A Comprehensive Comparison of 529 vs ABLE Accounts and Considerations for Implementing ABLE with CSPM

This content provides detailed information on the differences between 529 and ABLE accounts, including beneficiary limits, contribution limits, income limitations, expenses, recapture rules, reporting requirements, and more. It also discusses considerations for integrating ABLE accounts with CSPM, addressing issues related to funding, staffing, contractual obligations, and verification of disability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

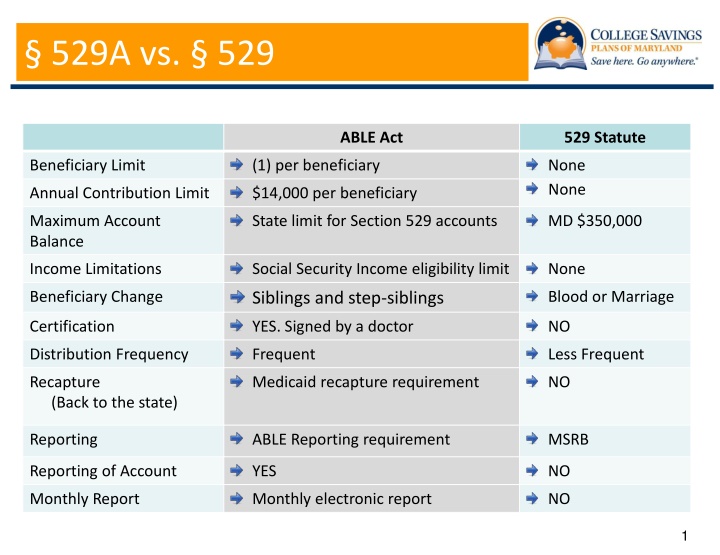

529A vs. 529 ABLE Act 529 Statute Beneficiary Limit (1) per beneficiary None None Annual Contribution Limit $14,000 per beneficiary Maximum Account Balance State limit for Section 529 accounts MD $350,000 Income Limitations Social Security Income eligibility limit None Beneficiary Change Blood or Marriage Siblings and step-siblings Certification YES. Signed by a doctor NO Distribution Frequency Frequent Less Frequent Recapture (Back to the state) Medicaid recapture requirement NO Reporting ABLE Reporting requirement MSRB Reporting of Account YES NO Monthly Report Monthly electronic report NO 1

529A vs. 529 (cont.) ABLE Act 529 Statute Yearly Eligibility YES NO NO Home State Requirement YES or contracting state. Expenses Qualified Disability Qualified Tuition Tax Penalty on Non-Qualified Expenses 10% Exceptions: Death Contribution growth is returned to the account before the federal tax filing deadline. 10% Exception: Death Disability preventing beneficiary from attending college Verification of Qualified Expenses TBD Taxpayer 2

Qualified Expenses 529 Plans ABLE Accounts Dictated by IRS Publication 970 Education Housing Assistive technology and personal support services Transportation Employment training and support Health Prevention and wellness Financial management and administrative services Legal fees Expenses for oversight and monitoring Funeral and burial expenses Other expenses approved by the Treasury Secretary Generally: Tuition Books and Supplies (as required by the university) Room and Board (student must be enrolled at least half-time) Expenses of a special-needs beneficiary necessary for enrollment at an eligible institution 3

ABLE ACT (cont.) Considerations for locating ABLE with CSPM: Board Currently 10 people/ ABLE would add 10 more How would the Board address the diverse issues governing both plans? Staffing and funding CSPM is funded by the program fees generated from the Plans Start up costs for ABLE? Who would fund them? Who would take on the administrative costs to add additional staff ? Contractual Obligations T. Rowe Price Program manager would they be willing to amend their contract? Future RFP in 2016 What role should Community Development Financial Institutions play? Verification of Disability Who will do it? Who will take on the administrative burden? Medical Information Privacy Issue Increase administrative costs 4