Towards a Modern VAT System for Intra-Union Trade

The European Commission aims to replace the current fragmented and complex VAT system for intra-Union trade with a definitive system. This new system, based on taxation at the destination, seeks to reduce VAT fraud, enhance compliance, and bring uniformity to EU supplies. The two-step legislative approach intends to implement the definitive system by 2022, starting with B2B trade of goods. The anticipated benefits include an 83% reduction in cross-border VAT fraud and significant cost savings for businesses.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

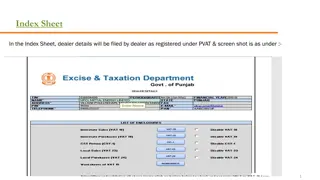

Definitive VAT system for intra-Union trade of goods COM(2018)329 of 25 May 2018 European Commission TAXUD 11 September 2018

Why is time for a definitive VAT system? The current system for B2B trade in force since 1993 is transitional in nature (Article 402 of the VAT Directive) It is fragmented, complex, burdensome for businesses and hampers intra-Union trade VAT fraud responsible for EUR 50 billion revenue loss a year in the EU; EUR 160 billion the size of the VAT GAP The creation of a simple, modern and fraud-proof VAT system is a fiscal priority (Annual Growth Survey 2017)

technical and political choices 2011 Communication on the Future of VAT: change from taxation at origin to taxation at destination Taxation in the MS of origin politically unachievable (Ecofin conclusions, May 2012) 2016 VAT Action Plan "Time to decide": the best option is charging VAT on cross-border supplies of goods and services The Council and the European Parliament endorsed a definitive system based on taxation at destination (Ecofin conclusions May 2016; November 2016) 2017 Communication "Time to act" sets out the legislative approach

Two-step approach 1 legislative step: October 2017 proposal: notion of CTP + cornerstones of the definitive system for intra-Union B2B trade of goods (Article 402 of the VAT Directive) May 2018 proposal: detailed technical provisions for the operation of the definitive system (envisaged entry into force 1 July 2022) 2 legislative step : Definitive system extended to services (after implementation and monitoring of 1 step)

Benefits Cross-border VAT fraud reduced by 83% with saving of EUR 41 billion a year (4,5% of the EU VAT revenue) VAT Compliance costs reduction for businesses of EUR 1 billion Less derogations, more uniformity: intra-EU supplies and domestic supplies treated the same way

Current VAT system for intra-EU B2B trade A cross-border sale from Member State A to Member State B is split in two transactions for VAT purposes: An exempt Intra-Community supply in the MS of departure of goods (A) An Intra-Community acquisition taxed in MS of arrival of goods (B) VAT is payable by the customer who integrates the invoice and accounts for VAT on the Intra-Community acquisition in MS B 6

Definitive VAT system for Intra-Union B2B trade It is proposed one single transaction for VAT purposes taxed in the Member State of arrival of goods (B): The supplier (not-established in MS B) is liable for VAT but can account and pay VAT of MS B via an improved One-Stop-Shop mechanism or VAT is payable by the customer only if certified taxable person in MS B while the supplier will issue an invoice without VAT (similar to the current situation) 7

1st element of the definitive system New concept of intra-Union supply of goods: Article 14(4)(3) supply by a taxable person to a taxable person or non-taxable legal person with transport or dispatch of goods from one Member State to another excluded from the concept: Article 14(5) - supplies of goods with assembly or installation; - exempt supplies under Articles 148-151 (e.g. fuelling and provisioning of vessels and aircraft); - supplies covered by the farmer scheme intra-EU transfer of goods by a taxable person assimilated to intra- Union supply (amendment to Article 17)

1st element of the definitive system Abolition of the intra-Community acquisition Everything related to intra-Community acquisitions (e.g. thresholds) Everything related to intra-Community supplies abolished (e.g. triangulation arrangements) Deletion of the exemption for intra-Community supplies Intra-Union supplies always subject to VAT: no thresholds

2st element of the definitive system New place of supply rule: Article 35a Intra-Union supplies are taxed where the transport ends (taxation at destination) Except supplies made under the margin scheme which will be taxed where the transport begins under Article 32 (Art. 35c) New means of transport remain taxable in the MS of arrival also when the customer is a non-taxable person (Art. 35b) other rules on the place of supply of goods remain unchanged (e.g. supply with and without transport; supply with assembly or installation; gas and electricity)

3rd element of the definitive system Single chargeability rule for intra-Union supplies: Article 67 VAT is chargeable on the issue of the invoice or on the expiry of the fifteenth day of the month following that in which the taxable event occurs Same rule applies to the supply of new means of transport when customer is a non-taxable person

Who pays VAT? VAT on Intra-Union supplies will be payable by the supplier, as for any taxable supply of goods and services under the general rule of Article 193 of the VAT Directive or by the acquirer only if "certified taxable person" (CTP) and when the supplier is not established in the MS of taxation under the new Article 194a

CTP in the definitive VAT system for making the EU VAT system more fraud proof, only reliable traders will account for VAT as recipient of intra-Union supplies of goods (reverse charge) Notion defined in the 2017 proposal (new Article 13a): criteria, exclusions and procedure harmonised at EU level Certification granted by the tax authority of the MS where the applicant is established and recognised in all MSs CTP status will be verified on-line through the VAT information electronic exchange system (VIES)

Other reverse charge provisions In the definitive system the reverse charge will remain applicable as "anti-fraud" measure only for services Art. 200 - New means of transport where the supplier is a taxable person (cross-border supply) status quo maintained Art. 199 optional and permanent RC for goods and services not touched by the proposal Art. 199a optional and temporary RC for goods and services until December 2028 but limited to services from July 2022 Art. 199b - Quick reaction mechanism to combat fraud limited to services

New One-Stop-Shop (OSS) scheme to build on the current MOSS for EU traders in place from 2015 for TBE services which will be extended to all B2C supplies of good and services from 2021 (E-commerce package, December 2017) available from July 2022 for traders established in the EU or with an appointed representative established in the EU to pay, declare and deduct VAT on B2B supplies of goods and services when the supplier is liable to pay VAT but is not established in the MS of taxation It will also cover purchases of goods by certified traders (liable for VAT) who are not-established in the MS of taxation Submission of quarterly OSS VAT return or monthly if the Union annual turnover is above EUR 2,5 billion

VAT obligations for intra-Union supplies One single VAT registration within the EU (in principle) Mandatory invoicing for intra-Union supplies (according to rules of the Supplier's MS) Recapitulative statements maintained only for services (reporting obligation removed for goods) Two VAT returns (in principle): 1. Current VAT return for domestic supplies 2. OSS VAT return for intra-Union supplies if the person liable for VAT is not established in the MS of taxation

Data in the OSS VAT return VAT number in the MS of identification for OSS scheme (the same allocated in the internal system) For each MS of taxation in which VAT is chargeable Total value of goods and services supplied exclusive of VAT o The total amount per rate of the chargeable VAT o The total amount of chargeable VAT on supplies of goods and services o The amount of VAT for which deduction is made o Amendments related to previous tax periods o Net amount of VAT to be paid or credited o For each MS other than MS of identification The total value of supplies of goods for each MS where the goods are transported o from + VAT number The total value of supplies of services for each MS where there is an establishment o from which the services are supplied + VAT number

VAT deduction in the OSS scheme Traders will pay the net amounts of VAT due in each Member State of taxation to a designated banking account (Art. 369i) In case of several establishments in the Union, the deductible proportion of VAT is determined by each MS of establishment for all the transactions carried out from that establishment (Art. 369ag) The input VAT can be claimed back via the refund procedure for "non- established traders" in the MS concerned, if there are not supplies covered by the OSS scheme for which VAT is chargeable in that MS (Art. 369j) VAT credit in a given tax period is carried forward to the following period or can be refunded by the MS concerned (Art. 369ia)

What else does not change? almost everything related to importation of goods almost everything related to supply of services exemptions on exports, exemptions related to international transport (Art. 148-150 of the VAT Directive), exemption related to international trade (Art. 154 163) customs procedures No 42 and 63 with adaptations (e.g. the importation of goods followed by an intra-Union supply of goods will remain exempt) reverse charge for cross-border supplies and investment gold (Art. 196 and Art. 198)