Enhancing Child Development through Social Policy: Insights on Child Development Accounts and Inclusive 529 College Savings Plans

Explore the transformative potential of Child Development Accounts (CDAs) and Inclusive 529 College Savings Plans in promoting lifelong asset-building for children, focusing on education, well-being, and inclusive policy strategies. The evidence suggests that these initiatives can positively impact saving behavior, psychological well-being, and future orientation, contributing to a more universal and progressive approach to child development.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Creating and Testing Social Policy: Evidence from SEED for Oklahoma Kids Research Yunju Nam, Youngmi Kim, Margaret Clancy, Michael Sherraden, and Robert Zager Federal Reserve Bank of Dallas November 1, 2011

Child Development Accounts (CDAs) Child Development Accounts are saving and asset building accounts, initiated by public policy. Ideally, CDAs are lifelong (begin at birth), universal (available to all), and progressive (greater subsidies for the poorest children). (for policy concept, see Sherraden, 1991)

Asset Building for Development Often via Education CDA policies are focused on asset building for child development, education, lifelong well-being. Saving behavior matters for CDAs, but this is not the primary focus. Psychological and behavioral effects may include hope, control, future orientation, effort (e.g., Elliott & Beverly, 2011). By design, CDA policies can be very paternalistic, with automatic enrollment, restrictions on access until a certain age, and restrictions on use.

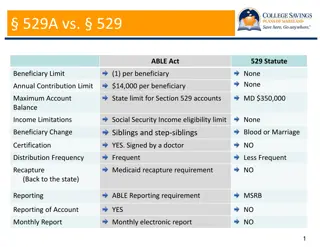

Inclusive 529 College Savings Plans Some state 529 plans are more progressive than others. A number of states have implemented inclusive policy strategies. Inclusive features make 529s more accessible to low- and moderate-income families.

529 Plan Potential for Inclusion Most plans require small initial contributions (median is $25). Eleven states provide matching contributions for low-to-moderate income families. States offer a limited selection of funds with different risk and return characteristics. The trend toward low fees continues, but not all plans are low cost . (for 529 policy assessment, see Clancy et al., 2004, 2006, 2011)

Potential of 529 Plans for a Universal and Progressive CDA in the US Every state has at least one 529 plan. Inclusive features that can be built into the policy which would not happen via saving products in the market. Centralized CDA administration facilitates outreach, a systematic database, and assessment.

SEED for Oklahoma Kids (SEED OK) Research Design and Early Results

A Policy Test of CDAs: SEED for Oklahoma Kids (SEED OK) Policy and research initiative designed to test the idea of universal and progressive accounts, lifelong asset building SEED research is multi-method: Experiment, Account Monitoring, and In-depth Interviews Oklahoma selected for the SEED OK experiment through a competitive process

SEED OK Research Design An experiment with random sample of newborns from a statewide population Oversamples of African Americans, Latinos, and American Indians Random assignment to treatment group (n=1,358) and control group (n=1,346) Integrated into an existing policy structure the Oklahoma College Savings Plan, or OK 529

SEED OK Research Data Type Dates Source Oklahoma State Department of Health April - Jun 2007 and Aug - Oct 2007 Birth records Baseline survey Aug 2007 - Apr 2008 RTI International OK 529 account and savings records Jan 2008 - June 2009 (quarterly through 2014) Program Manager (TIAA-CREF)

Oklahoma College Savings Plan (OK 529) State-sponsored 529 savings program Tax deduction and tax-free growth of earnings Can be used for post-secondary education at: Colleges and universities Graduate and post-graduate schools Community colleges Certain proprietary and vocational schools

SEED OK 529 Savings Plan Account Auto-enrollment in the OK 529 for treatment group newborns Account owned by the state Treatment child named as beneficiary $1,000 initial deposit Invested in the OK 529 Balanced Option State-owned account can be used for post- secondary education until child reaches age 30

Other Features of SEED OK Design Savings match for income-eligible treatments on their deposits of up to $250 per year for 4 years (2008 - 2011) Follow-up telephone interviews with all treatments and controls in 2011 and possibly again later In-depth interviews with select SEED OK participants from Fall 2009 through Spring 2010 and possibly again later

SEED OK 529 Accounts SEED OK tracks three types of OK 529 accounts for the child: State-owned Participant-owned (parent or caregiver) Other private (relatives or friends) As a policy concept, these can be viewed together as a single integrated 529 account. Any control has complete access to open a 529 account in the SEED OK experiment.

SEED OK Accounts and Incentives Account Type Treatment Control OK 529 account opened automatically with $1,000 No state-owned OK 529 account State-owned account OK 529 account opening encouraged Time-limited $100 account opening incentive Savings matched, if income eligible Family, friend, etc. can open account for child No incentives OK 529 account may be opened No information or incentives offered Participant- owned account Family, friend, etc. can open account for child No incentives Other private account

A Compromise to Test the Policy The CDA policy concept is a single, integrated account into which all deposits would flow. SEED OK uses an existing policy structure (OK 529), and so must use the current account structure. In SEED OK, different deposits go into different 529 accounts, all with the child as the beneficiary. This is cumbersome and imperfect but allows us to test the policy concept.

SEED OK Key Research Questions Can Child Development Accounts increase: (1) 529 account holding, (2) saving by participants, and (3) total 529 assets? Later, SEED OK can assess (4) child development and well-being. (see Nam et al., 2011)

529 Account Holding 99.9% for treatments vs. 2.3% for controls, and 16.4% of participants have their own account Huge impacts compare to: 62% take up of 529 account in MI SEED impact assessment, with $800 initial deposit, but requiring sign up(Marks et al, 2009). 3.8% of OK households with children up to age 18 holding any OK 529 account (State Treasurer, 2011).

Participant Savings Average savings of $43 by treatments vs. $13 by controls in their private accounts: Effect size (saving amount), so far, is positive but quite modest. We know from qualitative research that families have a hard time thinking about college savings with newborns (especially during a recession). Nevertheless, positive impact on seeding college savings for people who might not otherwise save. We will see if they save more going forward.

Asset Building Mean 529 total assets are $1,080 for treatments vs. $40 for controls: Because asset building is a main SEED OK goal, this is strong and meaningful policy result. To be sure, this outcome is structured and paternalistic as all CDA policies are...but Social Security and 401(k) retirement plans are also structured and paternalistic.

Overall Account Opening and Savings Impacts State-owned account: close to 100% success of automatic account opening with $1,000 deposit for treatment participants (one out of 1,361 declined account) Impacts of SEED OK on account opening and on deposit and saving amounts are statistically significant for the state-owned and participant- owned accounts, but not for other private accounts

Summary and Conclusions: Child Development and Well-Being The long-term test will be whether CDAs eventually yield positive impacts on: parental attitudes and behaviors child development in early years child expectations for education child educational performance child health and other measures of well-being

Summary and Conclusions: Toward an Inclusive CDA Policy? If a universal and progressive CDA policy is desirable (in the way that universal Social Security is desirable), then SEED OK has demonstrated policy feasibility by using the 529 policy system. If the critical policy test is positive impacts on education and other measures of well-being of children, then SEED OK is still in the early stages. Wave 2 of the survey has just been completed.

Acknowledgements SEED OK: Policy Demonstration: Oklahoma Governor, Treasurer, and Department of Health; TIAA-CREF Funders: Ford Foundation, Charles Stewart Mott Foundation, Lumina Foundation for Education Survey Research: RTI International

Resources and Contact Information http://csd.wustl.edu/ mclancy@wustl.edu 314-935-8178