Overview of Electron Technologies Business Rescue Plan

Electron Technologies (PTY) LTD has been operating for over 50 years as electrical contractors and consultants, facing financial challenges due to economic downturns and debt moratoriums. The company has taken various actions to reduce costs and improve cash flow, including moving to smaller premises and cutting unnecessary expenditures. The business rescue process timeline, salient dates, and background information are outlined in the plan.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

ELECTRON TECHNOLOGIES ELECTRON TECHNOLOGIES (PTY) LTD (PTY) LTD OVERVIEW OF BUSINESS RESCUE PLAN BA Holford M.Com; C.A.(S.A.) Business Rescue Practitioner

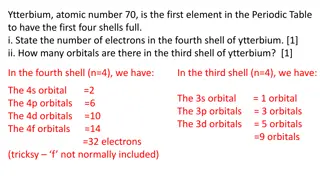

SALIENT DATES SALIENT DATES 27 September 2019 placed in business rescue 30 September 2019 Business Rescue Practitioner appointed 9 October 2019 First meeting of creditors and affected parties convened 9 October 2019 Creditors agree to an extension to 25 November 2019 for submission of business rescue plan 25 November 2019 Business Rescue Plan circulated to all creditors 27 November 2019 notice of meeting to be held on 5 December 2019 to approve business rescue plan circulated to all creditors

BACKGROUND TO BUSINESS RESCUE BACKGROUND TO BUSINESS RESCUE Electron has been operating for over 50 years as electrical contractors and consultants to various sectors of industry and civil engineering In recent years it has been involved in major civil construction projects Due to the downturn in the economy resulting from to the macro- economic climate in South Africa and the political instability arising from the Zuma regime, the company has been hard hit by various large civil engineering companies being placed in business rescue and a considerable amount of money due to Electron falling within a debt moratorium. The impact of this has obviously been profound on the cash flow of the company and its ability to pay creditors in the short-term

IMPACT ON CASH FLOW IMPACT ON CASH FLOW BUSINESS RESCUE Basil Read Group Five Construction Esor Construction CMC R1 931 042 13 121 863 115 893 1 116 256 16 285 054 BAD DEBTS ORO MANAGEMENT SERVICES 2 670 605

ACTIONS TAKEN BY MANAGEMENT AND THE ACTIONS TAKEN BY MANAGEMENT AND THE BUSINESS RESCUE PRACTITIONER BUSINESS RESCUE PRACTITIONER The board of directors immediately placed the company in business rescue, rather than wait A decision was made to move the factory to smaller premises to reduce the rent by approximately R500 000 per year. All leave bonuses , due to be paid in December 2019, were suspended and immediate negotiations were undertaken with the relevant employee representatives. All expenditure has been investigated and unnecessary expenditure has been stopped. This has resulted in the forecast expenditure being reduced for the year ending 29 February 2020 by R2 million and for the year ending 28 February 2021 by R3,5 million compared to that of the 2018 financial year.

FUTURE SALES PROSPECTS FUTURE SALES PROSPECTS Because of the loss of 4 major clients in the civil engineering industry, and the possibility of more, the company has reduced its sales forecast for the year ending 29 February 2021, to be conservative However, it is anticipated that the forecast sales for the 2021 year will be better than forecast as orders and enquiries continue to come in despite the fact that the company is in business rescue. A decision has been made to avoid any further business where civil construction firms are the main contractor and Electron acts as sub- contractor due to the uncertainty surrounding the civil engineering industry. The Cape town branch has been identified as being a branch with significant potential and a number of enquiries and tenders are emanating from the Western Cape.

POSSIBLE THREATS TO THE BUSINESS PLAN POSSIBLE THREATS TO THE BUSINESS PLAN The collapse of more civil construction companies The refusal of suppliers to supply the company due to it being in business rescue. Loss of expertise through resignation of key employees Continued failure of Government to provide the necessary kick-start to improve the economy. Failure of Government to pay promptly in terms of contracts

DIVIDENDS PAYABLE TO CREDITORS DIVIDENDS PAYABLE TO CREDITORS PROJECTED FINANCIAL STATEMENTS BALANCE SHEET Shareholders Equity Share capital Non-distributable reserves Retained earnings 27 Sep 19 28 Feb 20 28 Feb 21 28 Feb 22 990100 139596 2215458 3345154 990100 139586 5716773 6846459 990100 139586 11531285 12660971 990100 139586 23643912 24773598 Long Term Loans and Deferred Tax Long term lease Shareholders' Loans - pre business rescue Deferred Tax 357573 4020127 -1468248 6254606 234285 4020127 110997 4020127 0 4020127 0 0 0 11100871 16792095 28793725 Represented by: Fixed Assets At cost less accumulated depreciation Current Assets Stock on hand Work in progress Deposits Accounts receivable Bank balance 1561065 49409467 908416 17210812 495723 30794516 1325686 54475879 8762703 16430068 495723 21187615 7599770 55801565 44700695 32823746 3747144 2617249 5512556 1145686 40651229 7074744 13265145 495723 14283300 5532317 41796915 25004821 16823746 3063826 2617249 2500000 965686 48648328 9118319 17096848 495723 18015645 3921793 49614014 20820289 11823746 3879114 2617429 2500000 50970532 44715926 32823746 Current Liabilities Pre-business rescue creditors Post commencement creditors Provisions Advance payments on contracts Bank overdraft 3379624 8512556 6254606 11100871 16792094 28793725 0 0 0 0 Repayment of pre-business rescue creditors Cents in Rand - estimated * this will be paid in 2022 and 2023 or sooner dependent on the performance of the company 16000000 5000000 11823746 15 49 36

SOURCE OF FUNDING FOR CREDITOR SOURCE OF FUNDING FOR CREDITOR PAYMENTS PAYMENTS The company currently is owed approximately R14 million in retention money held by the customers. These fall due at various intervals and as at the 27th September 2019 these retentions amounted to R14.3 million The retentions are a rolling process as each month some are paid and new retentions are held as work continues. The retentions as at the 27th September 2019 will contribute significantly to the first payment to creditors, which is anticipated to be early in the new financial year and will continue at regular intervals and will be supplemented from profits of the company. In addition, all dividends received from companies in business rescue will be paid over to creditors.

INFLUENCES ON THE PAYMENTS TO CREDITORS INFLUENCES ON THE PAYMENTS TO CREDITORS Prompt collection of all retention money as it falls due No adverse trading conditions suddenly arising No further customers in the industry going into business rescue Dividends paid by current customers in business rescue as indicated

THANK YOU Any questions