Federal Reimbursement Timekeeping Requirements for Ohio Department of Transportation

Ohio Department of Transportation's audit supervisor, Diane Wright, discusses the importance of complying with timekeeping requirements for federally funded projects to be eligible for reimbursement. The content covers OMB Circular A-87, labor rates, employee activities, and timecard guidelines. LPAs must follow these guidelines to recover fringe benefits and overhead costs.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Ohio Department of Transportation Diane Wright, External Audit Supervisor, LPA Program Division of Finance October 2011

History & Background Timekeeping Requirements Actual Cost Method Safe Harbor Method Cost Allocation Plan (CAP) Method Approval Process

OMB Circular A-87 Establishes cost principles that must be followed on Federally funded projects Attachment B Section 8(h) Lists several timekeeping requirements These requirements MUST be followed for CE Labor to eligible for Federal reimbursement

LPAs MUST comply with the timekeeping requirements of A-87 for CE labor to be eligible for Federal reimbursement LPAs are also able to recover fringe benefits and overhead for CE labor 3 methods Audit Memo Cost Recovery for Fringe Benefits and Overheadaddresses CE reimbursement Memo is in the LPA Manual and on the LPA Audit website

Labor rates billed on Federal projects must be based on payrolls The labor rate billed on the project must match the pay rate actually paid to the employee Supporting documentation is the payroll report

Employees working on multiple activities must support their time on a timecard if they work on (in a year): More than one Federal project A Federal project and a non Federal project A direct activity and an indirect activity An unallowable activity and an allowable activity

Timecards MUST: Reflect an after the fact distribution of actual activity of each employee Account for all hours worked plus any leave time used Be prepared at least monthly and must coincide with one or more pay periods Be signed and dated by the employee

Weekly Timecard For Week Ending: 10/8/2011 Week #1 Monday Tuesday Wednesday Thursday Friday Total Project Name Project # Time Time Time Time Time Weekly Hours Federal job 1 1 8:00 5:00 PM 8 Federal job 2 2 8:00 12:00 4 Local job 1 3 1:00 5:00 4 local job 2 4 8:00 5:00 8 Admin Time n/a 0 Vacation n/a 8:00 5:00 8 Sick n/a 8:00 5:00 8 Total Daily Hours 8 8 8 8 8 40 Employee Signature Date

Summary: In order for CE costs to get reimbursed LPAs MUST: Track time each day by activity on timecards This must be done by all employees working on multiple activities Timecards MUST be reviewed, signed, and show all hours Only tracking hours worked on Federal projects or only tracking hours while a Federal project is in progress is noncompliant

LPAs are reimbursed for the actual cost of fringe benefits plus the actual labor cost The employer share of the fringe benefits can be found on the payroll reports. Note: Fringes do NOT increase for OT hours LPAs do NOT recover overhead costs

Employee 1 Pay Rate $ 15.80 RegTotal $ 862.00 A Fringe Rate $ 5.75 OT Total $ 206.15 B Loaded Reg Rate $ 21.55 Amtto Invoice $ 1,068.15 Hours Worked 40 RegTotal $ 862.00 A OT Rate $ 23.70 Fringe Rate $ 5.75 Loaded OT rate $ 29.45 OT Hours Worked 7 OT Total $ 206.15 B

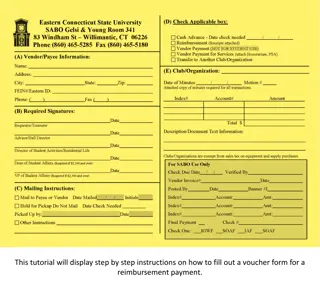

To use this method you MUST: Obtain approval from ODOT Office of External Audits PRIOR to labor being incurred Include with your CE invoices: Timesheets to support number of hours worked Payroll summary report(s) to support pay rate and fringe rate for each employee

LPAs are reimbursed for fringe benefits and overhead costs using set rates determined by the Auditor of State Fringe rate is 30% and applied to direct labor (excluding OT premium) Overhead rate is 38% and is applied to direct labor (excluding OT premium) plus the fringe cost Template is available on LPA Audit website http://www.dot.state.oh.us/Divisions/Finance/Auditing/Pa ges/LocalPublicAgencies-LPA.aspx

Direct Labor - In Dollars Less Overtime Premium Direct Labor Subtotal Fringe Rate @ 30% Fringe in Dollars $ $ $ 712.50 (37.50) 675.00 30% 202.50 $ Direct Labor (Less Overtime Premium) $ $ $ 675.00 202.50 877.50 38% 333.450 + Fringe in Dollars Direct Labor + Fringe in Dollars Overhead Rate @ 38% Overhead in Dollars $ Direct Labor - In Dollars + Fringe in Dollars + Overhead in Dollars Total Charged $ $ $ $ 712.50 202.50 333.450 1,248.45

To use this method you MUST: Obtain approval from ODOT Office of External Audits PRIOR to labor being incurred Include with your CE invoices: Timesheets to support number of hours worked Payroll summary report(s) to support pay rate each employee

LPAs are reimbursed for fringe benefits and overhead costs using rates calculated in accordance with OMB Circular A-87 Rates are calculated based on the LPAs annual financial information Most complex method All CAP rates are inspected by ODOT All CAP rates are subject to audit by ODOT Template is available on LPA Audit website http://www.dot.state.oh.us/Divisions/Finance/Auditin g/Pages/LocalPublicAgencies-LPA.aspx

Direct Labor - In Dollars Less Overtime Premium Direct Labor Subtotal CAP Fringe Rate Fringe in Dollars $ $ $ 712.50 (37.50) 675.00 32% 216.00 $ Direct Labor (Less Overtime Premium) $ $ $ 675.00 216.00 891.00 86% 766.260 + Fringe in Dollars Direct Labor + Fringe in Dollars CAP Overhead Rate Overhead in Dollars $ Direct Labor - In Dollars + Fringe in Dollars + Overhead in Dollars Total Charged $ $ $ $ 712.50 216.00 766.260 1,694.76

To use this method you MUST: Obtain approval from ODOT Office of External Audits PRIOR to labor being incurred Include with your CE invoices: Timesheets to support number of hours worked Payroll summary report(s) to support pay rate for each employee

All methods must be approved by ODOT Office of External Audits Actual Cost and Safe Harbor approvals are valid through 12/31 CAP rates must be submitted to ODOT by 3/31 and are valid through the following 3/31 The approved rates can NOT be applied to labor incurred prior to receiving approval

Diane Wright, LPA External Audit Supervisor Diane.wright@dot.state.oh.us Jana Cassidy, External Audits Administrator Jana.cassidy@dot.state.oh.us http://www.dot.state.oh.us/Divisions/Finance/Auditing/Pag es/LocalPublicAgencies-LPA.aspx Ohio Department of Transportation 1980 W. Broad St., 4thFloor Columbus, Ohio 43223 614-387-7631