Day-Ahead Ancillary Services Initiative: Current Updates and Future Plans

The ISO-NE is introducing the Day-Ahead Ancillary Services Initiative (DASI) to procure and price ancillary services efficiently. Key discussions include the strike price adder approach and the Forward Reserve Market logistics. Stakeholder feedback is sought on the strike price adder concept, with considerations for a dynamic approach. Learn about the motivation for a dynamic strike price adder and the potential benefits to both the energy market and consumers.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

N E P O O L M A R K E T S C O M M I T T E E | M A R C H 7 - 9 , 2 0 2 3 | W E S T B O R O U G H , M A Day-Ahead Ancillary Services Initiative (DASI) Procure and price services required for a reliable operating plan in the Day-Ahead Energy Market Ben Ewing Zeky Murra Anton E C O N O M I S T P R I N C I P A L A N A L Y S T ISO-NE PUBLIC 1

WMPP ID: 162 Day-Ahead Ancillary Services Initiative Proposed Effective Date: Dec 2024 Mar 2025 With DASI, the ISO seeks to procure and price the ancillary service capabilities needed to meet real-time energy demand and deliver a reliable, next-day operating plan with an evolving generation fleet With DASI, these reliability requirements will be satisfied within the clearing of the day-ahead market (DAM) Today s discussion includes: Strike price adder approach Forward Reserve Market (FRM) sunset logistics ISO-NE PUBLIC 2

STRIKE PRICE ADDER In this module, we will: Describe the ISO s approach to a strike price adder Summarize a (preliminary) methodology to determine an adder ISO-NE PUBLIC 3

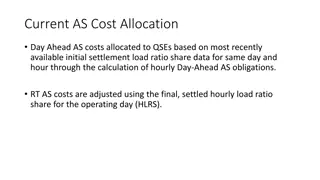

Strike Price Adder: Current Thinking In response to stakeholder feedback and requests, the ISO is assessing a strike price adder as part of the DASI design An adder implies that the strike price used to settle DA A/S awards would be set at a price above the expected RT LMP New terminology: Call the expected RT LMP the base strike price (before any strike price adder is applied) The ISO continues to evaluate the design and impact of a strike price adder We welcome feedback on the merits of an adder and the proposed approach to determining it ISO-NE PUBLIC 4

Background and Motivation During the Energy Security Improvements (ESI) proceeding, stakeholders proposed a fixed $10/MWh strike price adder Motivation: an adder could decrease the closeout risk associated with selling DA A/S, and reduce A/S costs to consumers ISO did not support this due to concerns that it may adversely dilute the incentives the DA A/S design provides Given filing deadline, ISO did not have time to fully assess this issue After a more thorough assessment, the ISO now believes a dynamic strike price adder can be developed that addresses these concerns Key Insight: As the incentives the A/S option design provides are likely to depend on system conditions, a dynamic adder can be designed to vary with expected RT conditions, rather than being fixed at $10/MWh ISO-NE PUBLIC 5

Conceptual Approach The practical goal is a simple adder formula that varies with (e.g.) the expected hourly real-time LMP (the base strike price) In hours when the impact on incentives from increasing the strike price is small, it may be acceptable to allow a higher adder to the expected RT LMP (e.g., possibly at, or above, $10/MWh) In other hours when the impact on incentives from increasing the strike price is large, we would limit the adder s adverse impacts by using a smaller (or potentially zero) adder The adder formula could potentially be based on other forecast next-day conditions (e.g., the load forecast), though using multiple forecast variables becomes more complex The aim is to produce a simple rule (adder formula on top of the base strike price) that meets the overall DASI design objectives and addresses stakeholders risk-related concerns The impact analysis modeling will also provide information on an adder s impact on DA A/S clearing prices and total costs/revenues ISO-NE PUBLIC 6

Conceptual Approach: Additional Considerations This dynamic adder approach is conceptually simple, but there are some complications in the details still being assessed The impact on incentives may affect resources differently: Across time: A resource s incentives may be affected differently by the same adder under different system conditions Across resources: The impact of an adder depends on a resource s RT marginal costs relative to the strike, and whether it clears any DA A/S that hour (see Appendix 1 for examples) To evaluate these impacts quantitatively, we are using market simulation analyses to identify the expected system conditions when an adder s: Aggregate impact would be small (so the adder could be larger), and Aggregate impact would be larger (so an adder should be smaller) ISO-NE PUBLIC 7

Methodological Approach We are performing calculations to measure the impact on incentives at varying strike price adders for different system conditions Using the DASI impact analysis simulation platform for a 2019-2021 study period Three basic steps: 1. Estimate the extent to which various strike price adder amounts would reduce DA A/S sellers incentives to invest and take actions to be able to deliver in RT if dispatched (i.e., to resolve the misaligned incentives problem) 2. Evaluate how this change in incentives due to an adder varies based on the base strike price and other observable system conditions known prior to the DA market (e.g., load forecast) 3. Construct a simple rule (formula) that allows for a higher strike price adder when the impact on incentives is small, and a lower adder (or no adder) when the impact is significant ISO-NE PUBLIC 8

Current Thinking and Direction The observations here are based on preliminary results for a limited sample of hours; they may evolve with further analysis In many hours annually, it appears that a modest adder (of, say, $10/MWh) may not materially impact the aggregate incentives of DA A/S sellers This tends to occur when expected RT prices are low, when we may expect most resources clearing DA A/S have RT MC > base strike The conditions when the reverse apply (a material impact) are more involved and under ongoing analysis Market-wide, an adder s impact on incentives does not appear to change discretely at some specific threshold value of the expected RT LMP Suggests a sensible approach may be to phase out the adder as the expected RT LMP increases (or possibly as a function of another observable measure of next-day hourly system conditions) We expect to have data and further recommendations for review and discussion at the April MC meeting ISO-NE PUBLIC 9

Strike Price Adder: Key Takeaways The effect of an adder on incentives, and therefore on the effectiveness of the DA A/S design, depends on market conditions that may vary day-to-day (and hour-to-hour) This suggests a dynamic adder may be superior to a constant strike price adder (e.g. $10/MWh in all hours) ISO is currently developing an empirical methodology to determine how, as a function of system conditions, different adders are likely to affect DA A/S sellers incentives and prices The aim is to produce a simple rule (adder formula on top of the base strike price) that meets the overall DASI design objectives and addresses stakeholders risk-related concerns ISO-NE PUBLIC 10

FORWARD RESERVE MARKET (FRM) SUNSET ISO-NE PUBLIC 11

Revision 1: - Date correction FRM Sunset Overview As discussed at the October 2022 MC, the ISO proposes to sunset the FRM with the implementation of DASI, conditional upon DASI s acceptance by the FERC Allowing the FRM and DASI to overlap would raise concerns Double compensation: resources could sell the same MW of reserve capability twice; once in the FRM, and again as DA A/S Double exposure: resources could face financial losses in two separate markets (FRM penalties, DA A/S closeout) for a single failure Participation disincentive: simultaneous implementation of DASI and FRM could divide the markets, reducing the competitiveness of each and increasing clearing prices see previous FRM Sunset materials (slide 8) from 2020 ESI discussions ISO-NE PUBLIC 12

FRM Sunset Timing and Logistics The proposed DASI effective date range falls within the Winter 2024/25 FRM procurement period To avoid an overlap, ISO proposes to truncate the Winter 2024/25 FRM procurement period This final period will end on the last day of the month prior to the DASI planned go live implementation date The duration of this FRM procurement period will be reflected in the FRM assumptions, posted in advance of this Forward Reserve Auction This will account for any adjustments to the DASI implementation date that may occur between the time DASI is filed and the time the FRM assumptions are posted ISO-NE PUBLIC 13

FRM Sunset Illustrative Example For illustrative purposes, suppose the DASI effective date was determined to be March 1, 2025 The Winter 2024/25 FRM procurement period would, as a result, span Oct 2024 Feb 2025 This truncated period would be reflected in FRM assumptions document for this auction Participants would consider five months of FRM obligation, rather than eight months, in their FRM offers ISO-NE PUBLIC 14

FRM Sunset Key Takeaways It would be problematic if there was an overlap between an FRM procurement period and DASI implementation The ISO proposes to sunset the FRM in conjunction with DASI s implementation, conditional on DASI s acceptance The Winter 2024/25 FRM procurement period will be truncated, and end on the monthly boundary prior to DASI s planned implementation date ISO-NE PUBLIC 15

STAKEHOLDER QUESTIONS ISO-NE PUBLIC 16

FAQ: Can you clarify the elements of the ISOs load forecast, which will be applied in the FER? The ISO s day-ahead load forecast reflects the expected RT load, internal to the New England control area, that the ISO must satisfy with its DA operating plan Today, this hourly load forecast value incorporates adjustments to reflect (i.e., is lower to account for): Expected output of settlement-only resources (which do not participate in the DAM) Expected output behind-the-meter generation, such as BTM solar facilities This existing practice will continue with DASI The hourly load forecast value does not reflect: demand that is dispatchable in real-time, such as energy storage load (i.e., DARD load) Energy exports to other balancing areas ISO-NE PUBLIC 17

FAQ: Will the ISO support inclusion of a review provision in the Tariff, as was included in the ESI filing? Yes. We ve discussed with the IMM, and will include similar language to that which the ISO filed with ESI in the package of changes we file with DASI The language filed with ESI is included in Appendix 2, for reference ISO-NE PUBLIC 18

FAQ: What are the highest payment rates that might occur in the DAM with DASI? *this value does not account for congestion and loss pricing, which vary by location ISO-NE PUBLIC 19

FAQ: Can you clarify the ISOs proposal to not apply Ecomin as a lower bound for offline fast-start resources DA A/S awards? This is standard practice at many ISOs that clear A/S in their DAMs MISO, PJM, and NYISO do not apply Ecomin as a lower bound in clearing DA A/S This addresses DA A/S price formation issues, by avoiding lumpiness and enabling the highest cleared A/S offer(s) to set DA A/S prices recall similar logic is applied by Fast-Start Pricing in the RT market, relaxing Ecomin to allow lumpy fast-start resources to set price in real-time This price formation logic enables the design to (a) avoid DA A/S clearing prices that do not cover cleared A/S sellers offer prices, and (b) avoid complicated new DA A/S-specific uplift mechanisms to fix that problem This design treatment aligns with today s real-time reserve rules Ecomin is not enforced in RT reserve designations in ISO-NE This has not been a source of reliability concerns in real-time, and we do not expect it to be one in the day-ahead context In real-time, fast-start resources that are in merit for energy will be dispatched to (at least) their Ecomin ISO-NE PUBLIC 20

STAKEHOLDER SCHEDULE ISO-NE PUBLIC 21

Stakeholder Schedule Stakeholder Committee and Date Scheduled Project Milestone Markets Committee - Oct. 12-13, 2022 Overview and initial proposed design discussion Markets Committee - Nov. 8-10, 2022 Continue design discussions Markets Committee - Dec. 6-8, 2022 Continue design discussions Markets Committee - Jan. 10-12, 2023 Continue design discussions Markets Committee - Feb. 7-9, 2023 Continue design discussions Markets Committee - Mar. 7-9, 2023 Continue design discussions and discuss strike price adder approach Markets Committee - Apr. 11-12, 2023 Continue design discussions and initial review of impact analysis results Markets Committee - May 9-10, 2023 Present draft of the ISO s proposal and initial Tariff redlines; Continue review of impact analysis results; Discussion of any potential amendments* Markets Committee - Jun. 6-7, 2023 Present any design refinements to the ISO s proposal and review Tariff redlines focusing on revisions since the prior meeting; Continue review of impact analysis results; Continue discussion of any potential amendments to the ISO proposal including Tariff language* Markets Committee - Jul. 11-12, 2023 Vote on DASI proposal and any proposed stakeholder amendments Participants Committee - Aug. 3, 2023 Vote on DASI proposal and any proposed stakeholder amendments *Members should provide their materials in advance so that they can be distributed by the posting date for the relevant MC meeting and should work with NEPOOL Counsel in the drafting of any desired Tariff changes or amendments to the ISO proposal ISO-NE PUBLIC 22

Ben Ewing ( 4 1 3 ) 5 3 5 - 4 3 6 1 | B E W I N G @ I S O - N E . C O M Zeky Murra Anton ( 4 1 3 ) 5 4 0 - 4 4 4 8 | Z M U R R A A N T O N @ I S O - N E . C O M ISO-NE PUBLIC 23

APPENDIX 1 STRIKE PRICE ADDER CONCEPTUAL CONSIDERATIONS ISO-NE PUBLIC 24

Conceptual Considerations: Roadmap Graphically, we will walk through the key considerations when designing the strike price adder, and make the following observations: 1. Including an adder that increases the strike price could inefficiently decrease resources incentives to be available in RT 2. The potential decrease in incentives may affect resources differently A resource s incentives may be affected differently by the same adder under different system conditions Different resources may be affected differently by the same adder under the same system conditions 3. To measure the total market reduction in incentives from an adder, we need to estimate the aggregate impact on resource incentives associated with different strike price adders under a range of system conditions ISO-NE PUBLIC 25

A Strike Price Adder Could Decrease Incentives To evaluate the effect of an adder on a resource s incentives, we compare the base strike price to its marginal cost (MC) of providing energy Background for the next several slides observations is provided in the ISO s November 2022 Markets Committee presentation When K<MC, a resource has efficient incentives to be available in RT A small increase in the strike price will not decrease such incentives When K>MC, a resource has below-efficient incentives to be available in RT A small increase in the strike price will decrease such incentives In the following graphical explanation, consider Resource A with a RT energy MC of $40/MWh ISO-NE PUBLIC 26

A Strike Price Adder Could Decrease Incentives, or Not Impact Incentives, Depending on a Seller s RT MC No incentive change when the strike price increases Incentive decrease when the strike price increases A similar figure was provided in November 2022 s MC (slide 53) ISO-NE PUBLIC 27

The Same Strike Price Adder Can Affect a Resource Differently, Based on System Conditions During the November 2022 Markets Committee presentation (Slide 52) we noted that the incentive to be available in RT is the system s expected cost to replace a resource s energy in RT Under certain system conditions, more resources may see their incentives decrease with a strike price adder and/or the system s expected cost of energy replacement in RT may be higher (meaning the reduction in incentives from the efficient level is greater) Under these conditions, the resource s incentive to be available in RT is more significantly impacted by a strike price adder Key insight: the effect of an adder on incentives will be different, depending on system conditions For the next graph, suppose that under stressed system conditions, resource A s MC increases to $60/MWh ISO-NE PUBLIC 28

The Same Strike Price Adder Can Affect a Resource Differently, Based on System Conditions Same increase in strike price, different incentive effect, depending on system conditions $10 $10 ISO-NE PUBLIC 29

The Same Strike Price Adder Can Affect Resources Differently Same increase in strike price, different incentive effect for resources A and B ISO-NE PUBLIC 30

The total market reduction in incentives from an adder depends on how many resources are affected and by how much In a given hour, resources have heterogeneous MC of selling energy In the last example, the strike price adder would reduce the incentive for Resource B while having no impact on the incentive for Resource A When estimating the total impact of an adder on incentives, we must therefore consider both how many resources incentives are affected (how many resources are like Resource B?) and how much the incentive decreases for impacted resources (how much does Resource B s monetary incentive decrease as a result of the adder?) ISO-NE PUBLIC 31

Summary of the Conceptual Considerations Increasing the strike price could inefficiently decrease resources incentives to take costly actions, in advance of the operating day, in order to invest and take actions to be able to deliver in RT if dispatched The potential decrease in incentives of a given adder may affect a resource differently, depending on system conditions The potential decrease in incentives of a given adder may affect different resources differently under the same system conditions Resources have different marginal costs and clear different amounts of DA A/S, all of which needs to be considered when measuring the market decrease in incentives of an adder We are developing an empirical methodology to measure such effects This will then allow us to develop a strike price adder design that limits the extent to which incentives are reduced ISO-NE PUBLIC 32

APPENDIX 2 ISO-NE PUBLIC 33

Tariff language filed April 2020 with ESI, regarding IMM review of major market design changes ISO-NE PUBLIC 34