Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

Enhancing Domestic Revenue Mobilization in South Sudan: NRA Initiatives

The presentation by Hon. Athian Ding Athian, NRA Commissioner General, at the 1st National Economic Conference in South Sudan focused on the National Revenue Authority's mandate, strategic plan, revenue performance, and policy options for boosting non-oil revenue. The NRA aims to achieve a Tax-to-GD

1 views • 21 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

An Introduction to Cargo Revenue Management

\nIn the bustling world of air cargo, where efficiency and profitability are paramount, Cargo Revenue Management (CRM) emerges as a pivotal strategy for airlines and logistics companies. This intricate process involves the optimization of cargo space to maximize revenue, ensuring that every inch of

3 views • 5 slides

Revenue Management Systems (RMS) for Cargo

In the competitive and dynamic world of cargo transportation, optimizing revenue is crucial for the sustainability and growth of businesses. Revenue Management Systems (RMS) for cargo have emerged as vital tools in this endeavor, leveraging advanced technology to enhance profitability. This blog pro

1 views • 7 slides

Revenue Management for Air Cargo by Revenue Technology Services

Revenue management for air cargo is a crucial aspect of modern logistics, aimed at maximizing revenue through effective planning and strategic pricing. Revenue Technology Services (RTS) offers innovative cargo solutions designed to optimize the use of air cargo space, enhance operational efficiency,

1 views • 6 slides

Collaborative Planning in Cargo Revenue Management

In today's fast-paced and competitive logistics industry, effective cargo revenue management is crucial for maximizing profitability and ensuring operational efficiency. Revenue Technology Services (RTS) has been at the forefront of providing innovative solutions for the cargo industry, emphasizing

1 views • 6 slides

Compliance and Regulatory Considerations in Cargo Revenue Management

Cargo revenue management is an intricate balancing act that involves maximizing revenue while managing the capacity and pricing of cargo space. For companies like Revenue Technology Service (RTS), the key to successful cargo revenue management lies not only in optimizing these factors but also in en

1 views • 5 slides

Training and Development for Cargo Revenue Managers

In today's fast-paced and ever-evolving business environment, the role of a cargo revenue manager is more critical than ever. The field of cargo revenue management is a dynamic and complex area that requires professionals to stay updated with the latest industry trends, technologies, and strategies.

1 views • 6 slides

Advanced Analytics for Cargo Revenue Enhancement

In the fast-evolving world of logistics and transportation, optimizing revenue streams is crucial for maintaining competitive advantage. One of the most effective ways to achieve this is through advanced analytics. Leveraging sophisticated data analysis techniques, revenue technology services can tr

1 views • 5 slides

Overview of Army Modeling and Simulation Office

The U.S. Army Modeling and Simulation Office (AMSO) serves as the lead activity in developing strategy and policy for the Army Modeling and Simulation Enterprise. It focuses on effective governance, resource management, coordination across various community areas, and training the Army Analysis, Mod

1 views • 8 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

Capacity Zone Modeling for Forward Capacity Auction 17 Results

This presentation unveils the Capacity Zone modeling calculations for Forward Capacity Auction 17 associated with the 2026-2027 Capacity Commitment Period by ISO-NE PUBLIC. It delves into boundary definitions, import-constrained zone modeling, and market rules guiding the assessments and modeling pr

0 views • 16 slides

Distribution Feeder Modeling and Analysis Overview

This document delves into the modeling, optimization, and simulation of power distribution systems, specifically focusing on Distribution Feeder Modeling and Analysis. It covers the components of a typical distribution feeder, series components, Wye-Connected Voltage Regulator modeling, and equation

0 views • 14 slides

Virgin Islands Police Department Revenue Estimation Conference Highlights

The Virgin Islands Police Department held a revenue estimating conference on March 14, 2023, led by Commissioner Ray Martinez. The event discussed current fees for various services provided by the department, revenue generation and projections over fiscal years, annual revenues and projections, as w

1 views • 10 slides

Understanding Data Modeling vs Object Modeling

Data modeling involves exploring data-oriented structures, identifying entity types, and assigning attributes similar to class modeling in object-oriented development. Object models should not be solely based on existing data schemas due to impedance mismatches between object and relational paradigm

0 views • 17 slides

Evolution of Modeling Methodologies in Telecommunication Standards

Workshop on joint efforts between IEEE 802 and ITU-T Study Group 15 focused on information modeling, data modeling, and system control in the realm of transport systems and equipment. The mandate covers technology architecture, function management, and modeling methodologies like UML to YANG generat

1 views • 16 slides

Understanding Geometric Modeling in CAD

Geometric modeling in computer-aided design (CAD) is crucially done in three key ways: wireframe modeling, surface modeling, and solid modeling. Wireframe modeling represents objects by their edges, whereas surface modeling uses surfaces, vertices, and edges to construct components like a box. Each

1 views • 37 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

0 views • 21 slides

Mathematical Modeling and Error Analysis in Engineering

Mathematical modeling plays a crucial role in solving engineering problems efficiently. Numerical methods are powerful tools essential for problem-solving and learning. This chapter explores the importance of studying numerical methods, the concept of mathematical modeling, and the evaluation proces

0 views • 10 slides

Introduction to Dynamic Structural Equation Modeling for Intensive Longitudinal Data

Dynamic Structural Equation Modeling (DSEM) is a powerful analytical tool used to analyze intensive longitudinal data, combining multilevel modeling, time series modeling, structural equation modeling, and time-varying effects modeling. By modeling correlations and changes over time at both individu

0 views • 22 slides

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through t

0 views • 14 slides

System Modeling and Simulation Overview

This content provides insights into CPSC 531: System Modeling and Simulation course, covering topics such as performance evaluation, simulation modeling, and terminology in system modeling. It emphasizes the importance of developing simulation programs, advantages of simulation, and key concepts lik

0 views • 28 slides

Revenue synergy

,\n\nI'm excited to introduce Revenue Synergy's exceptional revenue cycle management and medical billing services. As the top medical billing company in the US, we offer innovative solutions that optimize your revenue cycle and enhance financial performance. Our team ensures precise billing, minimiz

0 views • 5 slides

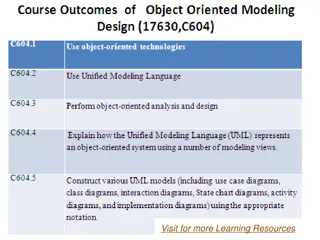

Understanding Object Modeling in Software Development

Object modeling is a crucial concept in software development, capturing the static structure of a system by depicting objects, their relationships, attributes, and operations. This modeling method aids in demonstrating systems to stakeholders and promotes a deeper understanding of real-world entitie

1 views • 65 slides

Coupled Ocean-Atmosphere Modeling on Icosahedral Grids

Coupled ocean-atmosphere modeling on horizontally icosahedral and vertically hybrid-isentropic/isopycnic grids is a cutting-edge approach to modeling climate variability. The design goals aim to achieve a global domain with no grid mismatch at the ocean-atmosphere interface, with key indicators such

1 views • 21 slides

ALA FY 2017 Financial Report Summary

ALA's FY 2017 financial report highlights total revenues, expenses, net operating revenue, revenue sources, general fund summary, and detailed revenue and expense breakdowns. Revenues amounted to $48,808,627 with net revenue of $314,944. Key revenue sources included dues, contributions, grants, and

1 views • 16 slides

Fire and Smoke Modeling Evaluation Effort (FASMEE) Overview

FASMEE is a collaborative project aimed at assessing and advancing fire and smoke modeling systems through critical measurement techniques and observational data. Led by key technical leads, FASMEE focuses on diverse modeling areas such as fire growth, effects, coupled fire-atmosphere behavior, smok

5 views • 30 slides

Subarea and Highway Corridor Studies: Travel Demand Modeling and Refinements

In this lesson, we delve into subarea and corridor studies focusing on travel demand model refinements, highway network coding, corridor congestion relief, and trip assignment theory. Subarea modeling plays a crucial role in forecasting travel within smaller regions with detailed traffic patterns, t

1 views • 45 slides

Essential Steps for Setting up a Modeling Study

Ensure clarity on modeling goals and uncertainties. Select sample areas strategically based on interest and available data. Determine appropriate resolution for modeling. Define variables to model and validate the model effectively. Assess sample data adequacy and predictor variables availability. E

0 views • 9 slides

Advancing Computational Modeling for National Security and Climate Missions

Irina Tezaur leads the Quantitative Modeling & Analysis Department, focusing on computational modeling and simulation of complex multi-scale, multi-physics problems. Her work benefits DOE nuclear weapons, national security, and climate missions. By employing innovative techniques like model order re

0 views • 6 slides

Alisal Union School District 2021-2022 Budget Workshop Overview

The Alisal Union School District held a budget workshop to review revenue projections, expenditure projections, enrollment and staffing projections, additional federal and state funding, and supplemental and concentration expenditures. The workshop highlighted revenue sources, including local contro

2 views • 26 slides

Understanding Revenue Limits and Calculation Process in School Financial Management

This educational material covers topics such as revenue limits, the components within revenue limits, what falls outside of the revenue limit, and a four-step process for revenue limit calculation in the context of school financial management. It includes detailed information on the regulation of re

0 views • 34 slides

Understanding Revenue Requirements for Non-program Food Sales

Non-program food revenue plays a crucial role in school food service operations. Schools need to ensure that the revenue from non-program food sales meets a specified proportion to cover costs effectively. Failure to comply may result in corrective action during reviews by the state agency. To meet

0 views • 9 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Analysis of State Budget Trends by John Gilbert - Nov. 1, 2020

This comprehensive analysis by John Gilbert, a Budget and Revenue Analyst, delves into the multiyear trend of state budget outlook, general revenue fund trends, sources, growth, and projections. The analysis includes comparisons between revenue and expenditures, trend-based revenue projections, grow

0 views • 5 slides

NetLogo - Programmable Modeling Environment for Simulating Natural and Social Phenomena

NetLogo is a powerful and versatile programmable modeling environment created by Uri Wilensky in 1999. It allows users to simulate natural and social phenomena by giving instructions to multiple agents operating independently, making it ideal for modeling complex systems evolving over time. NetLogo

0 views • 7 slides

The Economics and Politics of Foreign Aid and Domestic Revenue Mobilization

This study explores the relationship between foreign aid, taxation, and domestic revenue mobilization, highlighting the impact of aid on tax/GDP ratios and the constraints faced in revenue systems. It discusses how aid influences policy choices, accountability, and bureaucratic costs, impacting reve

0 views • 25 slides

Understanding Revenue Recognition Guidelines under LKAS 18

LKAS 18 provides guidelines on how to recognize revenue from various sources like sale of goods, rendering services, interest, royalties, and dividends. Revenue recognition is based on specific conditions being met, such as transfer of risks and rewards of ownership, reliable measurement of revenue,

0 views • 26 slides

Overview of Exchequer Returns for End-Q1 2023

The Exchequer Returns for End-Q1 2023, as reported by John McCarthy, Chief Economist of the Department of Finance, indicate a year-on-year increase in total revenue, driven by growth in tax revenue. However, non-tax revenue decreased significantly. Expenditure also saw a notable rise, particularly i

0 views • 12 slides