The Shift Towards DB-Like Features in DC Plans

DC plans are evolving to resemble DB plans by focusing on decumulation strategies and addressing underfunding issues. The challenges faced by DB investing highlight the importance of incorporating elements like guaranteed income, inflation protection, and effective decumulation processes in DC plans to ensure long-term financial security. By learning from the strengths and weaknesses of DB plans, DC plans can offer a more comprehensive retirement solution for participants.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

DC Plans Should Look and Feel More Like DB Plans Laurence B. Siegel May 2018

DB pension funds Saving now to pay a bill that comes due in 20, 30, 40 years Not only the most sophisticated financial service ever designed (Bill Sharpe), but the most important Either it is very hard, or we are very bad at doing something simple. Which is it?

Why DB investing is hard Market risk Liability risk Discount rate Changes in the promise Agency risk Underfunding risk Theft risk (large sums of money are easy target for rent seekers) Time risk (everything else than can happen)

OK, lets start over DC plans are the fresh start Have succeeded tremendously But they, too, are underfunded And, most seriously, have not given thought to decumulation to make them more like DB plans, which got decumulation right

The crisis crisis Everything s a crisis For DC plans to succeed, let s not replicate aspects of DB that have failed/likely to fail Underfunding Unrealistic discount rates Amortization and smoothing, concealing true results Failure to make even small contributions required given unrealistic assumptions Agency issues, e.g. managed by boards of directors with no skin in the game Lump-sum payout

What does the DB system offer that a DC plan would like to provide Stream of consumption Guaranteed over lifetime of uncertain length Inflation protection? Handholding through decumulation Plus possibility of upside

Decumulation outline Decumulation without annuities 4% rule (spend 4% of initial assets + inflation) Endowment rule (spend 5% of current MV) ARVA best practices Decumulation with annuities Annuity-only (DB plan) Combining conventional investing and annuities (Sexauer-Siegel-Totten)

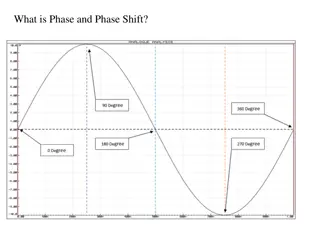

The 4% rule: very high risk Either spending into ruin, or not spending enough But wealth is explosive (+ or ) Spending is constant (real). . . $12,000,000 $500,000 Portfolio? Value? (Prior? to? Each? Period's? Spending) $450,000 99th? Percentile $10,000,000 $400,000 90th? Percentile 75th? Percentile $350,000 $8,000,000 Mean $300,000 $6,000,000 Annual? Spending Median $250,000 4%? of? initial? assets? at? time? of? retirement,? 25th? Percentile $200,000 $4,000,000 10th? Percentile $150,000 1st? Percentile $100,000 $2,000,000 One? Random Run $50,000 $0 $0 0 5 10 15 20 25 30 35 40 Year? of? Retirement 0 5 10 15 Year? of? Retirement 20 25 30 35 40

Endowment rule Won t run out of money, but could run very low on funds/spending Same volatility as market If market performs well, leaves a lot on table

ARVA: Annually Recalculated Virtual Annuity Each year, spend what a freshly calculated annuity payment (at updated term, interest rate, and asset value) would be in its first year Next year, repeat the process! i.e. spend-down over exactly the specified time horizon using annuity math nothing left over, no chance of ruin Satisfies budget constraint: PV of spending = MV of assets at all times

ARVA spending example: Risky portfolio, E(r) = 6.9%, = 11% $500,000 e(r)=6.9%, risk=11% Rf=3% Assets0=$2,525,000 $450,000 $400,000 Risk-free spend=$100,000/yr $350,000 You might be able to spend a great deal more . . . 99th Percentile Annual Spending 90th Percentile $300,000 75th Percentile $250,000 Mean Median $200,000 25th Percentile 10th Percentile $150,000 1st Percentile One Random Run $100,000 But you might instead end up spending much less! $50,000 $0 0 5 10 15 20 25 30 35 40 Year of Retirement

With ARVA, assets subject to spending always last full term $12,000,000 Portfolio Value (Prior to Each Period's Spending) $10,000,000 99th Percentile $8,000,000 90th Percentile 75th Percentile Mean $6,000,000 Median 25th Percentile $4,000,000 10th Percentile 1st Percentile One Random Run $2,000,000 $0 0 5 10 15 20 25 30 35 40 Year of Retirement

ARVA doesnt take advantage of insurance principle Although like an annuity in terms of time horizon, doesn t allow deceased investors to pay for the still living Save for extreme old age to avoid small probability of ruin Low spending rate Most investors will leave a lot of money on table Reshaping can help Is there another path to retirement security?

Combining conventional investing and annuities Age 65-85: Spend down DC savings After age 85: Live on payout from annuity or mini-DB plan Makes retirement saving and spending a manageable problem Annuity or mini-DB plan is cheap Allows for upside

Spending: Risky portfolio, 20-year spend-down, then deferred annuity $350,000 99% 95% 90% 75% Mean 50% 25% 10% Annual spneding based on $1 million initial investment 5% 1% (log scale) $61,824 $50,964 $35,000 0 5 10 15 20 25 30 35 40 Years after retirement

Wealth Path Risky portfolio, 20-year spend-down, then deferred annuity $1,600,000 $1,400,000 99% 95% 90% 75% Wealth before current-period spend $1,200,000 Mean 50% 25% 10% 5% 1% $1,000,000 $800,000 $600,000 $400,000 $200,000 $0 0 5 10 15 20 25 30 35 40 45 Years after retirement

Spending: Low-risk portfolio, 20-year spend-down, then deferred annuity $350,000 99% 95% 90% 75% Mean 50% 25% 10% $1 million initial investment Annual spneding based on 5% 1% $61,824 $50,964 $35,000 0 5 10 15 20 25 30 35 40 Years after retirement

Problems with annuities Default (counterparty) risk Insurance companies may not be hedged to risks in annuity book of business Long-term liability comes after all other payouts Illiquidity can t change your mind Lack of transparency High fees Adverse selection (Groucho)

Annuity solutions: Issuer A challenge to the industry Separate corporate structure with no bleed from other products/risks Treasury-only portfolio that is duration-hedged to the liability Standardized contracts with transparent pricing Fully participating, so surprises (+/ , mostly mortality risk) are credited/charged to participants and do not bankrupt issuer Large pools to minimize adverse selection

Annuity solutions: Investor Diversify buy 2 or 3 annuities Include foreign issuer? Still exposed to systemic risk, however Don t buy highest yield! Avoid complexity, buy pure longevity insurance (single premium, no period certain) Keep some money in reserve outside the annuities

Further issues Pension problem is in real economy Longer life spans Relatively short work lives (can be made longer) Relatively low real rates of return So you can t financially engineer your way out of it But let s do the best we can we re financial engineers and don t control the real economy Blend conventional investing with guaranteed (insurance) income products Think in terms of generating income as the reason for accumulating the DC assets in the first place (Merton)