Briefing to the Standing Committee on Appropriations on Adjustments Appropriation Bill

The presentation by Ms. Funani Matlatsi, DDG: CFO District Development Model, covers the adjustments in the national expenditure outcome, rationale for unallocated funds, impact on LGES, financial performance of the Municipal Infrastructure Grant, measures to mitigate fund stopping, steps to settle

3 views • 37 slides

ECC Social Value Reporting and Evaluation Framework

Essex County Council (ECC) has implemented a robust Social Value Reporting and Evaluation framework based on the Local Government Association's National TOMs method. This framework categorizes and assesses social value contributions in two parts - Value Score and Supporting Statement Score - to deri

3 views • 16 slides

Importance of Integrating Sustainability Reporting in Government Accounting

Sustainability reporting in government accounting in Africa promotes transparency, supports Sustainable Development Goals, attracts investments, manages resources, enhances efficiency, and fosters partnerships. The role of government accounting is crucial for transparent and sustainable governance t

3 views • 9 slides

Overview of Fall 2019 Reporting Information Session

High-level overview of TRS reporting for Fall 2019 including legislative changes, summary of rate changes for fiscal years, tips on starting a new year, and additional reporting tips. The presentation emphasizes the importance of accurate reporting and compliance with TRS Laws and Rules. Ensure time

1 views • 29 slides

Delete Inventory Adjustments in QuickBooks Online and Desktop

Delete Inventory Adjustments in QuickBooks Online and Desktop\nDeleting inventory adjustments in QuickBooks is easy. To delete an inventory adjustment in QuickBooks Online, go to \"Inventory\" > \"Inventory Adjustments\", find the adjustment, click it, and choose \"Delete\". For QuickBooks Desktop,

1 views • 4 slides

Mandatory Reporting Guidelines for Suspected Child Abuse/Neglect

Understanding mandatory reporting requirements for child abuse and neglect is crucial for various professionals and individuals working with children. This content emphasizes the legal obligations and procedures involved in reporting suspected cases, ensuring immunity for those reporting in good fai

1 views • 6 slides

Workplace Adjustments and Employee Lifecycle Overview

This content discusses the key stages in the employee lifecycle where workplace adjustments may be necessary to support employees effectively. It emphasizes the importance of providing reasonable adjustments as required under the Equality Act 2010, especially during recruitment, induction, performan

3 views • 4 slides

Comprehensive Overview of PIMS Staff Reporting for School Year 2022-2023

Offering insights into PIMS Staff Reporting agenda, reasons for data reporting, roles of EL Coordinators, and details on Professional Staff reporting criteria and templates. The content covers federal reporting requirements, Equitable Access data, and trends in education personnel.

1 views • 39 slides

WIOA Performance Data Collection and Reporting Overview

Requirements for reporting under the WIOA program, including data collection, negotiations, and outcomes reporting. Details on the reporting periods, reporting entities, core programs, partners, and the individuals included in the Participant Individual Record Layout (PIRL) reports.

6 views • 25 slides

Resource Adequacy Load Forecast Adjustments 2023

The document outlines the process of adjusting load forecasts for resource adequacy in 2023, focusing on factors such as IOU service areas, coincidence factors, peak demand estimates, LSE-specific adjustments, demand-side programs, and pro-rata adjustments. It includes detailed data and forecasts fo

1 views • 15 slides

Understanding FFATA Subaward Reporting System (FSRS) at HUD

FFATA requires federal award information to be publicly available on a searchable website. FSRS is a reporting tool for prime awardees to report sub-recipient/contractor awards and executive compensation data. This article delves into FFATA requirements, FSRS roles, responsibilities, and reporting p

2 views • 15 slides

Changes in FIDE Rating Regulations from 1 January 2022

The FIDE Rating Regulations underwent significant changes effective 1 January 2022. These changes include adjustments to the minimum time controls required for players based on their ratings, modifications to the intermediate time control rules, updates to monthly reporting guidelines for tournament

0 views • 11 slides

Overview of Retirement of a Partner and its Effects

Understanding the process of retirement of a partner in a business entity is essential as it involves various adjustments and implications on the firm's financial structure. When a partner retires, it can lead to changes in profit-sharing ratios, adjustments in assets and liabilities, and the treatm

0 views • 15 slides

Understanding 1099 Reporting Guidelines and Systems

The article provides insights into the 1099 reporting process, including details about the Miscellaneous Income System (MINC), Form 1099 issuance, criteria for 1099 reporting, the Statement of Earnings System (EARN), and the Special Payroll Processing system (SPPS). It explains the responsibilities

2 views • 15 slides

Streamlining Electronic Reporting of COVID Lab Results to OSDH

This documentation outlines the process of electronically reporting COVID lab results to the Oklahoma State Department of Health (OSDH). It covers the purpose, available options, specifications, formats, and the onboarding and testing process, aiming to accelerate the reporting of healthcare facilit

0 views • 9 slides

Overview of 1099 Reporting Systems

The 1099 Reporting Systems consist of MINC, EARN, and SPPS, which are used for IRS 1099 reporting purposes. These systems handle transactions and generate Form 1099 for recipients based on predefined criteria. Taxpayers are responsible for accurate reporting to the IRS, with reporting thresholds set

0 views • 15 slides

Understanding Grant Award Adjustments and Budget Modifications

Grant award adjustments involve modifications to federal awards, such as reallocating funds or changing project scope. Recipients must initiate a Grant Adjustment Notice (GAN) for budget modifications and follow specific guidelines to ensure timely processing and approval. Different criteria apply f

8 views • 6 slides

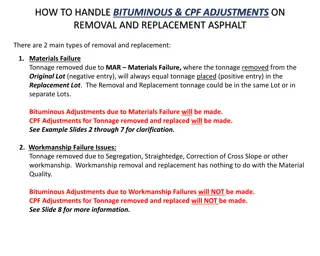

Handling Bituminous & CPF Adjustments on Removal and Replacement of Asphalt

Learn how to manage bituminous and CPF adjustments when removing and replacing asphalt due to materials failure or workmanship issues. Understand the process for adjustments within the same lot or different lots, including entering tonnage, dates, and certifications. Follow step-by-step instructions

0 views • 8 slides

Introduction to the new Student Support Framework

The new student support framework, introduced in September 2022, aims to provide inclusive support for various student groups by streamlining procedures and enhancing accessibility to support services. It covers areas such as extenuating circumstances policy, reasonable adjustments, support to study

0 views • 36 slides

Hemp Acreage Reporting & Certification Q&A with USDA

Explore essential information about Hemp Acreage Reporting, Certification, and compliance procedures in this Q&A session with the Farm Service Agency (USDA). Learn about important deadlines, required documentation, and the significance of reporting accuracy for various programs. Discover how to file

0 views • 15 slides

Guidelines for Transacting Periods and Posting Levels in mSCOA Vendor Reporting

The presentation by National Treasury outlines the structure of transacting periods within a financial year under mSCOA, emphasizing the importance of accurate reporting and closing balances. It details the specific purposes of each transacting period, such as closing month 12 automatically on 30th

0 views • 11 slides

UNEP Support for Improving UNCCD Reporting Procedures

UNEP has been providing support since 2010 to enhance the reporting processes of the UNCCD, focusing on streamlined funding approaches, technical assistance, and capacity building. Key outcomes include the development of reporting tools, online reporting systems, and building credible data from coun

0 views • 14 slides

Climate Change Monitoring, Reporting, and Verification (MRV) Training Session Overview

This document outlines the purpose and reporting requirements for the development of a Climate Change Monitoring, Reporting, and Verification (MRV) system, focusing on projections and scenarios. It highlights the importance of collecting information for climate mitigation, assisting Serbia in meetin

0 views • 19 slides

Travel Pay Guidance and Work Schedule Adjustments for Payroll Services

Explore scenarios related to travel pay, holidays, dual employment, and work schedule adjustments in the context of payroll services. Understand how to calculate hours worked, handle holidays, manage overtime, and make scheduling adjustments to avoid overtime. Access additional resources for trainin

0 views • 15 slides

Transitioning to Incident-Based Crime Reporting: Enhancing Transparency and Accountability

Anytown Police Department (APD) is leading the transition from Summary Reporting to Incident-Based Reporting through the National Incident-Based Reporting System (NIBRS). This change promotes transparency, provides detailed crime data to the public, and improves statewide and national crime statisti

3 views • 17 slides

Insights into Structured Reporting Practices in Colorectal Cancer Imaging

A survey conducted by Dr. Eric Loveday at North Bristol NHS Trust revealed the current landscape of structured reporting in MRI and CT scans for rectal and colon cancer. Results indicate a positive outlook towards implementing national standards for structured radiology reporting, with an emphasis o

0 views • 7 slides

Simpler Systems Reporting Pilot for Financial Data Enhancement

The Simpler Systems Reporting Pilot is underway to enhance financial data reporting at the university campus. Led by Vice President Ryan Nesbit's team, this initiative aims to improve University-wide financial reporting mechanisms and accessibility to data through the Simpler tool. The pilot include

0 views • 5 slides

Understanding Budget Adjustments vs. Budget Amendments in AEL WIOA Summer Institute

Explore the differences between budget adjustments and budget amendments in the context of AEL WIOA Summer Institute's financial processes. Budget adjustments allow for moving a sum less than 20% without an amendment, while budget amendments involve larger changes and require specific approvals. Lea

0 views • 24 slides

Update on Modeling and Coordination Discussions

Weekly coordination calls with Ramboll and discussions with EPA OAQPS leads focused on Regional Haze and modeling adjustments. Final draft of procedures document with visibility projections and glide slope adjustments. Upcoming RTOWG meetings covering methodology, projections, and modeling evaluatio

0 views • 5 slides

Overview of WISEdata Snapshot Preparation and Reporting Requirements

The WISEdata Snapshot Preparation provides crucial details on data entry, validation, and reporting processes for educational institutions. It outlines the importance of accurate data collection for federal reporting, public reporting, and funding determinations. Additionally, the Snapshot Reporting

0 views • 41 slides

Ensuring Chemical Reporting and Preparedness at the DEQ

The Chemical Reporting and Preparedness section at the DEQ focuses on regulations under EPCRA, prompted by incidents like the Bhopal tragedy. EPCRA covers Tier II reporting, spill reporting, LEPCs, State Emergency Response Commission, and Oklahoma Hazardous Materials Emergency Response Commission. T

0 views • 17 slides

ARPA Reporting Overview and SLFRF Guidelines in Alaska

This document outlines the reporting overview for the ARPA (American Rescue Plan Act) and specific guidelines for the Coronavirus State and Local Fiscal Recovery Fund (SLFRF) in Alaska. It covers acceptance, use, and reporting of funds, as well as designating staff roles for managing reports. The co

2 views • 22 slides

Feedback Analysis on Medication Incident Reporting in Hospitals

Feedback received from IMSN members on NIMS and incident reporting revealed various issues affecting the rates at which staff report medication incidents/near misses within hospitals. Major themes included staffing numbers and turnover, pharmacist involvement in incident reporting, clinical pharmacy

0 views • 12 slides

Adjustments to SmartConnect and Popdock Pricing in AUD, NZD, and CAD Currencies Effective January 4, 2021

Starting January 4, 2021, there will be adjustments to SmartConnect and Popdock pricing in AUD, NZD, and CAD currencies. The pricing changes include SmartConnect monthly subscription plans and 8-year site license models, with different tiers offering various features and support options. Certain ser

0 views • 10 slides

Understanding Federal Partnership Audits and Their Impact on State Revenue Departments

The presentation discusses the impact of federal partnership audits on state revenue departments, emphasizing how states benefit from federal audit efforts. It covers topics such as reporting federal audit adjustments, the background of federal audit adjustments, and the final determination process.

0 views • 51 slides

Understanding District Characteristic Adjustments in Education Funding

Various types of formula adjustments are used to address the diverse costs of education among schools and districts, including district size adjustments, necessarily small schools adjustments, density adjustments, regional cost adjustments, and transportation funding approaches. These adjustments ai

0 views • 11 slides

Importance of Wildland Fire Reporting to the Fire Community

Wildland fire reporting plays a critical role in providing accurate data for effective fire management. Defined state fires and challenges in reporting impact funding, risk management, and agency support. Comprehensive reporting like the Wildland Fire Occurrence Reporting for Massachusetts is essent

0 views • 6 slides

How Automatic Adjustments in Microwave Ovens Simplify Cooking

Discover how automatic adjustments in microwave ovens make cooking easier by optimizing time, power, and precision for perfectly cooked meals every time. \/\/lahorecentre.hashnode.dev\/how-automatic-adjustments-in-microwave-ovens-simplify-cooking

7 views • 1 slides

Streamlining Research Progress Reporting for NIH Awards

Research Performance Progress Report (RPPR) is a standardized mechanism to facilitate interim progress reporting for NIH-funded projects, aiming to enhance consistency and minimize administrative burdens. It replaces the eSNAP process for certain types of awards and fellowship grants. RPPR includes

0 views • 12 slides

Central Benefits Annual Reconciliation Updates and Reporting Strategy

Updates and revisions related to the annual reconciliation process have been outlined, including the introduction of new accumulator and earnings codes, adjustments in December 2018 remittance reporting, and details on STAR and WRS reporting process. These changes aim to enhance accuracy and ensure

0 views • 18 slides