Day-Ahead Ancillary Services Initiative Overview

The Day-Ahead Ancillary Services Initiative (DASI) aims to procure and transparently price ancillary services to ensure a reliable operating plan in the Day-Ahead Energy Market. With DASI, the ISO seeks to meet key day-ahead reliability requirements within the clearing of the day-ahead market, eliminating the need for out-of-market solutions. The proposal includes key design concepts and scope discussions, focusing on satisfying day-ahead reliability standards within the DAM by incorporating load forecasts and introducing new products like Energy Imbalance Reserve (EIR). The initiative addresses the need for physical supply capability, operating reserves, and better resource clearing in the day-ahead market to enhance reliability.

Uploaded on Jul 20, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

M A R K E T S C O M M I T T E E | O C T O B E R 1 2 - 1 3 , 2 0 2 2 | W E S T B O R O U G H , M A Day-Ahead Ancillary Services Initiative (DASI) Procure and transparently price services required for a reliable operating plan in the Day-Ahead Energy Market Ben Ewing Chris Geissler M A N A G E R , E C O N O M I C A N A L Y S I S P R I N C I P A L A N A L Y S T ISO-NE PUBLIC 1

WMPP ID: 162 Day-Ahead Ancillary Services Initiative Proposed Effective Date: Q4 2024/Q1 2025 With DASI, the ISO seeks to procure and transparently price the ancillary service capabilities needed for a reliable, next- day operating plan with an evolving generation fleet Currently, the ISO relies on out-of-market means to meet key day- ahead reliability requirements With DASI, these reliability requirements will be satisfied within the clearing of the day-ahead market (DAM) This initial discussion will have several components: Overview of key DASI concepts and project scope Discuss rationale for DASI Proposed schedule of stakeholder discussions ISO-NE PUBLIC 2

DASI DESIGN CONCEPTS AND SCOPE The ISO s proposal reflects a subset of concepts introduced during 2019-2020 stakeholder discussions on proposed Energy Security Improvements (ESI) Over the next several slides, we discuss key design concepts that are in scope for DASI, and others that are out-of-scope ISO-NE PUBLIC 3

Rationale for Change Satisfy key day-ahead reliability standards within the DAM ISO is required to have a next-day operating plan with sufficient: Physical supply capability to meet the load forecast NERC-TOP-002-4 Operating reserves to meet reserve requirements NERC-BAL-002-3, NPCC Directory #5 The DAM provides the basis for the ISO s next-day operating plan, but the present DAM is incomplete Today, the DAM does not clear resources to satisfy these two day- ahead reliability requirements With DASI, the ISO proposes to bring these day-ahead reliability requirements into the DAM ISO-NE PUBLIC 4

Key DASI design elements Load Forecast. Incorporate the load forecast into a co-optimized DAM clearing and pricing process New DAM constraint: Forecast Energy Requirement (FER) New DAM product: Energy Imbalance Reserve (EIR) Operating Reserve. Procure fast-start and fast-ramping capabilities through the co-optimized DAM clearing and pricing process New system-level DA constraints: TMSR requirement, Total 10-minute requirement, Total 30-minute requirement New Products: Flexible Response Services (FRS) Day-Ahead Ten-Minute Spinning Reserve (DA TMSR) Day-Ahead Ten-Minute Non-Spinning Reserve (DA TMNSR) Day-Ahead Thirty-Minute Operating Reserve (DA TMOR) Call-option settlement design. Settling DA A/S awards as call options on real-time energy provides efficient incentives for sellers of DA A/S products to be able to perform in real-time ISO-NE PUBLIC 5

Key DASI design elements (contd) Voluntary Participation, with Mitigation Participants may choose whether or not to submit DA A/S offers Mitigation design will address physical and economic withholding concerns Forward Reserve Market (FRM) sunset The existing FRM is not compatible with DASI With DASI implementation, the ISO proposes to retire the FRM The ISO is open to the concept of a future replacement long-forward market for reserves Forward markets require sound spot markets It is important for the ISO and region to develop and fully understand the spot market (DASI) before a forward market could be designed ISO-NE PUBLIC 6

Concepts out-of-scope for DASI design 90- and 240-minute DA A/S products are not included ( Replacement Energy Reserves , or RER) These products are significantly more complicated to design and implement, and will be considered as part of a future project Noted previously to the Markets Committee in the ISO s April 2022 memorandum A long forward market is not included Consideration of this element with ESI was focused on energy security DASI is being pursued outside the context of energy security ISO-NE PUBLIC 7

Putting todays discussion in context DASI design discussions will cover a number of important topics Rationale for DASI (today) Call-option settlement design Competitive offer formulation Mitigation design Co-optimized clearing and pricing Credits and cost allocation Impact analysis We ll discuss the timing and expected content of each of these topics at the end of today s presentation ISO-NE PUBLIC 8

OVERVIEW OF CURRENT PRACTICE FOR MEETING DAY-AHEAD RELIABILITY REQUIREMENTS ISO-NE PUBLIC 9

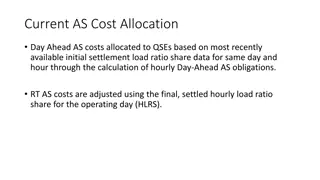

Todays day-ahead practice Operating Reserves The DAM is cleared in two sequential optimizations First, a unit commitment process Second, a dispatch and pricing process Operating reserve requirements are applied during the DA commitment process, but are not applied during the DA dispatch and pricing process This ensures that sufficient unloaded ramp-up capability on committed units DA, and sufficient offline fast-start capability, is available to meet expected real-time reserve requirements This does not provide information, settlement obligations, prices, or compensation to the resources that the ISO counts on to meet the operating reserve requirements for the next-day operating plan ISO-NE PUBLIC 10

Todays day-ahead practice Load Forecast The load forecast is satisfied through the out-of-market Reserve Adequacy Analysis (RAA) process, following the clearing of the DAM The RAA addresses any energy gap between (1) DAM committed physical supply, and (2) the load forecast and operating reserve requirements RAA may rely upon a DAM committed resource above its DAM energy schedule RAA may commit additional resources (supplemental commitments), or extend the commitment duration of a DAM-committed resource The RAA does not provide settlement obligations, prices, or compensation to the resources (or portions thereof) that the ISO counts on to meet the load forecast requirement of the next-day operating plan ISO-NE PUBLIC 11

RATIONALE FOR DAY-AHEAD ANCILLARY SERVICES ISO-NE PUBLIC 12

Overview of todays discussion on the rationale for DASI The impacts of the existing DAM design Design objectives and proposed solution Other ancillary service design concepts do not fully address these adverse impacts, and do not satisfy the design objectives ISO-NE PUBLIC 13

Todays discussion is intended to provide an initial overview We plan to discuss the challenges with the current market design, and the proposed DASI approach to address them, in more detail at future Markets Committee meetings This future discussion will include more information and numerical examples illustrating how today s practices can produce inefficient outcomes, and how these inefficiencies are resolved by the ISO s proposed solution Welcome stakeholder feedback and questions on these topics ISO-NE PUBLIC 14

THE IMPACTS OF THE EXISTING DAM DESIGN Consequences of managing the reliability requirements of a next-day operating plan without procuring these services through market products ISO-NE PUBLIC 15

Context: Setting up the system today To meet key day ahead reliability requirements, the ISO must set up the system to have sufficient capability to meet the load forecast and expected real-time reserve requirements At present, the only product that resources sell in the DAM is energy, where the quantity sold depends on participant DA energy offers and demand bids Thus, there are two potential gaps between what the DAM clears and the key DA reliability requirements Energy imbalance when the market clears less physical energy supply than the load forecast Reserves to cover any system ( source-loss ) contingencies ISO-NE PUBLIC 16

There is a missing market for these reliability services At present, there are not well-defined products corresponding with these key reliability services in the DAM that participants can offer or sell Instead, ISO relies upon unloaded online fast-ramping capability and offline fast-start capability to meet these requirements for a reliable next-day operating plan Without market products, there are no settlement obligations, prices, or compensation provided to the resources the ISO counts on to provide these services ISO-NE PUBLIC 17

These missing DA markets can have several adverse impacts on system reliability and efficiency 1. Information: Resources that are being counted on to provide these key reliability services may not know that the ISO is relying upon them to be able to provide energy, possibly on short notice, during all or part of the next operating day 2. Inefficient DA awards: Without clearly specified offer prices for these services, the DAM optimization cannot efficiently select the resources to provide them (continued next slide) ISO-NE PUBLIC 18

These missing DA markets can have several adverse impacts on system reliability and efficiency (cont d) 3. Poor price signals: ISO s current practices to satisfy these key reliability requirements are unpriced, which can reduce DA and RT energy prices below resources costs, contrary to sound economic principles 4. Misaligned incentives: Because resources are not compensated for providing these services in the DAM, their incentives to invest in their ability to reliably provide energy in RT are inefficiently low Next: Discuss each of these adverse impacts in more detail ISO-NE PUBLIC 19

1. Information: Resources may not know when they are being counted on to provide these key reliability services While the ISO may rely upon a unit in its day-ahead operating plan to fill the energy gap, or for contingency response, this is not signaled to the Market Participant in a clear and transparent manner This lack of information may reduce efficiency and reliability if the resource would have made different arrangements with better information about its role in satisfying the DA reliability requirements ISO-NE PUBLIC 20

2. Inefficient DA awards due to missing DA ancillary services markets DAM does not consider resources costs associated with providing key reliability services that are (as noted earlier) required of the day-ahead operating plan Rather, the current practice implicitly assumes that these services can be provided at no cost, by all resources (or portions of resources) that have the capability to do so and that were not scheduled for DA energy Not including these costs in today s DAM can produce inefficient DA awards ISO-NE PUBLIC 21

3. Poor price signals (Part A): Current practices send the wrong price signals The current practice of committing resources to provide these reliability services in an unpriced manner can serve to reduce energy prices That is the not the economically sensible price signal The need for more capability to meet the region s reliability needs should instead result in an increase in energy prices EMM finds that additional generation was committed DA to meet the system 10-minute spinning reserve requirement in between 3,389 to 4,054 hours over the past three years* Corresponds to 39 to 46 percent of all hours across the year *See page 28 of their 2021 Assessment of the ISO New England Electricity Markets report, available at https://www.iso- ne.com/static-assets/documents/2022/06/iso-ne-2021-som-report-full-report-final.pdf ISO-NE PUBLIC 22

3. Poor price signals (Part B): Current practices create uplift payments With the reduced energy market prices and the commitment of higher-cost resources to meet day-ahead operating plan reliability requirements, there is an increased need for out-of- market uplift payments to ensure committed resources cover their costs Uplift yields different compensation for the same services These out-of-market payments also reduce the transparency of prices and costs to market participants Potomac Economics estimates such practices resulted in roughly $4 to $5 million in DA NCPC payments annually over the past three years* *See page 28 of their 2021 Assessment of the ISO New England Electricity Markets report, available at https://www.iso- ne.com/static-assets/documents/2022/06/iso-ne-2021-som-report-full-report-final.pdf ISO-NE PUBLIC 23

4. Misaligned incentives can produce a less efficient and less reliable system As explained during stakeholder discussions in 2019 2020 on the Energy Security Initiatives proposal, current rules can lead to misaligned incentives More specifically, a generator that is being counted on to fill the energy gap, or to prepare for contingencies, does not fully internalize the replacement costs associated with its (potential) real-time non-performance Misaligned incentives produce a less efficient and less reliable system due to underinvestment ISO-NE PUBLIC 24

Misaligned incentives can apply to a broad set of resources Misaligned incentives can manifest in several ways Earlier discussions with stakeholders largely focused on incentives for resources to procure gas after the DAM cleared However, the adverse impacts of the misaligned incentives extend to a broad set of resources as they undermine incentives to make a range of efficient investments in maintenance, capital expenditures, and other costly actions that improve their RT performance Upcoming presentation (Nov. MC): Numerical examples showing how the misaligned incentives can occur under current market rules ISO-NE PUBLIC 25

Introducing new DA products to fill the missing markets does not necessarily resolve the misaligned incentives on its own To efficiently address the misaligned incentives, new DA products must lead resources selling these products to fully internalize the replacement costs of not providing RT energy (when needed) When this condition is met, suppliers providing DA A/S will incur costs (fuel, investment, operational, etc.) when it is socially efficient to do so, and will not incur costs when not ISO-NE PUBLIC 26

Key Takeaway 1: The DA product definition will play a critical role in determining if the design is effective in addressing the adverse impacts identified A range of DA products could be introduced to fill the missing DA markets that exist today However, not all products will create efficient incentives for resources selling these services to incur costs to reliably provide these services when it is socially beneficial to do so Careful thought must be given to how to design these products to align resource incentives with society s best interests ISO-NE PUBLIC 27

Key Takeaway 2: The adverse consequences of these missing markets will grow with the clean energy transition Presently, there is typically sufficient fast-start and fast- ramping resource capability in the New England system to fill the gaps without a market for these products However, if we continue to not compensate resources for these reliability services, they may exit the market or choose not to continue to incur the costs necessary to reliably provide them (supply of these services will decrease) Growth in weather-dependent resources will require more of these capabilities for when the sun does not shine or the wind does not blow (demand for these services will increase) It is important to address these adverse impacts now, before the efficiency and reliability consequences of inaction increase further ISO-NE PUBLIC 28

DESIGN OBJECTIVES AND PROPOSED SOLUTION ISO-NE PUBLIC 29

Day-ahead ancillary services: Design objectives Reliable operating plan: Ensure that the ISO satisfies the key day- ahead operating plan reliability requirements Efficient incentives: Create incentives for resources providing these services to make efficient investments and operating decisions Transparent prices: Compensate resources at competitive prices that transparently signal the incremental cost of providing these reliability services Non-discriminatory and technology neutral: Compensate all resources that provide these reliability services similarly, with technology-neutral DA ancillary service obligations ISO is proposing a DA ancillary services design that addresses each of the adverse impacts identified earlier, and achieves each of these design objectives ISO-NE PUBLIC 30

Solution concept builds on those used in other RTOs, and improves upon two key design issues Several other RTOs co-optimize energy and reserves in their DAM Our approach is similar in most respects, but it includes two new (related) design improvements First, it includes new constraints and products to ensure that the DAM is able to satisfy the load forecast New DAM constraint: Forecast Energy Requirement (FER) New DAM product: Energy Imbalance Reserve (EIR) Second, it settles all DA A/S products as call options on RT energy, to provide efficient incentives for resources to be able to provide RT energy when needed (more on this further below) ISO-NE PUBLIC 31

ISOs proposed solution concept addresses External Market Monitor s recommendation [W]e recommend that the ISO implement operating reserve requirements in the day-ahead market that are co-optimized with energy. * Recommendation notes that these requirements should include [a] forecasted energy [requirement] The ISO is evaluating potential solutions to this recommendation in its Day-Ahead Ancillary Services Improvements Project, and we strongly support this effort. * DASI design aligns with EMM s recommendation as it: Co-optimizes DA ancillary services and energy Includes requirements for reserves and forecasted energy *See page 32 of their 2021 Assessment of the ISO New England Electricity Markets report, available at https://www.iso- ne.com/static-assets/documents/2022/06/iso-ne-2021-som-report-full-report-final.pdf. ISO-NE PUBLIC 32

Clearing DA A/S, and settling as call options, addresses adverse impacts caused by missing markets To meet these constraints, the DAM will: Continue to procure DA Energy Settled as a forward sale of real-time energy, as today Also procure DA Ancillary Services Proposed to settle as call options on real-time energy Resources cleared to satisfy the DA reliability requirements will have a financial position (DA Energy, or DA A/S) that fully internalizes the replacement cost of energy if they do not perform in real-time Important: this is because the underlying product against which each is settled is real-time energy ISO-NE PUBLIC 33

Call-option settlement mechanics Options have a strike price, K, that is set prior to the DAM Resources selling DA A/S get paid a clearing price (set in the DAM) and are charged the difference between the RT LMP and K when the LMP exceeds the strike price If a resource sells DA A/S and then also sells energy in RT, it also receives the RT LMP for each MWh of energy produced In such cases, any option charges associated with high RT LMPs are (more than) offset by RT energy revenues ISO-NE PUBLIC 34

Set strike price to expected RT LMP to create efficient incentives for investment in RT performance If a resource sells DA A/S and is unavailable when needed in RT, it must pay for the incremental RT replacement cost of energy not delivered These incremental costs are equal to the RT LMP less K Allows system to procure this incremental energy in RT at a price no greater than K Creates strong incentives for resources to make efficient investments to be able to reliably provide energy in RT If strike price was instead set above the expected RT LMP, this would reduce sellers incentives to make efficient investments because non-performance in RT would be less costly ISO-NE PUBLIC 35

DASI solves todays DA informational shortcoming All resources being counted on to meet the DA reliability requirements will have financial positions coming out of DAM Provides clear and transparent information on extent to which ISO is counting on them to meet the day ahead operating plan s reliability requirements Also ensures such resources have skin in the game , as their compensation is linked to their ability to perform in real-time and they fully internalize the RT replacement cost of energy not delivered ISO-NE PUBLIC 36

DASI solves todays inefficient DA awards Competitive suppliers will submit DA energy and DA A/S offers reflecting their costs associated with providing each product DAM co-optimization will solve for the outcome that most efficiently awards energy and DA A/S positions to satisfy the DA energy and reliability requirements DAM co-optimization between energy and DA A/S therefore addresses the potential for inefficient DA awards that presently exists ISO-NE PUBLIC 37

DASI addresses the poor price signals concern Procuring all of the reliability requirements via DAM products eliminates the need to commit generators out-of-market to meet DA operating reserve and load forecast requirements Addresses External Market Monitor finding that ISO currently commits generators for 10-minute spinning reserves in almost half of all hours, where such commitments are unpriced* With prices for ancillary services that reflect resource costs, DASI is expected to decrease uplift payments, thereby reducing the extent to which different resources are paid different rates for the same service *See page 32 of their 2021 Assessment of the ISO New England Electricity Markets report, available at https://www.iso- ne.com/static-assets/documents/2022/06/iso-ne-2021-som-report-full-report-final.pdf. ISO-NE PUBLIC 38

DASI solves the misaligned incentives DA A/S sellers bear the full cost of replacing their energy (if they do not perform) under the call-option settlement design As a result, resources that sell DA A/S fully internalize the social benefits associated with their fuel, investment, and operational decisions This key insight is what allows the call-option framework to address the misaligned incentives it aligns the resource s incentives with society s best interests because the resource now bears the full replacement costs when it is not available to provide energy in RT Upcoming presentation (Nov. MC): Numerical examples showing how the DA option design resolves the misaligned incentives ISO-NE PUBLIC 39

DASI meets each of the identified design objectives Relies on market products to produces a reliable operating plan coming out of the DAM Creates efficient incentives by giving resources relied upon to meet these requirements financial positions in the DAM that lead them to fully internalize their replacement costs, thereby addressing the misaligned incentives Yields transparent prices that signal the competitive, market- based incremental costs of each key reliability service Non-discriminatory and technology neutral approach that allows these reliability needs to be met by any technologies physically capable of providing the required ancillary services ISO-NE PUBLIC 40

DASI proactively supports the clean energy transition DASI framework will help to facilitate the region s transition to a decarbonized power system with more renewable energy, where investment in fast-start/fast-ramping resources, and the reliability of these services, is even more critical The design concept, with the inclusion of both energy imbalance and flexible response service products, can be extended in the future to procure new DA services that may be identified to preserve a reliable next day operating plan in a rapidly evolving, weather-dependent power system Future extensions could include other FRS products or quantities, as supported by future studies and evolving needs ISO-NE PUBLIC 41

OTHER DESIGN CONCEPTS DO NOT FULLY RESOLVE THE ADVERSE IMPACTS IDENTIFIED AND DO NOT SATISFY THE DESIGN OBJECTIVES ISO-NE PUBLIC 42

The existing FRM is unable to address these concerns FRM obligations are limited to a subset of hours and products, and demand is specified seasonally These limitations mean FRM does not address the adverse impacts of the DA missing markets, as its products do not align with the DA reliable operating plan requirements The FRM offer price threshold restricts the prices at which resources with FRM obligations can offer energy, with the result that the FRM can cause inefficient RT outcomes and energy prices that exceed their competitive level This inefficiency has been critiqued pointedly by the EMM* *See pages 12-13 of their 2014 Assessment of the ISO New England Electricity Markets report, available at https://www.iso- ne.com/static-assets/documents/2015/06/isone_2014_emm_report_6_16_2015_final.pdf. ISO-NE PUBLIC 43

The FRM is unable to address these concerns (contd) Moreover, unlike DASI, the FRM does not: Allow resources to reflect costs associated with providing DA ancillary services in the DAM, which would lead to more efficient DA awards Provide transparent signals leading into the operating day about which resources are being counted on to fill the energy gap and to provide contingency response capability Ensure that the DAM can satisfy the next day operating plan s reliability requirements through market mechanisms Have a well-specified spot settlement mechanism, and as such, does not address the misaligned incentive ISO-NE PUBLIC 44

Propose to sunset the existing FRM with implementation of DASI The two designs cannot co-exist simultaneously, as this would effectively allow resources to sell ancillary services forward twice first via the FRM and second as a DA energy option Such overlapping products would raise a host of challenging design questions including: Could suppliers face a double exposure problem where they would settle against both forward positions with the same resource? How would demand for each product be determined given their overlapping nature? Having two overlapping products that do not work harmoniously could create double payment opportunities and/or reduce the efficacy of DASI in resolving the identified adverse impacts and satisfying the design objectives ISO-NE PUBLIC 45

Sun-setting the FRM is consistent with ISOs earlier recommendation and EMM s recommendation ISO first explained the incompatibility of the FRM with the introduction of DA ancillary services in a June 2020 Markets Committee presentation* Such a removal is consistent with EMM s recommendation to remove FRM, which was first flagged in their 2014 State of the Market Report** * Available at https://www.iso-ne.com/static-assets/documents/2020/06/a4_iso_presentation_frm_sunset.pptx **Available at https://www.iso-ne.com/static- assets/documents/2015/06/isone_2014_emm_report_6_16_2015_final.pdf ISO-NE PUBLIC 46

A day ahead forward sale of RT reserves design only satisfies some of the design principles Some other RTOs, such as NYISO, MISO, and SPP, procure co- optimized ancillary services in the DAM These RTOs settle their DA A/S against the RT reserve price, rather than as a call-option on the RT energy price This approach informs resources if they are being counted on to satisfy the day ahead reliability requirements, and improves transparency Moreover, it cannot be extended to settle EIR obligations (for which there is no distinct RT counterpart other than energy) Furthermore, that settlement design does not offer the same efficiency benefits as DASI (next) ISO-NE PUBLIC 47

The DA sale of reserves does not create efficient incentives By settling against the RT reserve price, resources do not internalize the replacement cost of their energy if they do not produce in RT Such a design therefore fails to align the resource s private incentive to be able to provide energy in RT (when needed) with its replacement cost Thus, misaligned incentives persist. Resources selling DA reserves would therefore invest less than is socially efficient in maintaining their ability to perform in RT While ad hoc non-performance penalties may rectify the weak incentives for resources selling DA reserves to be able to deliver energy, such penalties are unlikely to result in efficient outcomes, which require internalizing replacement costs when making investment decisions ISO-NE PUBLIC 48

NEXT STEPS AND STAKEHOLDER SCHEDULE ISO-NE PUBLIC 49

Coming soon: Further discussion of missing markets and their adverse impacts, design objectives, and alternative designs Discussion will emphasize the following: Why current rules can lead to the adverse impacts discussed, How these adverse impacts are resolved under the DASI design, and Why they would not be fully resolved under a forward sale settlement design similar to that employed in other RTOs Discussion will include numerical examples supporting these claims ISO-NE PUBLIC 50