheet account section Capital Drawings Land and Building Vehicles (at cost) Accumulated depreciation on vehicles Equipment (at cost) Accumulated depreciation on equipment Fixed Deposit: Sharma Investments Trading stock Debtors control Bank Loan: JSE Bank Creditors control Nominal accounts section Sales Cost of sales Debtors Allowances Bad debts Rent Income Salaries and wages Telephone Interest on overdraft Insurance Water and electricity Bank charges Stationery Debit Credit B1 B2 B3 B4 B5 B B7 B8 B9 B10 B11 B12 B13 672 500 74 828 400 000 390 000 112 500 90 000 36 920 39 200 69 216 54 416 13 244 45 475 40 932 N1 N2 N3 N4 N5 N6 N7 N8 N9 N10 N11 N12 870 757 574 240 9 872 1 368 37 440 89 004 5 772 432 6 748 5 848 3 368 15 456 1 829 768 1 829 768

Adjustments: 1. Closing inventories on 30 June 20.9, according to a physical stock taking: Trading inventory R67 360 Stationery R2 456 2. The bank statement for June 20.9 shows bank charges of R504. For some reason the bank did not deduct this from the bank account yet. 3. A handyman fixed some of the shelves in the store. He was paid R850 and this amount was accidentally posted to Land and Buildings. 4. The Owner, Dalumzi, donated canned fruit to the value of R5 578 to a welfare organisation. The transaction was never recorded. 5. The flower vendor that uses some of the shop space already paid her rent for July 20.9. 6. Interest on the fixed deposit is capitalised. According to the fixed deposit statement, R2 890 interest was earned for the financial year. 7. A debtor, N. Toko, was declared insolvent. She owed R1 200. Her estate will pay 60c in each Rand in July 20.9. Write off the rest as irrecoverable. 8. A customer who bought ten bags of flower, each with a cost price of R35, claimed that two of the bags were not fresh any longer and returned them. A credit note of R80 was issued to her.

9. S. Stoney deposited R600 directly into the bank account of the business. It was discovered that his account had previously been written off as bad. 10. Included in insurance is an amount of R1 440 paid for the period 1 October 20.8 to 30 September 20.9. 11. The telephone account of R400 for June is still outstanding. 12. The loan statement received from JSE Bank reflected the following: R Balance at the beginning of financial year Repayments during the year, including interest Interest at 15% per year capitalised Balance at end of financial year 60 475 15 000 ? 53 500 Calculate the interest on loan. The business is expected to pay R12 000 of the loan the following year. 13. Depreciation should be provided for: on Vehicles at 15% per year on the cost price. A second vehicle was bought by cheque on 1 May 20.9 for R240 000. on Equipment at 10% per year on the carrying value.

ACCOUNTING FOR ADJUSTMENTS: EXPANDED ACCOUNTING EQUATION: Assets + Expenses + Drawings (A E D)= Liabilities + Capital + Income (L C I) Assets + Expenses + Drawings Have DEBIT balances/totals They will increase (+) on the debit side and decrease(-) on the credit side Liabilities + Capital + Income Have CREDIT balances/totals They will increase (+) on the credit side and decrease (-) on the debit side Expenses and Income affect Equity: Expenses decrease equity whilst Income increase Equity ADJUSTMENT 1: Dr Cr A E D + - L C I - + Effect on Equity + - Income Incr (cr) Decr (dr) Expense Decr (cr) Incr (dr) (a) Trading stock surplus: 69216 5 578 + 70 67 360 = 3 652 (This reflects the amount in the Trial Balance, minus Donation not taken into account, plus credit note not taken into account and minus amount according to physical stocktaking) ACCOUNT DEBITED ACCOUNT CREDITED Trading Stock Trading Stock surpus AMOUNT R3 652 EFFECT OF ACCOUNTING EQUATION Journal Source document Journal Voucher Account Debit Trading Stock Account Credit A E L GJ Trading Stock surplus + + 0 Asset: Trading stock Increase; and Income: Trading stock surplus Increase (Equity +)

(b) Consumable Stores on hand: This is given as R2 456 ACCOUNT DEBITED Consumable stores on hand ACCOUNT CREDITED Stationery AMOUNT R2 456 EFFECT OF ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Account Credit Stationery A E L Consumable stores on hand + + 0 Asset: Consumables Stores on hand Increase; and Expense: Stationery Decrease (Eq+) ADJUSTMENT 2: Bank charges (not taken into account by the bank). The amount is given as R504. ACCOUNT DEBITED Bank Charges ACCOUNT CREDITED AMOUNT Bank R504 EFFECT ON ACCOUNTING EQUATION Journal Source document CPJ Bank Statement Account Debit Account Credit Bank A E L Bank charges - - 0 Expense: Bank Charges Increase (Eq -); and Asset: Bank - decrease

ADJUSTMENT 3: Correction of error. Repairs of R850 treated as Land and Buildings. ACCOUNT DEBITED ACCOUNT CREDITED Land and Buildings AMOUNT Repairs R850 EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Repairs Account Credit A E L Land and Buildings - - 0 Expense: Repairs Increase (Eq -); and Asset: Land and Buildings - decrease ADJUSTMENT 4: Donation of R5 578 to a welfare organisation. ACCOUNT DEBITED Donation ACCOUNT CREDITED Trading Stock AMOUNT R5 578 EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Donation Account Credit A E L Trading Stock - - 0 Expense: Donation Increase (Eq -); and Asset: Trading stock - decrease

ADJUSTMENT 5: Rent for July 20.9 prepaid. R37 440 paid for 13 months. This equals R2 880 per month. ACCOUNT DEBITED Rent Income ACCOUNT CREDITED Income received in advance AMOUNT R2 880 EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Rent Income Account Credit A E L Income received in adv 0 - + Income: Rent Income Decrease (Eq -); and Liability: Income Rec in Adv - increase ADJUSTMENT 6: Interest on fixed deposit of R2 890 earned. ACCOUNT DEBITED Fixed deposit ACCOUNT CREDITED Interest on fixed deposit AMOUNT R2 890 EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Fixed deposit Account Credit A E L Interest on Fixed deposit + + 0 Asset: Fixed deposit Increase ; and Income: Interest on Fix dep increase (Eq +)

ADJUSTMENT 7: Insolvent estate of a debtor who owed R1 200 will pay 60c in a rand in July. Write off the rest. ACCOUNT DEBITED ACCOUNT CREDITED Bad debts Debtors Control AMOUNT 480 EFFECT ON ACCOUNTING EQUATION Journal Source document Journal Voucher Account Debit Account Credit A E L GJ Bad debts Debtors control - - 0 Expense: Bad debts Increase (Eq -); and Asset: Debtors control - decrease ADJUSTMENT 8: 2 items with a cost R35 each returned by customer R80 credit note issued. ACCOUNT DEBITED ACCOUNT CREDITED Debtors Allowances Trading Stock Cost of Sales AMOUNT Debtors Control R80 R70 EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Debtors All Trading St Account Credit A E L Debtors control Cost of Sales - + - + 0 0 Asset: Trading stock Increase; Asset: Debtors control Decrease; and Expense: Debtors All increase (Eq -); Expense: Cost of Sales Decrease (Eq +)

ADJUSTMENT 9: Debt previously written off as bad has been paid - R600. ACCOUNT DEBITED Bank ACCOUNT CREDITED Bad debts recovered AMOUNT 600 EFFECT ON ACCOUNTING EQUATION Journal Source document Bank Statement Account Debit Bank Account Credit A E L CPJ Bad debts recovered + + 0 Asset: Bank Increase ; and Income: Bad debts recovered Increase (Eq +) ADJUSTMENT 10: Insurance of R1 440 paid for 1 Oct 20.8 to 30 Sep 20.9 3 months are prepaid 1440 x 3/12 = 360 ACCOUNT DEBITED ACCOUNT CREDITED Prepaid Expenses Insurance AMOUNT R360 EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Account Credit A E L Prepaid Expenses Insurance + + 0 Asset: Prepaid Expense Increase; and Expense: Insurance decrease (Eq +)

ADJUSTMENT 11: Telephone account of R400 still outstanding. ACCOUNT DEBITED Telephone ACCOUNT CREDITED Accrued Expenses AMOUNT 400 EFFECT ON ACCOUNTING EQUATION Journal GJ Source document Journal Voucher Account Debit Telephone Account Credit Accrued Expenses A 0 E - L + Expense: Telephone Increase (Eq -); and Liability: Accrued Expense Increase ADJUSTMENT 12: Interest on loan. R53 500 x 15/100 = R8 025 OR 60 475 15 000 53 500 = R8 025 ACCOUNT DEBITED Interest on loan ACCOUNT CREDITED AMOUNT R8 025 Loan EFFECT ON ACCOUNTING EQUATION Journal Source document GJ Journal Voucher Account Debit Account Credit A E L Interest on loan Loan 0 - + Expense: Interest on loan Increase (Eq -); and Liability: Loan Increase

ADJUSTMENT 13: Depreciation is calculated at 15% p.a. on cost of Vehicles and 10% p.a. on carrying value of Equipment. Veh: 390 000 240 000 = 150 000 x 15% = 22 500 + (240 000 x 15% x 2/12) = 28 500 Equipment: 90 000 36 920 = 53 080 x 10% = 5 308 ACCOUNT DEBITED Depreciation Depreciation ACCOUNT CREDITED AMOUNT 28 500 Accumulated depreciation on Vehicles Accumulated depreciation on Equipment 5 308 EFFECT ON ACCOUNTING EQUATION Journal Source document Journal Voucher Journal Voucher Account Debit Depreciation Accumulated depreciation on Vehicles Depreciation Accumulated depreciation on Equipment Account Credit A E L GJ - - 0 GJ - - 0 Expense: Depreciation Increase (Eq -); and Negative Asset: Accumulated depreciation Increase

POST-ADJUSTMENT TRIAL BALANCE After the adjustments have been completed, a Post adjustment Trial Balance is drawn up to make sure that the books still balance. This Trial Balance will have all the accounts in it. i.e. the Balance Sheet Accounts section including the new assets and liabilities for prepaid and accrued amounts, and the Nominal Accounts section including the new accounts for depreciation, trading stock deficit and trading stock surplus.

CLOSING TRANSFERS TO FINAL ACCOUNTS In order to calculate the profit, some housekeeping entries have to be made. The accounts in the nominal accounts section (after adjustments have been done) show the actual amount earned by the business (income) and actual cost of running the business (expenses) for the financial period. These accounts are closed by means of journal entries, as they have served their purpose.

8 steps of closing a set of books at the end of the accounting period These accounts are Debtors allowances Sales Cost of sales Trading Account [gross profit] Incomes/gains Expenses/Losses Profit and loss [net profit] Drawings Closed to Sales Trading Account Trading Account Profit and loss Account Profit and loss Account Profit and loss Account Capital Account Capital Account

FINAL ACCOUNTS Last accounts prepared at the end of the financial year/period: Trading account which calculates the gross profit by comparing sales and cost of sales. Profit and loss account which calculates the net profit by comparing all the gains/incomes with all the expenses/losses.

Example: Use the Pre-adjustment Trial Balance taken from the books of Butterworth Stores on 29 February 2020, the end of the accounting period. Required: draw up the Trading Account and the Profit and Loss account in the General ledger. BUTTERWORTH STORES PRE-ADJUSTMENT TRIAL BALANCE ON 29 February 2020 DEBIT CREDIT BALANCE SHEET ACCOUNTS Capital Drawings Land and building Equipment Accumulated depreciation: equipment Fixed deposit: Standard Bank [6% p.a] Loan: FNB Bank Trading stock Debtors control Bank Creditors control NOMINAL ACCOUNTS Sales Cost of sales Debtors allowances Current income Insurance Interest on fixed deposit Maintenance and repairs Material costs Packing material Rates Rent income Sundry operating expenses Wages 750 000 75 000 650 000 90 000 22 500 50 000 35 000 78 400 31 240 33 095 13 535 811 960 502 000 8 760 52 255 4 800 2 750 22 222 15 622 19 563 6 450 52 000 96 148 56 700 1 740 000 1 740 000

ADJUSTMENTS 1. Insurance includes an annual premium of R1 240 payable on 31 May. 2. The one and only employee was on leave at the end of February and did not receive her wage of R1 560. 3. The rates account for February 2012, R650, was only received on 5 March. 4. The tenant always pays her rent one month in advance. 5. The owner took trading stock costing R850 for her own use on 27 February 2020. No entry had been made for this. 6. Depreciation on equipment for the year at 10% p.a. on cost must still be brought into account. 7. Interest is still owing on the fixed deposit. 8. According to the statement received from FNB Bank interest on the loan of R3 280 for the year had been capitalized. 9. A physical inventory on 29 February 2020 showed: 10. Trading stock on hand costing R75 400 11. Packing material on hand costing R1 270.

SOLUTION: Insurance 1 240 x 3 / 12 = R310 Rent income 52 000/13 = R4 000 Interest on fixed deposit 50 000 x 6/100 = 3 000. TRADING ACCOUNT Cost of sales 502 000 Sales [811 960 8 760] 803 200 Profit and loss (gross profit) 301 200 803 200 803 200 PROFIT AND LOSS 4 490 22 222 Insurance [4 800 -310] Maintenance and repairs Trading Account Current income Interest on fixed deposit [2 750 + 250] 301 200 52 255 Material costs 15 622 3 000 Packing Material [19 563 1 270] Rent income [52 000 4000] 18 293 48 000 Sundry operating expenses Wages [56 700 + 1 560] Depreciation Trading stock deficit [78 400 850 75 400] 96 148 58260 9 000 2 150 Interest on loan Capital [net profit] 3 280 167 890 404 455 404 455

POST-CLOSING TRIAL BALANCE The last step in the accounting cycle is to prepare a post- closing trial balance. A post-closing trial balance is prepared after closing entries are made and posted to the ledger. It is the third (and last) trial balance prepared in the accounting cycle. It s purpose is to test the equality between debits and credits after closing entries are prepared and posted. The post-closing trial balance contains real accounts only since all nominal accounts have already been closed at this stage.

The post- closing trial balance is used to verify that the total of all debit balances equals the total of all credit balances, which should net to zero. A post- closing trial balance contains no revenue, expense, gain, or loss and owner s drawings account, since these accounts will not carry a balance after the accounting period has ended. The balances of the nominal accounts (income, expense, and withdrawal accounts) have been absorbed by the capital account. Hence, you will not see any nominal account in the post-closing trial balance.

EXAMPLE OF A POST- TRIAL BALANCE Qhama Traders Post-closing trial balance as at 30 June 2020 Balance sheet accounts section Capital Land and buildings Vehicles Accumulated depreciation on vehicles Equipment Accumulated depreciation on equipment Debtors control Trading stock Bank Cash float Petty cash Creditors control Accrued expense Accrued income Prepaid expense Income received in advance Debit Credit 900 600 350 000 480 000 200 000 160 000 80 000 50 000 120 000 88 000 2 500 1 500 66 000 8 000 4 300 3 200 4 900 1 259 500 1 259 500