Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

Enhancing Domestic Revenue Mobilization in South Sudan: NRA Initiatives

The presentation by Hon. Athian Ding Athian, NRA Commissioner General, at the 1st National Economic Conference in South Sudan focused on the National Revenue Authority's mandate, strategic plan, revenue performance, and policy options for boosting non-oil revenue. The NRA aims to achieve a Tax-to-GD

1 views • 21 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

1 views • 7 slides

An Introduction to Cargo Revenue Management

\nIn the bustling world of air cargo, where efficiency and profitability are paramount, Cargo Revenue Management (CRM) emerges as a pivotal strategy for airlines and logistics companies. This intricate process involves the optimization of cargo space to maximize revenue, ensuring that every inch of

3 views • 5 slides

Revenue Management Systems (RMS) for Cargo

In the competitive and dynamic world of cargo transportation, optimizing revenue is crucial for the sustainability and growth of businesses. Revenue Management Systems (RMS) for cargo have emerged as vital tools in this endeavor, leveraging advanced technology to enhance profitability. This blog pro

1 views • 7 slides

Revenue Management for Air Cargo by Revenue Technology Services

Revenue management for air cargo is a crucial aspect of modern logistics, aimed at maximizing revenue through effective planning and strategic pricing. Revenue Technology Services (RTS) offers innovative cargo solutions designed to optimize the use of air cargo space, enhance operational efficiency,

2 views • 6 slides

Collaborative Planning in Cargo Revenue Management

In today's fast-paced and competitive logistics industry, effective cargo revenue management is crucial for maximizing profitability and ensuring operational efficiency. Revenue Technology Services (RTS) has been at the forefront of providing innovative solutions for the cargo industry, emphasizing

1 views • 6 slides

Compliance and Regulatory Considerations in Cargo Revenue Management

Cargo revenue management is an intricate balancing act that involves maximizing revenue while managing the capacity and pricing of cargo space. For companies like Revenue Technology Service (RTS), the key to successful cargo revenue management lies not only in optimizing these factors but also in en

2 views • 5 slides

Training and Development for Cargo Revenue Managers

In today's fast-paced and ever-evolving business environment, the role of a cargo revenue manager is more critical than ever. The field of cargo revenue management is a dynamic and complex area that requires professionals to stay updated with the latest industry trends, technologies, and strategies.

2 views • 6 slides

Advanced Analytics for Cargo Revenue Enhancement

In the fast-evolving world of logistics and transportation, optimizing revenue streams is crucial for maintaining competitive advantage. One of the most effective ways to achieve this is through advanced analytics. Leveraging sophisticated data analysis techniques, revenue technology services can tr

2 views • 5 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Virgin Islands Police Department Revenue Estimation Conference Highlights

The Virgin Islands Police Department held a revenue estimating conference on March 14, 2023, led by Commissioner Ray Martinez. The event discussed current fees for various services provided by the department, revenue generation and projections over fiscal years, annual revenues and projections, as w

2 views • 10 slides

Understanding Analysis of Variance (ANOVA) for Testing Multiple Group Differences

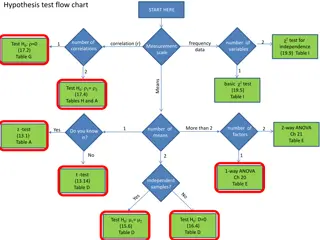

Testing for differences among three or more groups can be effectively done using Analysis of Variance (ANOVA). By focusing on variance between means, ANOVA allows for comparison of multiple groups while avoiding issues of dependence and multiple comparisons. Sir Ronald Fisher's ANOVA method provides

0 views • 28 slides

Biometrical Techniques in Animal Breeding: Analysis of Variance in Completely Randomized Design

Biometrical techniques in animal breeding involve the use of analysis of variance (ANOVA) to partition total variance into different components attributable to various factors. In completely randomized designs, experimental units are randomly assigned to treatments, ensuring homogeneity. The total n

1 views • 34 slides

Analysis of Variance in Completely Randomized Design

This content covers the analysis of variance in a completely randomized design, focusing on comparing more than two groups with numeric responses. It explains the statistical methods used to compare groups in controlled experiments and observational studies. The content includes information on 1-way

0 views • 48 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

1 views • 21 slides

Understanding Variance and Its Components in Population Studies

Variance and its components play a crucial role in analyzing the distribution of quantitative traits in populations. By measuring the degree of variation through statistical methods like Measures of Dispersion, researchers can gain insights into the scatterness of values around the mean. Partitionin

1 views • 22 slides

Understanding Bias and Variance in Machine Learning Models

Explore the concepts of overfitting, underfitting, bias, and variance in machine learning through visualizations and explanations by Geoff Hulten. Learn how bias error and variance error impact model performance, with tips on finding the right balance for optimal results.

0 views • 22 slides

Understanding Measures of Variability: Variance and Standard Deviation

This lesson covers the concepts of variance and standard deviation as measures of variability in a data set. It explains how deviations from the mean are used to calculate variance, and how standard deviation, as the square root of variance, measures the average distance from the mean. Degree of fre

2 views • 26 slides

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through t

0 views • 14 slides

Revenue synergy

,\n\nI'm excited to introduce Revenue Synergy's exceptional revenue cycle management and medical billing services. As the top medical billing company in the US, we offer innovative solutions that optimize your revenue cycle and enhance financial performance. Our team ensures precise billing, minimiz

0 views • 5 slides

Understanding Analysis of Variance (ANOVA) in Animal Genetics & Breeding

ANOVA is a statistical method that partitions the total variance into components attributable to different factors in animal genetics and breeding. This lecture covers the concept of ANOVA, its types, application in Completely Randomized Design, calculations of Sum of Squares, and Mean Squares. It e

0 views • 36 slides

Costing and Variance Analysis in Manufacturing Processes

The content discusses various scenarios related to costing and variance analysis in manufacturing processes. It addresses topics such as direct materials usage variance, direct labor mix and yield variances, total direct labor efficiency variance, and standard costing system variances. The examples

2 views • 8 slides

ALA FY 2017 Financial Report Summary

ALA's FY 2017 financial report highlights total revenues, expenses, net operating revenue, revenue sources, general fund summary, and detailed revenue and expense breakdowns. Revenues amounted to $48,808,627 with net revenue of $314,944. Key revenue sources included dues, contributions, grants, and

1 views • 16 slides

Noida Power Company Limited True-up and ARR Summary for FY 2021-22

The document presents the true-up and annual revenue requirement (ARR) details for Noida Power Company Limited for the fiscal year 2021-22. It includes components of ARR, variance analysis, revenue surplus details, expenses breakdown, and other financial aspects. The report highlights deviations, re

0 views • 44 slides

Alisal Union School District 2021-2022 Budget Workshop Overview

The Alisal Union School District held a budget workshop to review revenue projections, expenditure projections, enrollment and staffing projections, additional federal and state funding, and supplemental and concentration expenditures. The workshop highlighted revenue sources, including local contro

2 views • 26 slides

Analysis of Variance in Women's Professional Bowling Association - 2009

This study conducted a 2-Way Mixed Analysis of Variance on the Women's Professional Bowling Association qualifying rounds in 2009 at Alan Park, Michigan. The analysis focused on factors including oil pattern variations and different bowlers, each rolling sets of games on different patterns to measur

0 views • 16 slides

Variance Reduction Techniques in Monte Carlo Programs

Understanding variance reduction techniques in Monte Carlo simulations is essential for improving program efficiency. Techniques like biasing, absorption weighting, splitting, and forced collision help reduce variance and enhance simulation accuracy. By adjusting particle weights and distributions,

0 views • 37 slides

Statistics: Understanding Variance and Standard Deviation

Understand the concepts of population variance, sample variance, and standard deviation. Learn how to calculate these measures for sample and grouped data, and their significance in analyzing data dispersion. Discover the differences between population and sample variance, and when to use each measu

0 views • 11 slides

Understanding Revenue Limits and Calculation Process in School Financial Management

This educational material covers topics such as revenue limits, the components within revenue limits, what falls outside of the revenue limit, and a four-step process for revenue limit calculation in the context of school financial management. It includes detailed information on the regulation of re

1 views • 34 slides

Understanding Variance and Covariance in Probabilistic System Analysis

Variance and covariance play crucial roles in probabilistic system analysis. Variance measures the variability in a probability distribution, while covariance describes the relationship between two random variables. This lecture by Dr. Erwin Sitompul at President University delves into these concept

1 views • 30 slides

Understanding Revenue Requirements for Non-program Food Sales

Non-program food revenue plays a crucial role in school food service operations. Schools need to ensure that the revenue from non-program food sales meets a specified proportion to cover costs effectively. Failure to comply may result in corrective action during reviews by the state agency. To meet

0 views • 9 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Analysis of State Budget Trends by John Gilbert - Nov. 1, 2020

This comprehensive analysis by John Gilbert, a Budget and Revenue Analyst, delves into the multiyear trend of state budget outlook, general revenue fund trends, sources, growth, and projections. The analysis includes comparisons between revenue and expenditures, trend-based revenue projections, grow

1 views • 5 slides

Understanding One Factor Analysis of Variance (ANOVA)

One Factor Analysis of Variance (ANOVA) is a statistical method used to compare means of three or more groups. This method involves defining factors, measuring responses, examining assumptions, utilizing the F-distribution, and formulating hypothesis tests. ANOVA requires that populations are normal

0 views • 23 slides

Approaches to Variance Estimation in Social Policy Research

This lecture discusses approaches to estimating sampling variance and confidence intervals in social policy research, covering topics such as total survey error, determinants of sampling variance, analytical approaches, replication-based approaches, and the ultimate cluster method. Various methods a

1 views • 34 slides

Understanding Bias and Variance in Machine Learning

Exploring the concepts of bias and variance in machine learning through informative visuals and explanations. Discover how model space, restricting models, and the impact of bias and variance affect the performance of machine learning algorithms. Formalize bias and variance using mean squared error

0 views • 21 slides

Teaching Budgets and Variance Analysis in Business Qualifications

Explore resources and activities like "this.webinar.20.mins" and "Dont Tell the Bride" that introduce the concepts of budgets and variance analysis in business education. Engage in activities like "Calculate the total profit variance" to practice analyzing budgeted versus actual profits. Find more r

0 views • 10 slides

The Economics and Politics of Foreign Aid and Domestic Revenue Mobilization

This study explores the relationship between foreign aid, taxation, and domestic revenue mobilization, highlighting the impact of aid on tax/GDP ratios and the constraints faced in revenue systems. It discusses how aid influences policy choices, accountability, and bureaucratic costs, impacting reve

0 views • 25 slides

Understanding Revenue Recognition Guidelines under LKAS 18

LKAS 18 provides guidelines on how to recognize revenue from various sources like sale of goods, rendering services, interest, royalties, and dividends. Revenue recognition is based on specific conditions being met, such as transfer of risks and rewards of ownership, reliable measurement of revenue,

0 views • 26 slides