Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

Campus Housing Financial Overview and Capital Projects 2023/24

Campus Housing at Waterloo manages a large operation with a $37M annual budget, providing housing for graduate students and first-year students. The housing operation aims for financial sustainability, relying heavily on residence fees. Capital projects for 2023 include various upgrades and repairs

1 views • 8 slides

Comprehensive Guide for Visa, Residence Permit, Subsistence Allowance, and Insurance for International Science Programme at Uppsala University

This guide provides essential information on obtaining a visa/residence permit, requesting support documents from ISP, acquiring subsistence allowance, handling insurance, navigating weather conditions, and accessing important web pages for students participating in the International Science Program

0 views • 19 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

Guide to Residence Permit for Studies in Sweden

A comprehensive guide on obtaining a residence permit for studies in Sweden, covering requirements, validity, financial support, health insurance, permits for family members, application process, key tips, common mistakes, and FAQs. Learn about the necessary documents, study period validity, renewal

1 views • 33 slides

way to obtain Residence certificate in Tamil Nadu Revenue

Indian citizens can apply for a residence certificate, a crucial document confirming their long-term residency in a nation, state, city, town, or village, through the e-Sevai Tamil Nadu portal. \nTo know more: \/\/obcrights.org\/blog\/certificates\/revenue-certificates\/residence-certificate\/how-to

5 views • 5 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Real Estate Services | Thehomeloanarranger.com

Thehomeloanarranger.com offers exceptional Real Estate Services that can help you secure your ideal residence. Please trust us to help you navigate the emotional process of finding your ideal residence.\n\n\/\/thehomeloanarranger.com\/

3 views • 1 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Property Purchase Guidance | Thehomeloanarranger.com

Discover your ideal residence with the guidance of Thehomeloanarranger.com expert advice on property acquisition. Please allow us to guide you to your ideal residence.\n\n\/\/thehomeloanarranger.com\/`

3 views • 1 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

The Role of Anti-Deferral in a Post-GILTI World

Surveying the evolution of international taxation, exploring the impact of source and residence taxation on subpart F, proposing a modified GILTI aligned with Pillar Two, advocating for a streamlined residence-based tax system, and recommending restrictions on subpart F to focus on passive income an

1 views • 40 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Your Home on the Hill: Housing and Residence Life Overview

Explore the required housing policy for freshmen and sophomore students, including exemptions. Learn about the extensive renovations and various residence hall options available, including single-gender, all-female, all-male, co-ed community style, and co-ed hotel style halls at the Hilltopper campu

0 views • 19 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Saint Leo University First Year Housing Guide 2017-2018

Welcome to the First Year Housing Selection Guide for Saint Leo University's incoming first-year students. This guide provides information on the housing selection process, including completing applications, forming roommate groups, and understanding room assignments. Important dates, logging into y

0 views • 11 slides

Residence Returning Scheme Points Allocation Guidelines

This document outlines the points allocation guidelines for the Residence Returning Scheme, covering categories such as Academic Excellence, University Contributions, Hall-Based Contributions, and Discipline Deduction. It provides detailed criteria for scoring in each category, including GPA points

0 views • 21 slides

Innovative Design-Build Approach for New Residence Hall Project

Explore the innovative approach of Progressive Design-Build for a new residence hall project, aiming to maximize cost-effectiveness, student amenities, and campus impact. The collaboration between designers and builders results in significant time savings, fiscal benefits, and efficient project deli

0 views • 15 slides

Maple View Retirement Residence - Your Home for Comfort and Care

Immerse yourself in the tranquil surroundings of Maple View Retirement Residence, where personalized care, delicious home-cooked meals, engaging activities, and a dedicated staff await you. Enjoy a variety of services including recreational programs, wellness initiatives, and nutritious menus design

0 views • 9 slides

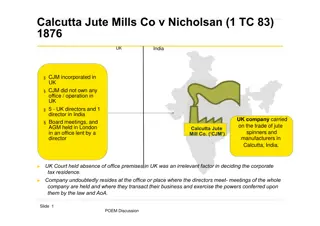

Landmark POEM Cases on Corporate Tax Residence

Landmark court cases - Calcutta Jute Mills Co. v. Nicholsan, Cesena Sulphur Company v. Nicholsan, and De Beers Consolidated Mines Ltd. v. Howe - highlight key factors determining corporate tax residence. Each case emphasizes the importance of where directors meet, transact business, and exercise pow

0 views • 11 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Nevada Department of Taxation Guidelines for Repair and Reconditioning Services

Tax guidelines for repair and reconditioning services in Nevada provided by the Department of Taxation. Covers taxable repair labor, treatment of parts, repairmen as retailers or consumers, fabrication vs. refurbishing labor, painters, polishers, finishers, and replacement parts taxation.

0 views • 11 slides

Understanding Migrant Worker Experiences in Canada

This study explores the experiences of migrant workers transitioning to permanent residence in Canada, highlighting the increasing trend of such transitions and the challenges faced. The research delves into factors influencing their decision to seek permanent residence, the issues encountered durin

0 views • 28 slides

Guide to Temporary and Permanent Residence in the Czech Republic for International Students and Employees

In this guide, you will find information on the procedures and requirements for obtaining temporary and permanent residence in the Czech Republic as an international student or employee. From registration with the Foreign Police to the application process for a Certificate of Temporary Residence, th

0 views • 34 slides

Returning Scheme and Criteria for Residence Recommendations

The Returning Scheme and Criteria for Residence Recommendations outline the key attributes, points allocation, and evaluation process for residents seeking to return to their hall. Points are awarded based on academic excellence, university contributions, hall-based activities, and discipline. The s

0 views • 20 slides

Complete Guide to Obtaining Residence and Work Permits in Turkey

Learn how to obtain a residence permit in Turkey for living and working, including the required documents and application process. Discover the steps to get a work permit, whether applying from inside or outside Turkey, and the necessary procedures for foreigners. Get all the information you need to

0 views • 12 slides

Exploring Campus Living: A Comprehensive Guide

Discover the various college living options, from on-campus residence halls to off-campus apartments. Learn about residence hall types, amenities, and Living-Learning Communities that enhance the student experience. Explore themed Living Learning Communities and roles of individuals in campus living

0 views • 11 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Economic Porosity and Primitive Capital Accumulation in Mozambique

In this presentation by Carlos Nuno Castel-Branco, the concept of economic porosity and its consequences in Mozambique are examined. The discussion includes the historical rationale for economic porosity, magnitude of economic dynamics, taxation issues, investment patterns, capital flight, and publi

0 views • 36 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purc

0 views • 10 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

Public Economics Course Summary - EHESS & Paris School of Economics

The Public Economics course at EHESS & Paris School of Economics offers an introduction to taxation history, government intervention theories, and policy incidence across developed and developing countries. The syllabus covers topics like welfare analysis, wealth taxation, and optimal taxation strat

0 views • 11 slides

Enhancing Student Experiences Through Faculty-in-Residence Programs

Explore the Faculty-in-Residence (FIR) program at CSUSB, focusing on the interactions between faculty and students, the impact on students, and the collaborative efforts to build community in residence halls. The program aims to bridge the gap between student affairs professionals and faculty, provi

0 views • 13 slides

The Case for Progressive Taxation: Ensuring Equality Through Fair Contributions

Progressive taxation involves higher tax rates for individuals with higher incomes or greater wealth, aiming to bridge economic and gender inequalities. This system can be achieved through well-designed tax scales, exemptions, and thresholds, ultimately contributing to fair distribution of contribut

0 views • 8 slides