WISCONSIN FARM TO SCHOOL

Wisconsin Farm to School (F2S) program promotes healthy eating habits in children by connecting schools with locally grown and produced products. The goals include improving children's health, enhancing knowledge about agriculture and nutrition, and supporting local economies. Community support is c

0 views • 27 slides

Understanding WISEdata Finance and WUFAR in Wisconsin School Finance Updates

Explore the WISEdata Finance system in Wisconsin, which involves vendors pulling the current Wisconsin Uniform Financial Accounting Requirements (WUFAR) chart of accounts from DPI, pushing data to the WDF, and more. Learn about the mindset shift needed for data submissions and the updates for fiscal

1 views • 43 slides

Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

Enhancing Domestic Revenue Mobilization in South Sudan: NRA Initiatives

The presentation by Hon. Athian Ding Athian, NRA Commissioner General, at the 1st National Economic Conference in South Sudan focused on the National Revenue Authority's mandate, strategic plan, revenue performance, and policy options for boosting non-oil revenue. The NRA aims to achieve a Tax-to-GD

1 views • 21 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

An Introduction to Cargo Revenue Management

\nIn the bustling world of air cargo, where efficiency and profitability are paramount, Cargo Revenue Management (CRM) emerges as a pivotal strategy for airlines and logistics companies. This intricate process involves the optimization of cargo space to maximize revenue, ensuring that every inch of

3 views • 5 slides

Revenue Management Systems (RMS) for Cargo

In the competitive and dynamic world of cargo transportation, optimizing revenue is crucial for the sustainability and growth of businesses. Revenue Management Systems (RMS) for cargo have emerged as vital tools in this endeavor, leveraging advanced technology to enhance profitability. This blog pro

1 views • 7 slides

Revenue Management for Air Cargo by Revenue Technology Services

Revenue management for air cargo is a crucial aspect of modern logistics, aimed at maximizing revenue through effective planning and strategic pricing. Revenue Technology Services (RTS) offers innovative cargo solutions designed to optimize the use of air cargo space, enhance operational efficiency,

1 views • 6 slides

Collaborative Planning in Cargo Revenue Management

In today's fast-paced and competitive logistics industry, effective cargo revenue management is crucial for maximizing profitability and ensuring operational efficiency. Revenue Technology Services (RTS) has been at the forefront of providing innovative solutions for the cargo industry, emphasizing

1 views • 6 slides

Compliance and Regulatory Considerations in Cargo Revenue Management

Cargo revenue management is an intricate balancing act that involves maximizing revenue while managing the capacity and pricing of cargo space. For companies like Revenue Technology Service (RTS), the key to successful cargo revenue management lies not only in optimizing these factors but also in en

1 views • 5 slides

Training and Development for Cargo Revenue Managers

In today's fast-paced and ever-evolving business environment, the role of a cargo revenue manager is more critical than ever. The field of cargo revenue management is a dynamic and complex area that requires professionals to stay updated with the latest industry trends, technologies, and strategies.

1 views • 6 slides

Advanced Analytics for Cargo Revenue Enhancement

In the fast-evolving world of logistics and transportation, optimizing revenue streams is crucial for maintaining competitive advantage. One of the most effective ways to achieve this is through advanced analytics. Leveraging sophisticated data analysis techniques, revenue technology services can tr

1 views • 5 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Virgin Islands Police Department Revenue Estimation Conference Highlights

The Virgin Islands Police Department held a revenue estimating conference on March 14, 2023, led by Commissioner Ray Martinez. The event discussed current fees for various services provided by the department, revenue generation and projections over fiscal years, annual revenues and projections, as w

1 views • 10 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

0 views • 21 slides

Understanding Community Housing Needs in Wisconsin

Explore the importance of housing in Wisconsin communities, how property tax plays a vital role, major assessment classes, and the comparison of data sources between the Wisconsin Department of Revenue and US Census. Learn about the housing market trends, including sales volume and price points of h

0 views • 26 slides

Understanding Dental and Vision Benefits for Wisconsin State Employees

Explore the dental and vision benefits available to Wisconsin State employees, including details on uniform dental benefits, coverage options, annual maximums, orthodontic services, and waiting periods. Learn about the two dental plans offered by EPIC in Wisconsin, coverage percentages for basic and

1 views • 28 slides

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through t

0 views • 14 slides

Exploring the History of the First People in Wisconsin

Discover the fascinating journey of the Paleo-Indians, the first people to inhabit North America, as they ventured into Wisconsin in pursuit of sustenance and established semi-nomadic lifestyles. Uncover how raw materials like copper, stone, wood, and bone anchored these communities in the region, l

0 views • 12 slides

ALA FY 2017 Financial Report Summary

ALA's FY 2017 financial report highlights total revenues, expenses, net operating revenue, revenue sources, general fund summary, and detailed revenue and expense breakdowns. Revenues amounted to $48,808,627 with net revenue of $314,944. Key revenue sources included dues, contributions, grants, and

1 views • 16 slides

Monitoring Wisconsin's Opioid Overdose Epidemic Through Ambulance Data

Utilizing Wisconsin's Ambulance Run Data System (WARDS), this initiative aims to enhance opioid overdose surveillance by analyzing nonfatal overdose data in real-time. By developing specific case definitions and identifying key variables of interest, the project seeks to improve the timeliness of mo

0 views • 25 slides

Audit Requirements and Compliance Guidelines for Wisconsin Educational Institutions

Explore the audit requirements and compliance guidelines applicable to educational institutions in Wisconsin, including special education fiscal auditing, Uniform Administrative Requirements, and risk-based program identification. Learn about the State Single Audit Guidelines, Wisconsin School Distr

1 views • 26 slides

Wisconsin Unemployment Insurance Overview

Wisconsin Unemployment Insurance (UI) program was established in 1932 as part of the Social Security Act. Paid for by state and federal payroll taxes, UI provides economic support to unemployed workers. Administered by the Department of Workforce Development, the program offers benefits based on a p

0 views • 43 slides

Wisconsin Attorney General Brad D. Schimel's Open Government Summit Overview

Explore the role of Wisconsin's Attorney General in promoting open government through public records law interpretation, formal opinions, and enforcement actions. Learn about the history of sunshine laws in Wisconsin and the responsibilities of the Public Records Board in managing state records.

1 views • 48 slides

Alisal Union School District 2021-2022 Budget Workshop Overview

The Alisal Union School District held a budget workshop to review revenue projections, expenditure projections, enrollment and staffing projections, additional federal and state funding, and supplemental and concentration expenditures. The workshop highlighted revenue sources, including local contro

2 views • 26 slides

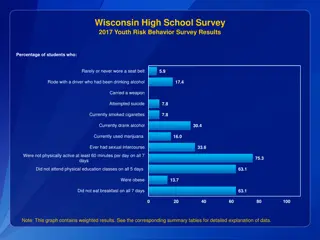

Wisconsin High School Survey 2017 Youth Risk Behavior Statistics

This report presents the results of the Wisconsin High School Survey 2017, focusing on various risky behaviors among students. The data includes percentages and numbers of students who engaged in behaviors such as not wearing a seat belt, riding with a driver who had been drinking, carrying weapons,

0 views • 4 slides

Understanding Wisconsin's Concealed Carry Law: Don't Shoot Yourself in the Foot

Explore the key aspects of Wisconsin's Concealed Carry Law, including permits, prohibited venues, rights of individuals, and considerations for employers and business owners. Learn about the requirements, restrictions, and implications of carrying concealed weapons in Wisconsin to ensure compliance

0 views • 17 slides

Understanding Wisconsin's New School Report Card System

Wisconsin has implemented a new accountability system to enhance understanding of school performance. The system uses a new scale aligned with national standards to compare schools across the country. This shift aims to provide a more accurate assessment of student achievement, aligning Wisconsin wi

0 views • 16 slides

Wisconsin National Guard Foundation, Inc.: Supporting Wisconsin National Guard Families

Wisconsin National Guard Foundation, Inc. is a charitable foundation established in 2021 to provide scholarships, grants, and professional development opportunities for Wisconsin National Guard families. The foundation aims to increase public awareness of the vital role played by the Wisconsin Natio

1 views • 7 slides

Understanding Revenue Limits and Calculation Process in School Financial Management

This educational material covers topics such as revenue limits, the components within revenue limits, what falls outside of the revenue limit, and a four-step process for revenue limit calculation in the context of school financial management. It includes detailed information on the regulation of re

0 views • 34 slides

Wisconsin Public Health Statutes Overview

Explore Wisconsin's public health history, statutes, and administrative rules, including the formation of the State Board of Health, consolidation of public health statutes in 1993, and the statutory duties of local boards of health. Learn about the chapters covering administration, communicable dis

0 views • 16 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Analysis of State Budget Trends by John Gilbert - Nov. 1, 2020

This comprehensive analysis by John Gilbert, a Budget and Revenue Analyst, delves into the multiyear trend of state budget outlook, general revenue fund trends, sources, growth, and projections. The analysis includes comparisons between revenue and expenditures, trend-based revenue projections, grow

0 views • 5 slides

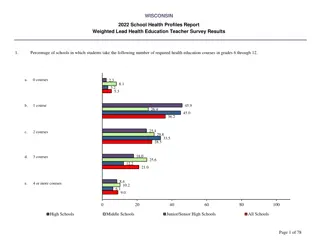

Wisconsin 2022 School Health Profiles Report

The Wisconsin 2022 School Health Profiles Report presents survey results on the percentage of schools requiring health education courses, the distribution of required courses by grade, materials provided to health education teachers, and skills addressed in the health education curriculum. The data

0 views • 78 slides

Enhancing Healthcare Emergency Preparedness and Response in Wisconsin

The Wisconsin Hospital Emergency Preparedness Program (WHEPP) focuses on supporting hospitals in planning and responding to mass casualty incidents and pandemics. It emphasizes the importance of healthcare coalitions, tier coordination, and disaster medical coordination centers. The program, funded

0 views • 30 slides

Land Use Case Law Update - Key Rulings and Facts of Murr v. Wisconsin

Key rulings and facts from the Murr v. Wisconsin case, including discussions on the Lot Combination Rule in Wisconsin, the property ownership by the Murrs along the St. Croix River, and the regulatory background leading to the case. Important points such as the unit of measurement in takings and its

0 views • 133 slides

Civil Rights Training for School Nutrition Professionals in Wisconsin

This comprehensive civil rights training program by the Wisconsin Department of Public Instruction is essential for school nutrition professionals to understand and comply with federal laws prohibiting discrimination based on protected classes. The training covers the importance of notifying the pub

0 views • 47 slides

Understanding Wispact Special Needs Trusts in Wisconsin

Wispact is dedicated to improving the lives of individuals with disabilities in Wisconsin through the management of special needs trusts. These trusts provide more opportunities and a better quality of life by preserving resources while maintaining eligibility for means-tested public benefits. Eligi

0 views • 22 slides

Wisconsin Forestry Budget Updates and Revenue Discussion

Updates and discussions on the forestry budget in Wisconsin, including revenue sources such as nurseries, timber sales, recreation, and GPR. The Division of Forestry collaborates to protect and sustainably manage the state's forests.

0 views • 9 slides

Overview of Exchequer Returns for End-Q1 2023

The Exchequer Returns for End-Q1 2023, as reported by John McCarthy, Chief Economist of the Department of Finance, indicate a year-on-year increase in total revenue, driven by growth in tax revenue. However, non-tax revenue decreased significantly. Expenditure also saw a notable rise, particularly i

0 views • 12 slides