The Reduced Rate of VAT in the Hospitality Industry

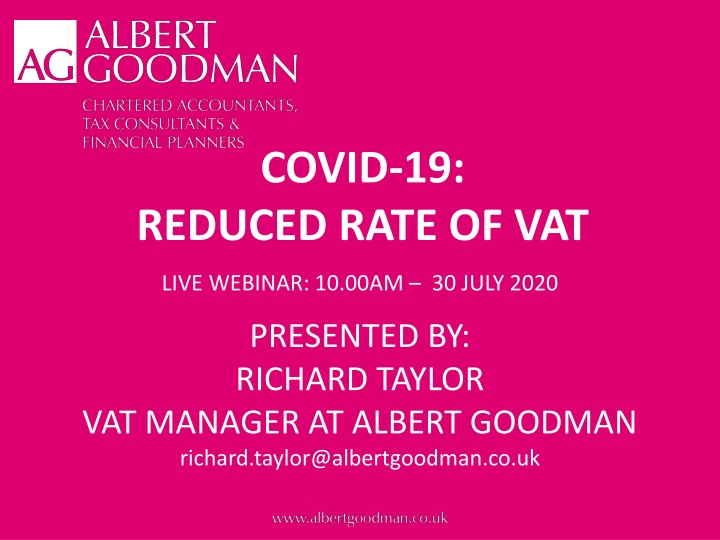

Delve into the intricacies of the Reduced Rate of VAT in the hospitality sector through this upcoming live webinar presented by Richard Taylor, VAT Manager at Albert Goodman. The webinar covers various aspects including catering, hotel and holiday accommodation, admission to attractions, and accounting practices. Gain insights into the application of reduced VAT rates in different scenarios such as catering on premises, takeaways, hotel stays, and more. Don't miss this opportunity to enhance your knowledge on VAT regulations and their impact on the hospitality business.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

COVID-19: REDUCED RATE OF VAT LIVE WEBINAR: 10.00AM 30 JULY 2020 PRESENTED BY: RICHARD TAYLOR VAT MANAGER AT ALBERT GOODMAN richard.taylor@albertgoodman.co.uk

REDUCED RATE OF VAT Format of webinar: Catering Hotel & Holiday Accommodation Admission to Attractions Accounting - record keeping, deposits etc Eat Out to Help Out Q & A

REDUCED RATE OF VAT Catering - takeaways Specifically excludes alcoholic beverages Hot takeaway food and beverages for consumption off the premises on which they are supplied Hot food is above ambient temperature and has either been heated to be served hot been heated to order been kept hot after cooking, heating or reheating sold in heat retentive packaging or packaging designed for hot food been advertised as hot

REDUCED RATE OF VAT Catering on premises Any food or non alcoholic drink, that is Supplied in the course of catering for consumption on premises What is catering? N709/1 - ordinarily the supply of prepared food and drink involving a significant element of service Grp 1 Sch 8 says any supply for consumption on premises on which supplied Does not include catering off site e.g. weddings or events

REDUCED RATE OF VAT Hotel & Holiday Accommodation Hotels, inns, boarding houses and similar establishments Reduced rate applies to the provision of Sleeping accommodation Accommodation in a room used for the supply of catering (even if catering supplied by third party) Packages such as weddings are complex, if catering separate reduced rate applies but not if single package TOMS reduced rate applies to in-house supplies

REDUCED RATE OF VAT Hotel & Holiday Accommodation What is a similar establishment? Includes any premises in which furnished sleeping accommodation is provided that is used or held out as being suitable for use by visitors or travellers Examples are: Motels Guesthouses B&B establishments Serviced flats This will pick up Airbnb type arrangements

REDUCED RATE OF VAT Hotel & Holiday Accommodation Holiday accommodation Accommodation advertised for holiday or leisure use Includes Houses Flats Chalets Houseboats & boats (not day hire) Caravans (mobile homes, park homes, tourers & static) Beach hut Tents Motorhomes a license to occupy holiday accommodation granted between 15 July 2020 and 12 January 2021 will be temporarily reduced rated

REDUCED RATE OF VAT Caravans & Camping Pitch fees for tents Pitch fees for caravans, including pitches on holiday or leisure pitches Pitches on other sites for less than a year or where the caravan cannot be used as permanent place of residence

REDUCED RATE OF VAT Admissions to attractions Right of admission (including incidental goods) to: Cinemas Circuses and fairs Theatres, shows and concerts Museums and exhibitions Amusement Parks and zoos Also other similar cultural events each taxpayer is responsible for demonstrating supplies are eligible Not sporting events Cultural exemption takes precedence

REDUCED RATE OF VAT Accounting - schemes Temporary reduced rate applies - 15/07/20 to 12/01/21 Flat Rate Scheme some percentages have changed Catering services including restaurants & takeaways - 4.5% Hotel or accommodation - 0% Pubs - revised to 1% Retail schemes Point of sale need to identify sales at different rates If not possible to do this it may be able to use the catering adaption these require sampling exercises

REDUCED RATE OF VAT Accounting deposits etc Deposits & invoices for temporarily reduced rate (TRR) supplies Receipt of payment or the issue of a Tax Invoice creates a tax point VAT is due at rate in force when received If deposit or other payments received in TRR period - 5% If Tax Invoice issued in TRR period - 5% If deposits received or invoice issued before 15/07/20 20%, but if basic tax point in TRR period can use 5% - credit note required if invoice issued Basic tax point for services is when they are performed

REDUCED RATE OF VAT Accounting annual fees etc Where payments due periodically and an annual invoice issued (continuous supplies) Payments due in TRR period subject to 5% and new invoice should be issued Service preformed over period of time for single payment N700 para 30.8 says: When you make a supply of services, such as decorating, part of the work may take place before the date of a change in the tax rate or liability and part on, or after, that date. In such cases, provided that the supply can be apportioned .. you may, if you wish, charge tax at the old rate on the part of the work which was performed before the date of the change

REDUCED RATE OF VAT Eat Out to Help Out Scheme Applies all day, every Monday, Tuesday and Wednesday from 3 to 31 August 2020 Will cover costs of a 50% discount on food or drinks to eat or drink in (maximum of 10 discount per diner) Excludes alcohol and service charges VAT is payable on Eat Out to Help Payments To register go to www.gov.uk/guidance/register-your-establishment-for-the- eat-out-to-help-out-scheme

REDUCED RATE OF VAT HMRC Guidance https://www.gov.uk/government/publications/revenue- and-customs-brief-10-2020-temporary-reduced-rate-of- vat-for-hospitality-holiday-accommodation-and- attractions/guidance-on-the-temporary-reduced-rate-of- vat-for-hospitality-holiday-accommodation-and-attractions https://www.gov.uk/vat-record-keeping/vat-invoices https://www.gov.uk/guidance/vat-guide-notice- 700#changes-in-tax-rates-and-liability www.gov.uk/government/publications/vat-notice-733-flat- rate-scheme-for-small-businesses

REDUCED RATE OF VAT QUESTIONS & ANSWERS