County Budget Overview for FY 2019-2020

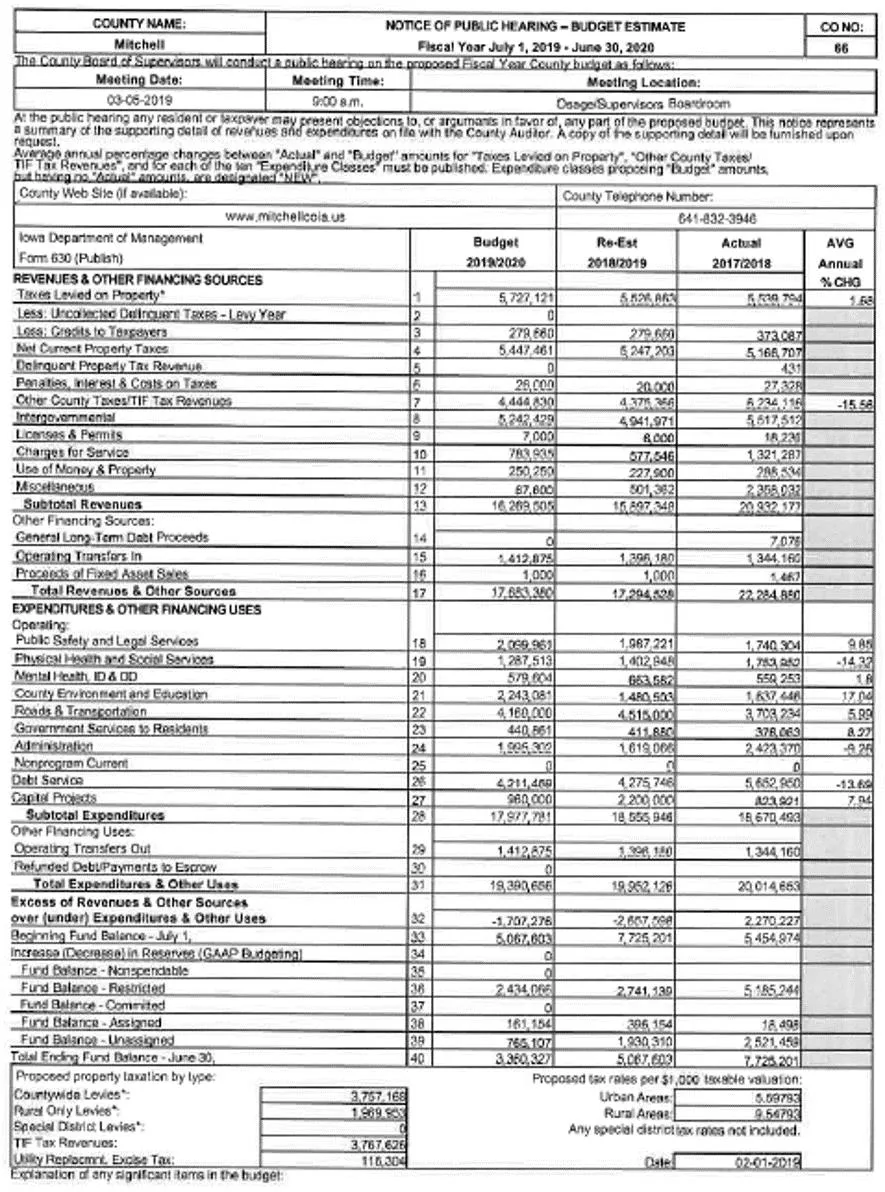

County budget for FY 2019-2020 includes details on the general funds, special revenue funds, capital projects, debt service, rural basic fund, and secondary roads fund. Key points include levy limits, fund allocations, increases in budget, and specific purposes for different funds.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

INCREASE IN BUDGET # 18-Inc of wages, health insurance & EMA contribution # 20-Inc. in reimbursement to Butler Co. for CSS Fund # 21-Inc. in conservation department due to Riverside Park Improvements # 22-Inc. in Secondary Roads Department # 23-Purchase of E Pollbooks for elections & other computer equipment

GENERAL FUNDS General Basic is at the levy limit of 3.50/thousand of taxable value. This levy is the same as last year. General Supplemental has no levy limit and is at 1.55100 for the new budget. This levy has an increase of .02782.

SPECIAL REVENUE FUNDS Special Revenue funds account for proceeds which are usually required by law or regulation to be accounted for in a separate fund and to be expended for specific purposes. Here is a list of what funds are considered special revenue: Mental health REAP Rural Basic TIF Sheriff R & B Co. Disposal Closure LOSST MCHHC Improve Secondary Roads Sheriff Asset Forfeiture Drug Enforcement Recorder Record Management Conservation Land Acquisition & HSA Fund

CAPITAL PROJECTS AND DEBT SERVICE Capital Projects fund is used in the acquisition or construction of major capital facilities and assets. 300,000 will go to remodel of County Services Building and Maintenance Garage. 660,000 will be used by the Secondary Roads Department for Roadway Construction. Debt Service: Debt Service fund is not going to be used this budget year.

RURAL BASIC FUND Rural Basic Fund is the operating fund for county services benefiting property not within incorporated areas of the county. The levy limit is 3.95/thousand of taxable value. Currently we have 5 sheriff deputies in the Rural Basic fund as well as Co. Disposal. This fund also gives property tax dollars to the Secondary Roads fund. The levy is the same as last year at the max rate of 3.95.

SECONDARY ROADS FUND Secondary Roads fund is used for the maintenance and repair of secondary roads, construction and maintenance of county bridges. Revenues from federal, state & county. Road Use Tax-Farm to Market-State. Transfers from General Basic and Rural Basic Funds are from property taxes. Transfers from General Basic are not to exceed the equivalent of a tax of 16 7/8/thousand of taxable value. This budget transfer will be: 133,262 Transfer from Rural Basic are not to exceed the equivalent of a tax of 3.375/thousand of taxable value. This budget transfer will be: 1,249,613

COUNTY SOCIAL SERVICES FUND The County Social Services fund or MH-DD fund which it was called previously is funded by taxes based on a levy determined by multiplying $ 35.18 by the most recently available population. For this budget the levy will be .54693 an decrease of .02782. Mitchell County is part of a 22 county social services region. Service coordination services is also included in this fund.

2018 VALUATIONS Valuations are set by the county assessor and the Dept. of Revenue. Valuation is the tax base to which the rate is applied and over which the levy is spread. Valuation X Rate (amount of tax per $1,000 of taxable value) = Taxes Levied-Dollars generated by the Tax Rates are set by local governments to generate the desired levy. The 2018 Valuation is 683,812,625 with Gas & Electric and 671,170,969 without Gas & Electric. This is an increase of 23,888,767 from the 2017 Valuation.

Rollbacks Rollback is applied to all classes of property: Ag-56.1324% Residential-56.9180%, Industrial and Commercial-90%. Railroads have a rollback also of 90%. A new class is Multi-Res.- 3 or more dwelling units (apartments, assisted living, mobile home parks) and that rollback is 75.0000%. Rollback for this class will continue to decrease by 3.75% until assessment year 2021. After that rollback will be equal to the residential rollback of that year. No backfill from the state to local governments for reduction of these revenues except commercial & industrial which is prorated. Rollbacks increased for Ag by 1.6844% and Res by 1.2971%.

TOTAL COUNTY LEVY The total county levy stayed the same as last year- 9.54793. Urban levy is 5.59793 same as last year. Property taxes levied: 5,727,121. From that figure we subtract 279,660 for the credits that the taxpayers receive. 5,727,121-279,660=5,447,461 is net tax rev.

Credits to Taxpayers Homestead and Military Credit is based on property value. Homestead Credit is 4,850 X levy. The state reimburses us 100% back for this credit. Military Credit is subtracted off the taxable value and then the levy is applied to the new value. State reimburses us about 20% of the cost of credits given. Ag & Family Farm is prorated by the state so we don t get 100% reimbursement.

Credits to Taxpayers Disabled Veteran Homestead Credit is given to disabled veterans with permanent & total disability ratings based on un-employability paid at the 100% disability rate. We currently have 27 taxpayers getting this credit which is applied against the entire amount of tax levied on the property. Business Property Tax Credit is given to taxpayers with properties that are classed commercial and industrial.

WIND TURBINES We have 136 wind turbines in 2 townships-Stacyville and Wayne. All turbines are assessed at 30% with a 90% rollback. They also receive a Business Property Tax Credit. This decreases the value. That value is used to make our debt payments for roads and the courthouse. The total value is 120,861,657.

Long Term Debt Payments Debt payments are made for roads, pre-treatment facility for VBC, and courthouse. Total principal and interest payments are-3,708,459. TIF Revenue, Special Assessment and LOST help make these payments. No revenue from property taxes are used to make our debt payments. TIF Revenue plus special assess. will be 3,708,459. Other debt are the 2 TIF Rebates for the Osage Co-op Elevator and Absolute Energy. Both are 10 year agreements.

What if we have no TIF? If we had no TIF, we would still have to make the debt payments. To make the payments we must use the debt service levy since we can t use any of the other levies we already have. If we take our valuation today we would raise our total county levy to 9.78536 instead of the 9.54793 which is our total levy in this budget. 880,514,567/3,708,459=.23743. This levy is in addition to the levies we already use. The wind turbine revenue is 2,481,000 and would not be able to make the debt payments.

Breakdown of Taxes Percentages are Based on the Abstract of Taxes for 2017 Payable in 2017-2018 County 24% Hospital Area School TIF Assessor County City School Other 730,224.46 562,401.27 4,831,354.07 224,156.20 5,526,748.17 2,163,399.11 8,284,866.50 354,744.84 Assessor 1% Hospital City 10% TIF 21% Area School TIF School 37% Assessor County City School Area School 2% Other Hospital 3% Other 2%

QUESTIONS ABOUT THE BUDGET Any questions???