Understanding Deductions in Personal Finance

In Lesson 2 of "Deductions: What You See Is Not What You Get," the content delves into concepts central to financial literacy. Covering topics like gross and net income, types of deductions, compound interest for retirement planning, and the workings of insurance (including health insurance), this l

1 views • 24 slides

IP Global - IT Solutions & Managed Services Provider Profile

IP Global is an IT solutions and managed services provider established in Poland in 2016, with a global presence covering 190 countries. They offer a wide range of services including network, system, and storage solutions, managed IT services, IT support, and 24/7/365 NOC/SOC high alert. With region

1 views • 17 slides

Understanding Amendment in Section 43B for MSME Presented by CA Naman Maloo

The recent amendment in Section 43B of the Income Tax Act introduces a new clause (h) focusing on payments to Micro and Small Enterprises (MSMEs). Payments to MSMEs must adhere to the time limits prescribed in the MSMED Act of 2006 for deductions to be allowed. This change emphasizes timely payments

0 views • 29 slides

Building Linux Boot Files with Templates for Multiple SoC Projects

Explore the intricacies of building Linux boot files using templates for various System on Chip (SoC) projects. Learn about Petalinux, Yocto, and the composition of Yocto recipes. Discover the advantages of decoupled layers in a typical Petalinux project and set goals to create your own Yocto layer.

7 views • 28 slides

Cách chăm sóc vết mổ đúng cách để mau lành

V\u1ebft m\u1ed5 sau sinh c\u1ea7n \u0111\u01b0\u1ee3c ch\u0103m s\u00f3c \u0111\u00fang c\u00e1ch \u0111\u1ec3 mau ch\u00f3ng li\u1ec1n s\u1eb9o. M\u1eb9 n\u00ean l\u00e0m g\u00ec \u0111\u1ec3 v\u1ebft m\u1ed5 sau sinh mau l\u00e0nh, kh\u00f4ng \u0111\u1ec3 l\u1ea1i s\u1eb9o l\u00e0 b\u0103n kho\u0

3 views • 3 slides

Automotive LiDAR System-on-Chip Market Stats from 2024-2033

The automotive LiDAR system-on-chip (SoC) market is expected to be valued at $29.3 million in 2024, which is anticipated to grow at a CAGR of 24.30% and reach $207.5 million by 2033.

5 views • 3 slides

Improvements for Energy Storage State of Charge Awareness

Updates made to NPRR1186 prior to the RTC+B project aim at enhancing awareness, accounting, and monitoring of Energy Storage Resources (ESRs). ERCOT reviewed and revised constraints related to Ancillary Service awards for ESRs, considering different scenarios. Changes were also implemented to addres

0 views • 35 slides

The Role of the Indian Government in Lowering Tax Deductions for NRIs

The Indian government assumes a crucial role in enabling reduced tax deductions for Non-Resident Indians (NRIs). By implementing diverse policies and initiatives, it strives to entice investments from NRIs while ensuring equitable taxation. These endeavors encompass tax treaties, specific provisions

0 views • 11 slides

Review 5 spa chăm sóc da mặt tốt nhất cho bà bầu

G\u1ee3i \u00fd nh\u1eefng spa ch\u0103m s\u00f3c da m\u1eb7t cho b\u00e0 b\u1ea7u uy t\u00edn, ch\u1ea5t l\u01b0\u1ee3ng cao \u0111\u01b0\u1ee3c nhi\u1ec1u kh\u00e1ch h\u00e0ng tin ch\u1ecdn.

0 views • 3 slides

Mách nhỏ bà bầu cách chăm sóc da mụn khi mang thai

Khi mang thai, vi\u1ec7c ch\u0103m s\u00f3c, l\u00e0m \u0111\u1eb9p da c\u1ee7a m\u1eb9 b\u1ea7u c\u1ea7n l\u01b0u \u00fd c\u1ea9n tr\u1ecdng h\u01a1n \u0111\u1ec3 tr\u00e1nh \u1ea3nh h\u01b0\u1edfng \u0111\u1ebfn thai k\u1ef3. V\u1eady ch\u0103m s\u00f3c da m\u1ee5n khi mang thai m\u1eb9 c\u1ea7n l

0 views • 3 slides

Chăm sóc sản phụ sau đẻ thường cần chú ý những gì

Sau khi sinh con, c\u01a1 th\u1ec3 ng\u01b0\u1eddi ph\u1ee5 n\u1eef s\u1ebd tr\u1edf n\u00ean y\u1ebfu \u1edbt n\u00ean c\u1ea7n ngh\u1ec9 ng\u01a1i nhi\u1ec1u h\u01a1n. D\u01b0\u1edbi \u0111\u00e2y l\u00e0 6 l\u01b0u \u00fd sau sinh th\u01b0\u1eddng m\u1eb9 n\u00ean nh\u1edb \u0111\u1ec3 ph\u1ee5c

0 views • 4 slides

Chăm sóc bà bầu sau thụ tinh nhân tạo như thế nào

Ch\u0103m s\u00f3c sau chuy\u1ec3n ph\u00f4i l\u00e0 nh\u1eefng c\u00e1ch ch\u0103m s\u00f3c m\u1eb9 b\u1ea7u sau khi th\u1ef1c hi\u1ec7n th\u1ee7 thu\u1eadt quan tr\u1ecdng, gi\u00fap t\u0103ng t\u1ef7 l\u1ec7 th\u1ee5 thai th\u00e0nh c\u00f4ng.

0 views • 3 slides

Solving Money Problems with Arithmetic

This chapter focuses on applied arithmetic concepts such as calculating mark-up, margin, compound interest, income tax, and net pay. It covers topics like percentages, income, deductions, and income tax rates in Ireland. Detailed examples on calculating tax payable, deductions, and net pay are provi

0 views • 12 slides

Understanding State of Charge Prediction in Lithium-ion Batteries

Explore the significance of State of Charge (SOC) prediction in lithium-ion batteries, focusing on battery degradation models, voltage characteristics, accurate SOC estimation, SOC prediction methodologies, and testing equipment like Digatron Lithium Cell Tester. The content delves into SOC manageme

0 views • 32 slides

Understanding Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

0 views • 20 slides

Enhancing FPGA/SoC Projects with Gitlab CI: A Comprehensive Overview

Exploring the significance of Continuous Integration (CI) in FPGA/SoC projects, this presentation delves into the basics of Gitlab CI, defining CI jobs, the benefits of CI practices, project objectives, and the future plans for supporting over 100 users. The focus is on creating a scalable, VM-based

0 views • 13 slides

Understanding Payslips and Overtime Calculations

Explore the world of payslips and overtime calculations with examples involving basic pay, overtime rates, gross pay, and net pay. Follow along as we calculate earnings for different scenarios like Joe the worker, Mark the joiner, Louise the admin assistant, and Zoe the nursery nurse. Understand how

0 views • 11 slides

Overview of Occupational Requirements Survey (ORS) and 2020 Estimates

The Occupational Requirements Survey (ORS) by the Bureau of Labor Statistics provides detailed insights into the occupational demands of various job roles, including physical, cognitive, and environmental requirements. The survey encompasses data on speaking requirements, weight lifting capabilities

0 views • 22 slides

Arizona Health Care Cost Updates Effective 04/01/2018

In these updates shared by Tara Lockner, the Deputy Assistant Director at the Programs Division of Member Services, changes regarding Share of Cost (SOC) deductions in medical expenses are highlighted. The proposed modifications will now allow SOC deductions for medical services that would have been

1 views • 6 slides

Understanding Income Tax Issues in the Ratemaking Process

This content explores various aspects related to income tax issues in the ratemaking process, including Accumulated Deferred Income Taxes (ADIT), Net Operating Losses (NOLs), Tax Normalization, Repair Deductions, and more. It provides insights on how ADIT is calculated, the significance of NOLs, dif

0 views • 24 slides

CM2BET Singapore Your Ultimate Guide to SG Pools Soccer Odds and Fixtures

At CM2BET, we understand the pulse of soccer betting and strive to offer a comprehensive platform that caters to all your betting needs. Our focus is on delivering accurate, real-time data about SG Pools soccer odds and the latest Singapore Pools soc

1 views • 3 slides

Enhancing Student Success through SoC Internship Program

School of Communication (SoC) provides personalized support to students, helping them navigate through advising, internships, and academic coursework. The SoC Internship Program offers valuable experience for students in various majors, preparing them for successful careers post-graduation. Through

0 views • 18 slides

Altera Tools & Basic Digital Logic Lab Prep Activities

In preparation for the lab, tasks include registering on the Altera website, ordering required boards, installing software, familiarizing with DE0-Nano-SOC board, exploring digital logic concepts, and practicing Verilog circuits like half adder, full adder, D Flip Flop. The activities involve downlo

0 views • 13 slides

Understanding System on Chip (SoC) Design and Components

Explore the world of System on Chip (SoC) design, components, and working flow. Learn about Intellectual Properties (IP), platform-based design, typical design flows, top-down design approach, and the emerging Electronic System Level (ESL) design flow. Discover the essential components of an SoC, su

0 views • 45 slides

Understanding Guardianship Fees and Participation Under Medicaid

This session delves into how DSHS utilizes Medicaid State Plan and Home & Community-Based Waiver rules for deductions related to guardianship fees. Topics covered include personal needs allowance arrangements, cost of care rules, participation distinctions, and specific guidelines for deductions. A

0 views • 67 slides

Advanced Controls and Systems Development in Accelerator Technology

Explore the cutting-edge technologies and extensive experience in system development within the Accelerator Control Division at BARC. The workshop covers a range of topics including SoC-FPGA system architecture, GUI development for RF control, EPICS application development, and lessons learned in im

0 views • 15 slides

Unified Approach for Performance Evaluation and Debug of System on Chip in Early Design Phase

This presentation discusses the challenges related to system-on-chip design, focusing on bandwidth issues, interconnect design, and DDR efficiency tuning. It explores the evolution of performance evaluation methods and the limitations of existing solutions. The need for a unified approach for early-

0 views • 28 slides

Comparing Before-Tax and After-Tax Deductions in Paychecks

Exploring the differences between before-tax and after-tax deductions in January and February paychecks, highlighting deductions with double premium amounts. Visual comparisons and analysis help understand the financial impact on income.

0 views • 10 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Basic Educational Series on Income Tax: Salaries and Income from House Property

This educational series covers the essentials of income tax related to salaries and income from house property. It delves into topics like charging sections, definitions, deductions, and responsibilities in employer-employee relationships. The content explains the basis of charge, annual value, admi

0 views • 43 slides

Cách chăm sóc phụ nữ mang thai IVF 3 tháng đầu

Th\u1ee5 thai th\u00e0nh c\u00f4ng trong \u1ed1ng nghi\u1ec7m IVF l\u00e0 m\u1ed9t qu\u00e1 tr\u00ecnh d\u00e0i, trong \u0111\u00f3, vi\u1ec7c ch\u0103m s\u00f3c thai IVF \u0111\u00f3ng vai tr\u00f2 quan tr\u1ecdng gi\u00fap m\u1eb9 sinh n\u1edf an t

0 views • 3 slides

Understanding Gross Receipts Taxation for Health Care Practitioners in New Mexico

New Mexico imposes gross receipts tax on individuals and businesses conducting business in the state. This presentation discusses the basic principles of the tax, exemptions for non-profits, and deductions available for health care practitioners. It outlines the specific deductions under Sections 7-

0 views • 10 slides

Money Management in Applied Arithmetic

This chapter focuses on practical applications of arithmetic related to money, including solving problems involving mark-up, margin, compound interest, income tax, and net pay calculations. Topics covered include percentages, income and deductions, income tax rates, and example scenarios to calculat

0 views • 12 slides

Physical Education Grading Policy and Procedures at CDHS

Physical Education at CDHS follows a detailed grading policy where each class is worth 10 points. Points are earned based on participation, effort, behavior, and adherence to rules. Deductions can occur for violations such as tardiness, inappropriate behavior, lack of participation, and disrespect o

0 views • 22 slides

Update on Real-Time Co-optimization Plus Batteries Task Force (RTCBTF)

The Real-Time Co-optimization Plus Batteries Task Force (RTCBTF) is progressing with meetings dedicated to RTC-SOC board approval of NPRR for RTC-SOC by December. The update covers the timeline, meeting discussions, and future topics to be addressed related to energy storage resources, market trials

0 views • 4 slides

Understanding IRC 280E in the Cannabis Industry

Explore the implications of IRC 280E on cannabis businesses, highlighting tax practitioner considerations, deductions limitations, and the history behind the enactment of this tax code. Learn about the impact of federal and state laws on deductions for businesses involved in the sale of controlled s

0 views • 19 slides

Aerobic Gymnastics Competition Guidelines and Rules

The guidelines for aerobic gymnastics competitions include compulsory elements, categories, competition spaces, deductions, and specific rules for different age groups. The competitions have specific parameters for elements allowed, lifting, floor elements, music length, maximum difficulty elements,

0 views • 17 slides

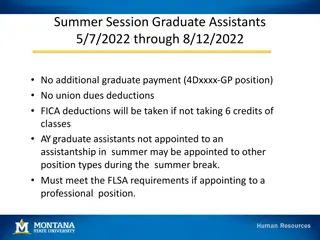

Guidelines for Summer Session Graduate Assistants 2022

Detailed guidelines for Summer Session Graduate Assistants from May 7, 2022, to August 12, 2022, regarding payment, deductions, appointment types, payroll dates, and EPAF instructions for teaching and research positions. The document also covers information on student workers during the summer sessi

0 views • 5 slides

Efficient Design Strategies for Minimizing Test Application Time in SoC

This paper discusses innovative design approaches to minimize test application time (TAT) in System-on-Chip (SoC) testing. It addresses challenges in incorporating hardware and power constraints into SoC test scheduling, focusing on test access mechanism (TAM) design and test scheduling strategies.

0 views • 23 slides

Understanding Work-from-Home Expense Deductions for Employees in the 2022-23 Financial Year

Explore the revised fixed cost method and actual cost method for claiming work-from-home expenses as a typical employee in the 2022-23 financial year. Learn about eligibility criteria, claimable expenses, calculation methods, necessary records to keep, and more. Take advantage of deductions while fu

0 views • 14 slides