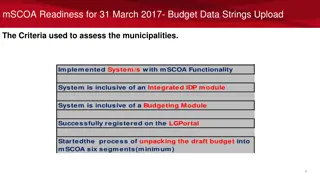

Guidelines for Transacting Periods and Posting Levels in mSCOA Vendor Reporting

The presentation by National Treasury outlines the structure of transacting periods within a financial year under mSCOA, emphasizing the importance of accurate reporting and closing balances. It details the specific purposes of each transacting period, such as closing month 12 automatically on 30th June and processing audit adjustments in period 14. The document also explains posting levels and provides an example illustrating how adjustments within the financial year should be handled. Adherence to these guidelines is crucial for financial accuracy and compliance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

mSCOA VENDOR REPORTING FORUM PERIOD CONTROL Presented by National Treasury 22 August 2017 1

Transacting Periods 1 8 9 2 7 10 15 3 6 11 14 4 5 12 13 A financial year now consists of 15 periods 2 2

Transacting Periods 12 Last month of transacting - June Month 12 will close automatically on 30 June All closing balances must be transferred with the year-end procedure to period one of the new year No back posting once the period is closed 3 3

Transacting Periods 13 Applicable during the period of preparation of the AFS Month 12 will close automatically on 30 June All adjustments in preparation and finalization of annual financial statements (AFS) will be processed in this period No backdating of transactions are permitted Will remain open until the annual financial statements are submitted for audit 4 4

Transacting Periods 14 Applicable for audit adjustment period Adjustments during the audit of the financial statements must be processed in period 14. No backdating of transactions permitted Will remain open until the audit of the financial statements is complete. 5 5

Transacting Periods 15 Prior period transactions and restatements Will be used to process all prior period adjustments and restatements that affect previous financial years that have been identified subsequent to the audit. Period 15 should be open throughout the financial year 6 6

Posting levels 7 7

Transacting Periods - Example Posting level M01 M02 M03 M04 Leave(IL-001-005-001)7 Opening Balance(IL-001-005-001-001) Increases(IL-001-005-001-002) Reductions (Outflow of Economic Benefits)(IL-001-005-001-003) Reductions (without Outflow of Economic Benefits)(IL-001-005-001-004) Reversals(IL-001-005-001-005) Increases (Passage of Time/Discounted Rate)(IL-001-005-001-006) Closing Balance(IL-001-005-001-007) Yes Yes Yes Yes Yes Yes 1000 300 -200 -100 -50 100 -200 500 -100 -300 200 -700 400 1400 800 1650 1500 1350 Adjustments within the financial year must be processed in the current month when identified (cannot reopen past months for correction) 8 8

Opening balance scematics OLD YEAR P12 P13 P14 Movement - 50 30 Closing balance 1,050 1,080 1,000 NEW YEAR P01 P02 P02 P02 Open balance 50 30 1,000 Movement 100 300 -250 100 Closing balance 1,100 1,450 1,200 1,330 9 9

Submissions The file structure for submission onto the LG Database: M12 June Actuals (Period 12) PAUD Pre-audited Actuals (Period 13) AUDA Audited Actuals (Period 14) RAUD Restated Audited Actuals (Period 15) 10 10

Thank you THANK YOU 11